Are you looking to invest in cryptocurrencies but unsure which one to buy? With so many options available, it can be overwhelming to decide how to invest your money. That’s why we’ve compiled a list of the best crypto to buy now, based on factors such as project developments, price performance, and market capitalization, as well as the overall potential for growth.

In this article, we’ll take a closer look at the most promising cryptocurrencies, including staples such as Bitcoin and Ethereum, and a combination of several other promising crypto projects. We’ll discuss their features, advantages, and potential drawbacks, as well as provide insights into market trends. Whether you’re a seasoned investor or just starting out, this article will help you make an informed decision about the best crypto to buy now.

So, let’s dive in and explore the best cryptocurrencies to invest in October 2024:

- ApeCoin – A leading NFT and metaverse project

- Bitcoin – The world’s oldest and largest crypto

- Uniswap – The largest decentralized trading protocol

- Avalanche – A leading “Ethereum killer”

- Sui – Robust and highly scalable L1 blockchain

- Ethereum – The leading DeFi and smart contract platform

- Aave – The biggest DeFi lending protocol

- Aptos – Highly performant L1 blockchain

- Solana – Smart contracts platform with high speeds and low fees

- Maker – The DeFi protocol behind the Dai stablecoin

- Polygon – A leading crypto scaling ecosystem

- Shiba Inu – A leading meme coin project

The 12 best cryptos to buy right now: Discover top investments for October 2024

The following three cryptocurrency projects highlight our investment selection thanks to important developments and upcoming events that make them especially interesting to follow in the near future. These projects are updated each week based on the most recent developments and trends taking place in the crypto market.

1. ApeCoin

ApeCoin (APE) is the native cryptocurrency of the Ape ecosystem, primarily associated with the Bored Ape Yacht Club (BAYC), one of the most popular NFT collections to date. Built as an ERC-20 token on the Ethereum blockchain, ApeCoin is designed to serve as the foundational currency of this growing community. It not only functions as a medium of exchange within the BAYC universe but also plays a crucial role in decentralized governance through the ApeCoin DAO. This governance model allows token holders to participate in decision-making processes that influence the future development of the ecosystem, from the allocation of funds to strategic initiatives.

In addition to governance, ApeCoin has broader utility within its ecosystem. It can be used to access exclusive features, events, and games developed by Yuga Labs, the creators of BAYC. The coin also powers an incentive structure that rewards participants and developers contributing to the ecosystem’s growth. APE is being integrated into a range of decentralized applications (dApps) and virtual experiences, particularly as Yuga Labs expands its ambitions in the metaverse with its “Otherside” project.

Why ApeCoin?

The ApeCoin team has launched ApeChain, a new blockchain that will allow ApeCoin holders to earn native yields when staking APE, ETH, and stablecoins. The new blockchain went live on Saturday and prompted more than a 100% increase in the price of APE, from roughly 80 cents to more than $1.60.

Along with the launch of the new chain, the team launched a portal that allows APE holders to bridge their tokens from Ethereum and Arbitrum to the newly launched ApeChain.

ApeChain is designed to facilitate NFT minting, trading, and decentralized application (dApp) use cases. It is also completely compatible with the APE token. It is built on the Arbitrum One technology as a layer 3 network.

“ApeCoin has introduced an automatic yield mode, allowing users to passively earn returns by staking their APE tokens. This new feature reinvests rewards automatically, maximizing yield over time,” head of 10x Research, Markus Thielen, remarked on the launch of ApeChain.

2. Bitcoin

Bitcoin (BTC) is the original decentralized digital currency, enabling peer-to-peer transactions without the need for intermediaries such as banks or financial institutions. It was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin was the first digital currency to eliminate the double spending problem without resorting to any central intermediaries.

Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers around the world. This means that the transactions are secure and transparent, as anyone can view them, but they are also anonymous, as the identity of the participants in the transaction is not revealed.

BTC can be bought and sold on cryptocurrency exchanges, and they can be stored in a digital wallet, which is a software program that securely stores private keys that are required to access and transfer the currency.

Bitcoin is often referred to as “digital gold” or a store of value, as it has a limited supply of 21 million coins, and its value is determined by market demand. Some people also see it as a hedge against inflation or a way to diversify their investment portfolio. It is by far the largest cryptocurrency by market cap in the industry, accounting for the value of more than 40% of all digital assets in circulation combined, making it arguably the most popular crypto to buy.

Why Bitcoin?

The U.S. Federal Reserve recently announced a 0.5% reduction in interest rates, which had a positive effect on many risk assets, including Bitcoin. This boost in momentum propelled Bitcoin above the $60,000 mark, with the price peaking locally at around $66,400. While there has been a slight pullback, Bitcoin has retained most of its gains, with the price hovering close to $63,600 at the time of writing.

Another significant event for Bitcoin markets came on September 21st, when the SEC (Securities and Exchange Commission) gave the green light to physically settled options contracts based on BlackRock’s IBIT spot Bitcoin ETF. However, it’s important to note that this product still awaits approval from the OCC (Options Clearing Corporation) and the CFTC (Commodity Futures Trading Commission).

This development is seen as bullish for Bitcoin, as the introduction of Bitcoin ETF options is expected to attract more institutional investors to the market. These options will provide institutional players with a new method for managing their Bitcoin exposure, offering them a fresh hedging opportunity.

Another development that could be seen as bullish for BTC is the expected rate cut for November. According to data tracked by CME Group, just a hair over 52% of traders believe that the Fed will bring down rates to 425-450 bps during the next meeting, which would be another 0.5% reduction in interest rates.

3. Uniswap

Uniswap is a decentralized exchange (DEX) that runs on the Ethereum blockchain. It was created in 2018 by Hayden Adams, and it allows users to trade various cryptocurrencies without the need for an intermediary or central authority.

Uniswap uses an automated market maker (AMM) system, which means that there is no order book or centralized exchange to match buyers and sellers. Instead, liquidity providers (LPs) contribute funds to liquidity pools, which are used to execute trades. Traders can swap one cryptocurrency for another by exchanging tokens with the liquidity pool, which uses a mathematical formula to determine the exchange rate.

The native cryptocurrency of the Uniswap platform is UNI, which is used for governance and for providing incentives to liquidity providers. UNI holders can participate in platform governance, including proposing and voting on changes to the protocol.

In the six years since its launch, Uniswap has grown to become the most popular decentralized exchange in the cryptocurrency ecosystem, with billions of dollars in trading volume and a large community of users and developers.

Why Uniswap?

Uniswap developers Uniswap Labs have announced their plans for a layer-2 network that will run on Ethereum. The L2 solution will be called Unichain and will be built on Optimism’s OP Stack.

According to the developers, the new L2 will be incredibly fast and will easily facilitate token swapping across multiple blockchains. Here’s what the developers wrote on X:

Unichain will be so fast, transactions will feel instant. It launches with 1 second block times, with 200-250 millisecond sub-block times coming soon. This type of speed isn’t just great for UX, it also improves market efficiency and lowers value lost to MEV.

Uniswap’s L2 solution could save an immense amount of funds over the course of a year. According to DeFi Report founder Michael Nadeau, $368 million in fees was paid out to Ethereum validators last year alone. Nadeau said that the winners of Uniswap’s move to Unichain will be Uniswap Labs, UNI token holders, liquidity providers, and Optimis. Meanwhile, Ethereum validators, ETH holders, and L2s currently enabling Uniswap will end up on the losing side.

4. Avalanche

Avalanche is a cryptocurrency and blockchain platform designed to provide high-speed, low-cost transactions for decentralized applications (dApps) and enterprise use cases. The Avalanche network is built on a DAG-optimized consensus mechanism called Avalanche, which uses a novel approach to achieving consensus among nodes on the network. This allows the network to process transactions quickly and efficiently, with the potential for over 4,500 transactions per second (TPS).

Avalanche uses its native token, AVAX, as a means of value transfer and to pay for transaction fees on the network. AVAX can also be staked by node operators to help secure the network and earn rewards in the form of additional tokens.

One of the key features of Avalanche is its support for interoperability between different blockchains, which allows for the transfer of assets and data between different networks. This is achieved through a technology called the Avalanche-X bridge, which enables cross-chain communication and allows developers to build dApps that can interact with multiple blockchains.

Why Avalanche?

The Avalanche Foundation has announced that it will purchase 1.97 million AVAX tokens, worth about $45 million at the time of writing. The tokens were initially sold to the Luna Foundation Guard, which was tasked with financially protecting and ensuring the stability of the Terra blockchain ecosystem. LFG bought the tokens in April 2022 for $100 million. About a month later, the Terra ecosystem collapsed in a spectacular fashion after the main algorithmic stablecoin, UST, lost its peg to the US dollar.

According to the Avalanche Foundation, the move is meant to guarantee that LFG complies with the original agreement’s limitations on token usage and protects the tokens from the complications of a bankruptcy trustee liquidation, while restoring almost 2 million AVAX to the Foundation’s reserves. It also strengthens the Foundation’s capacity to continue fostering the growth and development of the Avalanche ecosystem.

In addition to repurchasing AVAX, there’s another reason why Avalanche is in a good spot for investors. A new battle royale game, Off the Grid, is launching on Tuesday. The game uses Avalanche technology for NFT integration. In the early access phase, more than 1 million wallets have already been created, signaling massive interest from players. The game is launching on PlayStation, Xbox, and PC.

5. Sui

Sui is a layer 1 blockchain focused on scalability and high throughput. Thanks to its robust performance, Sui is positioned to become one of the leading chains in the Web3 and NFT space, challenging the likes of Ethereum and Solana.

Smart contracts on the Sui blockchain are written in the Move programming language, a language developed by a team of Facebook developers who worked on the Diem stablecoin project. Move was first prominently used by the Aptos team, which features a lot of individuals who worked on the Diem project before it was shut down.

The native token of the Sui blockchain is called SUI. The token is used to pay gas fees for transactions, staking, and compensating validators for securing the network, for funding Sui’s storage fund, and for the Sui ecosystem governance.

Why Sui?

The Sui token has been a very strong performer in the past month, recording a 120% upswing amid relatively poor market conditions. There have been several developments in the Sui ecosystem that could be responsible for investors’ optimism regarding the token.

An important development was definitely the launch of USDC stablecoin on the Sui blockchain in September, which made it easier for investors to deposit and withdraw funds using Sui dApps. The launch of the second most popular stablecoin on the blockchain helped spark an investor frenzy among Sui meme coin buyers. On October 7 alone, the market cap of Sui meme coins rose by 26% to $302 million, according to CoinCodex.

In addition, the Sui team announced last month that they will be selling a “first-of-its-kind” web3 gaming device dubbed SuiPlay0X1. The handheld device – which is similar to the popular Steam Deck – is powered by the AMD Ryzen 7 7840U CPU and comes with a 512 gigabyte SSD. It has 16 GB of RAM and a 7” full HD display. The device will cost $599 and will start shipping in the first half of 2025.

In other related news, 3DOS has partnered with Sui to create a decentralized 3D printing network, enabling users and manufacturers to connect globally for on-demand, local production. Sui acts as the coordination layer, synchronizing real-time production needs and resources. This integration aims to transform the $15.6 trillion manufacturing market by reducing costs, eliminating waste, and empowering local economies.

Finally, it’s worth noting that the Sui team recently significantly improved the way the network handles transactions. According to the blog post, Sui’s shared object congestion control introduces a new system to manage high-demand transactions more efficiently. It prioritizes transactions with higher gas fees and prevents delays by limiting the number of transactions affecting congested, or “hot,” shared objects. The new design allows for deferring and canceling transactions, improving execution order and preventing bottlenecks.

6. Ethereum

Launched in 2015 by Vitalik Buterin and a team of developers, Ethereum is a decentralized, open-source blockchain platform that allows developers to build decentralized applications (dApps) and smart contracts.

Ethereum has a wide range of use cases beyond just a store of value or medium of exchange. Ethereum’s smart contract functionality allows developers to build dApps that can run without the need for intermediaries, like centralized servers or institutions.

The Ethereum platform has gained widespread adoption and has become the backbone of the decentralized finance (DeFi) industry. DeFi applications built on Ethereum allow users to access financial services without relying on traditional banks or financial institutions. Ethereum’s smart contract functionality has also enabled the creation of non-fungible tokens (NFTs), which have gained popularity in the digital art and gaming worlds.

While Ethereum has a strong community and has been highly influential in the cryptocurrency industry, it also faces challenges, such as scalability issues and high gas fees. These issues have spurred the development of various Layer 2 scaling solutions. In the long run, future updates are supposed to massively increase Ethereum’s throughput bringing the transaction per second (TPS) figure from 15 to 100,000.

Why Ethereum?

The community, more precisely Illyriad Games co-founder Ben Adams, has announced a new Ethereum Improvement Proposal, EIP-7781. The new proposal aims to reduce block time by half, bringing it from 12 to 8 seconds.

To achieve a faster block time, Adams proposes reducing roll-up latency and distributing bandwidth usage over time to lower peak bandwidth requirements and maintain network efficiency.

According to Ethereum developer Justin Drake, the improvements could make Ethereum-based exchanges like Uniswap more than 1.2 times more efficient, which would save $100 million in arbitrage costs per year.

“It will make DEXes like Uniswap v3 roughly sqrt(12/8) ≈ 1.22x more efficient, saving roughly $100M in CEX-DEX arbitrage per year and ultimately leading to better execution for users.”

In addition to promising blockchain developments, Ethereum could be a good buy right now due to the very large discrepancies in price performance between BTC and ETH in recent months. Whereas Bitcoin gained as much as 47% since the start of the year, ETH gained just 6% in the same period. It could very well be the case that Etheruem’s rally is just around the corner.

7. Aave

Aave is a decentralized liquidity protocol that utilizes smart contracts to enable users to either borrow crypto assets or earn interest on their holdings in a decentralized fashion. While Aave operates as a series of smart contracts on a blockchain, most users engage with the protocol through interfaces like app.aave.com.

As of now, Aave allows users to earn a yield on roughly 20 different cryptocurrencies. Typically, stablecoins like USDT, USDP, and TUSD offer the highest returns. The yields available through Aave are influenced by market demand—when there’s high demand for borrowing a specific asset, the APY for those supplying that asset increases.

Additionally, Aave provides a staking option for holders of its AAVE governance token. This feature allows AAVE holders to earn yield while also enhancing the security of the Aave protocol. Originally launched on the Ethereum blockchain, Aave has since expanded to other platforms, including Avalanche, Optimism, Polygon, and Arbitrum.

Why Aave?

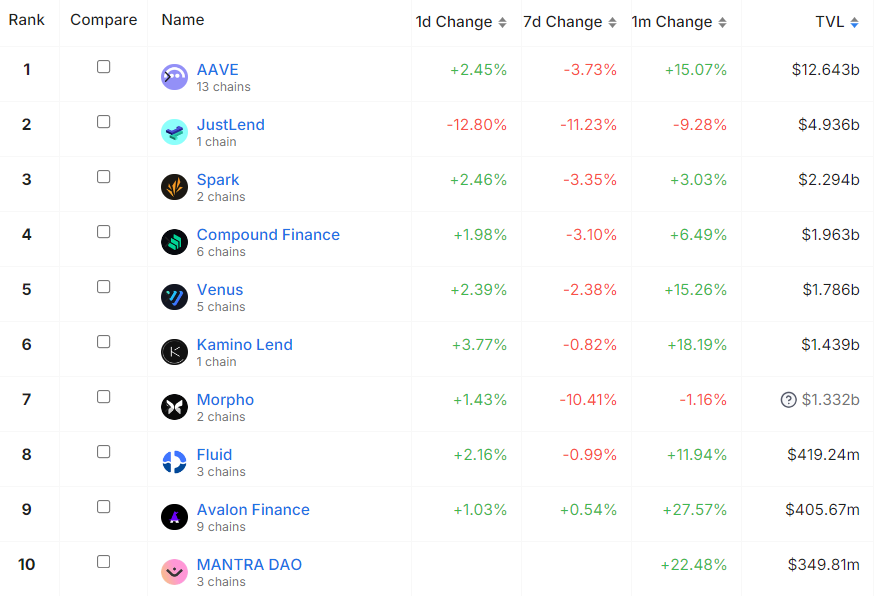

Crypto investment giant Grayscale has launched a new fund that provides exposure to Aave’s AAVE token, marking another addition to the company’s lineup of cryptocurrency products. Aave has become the largest cryptocurrency lending protocol by total value locked (TVL), according to DeFiLlama. At the time of writing, Aave has a TVL of $12.6 billion.

Rayhaneh Sharif-Askary, Grayscale’s head of product and research, stated that the Grayscale Aave Trust enables investors to engage with a protocol that has the potential to transform traditional finance through blockchain technology and smart contracts, thereby optimizing lending and borrowing processes.

This launch follows Grayscale’s recent introduction of the Avalanche Trust, which offers exposure to the AVAX token. The firm now manages over 20 cryptocurrency investment products, a portfolio that has expanded significantly since the launch of spot Bitcoin ETFs in January.

8. Aptos

Aptos is a Layer 1 blockchain launched by a team of former Diem stablecoin engineers. After Meta’s inability to launch its own stablecoin solution, some members of the Diem team used their expertise and new technologies to establish Aptos.

While Aptos was first founded in 2019, it wasn’t until October 2022 that its mainnet went online, thus making Aptos one of the youngest projects on our list. Perhaps thanks to the high pedigree of the Aptos team or the community’s interest in the promised 100,000 TPS claim, the Aptos ecosystem quickly rose through the ranks and became one of the most popular blockchain solutions.

Thanks to its high transactional throughput, Aptos attracted a great deal of interest, primarily from NFT creators and collectors. However, several other decentralized applications found their way to Aptos as well, such as PancakeSwap and Aries Markets, the largest dApp on Aptos in terms of TVL.

Why Aptos?

Aptos has seen remarkable ecosystem growth in the past couple of months. The blockchain recently surpassed 3.6 million monthly active accounts, peaking at 435,000 daily active accounts in mid-September. According to data from TheBlock, the number of active addresses on Aptos more than quintupled in the past 12 months, from 63,000 to 341,000.

The total value locked (TVL) across various decentralized finance (DeFi) protocols on Aptos also saw a tremendous increase in the same time period, having increased from $43 million to $548 million over the past year. According to DeFiLlama, decentralized trading platforms Aries Markets, Amnis Finance, and Thala are the most responsible for the massive TVL growth.

Meanwhile, the Aptos team has recently announced the second version of its programming language, Move 2. According to the team, the new update was “designed to make writing DeFi applications easier.” To achieve that, there are several important updates coming with the new Move version, such as a new compiler, VM, and dev tools.

However, Move 2 is not the only thing in the development pipeline. The team is also working on Raprt, a new consensus with minimal latency, and Block STM v2, a next-gen parallelism processing engine that can scale beyond 256 cores.

9. Solana

Solana is a smart contract platform known for its distinctive architecture, enabling it to handle thousands of transactions per second while maintaining very low costs. It accomplishes this by using a combination of a unique Proof-of-History algorithm and a Proof-of-Stake consensus mechanism. SOL, the native cryptocurrency of the platform, is one of the cheapest to transfer, with users typically paying less than $0.001 per transaction.

Founded in 2018 by Anatoly Yakovenko, Solana’s mainnet went live in March 2020 and experienced a surge in adoption throughout 2021. Despite a significant drop in value during the 2022 bear market, Solana remains one of the most robust ecosystems in the cryptocurrency space and continues to be seen as a potential candidate for significant future growth.

Why Solana?

It’s been an exciting week for Solana, largely due to the Breakpoint conference held in Singapore from September 20 to 21. Several major announcements during the event highlighted that the Solana ecosystem is thriving and will be worth watching closely in the coming weeks and months.

Perhaps the most significant news from the conference was the launch of the Firedancer Solana client prototype on the mainnet. This prototype, called “Frankendancer,” is laying the groundwork for a full Firedancer rollout, which is expected to substantially enhance Solana’s already impressive scalability.

In addition to the “Frankendancer” debut on mainnet, the complete Firedancer client has been deployed on the testnet, marking another important milestone for the project.

Another exciting development for Solana is the announcement from Solana Mobile of a new crypto-friendly smartphone, the Seeker. The Seeker, a successor to the Saga phone introduced in 2023, is slated for release in mid-2025, with 140,000 pre-orders already placed. The phone is currently available for pre-order at $500, but the price is expected to increase in the next phase of pre-orders.

10. Maker

Maker is a decentralized finance protocol on the Ethereum blockchain that issues and manages Dai, a decentralized stablecoin pegged to the US dollar. Users that hold assets that are supported as collateral (for example, ETH) can lock their coins into Maker’s smart contracts in order to issue Dai.

The system is overcollateralized—in order to mint Dai, users need to provide collateral that exceeds the value of minted Dai, and users are required to monitor the value of their collateral in order to avoid liquidation.

The MKR token is used as the governance token for the Maker, a decentralized autonomous organization that oversees the Maker protocol.

Maker was founded in 2014 by Rune Christensen, and the Dai stablecoin was launched in late 2017. Initially, the Maker protocol only supported ETH as collateral. With the launch of Multi-Collateral Dai in 2019, it also became possible to use other forms of collateral. Today, Dai is backed by a diverse range of assets, including ETH, (wrapped) BTC, USDC, USDP, and many others.

Why MakerDAO?

Maker is rebranding to Sky, a move that will see one of the oldest DeFi protocols revamp its products and services offering. Here’s a quick rundown of changes that the rebrand encompasses:

- Maker Protocol is now Sky Protocol.

- MKR token is now SKY token.

- USDS is an upgraded version of the DAI decentralized stablecoin.

- Sky Stars are decentralized projects within the Sky ecosystem that serve as a gateway to the Sky Protocol.

- Sky.Money is a non-custodial and permissionless gateway to the Sky Protocol.

The team has revealed that MKR will be upgraded to SKY on September 18th at a conversion rate of 1:24,000. With the price of MKR currently being around $1,525, a single SKY token should be worth about 6 cents post-upgrade. Meanwhile, USDS will retain its USD peg, meaning that DAI will be exchanged for USDS at a 1:1 ratio. Holders will have the option to voluntarily choose whether to keep their old tokens or exchange them for new ones.

11. Polygon

Polygon, formerly known as Matic Network, is a Layer 2 scaling solution for Ethereum that aims to provide faster and cheaper transactions while maintaining the security and decentralization of the Ethereum network.

Polygon uses a PoS consensus mechanism to validate transactions, which reduces the energy consumption and environmental impact of the network compared to the PoW consensus, which is most prominently used by Bitcoin. By using Polygon, developers can build and deploy dApps with lower fees, faster transaction speeds, and a better user experience.

The native cryptocurrency of Polygon is MATIC, which is used for transactions, staking, and governance on the network. MATIC is an ERC-20 token, meaning it runs on the Ethereum blockchain and can be stored in any wallet that supports ERC-20 tokens.

Polygon has gained popularity in the cryptocurrency industry as a solution to Ethereum’s scalability issues and has been adopted by various dApps, including Aave, Sushiswap, and Curve Finance. The network has also partnered with other blockchain projects, including Polkadot and Chainlink, to enable cross-chain interoperability.

Why Polygon?

The migration of the native MATIC token to the POL token has started, marking the long-awaited technical upgrade of the token. The MATIC token can be converted to POL at a 1:1 ratio. The upgrade will go live on September 4.

If you’re holding MATIC on Polygon PoS, no action from the user is required, as the token migration will be handled automatically. MATIC holders on Ethereum can use the migration tool to manually upgrade their tokens to POL. Meanwhile, centralized exchanges will handle the transition as they see fit, so it’s best to follow their official channels for details.

Here’s what the team wrote about the POL migration in the official post:

“The technical upgrade from MATIC to POL marks a critical juncture for Polygon networks, enhancing utility and aligning with the vision of Polygon as an aggregated network of blockchains. In the initial phase, POL succeeds MATIC as the native gas and staking token for the Polygon PoS network.”

According to Polygon, POL will eventually become the native digital asset for AggLayer, a blockchain system that aims to unite ZK-secured layer 1 and layer 2 chains and foster seamless operations. In their blog post, Polygon has likened AggLayer to the invention of TCP/IP, which created a seamlessly unified Internet. AggLayer’s goal is to do the same for the blockchain space.

12. Shiba Inu

Shiba Inu is a cryptocurrency that was created in August 2020 by an anonymous person or group of people under the pseudonym “Ryoshi”. It is an ERC-20 token on the Ethereum blockchain, which means it is a digital asset that is compatible with the Ethereum network and can be stored in any wallet that supports ERC-20 tokens.

Shiba Inu gained popularity in 2021 after it was listed on several cryptocurrency exchanges and gained attention on social media platforms like Twitter and Reddit. In fact, SHIB’s 2021 run is still one of the most impressive runs in crypto history, as the meme coin gained over 430,000x in a span of the year. It is often compared to Dogecoin, another meme-inspired cryptocurrency, as it features the Shiba Inu dog breed as its mascot.

However, unlike Dogecoin, the project aims to create a decentralized ecosystem for a variety of use cases, including decentralized exchanges, NFTs, and more. The development team has also created a Shiba Inu-themed decentralized exchange called ShibaSwap.

Why Shiba Inu?

LUCIE, the marketing lead behind the Shiba Inu project, has announced the upcoming launch of a decentralized autonomous organization (DAO). “While the DAO hasn’t been fully implemented yet, its introduction will mark a major milestone, giving Shibizens more control over decisions that impact the ecosystem,” she wrote in the post on X.

According to LUCIE, SHIB’s governance under the DAO structure will be handled by the Charity Council and the Culture & Heritage Council, although their specific roles are currently not known. “These councils will steer community initiatives, from charitable outreach to preserving the unique culture that defines Shib,” LUCIE wrote.

Interestingly, the announcement of the new DAO marks exactly one year since the launch of Shibarium, a layer 2 solution for the Shiba Inu ecosystem. In the first year, the protocol processed 418 million transactions, although the number of daily transactions dipped over the past couple of months.

With last year’s launch of Shibarium and the upcoming rollout of the DAO governance, Shiba Inu is rapidly becoming the most versatile community-led decentralized finance (DeFi) ecosystem in the industry.

Best cryptocurrencies to buy at a glance

| Native Asset | Launched In | Description | Market Cap* | |

| ApeCoin | APE | 2022 | A leading NFT and metaverse project | $1.02 bln |

| Bitcoin | BTC | 2009 | A P2P open-source digital currency | $1.25 tln |

| Uniswap | UNI | 2018 | The largest decentralized trading protocol | $4.81 bln |

| Avalanche | AVAX | 2020 | A leading “Ethereum killer” | $11.9 bln |

| Sui | SUI | 2023 | Robust and highly scalable L1 blockchain | $3.59 bln |

| Aptos | APT | 2022 | Highly performant L1 blockchain | $3.95 bln |

| Solana | SOL | 2020 | Smart contracts platform with high speeds and low fees | $67.05 bln |

| Maker | MKR | 2015 | The DeFi protocol behind the Dai stablecoin | $1.48 bln |

| Polygon | MATIC | 2017 | A leading crypto scaling ecosystem | $2.27 bln |

| Ethereum | ETH | 2015 | The leading DeFi and smart contract platform | $318 bln |

| Shiba Inu | SHIB | 2020 | A leading meme coin project | $8.50 bln |

| Aave | AAVE | 2020 | The biggest DeFi lending protocol | $1.05 bln |

Best crypto to buy for beginners

If you are just starting out in crypto, it is advisable to stick to cryptocurrency projects that are less prone to volatility and are generally more established. While this approach does have a downside, as it becomes much more difficult to expect triple-digit or larger gains, the major upside is that you are not exposed to projects that have a chance of failing and, thus, losing your entire investment.

In order to identify projects that are stable and thus feature low volatility, you can start by following the parameters listed below:

- The crypto asset has a market capitalization that places it into the cryptocurrency top 100 (roughly $550 million as of early 2024)

- The crypto asset is available for trading on the best crypto exchange platforms and can be exchanged for fiat currencies

- The crypto asset boasts healthy liquidity ($100M/day and more), which allows you to execute buy and sell orders quickly and without slippage

- The crypto asset is part of a reputable crypto project with clear goals, a realistic roadmap, and products and services that look to address real-world problems

Some of the best cryptos to buy for beginners are those that follow the above criteria and have earned their standing in the crypto market due to robust security, popular products and services, and clear growth potential. Some beginner-friendly crypto investments are:

- Bitcoin

- Ethereum

- Litecoin

- Cardano

- BNB

It is worth noting that cryptocurrency investments are inherently risky, even if you stick to the biggest and most reputable projects. The reason for this is simple – the crypto sector is relatively new, and the landscape might look completely different in the future.

Best crypto for long-term

When deciding which cryptocurrency to buy for the long term, it’s important to consider projects that are well-established, have a strong community, are highly liquid, have a large market cap, and have a clear reason for existing (such as solving a real-life problem, introducing new functionality, etc.). Without these characteristics, a project might fail to survive in the long term, rendering it a bad long-term investment.

It is worth noting that, typically, most long-term crypto investors are looking for projects that have the potential to generate decent returns but also provide a degree of investment stability. Roughly speaking, only the largest cryptocurrencies fit the bill, as others have a low market cap and liquidity that doesn’t bode well for a long-term commitment (unless you’re prepared to take on more risk).

In addition to Bitcoin and Ethereum, there are a number of other cryptocurrencies that fit the criteria of being low-risk, long-term crypto investments.

If you are planning to hold onto your digital assets for a longer period of time, it is best to take care of crypto custody yourself. Holding large amounts of crypto on an exchange can be risky, as we’ve seen over the years with the collapse of high-profile exchanges like Mt. Gox and FTX. Use one of the reputable crypto hardware wallets to store your crypto. Ledger hardware wallets, for instance, allow you to manage your crypto holdings easily and provide a much higher degree of security than crypto exchanges or even software crypto wallets.

Best place to buy crypto

One crucial aspect to consider when choosing which platform to use to buy crypto is the range of cryptocurrencies and trading pairs available. Since different exchanges support varying digital assets, it’s important to choose a platform that accommodates the specific cryptocurrencies you intend to trade.

Additionally, assessing an exchange’s liquidity and trading volume is essential. Higher liquidity generally results in improved price stability and faster trade executions. Furthermore, it is prudent to examine the fees charged by the exchange, encompassing deposit, withdrawal, and trading fees. Comparing fee structures across different exchanges can help you identify the most cost-effective option that aligns with your trading style. With that said, here are some of the best exchanges on the market right now:

- Binance – The best cryptocurrency exchange overall

- KuCoin – The best exchange for altcoin trading

- Kraken – A centralized exchange with the best security

By diligently considering these factors, you can make an informed decision and select a cryptocurrency exchange that meets your requirements for security, variety, liquidity, and affordability.

How we choose the best cryptocurrencies to buy

At CoinCheckup, we provide real-time prices for over 22,000 cryptocurrencies, with the list growing by dozens each day. As you can imagine, making a selection of a dozen top cryptocurrencies to buy out of such an immense dataset can be difficult and will for sure lead to some projects that should be featured being omitted. To minimize the chance of that happening, we follow certain guidelines when trying to identify the best cryptocurrencies to invest in.

Availability

One of the most important factors for any cryptocurrency investment is the crypto asset’s availability, meaning how easy it is to buy and sell it across various cryptocurrency exchanges. We tend to stay away from assets that are not available on major exchanges and require complex procedures to obtain.

Market Capitalization

Another important metric for identifying whether a crypto project is worth covering its market cap. A high market cap means that the project has reached a certain level of adoption from users, making it less risky to invest in.

Growth Potential

While this metric is mostly subjective, it is still an important metric on which we curate our selection. We won’t feature projects that we think are stagnating or have no real upside in the future.

Purpose and Use Case

We consider the purpose and use case of cryptocurrency, particularly in a real-world setting. Some cryptocurrencies focus on specific industries or applications, such as decentralized finance, gaming, or supply chain management.

Team and Development

The team and people involved in the project can tell you a lot about the potential of a particular cryptocurrency project. We examine the team’s experience, expertise, and track record and evaluate the development activity and updates to ensure the project is actively maintained and evolving.

The bottom line: What crypto should you buy right now?

The decision of which crypto to buy now is dependent on your own risk profile and investment goals. For some, investing in a crypto asset with a proven track record like Bitcoin is the only type of exposure to crypto they are willing to take on.

Meanwhile, those with a higher risk tolerance might see Bitcoin as too stable, looking instead toward newer and smaller projects that carry a higher degree of upside.

If you are looking for more investment ideas, check out our crypto price predictions section.