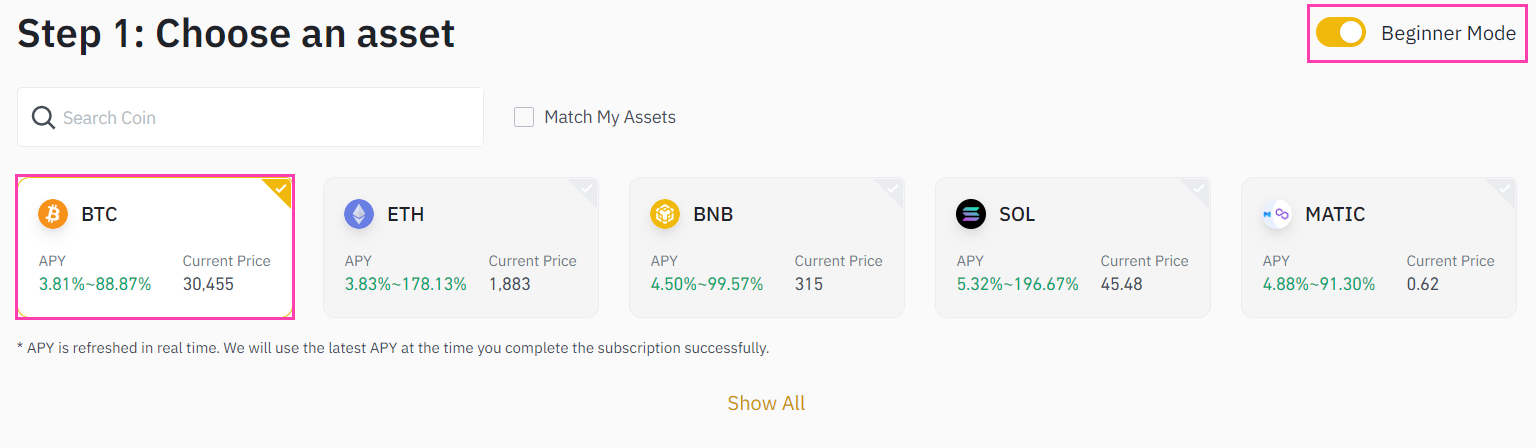

Binance Dual Investment is a unique product offered by the Binance cryptocurrency exchange. It’s designed to give users who want to buy a cryptocurrency at a lower price or sell a cryptocurrency at a higher price the chance to do so—all while earning interest at the same time.

When subscribing to a Dual Investment program on Binance, users have two main options. We’ll use Bitcoin and USDT in our example to help make it clearer.

“Buy Low”: Deposit USDT and use it to buy Bitcoin at the Settlement Date if it reaches the Target Price or lower. The deposit is earning interest in the meantime. If the price is above the Target Price on the Settlement Date, the USDT (plus accrued interest) is returned to the user.

“Sell High”: Deposit Bitcoin and sell it for a stablecoin at the Settlement Date if it reaches the Target Price or higher. The deposit is earning interest in the meantime. If the price is below the Target Price on the Settlement Date, the BTC (plus accrued interest) is returned to the user.

Before we delve deeper into Binance Dual Investment, we should clarify that Dual Investment is not a principal-guaranteed product, and there are risks associated with using it. For example, if your Target Price to buy Bitcoin is set at $30,000 and the market price drops to $29,000 on the Settlement Date, you will be buying BTC at $30,000 instead of the more favorable $29,000 price. The reverse is true if you’re using Dual Investment to sell at a higher price.

Due to the market volatility of cryptocurrencies, it’s possible that the value of your investment when your Dual Investment program ends can be lower than the value of your investment when you subscribe to the Dual Investment program.

Binance Dual Investment explained

Now that we’ve introduced Binance Dual Investment and the risks associated at the product, let’s take a closer look at how the product functions. First, let’s get familiar with five key concepts you will encounter when using the product.

Target Price

When you’re subscribing to a Dual Investment product to either “Buy Low” or “Sell High”, the Target Price refers to the price at which the deposited assets will be bought or sold on the Settlement Date (if the Target Price is reached).

Settlement Date

On the Settlement Date, the deposited assets will either be bought/sold or returned to you. This will depend on the relation between the Target Price and the price of the asset on the Settlement Date.

Please note that once you subscribe to a Binance Dual Investment product, you will not be able to edit or cancel your subscription. You will receive your funds on the Settlement Date—either the invested funds will be returned to you (plus interest), or you will receive the Target Currency.

Deposit Currency

The Deposit Currency is the asset you deposited into a Binance Dual Investment product. If you’re looking to “Buy Low”, you will be depositing stablecoins. If you’re looking to “Sell High”, you will be depositing “standard” crypto assets like Bitcoin, Ethereum or BNB.

Target Currency

The Target Currency is the asset that will be bought/sold automatically on the Settlement Date if the Target Price is reached. This will be a stablecoin if you’re looking to “Sell High”, and a “standard” cryptocurrency if you’re looking to “Buy Low”.

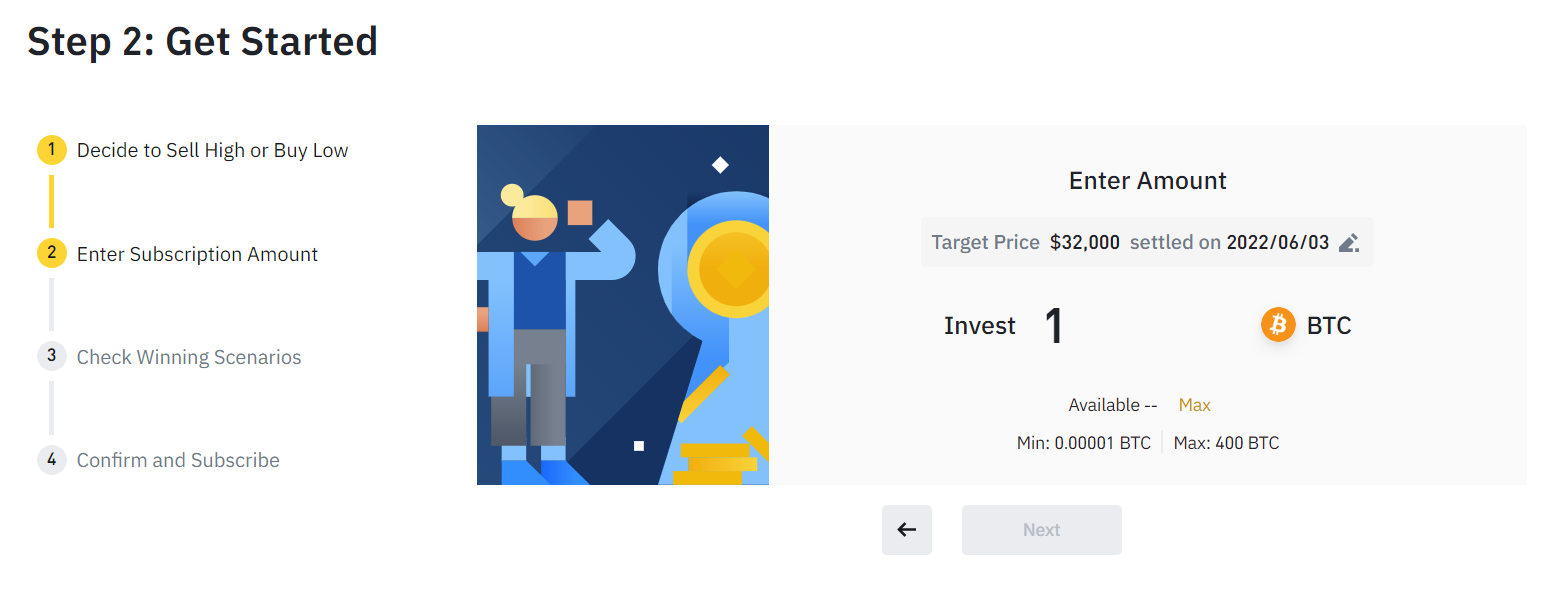

Subscription Amount

The amount that was deposited in the subscription to the Dual Investment product. If the Target Price is reached on the Settlement Date, this will be the amount used to buy or sell the Target Currency.

Dual Investment example and scenarios

Now that we know the most important concepts of the Dual Investment product, we’ll be going through an example of subscribing to Dual Investment and outline some of the possible scenarios that could happen.

In our hypothetical example, we hold Bitcoin and would like to sell if it reaches a higher price. We would also like to earn some interest on our BTC holdings in the meantime, so we choose Binance Dual Investment.

TIP: We selected “Beginner Mode” for our example, which will provide a clearer subscription process that’s suitable for users that don’t have experience with the Dual Investment product.

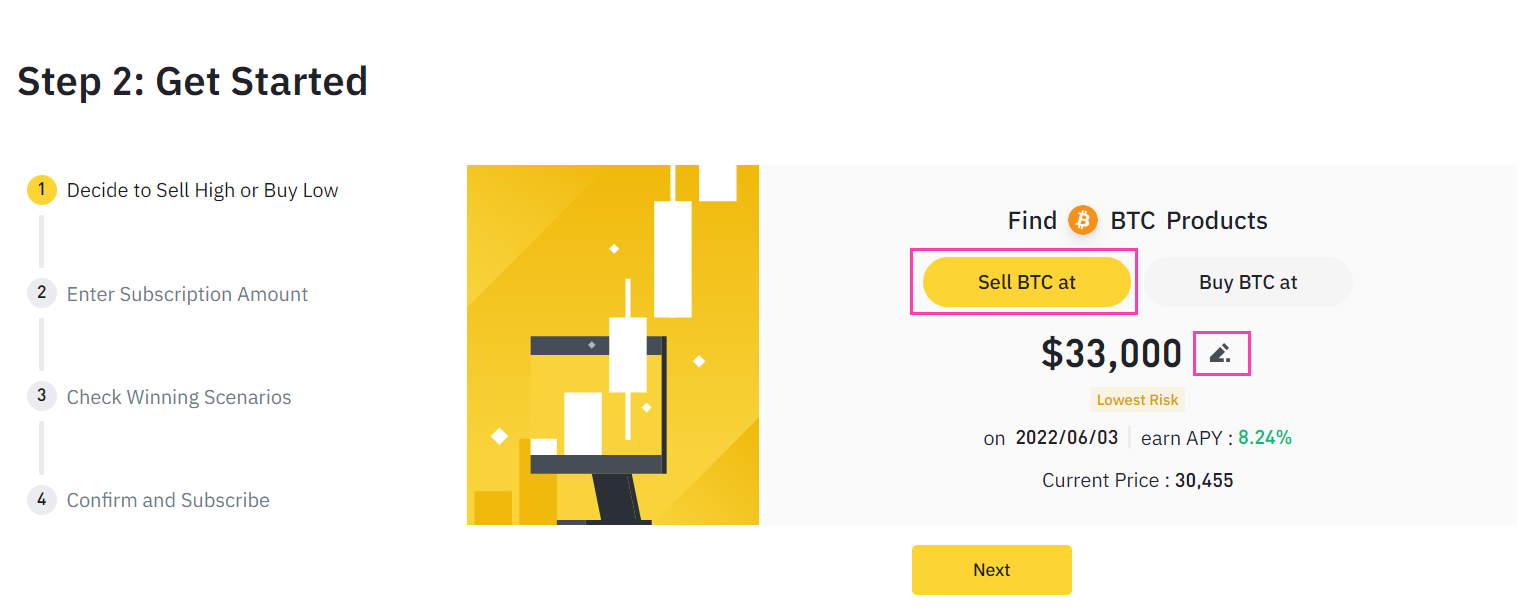

Now, we choose the “Sell BTC” option, since we’re trying to sell our BTC at a higher price.

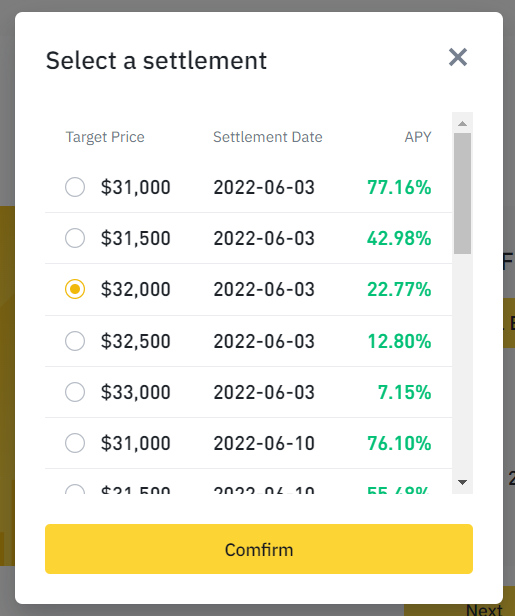

By clicking the pencil icon, we can select between the different Dual Investment plans for BTC that Binance currently has on offer. The three parameters are Target Price, Settlement Date and APY.

The APY that’s offered depends on how close the Target Price is to the current price, how far into the future the Settlement Date is, and other factors. If two products have the same Settlement Date, the one with the Target Price closer to the current price will have a higher APY.

Please note that APY means Annual Percentage Yield. This shows the percentage of your principal that you would earn as interest in a year. The programs offered on Binance Dual Investment typically last a lot less than one year.

Let’s say that it’s May 30, 2022, and the current price of Bitcoin is $30,000. We’ll choose a plan with a Target Price of $32,000, a June 3, 2022 Settlement Date, and an APY of 22.77%.

This is not investment advice. This example is only meant to explain how the Dual Investment product functions.

We’ll deposit 1 BTC into the product.

Let’s check out three hypothetical scenarios that could happen once the Settlement Date comes around.

Scenario 1

On the Settlement Date, the price of Bitcoin is at $31,500, which is below the $32,000 Target Price. The product is not exercised. We receive back our 1 BTC, plus 0,00311 BTC that we earned as interest. This is a better outcome than if we simply held our 1 BTC.

Scenario 2

On the Settlement Date, the price of Bitcoin is at $32,050, which is above our $32,000 Target Price. Our 1 BTC, plus the interest we earned on the BTC, is automatically sold for the BUSD stablecoin at the Target Price.

During the five days that our BTC was deposited, it accumulated 0,00311 BTC in interest, which equals about $99.5 at the Target Price. So, after all is said and done, we get 32,099 BUSD. This is more than we’d get if we simply held our BTC and sold it at $32,050.

Scenario 3

On the Settlement Date, the price of Bitcoin is at $32,200, which is above our $32,000 Target Price. Our 1 BTC, plus the interest we earned on the BTC, is automatically sold for the BUSD stablecoin at the Target Price.

During the five days that our BTC was deposited, it accumulated 0,00311 BTC in interest, which equals about $99.5 at the Target Price. So, after all is said and done, we get 32,099 BUSD. This is less than we’d get if we simply held our BTC and sold it at $32,200.

Why not just use a limit order?

A pretty common question when it comes to the Dual Investment product is:

“If you want to buy or sell a cryptocurrency at a different price than the current price, why not just use a limit order?”

This infographic provided by Binance provides a nice summary of how Dual Investment compares to simply using a limit order on the spot market. From it, you can clearly see that each method has its own advantages and disadvantages—the choice will ultimately depend on what you prioritize.

Recap – the pros and cons of Binance Dual Investment

To sum up, let’s lay out the main advantages and disadvantages of Binance Dual Investment:

Pros:

- The product doesn’t charge any trading fees

- APY can be very high

- Users can choose between many different Target Prices, APYs and Settlement Dates

Cons:

- Deposited funds are locked until the Settlement Date

- Can underperform a simple HODL strategy if the market price significantly deviates from the Target Price

- No trade occurs until the Settlement Date