Key Takeaways:

- Dual Investment is a unique savings/investment product that allows you to earn income, regardless of the direction the market goes

- Dual investment basically allows you to buy low or sell high a cryptocurrency at a set date in the future, earning high-interest income at the same time

- With Dual Investment, you will get back the deposit amount and interest income in either of the two currencies used, whether the order is fulfilled or not

- Dual Investment is a non-principal guarantee product, meaning that is isn’t fully protected against losses in the volatile crypto market

The cryptocurrency market can be a hard place to navigate, especially for newcomers. The majority of digital currencies are volatile, and the market can go in any direction, seemingly on a whim. One way to stay ahead and consistently earn returns for your investment is to use Binance’s Dual Investment.

Dual Investment is a sort of investment product that enables you to earn interest, regardless of the direction of the market. The central idea is to buy cryptocurrencies low and/or sell them high at a predetermined date in the future. With Dual Investment, you can achieve the following:

- Take profits at a calculated rate

- Buy the dip while earning passive income

- Grow your HODLed digital asset

- Grow your stablecoin stash

- Compounding your returns during a short-term volatile market

Are you thrilled by the idea of Dual Investment? Do you wish to understand what it entails? Are you eager to start buying low and selling high? We will discuss everything you need to know to get started and also guide you on how to move from the beginner mode to the advanced mode.

What is Dual Investment?

In simple terms, Dual Investment is a non-principal protected saving product that allows investors/traders to deposit a cryptocurrency and earn enhanced yield, based on two assets. Typically, it allows users to commit their digital assets (i.e. lock asset in a yield), make a prediction, and choose a settlement date. The return can either be paid in deposit currency when the product is not exercised or in alternate currency when the product is exercised.

A simpler way to describe Dual Investment is that it offers crypto investors opportunities to buy low or sell high at a preset date in the future. The main idea is to be positioned to earn interest, regardless of the direction the market goes.

Dual Investment – How Does It Work

With Dual Investment, crypto investors get the opportunity to buy an asset at a lower price or sell an asset at a higher price in the future. During the subscription period, the committed assets are locked. However, users can earn a high-interest yield during the subscription period, regardless of the market direction.

To fully understand how Dual Investment works, you need to look at the two distinct approaches – sell high and buy low:

Sell High

The sell high approach offers you a chance to sell your crypto at a high price on the settlement date if the market price reaches your target price.

The process is pretty straightforward. You need to deposit your desired cryptocurrency (not a stablecoin), choose a target price (a high price target you aim to sell at), then select the settlement date.

If on the settlement date, the market price is above your target price, it is considered a successful bet and your order is filled. When this is the case, your subscription amount and accumulated interest are sold at the target price and then you get your reward in BUSD.

On the other hand, if the market price of your asset is below the target price on the settlement date it is considered an unsuccessful bet, and the order is not filled. However, you will still receive the full amount you deposited, as well as accumulated interest income, in the same currency you deposited.

Buy Low

The buy low approach is similar to the sell high approach in many regards. It offers you a chance to buy crypto at a low price in the future if the market price reaches your target price.

To buy low, you need to deposit a stablecoin (BUSD or USDT), choose a currency to buy (for example ETH) and its price target, then choose a settlement date.

If on the settlement date, the market price is below the target price, it is considered a successful bet and the order is filled. If this is the case, your subscription amount and earned interest income will be used to buy the crypto (ETH in this case) at the target price.

If, on the other hand, the market price is higher than the target price, it is considered an unsuccessful bet and the order is not filled. In this case, you will still get the amount you deposited as the accrued interest in the deposit currency/stablecoin (either BUSD or USDT).

The Key Benefits of Dual Investment

Dual Investment is a relatively safe way to trade cryptocurrencies. Your sell high or buy low order will yield interest income, whether the order is filled or not. The only difference is that filled orders bring interest in the desired currency while unfilled orders bring interest in the deposited currency.

Other key benefits of Dual Investment, especially as offered by Binance, include:

- High-interest yield, regardless of the direction the market goes

- Wide selection of assets to buy low or sell high at targeted prices in the future

- Zero trading fees.

Comparing Dual Investment with Spot Limit Orders or HODLing

From what we’ve covered so far, it will seem Dual Investment is the best approach to crypto investing/trading. This is not the case in all instances.

How does Dual Investment compare with hodling? Are you better off spot limit orders instead of targeting to buy high or sell low with Dual Investment?

We will compare Dual Investment with hodling using the possible scenarios you can encounter in ‘Sell High’ Dual Investment.

There are three possible scenarios when you choose the crypto to sell high at a future date:

- Scenario 1: The target price is not reached. In this case, you will keep your crypto and enjoy the high-interest yield. Obviously, Dual Investment is better than hodling in this regard.

- Scenario 2: The target price is reached, but the market price is only slightly higher. Though you will sell your crypto at a price that is slightly lower than the market price, the accrued interest income will compensate for the price difference. In this case, Dual Investment is also better than hodling.

- Scenario 3: The target market is reached and the current market price is significantly higher than the target market. In this case, you will sell your crypto at a significantly lower price than the current market price. The additional interest income may compensate for the price difference to a certain level, but it won’t be enough. Ultimately, hodling is the winner in this scenario.

When compared to spot limit orders, the Dual Investment strategy appears to be more attractive for many reasons. For a start, you stand a chance to buy low or sell high at preset dates. Also, you will earn interest income whenever you use dual investment, irrespective of the direction the market goes. Again, there are no trading fees when you use Dual Investment, unlike when you use spot limit orders.

The only area spot limit orders have Dual Investment beat is in the level of risks associated with each respective trading product. With dual investment, there are higher chances that orders are not filled on the settlement date. This, however, does not mean you will lose your money. Rather, you are settled with the same currency and interest income, though the market value may drop.

Getting Started with Dual Investment

Are you willing to try Dual Investment? There are a few important terminologies you must understand:

- Subscription Amount is the amount you deposit when subscribing to a dual investment

- Target Price is the price you choose to either sell your asset (Sell high) or buy an asset (buy low)

- Settlement Date is the set date you will buy or sell the selected asset. 08:00 (UTC) is the checkpoint to determine whether the target price is reached.

- Settlement Price is the market price average 30 minutes before 08:00 (UTC) on the settlement date. Together with the target price, the settlement price determines whether an order is filled or not.

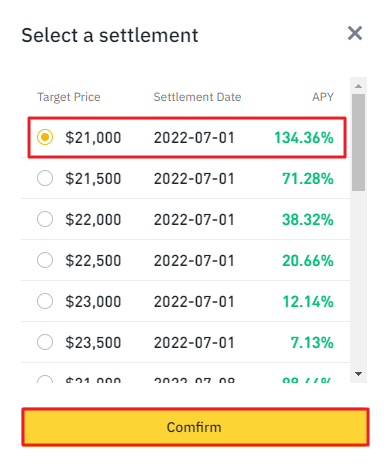

- Annual Percentage Yield (APY) is the interest you will earn if you lock your asset for 1 year. Of course, you can choose how long you want to lock the asset and the APY will be used to calculate your possible interest income.

- Subscription Period refers to the number of days from the subscription date to the settlement date

How to Subscribe to Dual Investment

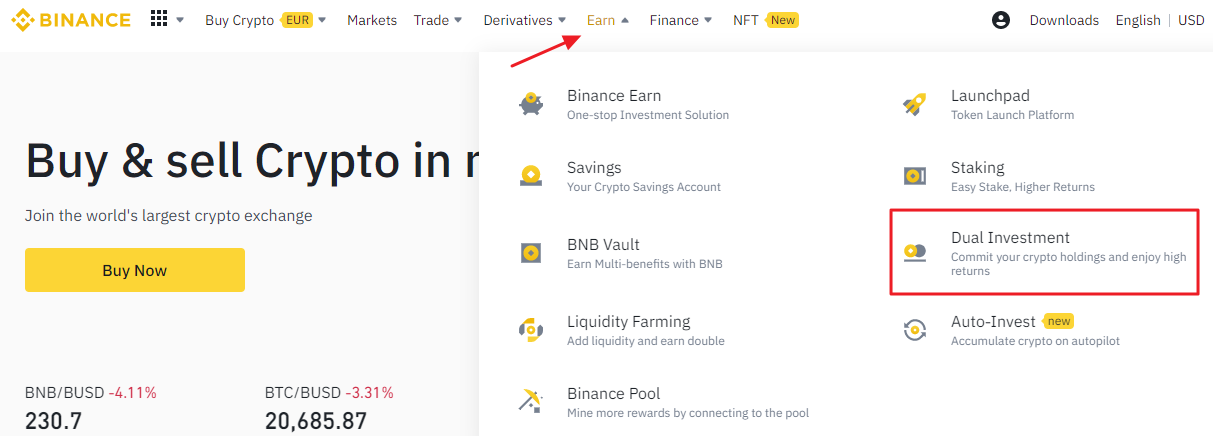

To subscribe to an investment product via Dual Investment on Binance, follow the simple steps below:

Step 1: Log in to your Binance account and go to [Earn] – [Dual Investment]

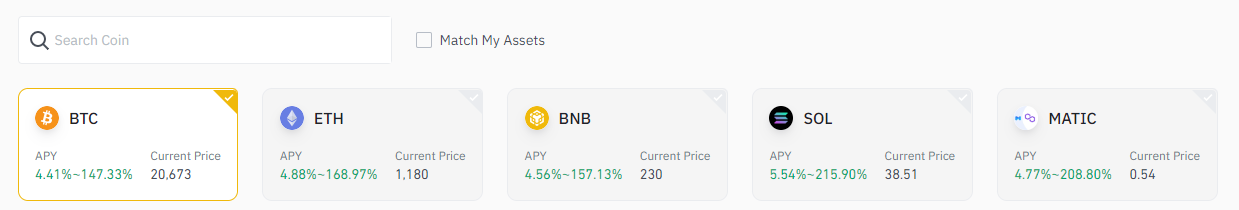

Step 2: Choose the asset you want to buy or sell and complete the Dual Investment quiz if it is your first time using the product

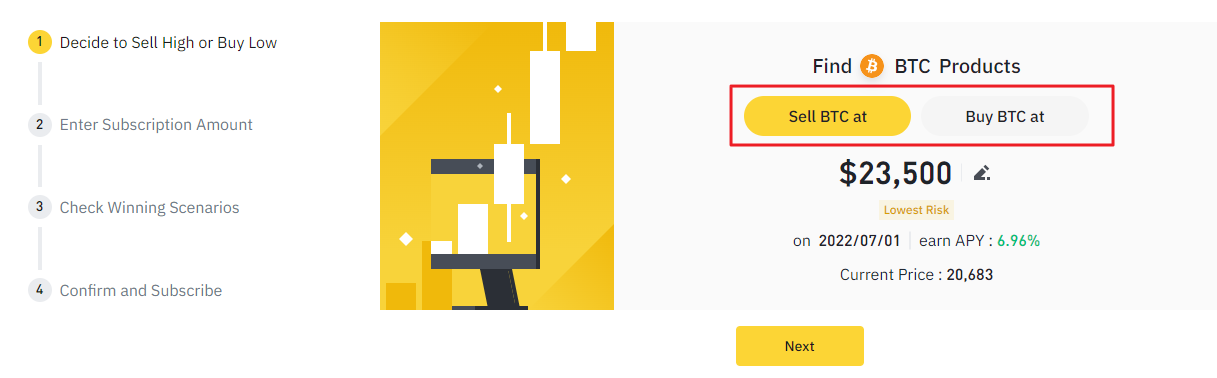

Step 3: Choose to either “Sell High” or “Buy Low”

Step 4: Enter your target price and select a settlement date

Step 5: Enter your subscription amount, read and agree to the ‘service agreement’ and click on [Subscribe]

Please note that we have used the “Beginner Mode” for the purposes of this guide due to a more streamlined and user-friendly interface.

Dual Investment Beginner Mode

It’s often best to start cautiously when you are new to an investment/saving product. Binance understands this and has created a beginner mode for Dual Investment. As the name suggests, this is a mode for beginners, and it provides a step-by-step guide through the subscription process.

You can enter and exit the beginner mode with a toggle button. It is advisable to use the beginner mode when you are just starting off. Once you are familiar with dual investment, you can turn it off and enjoy all the advanced features offered by Dual Investment.

What are the Risks Involved with Dual Investment?

Though Dual Investment offers several key benefits, it is not immune to risks. In fact, the risks are almost as prominent as the risks of buying and selling crypto at the spot market with a limit order. Understanding these risks can help you position yourself better.

Here are some risk factors you can expect with Dual Investment:

- If the market price surpasses your target price by a big margin (low or high), you will be forced to sell or buy the digital asset at an unfavourable price. You may lose some big opportunities to make huge returns.

- The dual investment trade can only happen at the settlement date and not any other day. Your potential earnings depend largely on what happens on that day and the market situation around 8:00 (UTC) on that day.

- Subscribed (locked) assets remain inaccessible to users until the settlement date. You can’t redeem the order or cancel it once you have subscribed.

Dual Investment is not a principal guaranteed product, meaning that it doesn’t protect against losses at the maturity of the investment. What this implies is that subscribing to dual investment doesn’t mean your crypto may not decrease in value upon maturation. The market price determines whether you make a profit or not. The only assurance is that you will earn interest income, regardless of the direction the market goes.

Wrapping Up

Binance Dual Investment allows you to earn passive income from your crypto investment, regardless of the direction the market goes. It is a worthy alternative to staking and hodling. Binance has been gracious enough to provide a beginner mode for newbies.

We’ve covered most things you need to know about Dual Investment and how to get started. You can learn more about the product here.