Cryptocurrency exchanges have achieved a massive degree of popularity as traders are attracted by the prospect of turning the price volatility of crypto assets to their advantage. To satisfy this demand, exchanges are now offering more and more advanced trading features such as margin trading, futures contracts and options.

However, not all cryptocurrency investors want to take on the risks of active trading. Losses from unsuccessful trades can pile on quickly, and shrink the value of your cryptocurrency holdings. Cryptocurrency exchanges like Binance understand that many of their users want to take a more passive approach to their crypto investing journey, and are providing products that allow users to earn yield on their crypto with considerably lower risks.

Binance offers a suite of passive income products under the “Earn” banner. In this article, we’ll mostly be focused on the Flexible Savings and Locked Savings products.

What are Binance’s Savings products?

The Savings products on Binance allow cryptocurrency holders to earn interest on deposited cryptocurrency holdings. The interest is generated from Binance lending the deposited funds to traders who are using leverage, and deploying them in other opportunities as well.

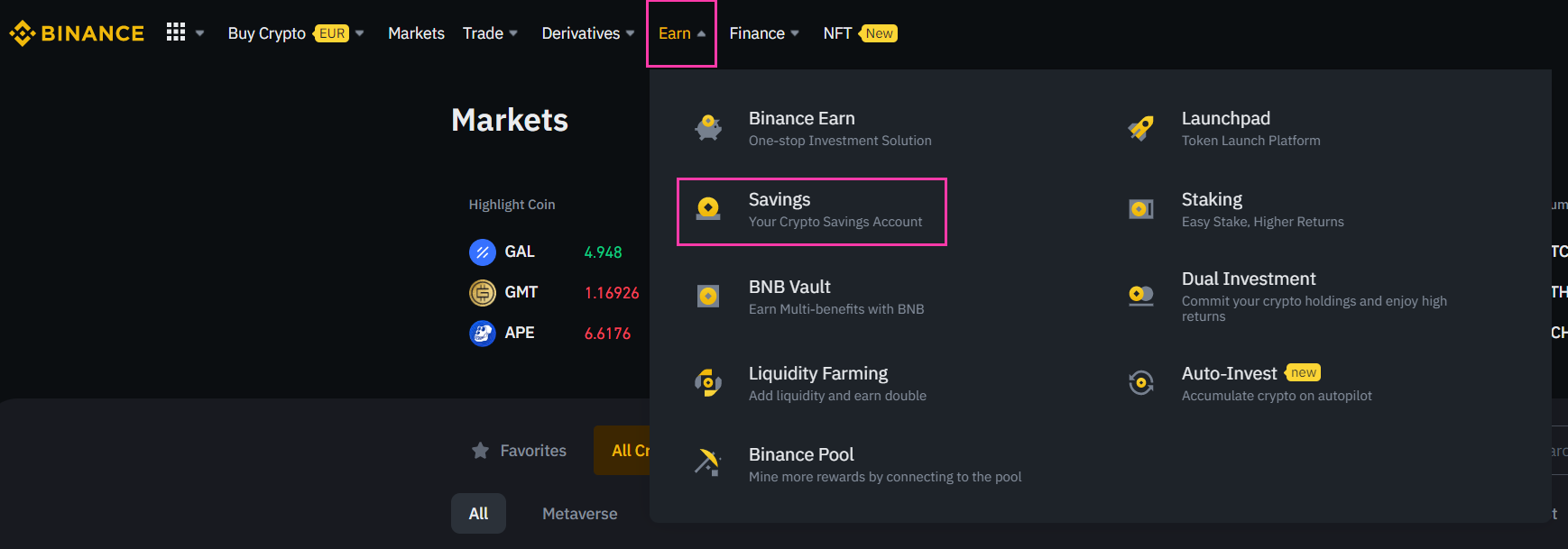

There are two types of Savings products offered by Binance—Flexible Savings and Locked Savings. You can find these products by going to the “Earn” section of the navigation menu, and selecting “Savings”.

Let’s explore what they have to offer and what the main differences between the two products are.

Flexible Savings

You can deposit your cryptocurrency into a Flexible Savings product to earn interest on your holdings. Perhaps the most distinctive feature of Flexible Savings is that you can withdraw your deposited funds at any time you wish.

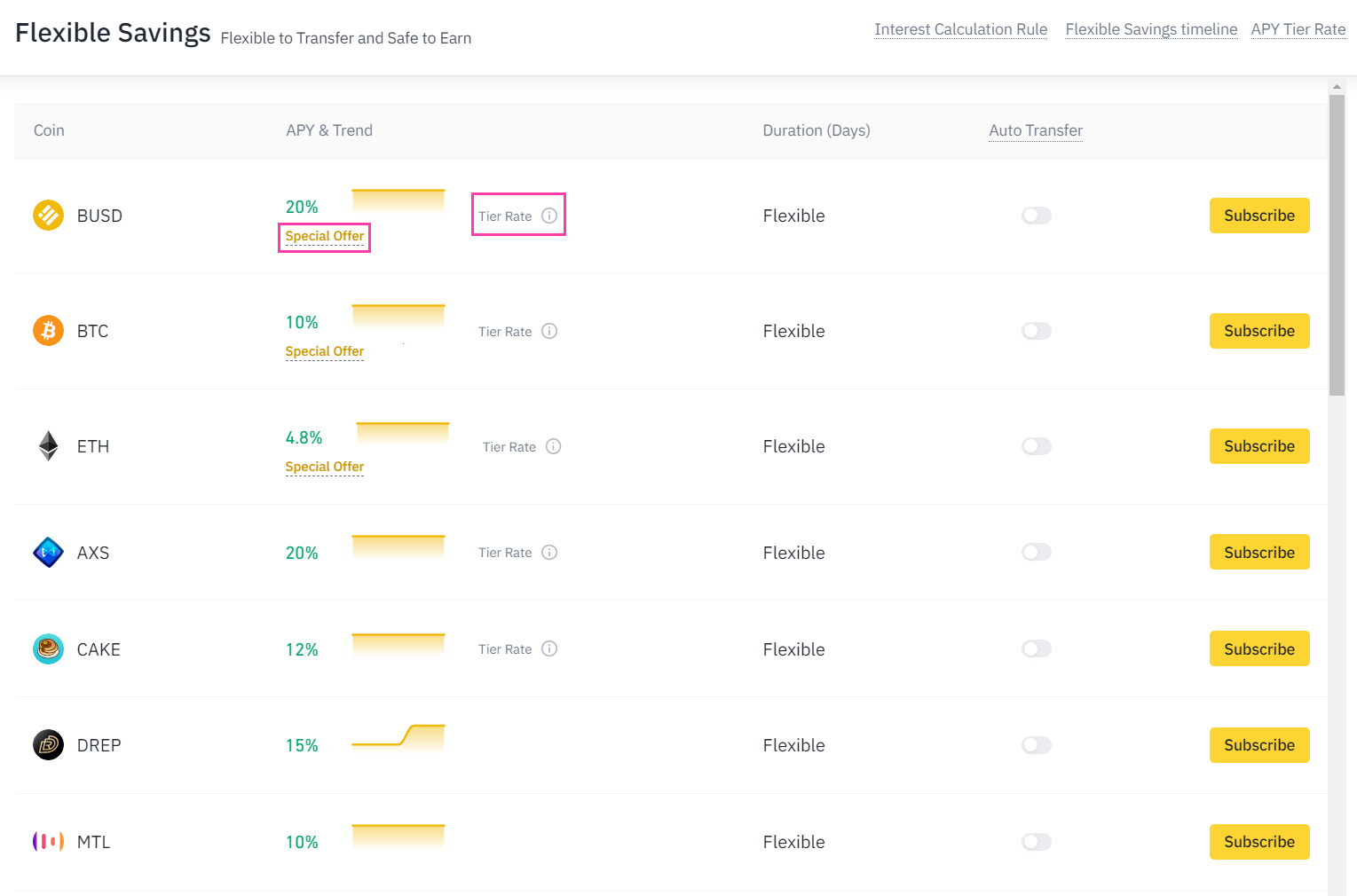

The interest rate you earn will fluctuate based on market demand. Sometimes, Binance holds special promotions where a higher interest rate is offered for specific coins for a limited period of time.

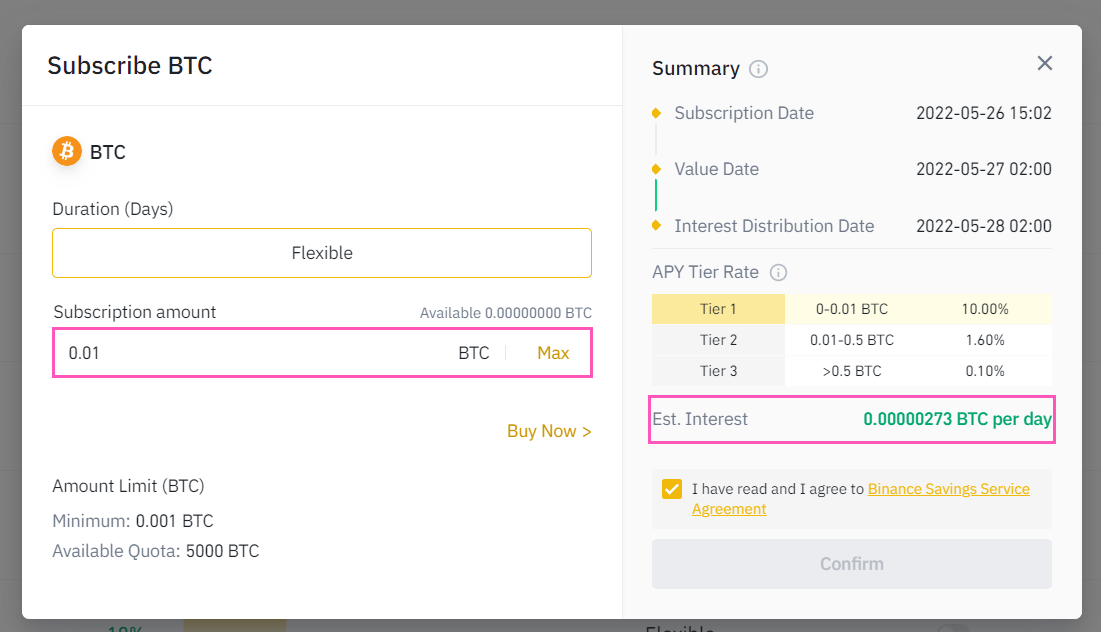

Another thing to keep in mind when it comes to Flexible Savings is that the interest rates for some of the programs are tiered. In practice, this means that smaller deposits will earn a bigger percentage in interest than bigger deposits. These types of programs can be identified through the “Tier Rate” notification.

Binance offers a massive variety of Flexible Savings programs. At the time of writing, it offers Flexible Savings programs for 185 different cryptocurrencies. So, whether you want to earn interest on your Bitcoin, Ethereum, BNB, or a low-market cap altcoin, chances are that you will be able to find the right Flexible Savings product for the job.

After clicking “Subscribe” next to the coin of your choice, you can choose how much you want to deposit into the product. The platform will provide you an estimate of how much you will be earning per day based on the current interest rate.

Here’s a roundup of what Flexible Savings has to offer:

- Earn interest on your cryptocurrency holdings

- Withdraw your coins at any time

- Fluctuating interest rate

- Large selection of supported coins

- Typically pays less than Locked Savings

Locked Savings

When using the Locked Savings products, you lock up your coins for a predetermined period. After the period ends, your coins and the accumulated interest are returned back into your Spot wallet.

Please keep in mind that the interest rates displayed on both Flexible Savings and Locked Savings are annualized. In other words, they tell you how much interest you would have earned if the funds were locked for one year.

In practice, Locked Savings programs last 7 days on the shorter side and 90 days on the longer side. You will be given an estimate in absolute terms of how much you can expect to earn before you commit to a Locked Savings program. If you choose a longer lock-up period, the interest will be higher.

Deposits into the Locked Savings products are denominated in “lots”. One lot can represent a different number of coins, depending on the cryptocurrency you’re looking to deposit.

Here’s a quick summary of what Locked Savings has to offer:

- Earn interest on your cryptocurrency holdings

- Deposited funds are locked for a predetermined period of time

- Fixed interest rate

- Smaller selection of supported coins

- Typically pays better than Flexible Savings

Promotions

Users who are new to Binance Savings can sometimes benefit from special promotions for first-time users. In April 2022, for example, Binance launched a special promotion for new users in which they could earn an APY of 20% on the GMT token for a limited period of time.

Binance also occasionally includes special offers with higher interest rates for selected cryptocurrencies. These promotions only last for a limited period of time, so consider checking out Binance Savings from time to time to see if any good deals are available.

What are the risks of using savings products on Binance?

Even though using Binance’s savings products is much less risky than actively trading via spot markets or derivatives, there’s still no guarantee that you’ll actually make money when all is said and done.

If you deposit a volatile crypto asset into a savings product, the yield you earn might not be enough to offset a price decline in the cryptocurrency you deposited. In other words, it’s possible that even if your holdings of a particular coin grow thanks to using savings products, the dollar value of your holdings could still be down in terms of dollar value compared to where you started.

The other set of risks comes from the fact that in order to use products like Flexible Savings and Locked Savings, you have to deposit your funds to the exchange. While Binance is considered a safe cryptocurrency exchange, you have to keep in mind that when you deposit your crypto to a centralized cryptocurrency exchange, you are giving up control of your private keys until you withdraw the crypto back to your own external wallet.

However, if you’re already holding a cryptocurrency on Binance and don’t intend to sell it in the short term, you assume practically no additional risks by putting it into a Flexible Savings program. There’s a slightly higher risk when it comes to Locked Savings due to the lock-up period.

Summing up

Binance Savings provides some very welcome benefits for users while keeping risks minimal. This is especially true for Flexible Savings, which has almost no downside since funds can be withdrawn at any time. Locked Savings provides higher interest, but comes with some extra limitations and supports a smaller amount of coins.

For traders who are comfortable with the underlying price volatility of the crypto assets they hold, Binance Savings is a great way to grow the size of their holdings passively. Of course, the upside is smaller than what can be achieved through active trading, but there’s also much less risk involved.