Dollar-cost averaging (DCA) is one of the most popular and lucrative investment strategies both in traditional financial markets and in the cryptocurrency space. It allows investors to diminish the effects of short-term volatility by making purchases at fixed time intervals, making it easier to focus on the long-term and ignore day-to-day market fluctuations. Binance Auto-Invest provides one of the easiest ways to implement the DCA strategy in crypto.

What is Auto-Invest?

Binance’s Auto-Invest is a part of the exchange’s Earn suite of products and services that are designed to give users the ability to grow their exposure to crypto and generate passive income sources with minimum risk. Binance users can utilize Binance USD (BUSD) and Tether (USDT) funds to set up automated recurring buys of 18 crypto assets at daily, weekly, bi-weekly, or monthly time intervals.

The list of digital currencies that can be bought at specified time intervals through Auto-invest includes*:

*The list of supported cryptocurrencies is subject to change. Visit Binance for an up-to-date list.

Auto-Invest launched in late 2021 as a crypto-to-crypto counterpart to fiat-oriented Binance Recurring Buy. To learn more about how to set up recurring fiat purchases to buy Bitcoin and other digital assets, check the article linked below.

Binance Recurring Buy – A Simple Way to Invest in Bitcoin on Monthly Basis

What is Portfolio Plan?

Portfolio Plan is the core feature of the Binance Auto-Invest service. In essence, it allows users to set up recurring cryptocurrency purchases at their preferred time intervals. However, that is far from the whole story as Binance’s offering provides a variety of customization options for a high degree of investment flexibility.

With Portfolio Plan, cryptocurrency investors can assign different weightings to different digital currencies. For example, you can set up an automated plan that triggers once every month and buys Bitcoin and BNB in a 50/50 split with the before assigned amount of BUSD or USDT funds.

Moreover, Binance allows users to set up multiple Portfolio Plans, with each consisting of up to 10 different cryptocurrencies. The minimum amount of funds you can invest in a single Portfolio Plan is 10 BUSD (or USDT equivalent).

Another benefit of Binance Auto-Invest is the integration with the company’s Savings product suite, which lets users take advantage of Flexible Savings options within the confines of each individual Portfolio Plan. It is worth pointing out that BNB bought via Auto-Invest is directly deposited into BNB Vault, where it accrues daily interest, whereas other digital currencies are deposited into their respective flexible saving accounts.

How to buy multiple cryptocurrencies with Portfolio Plan?

Buying digital assets in the spot market can be a bit intimidating for cryptocurrency newcomers due to the complexity of the trading interface and numerous advanced order options. Binance Auto-Invest, on the other hand, makes the buying process a breeze thanks to a highly intuitive and easy-to-use interface.

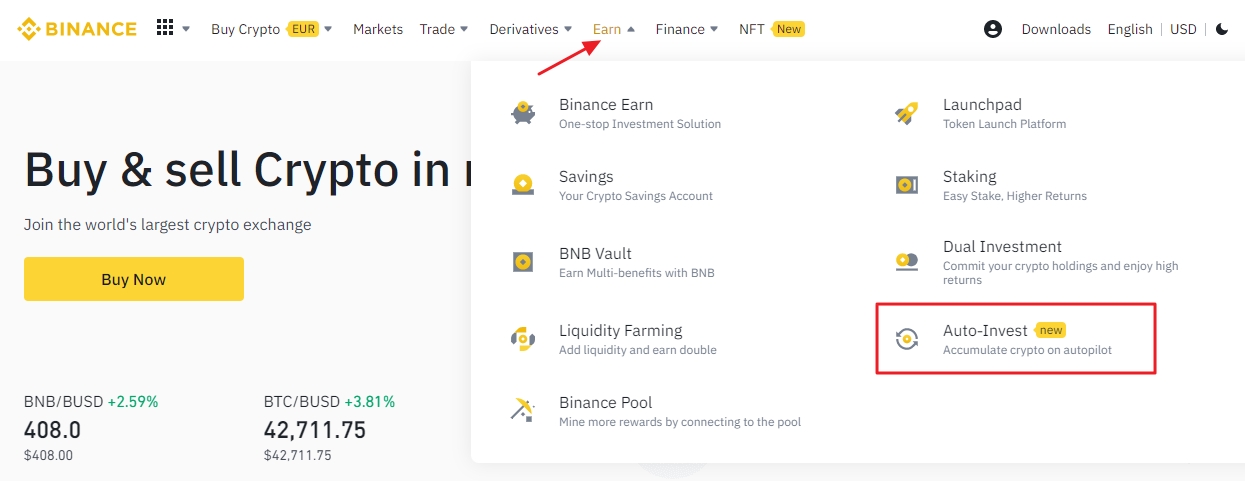

The Auto-Invest product can be accessed from the Earn drop-down menu on the Binance homepage.

To use Binance Auto-Invest and its Portfolio Plan feature, you must first register an account on Binance and provide the required KYC information. Click on the button below to create your first Auto-Invest plan.

A step-by-step guide to Binance Auto-Invest

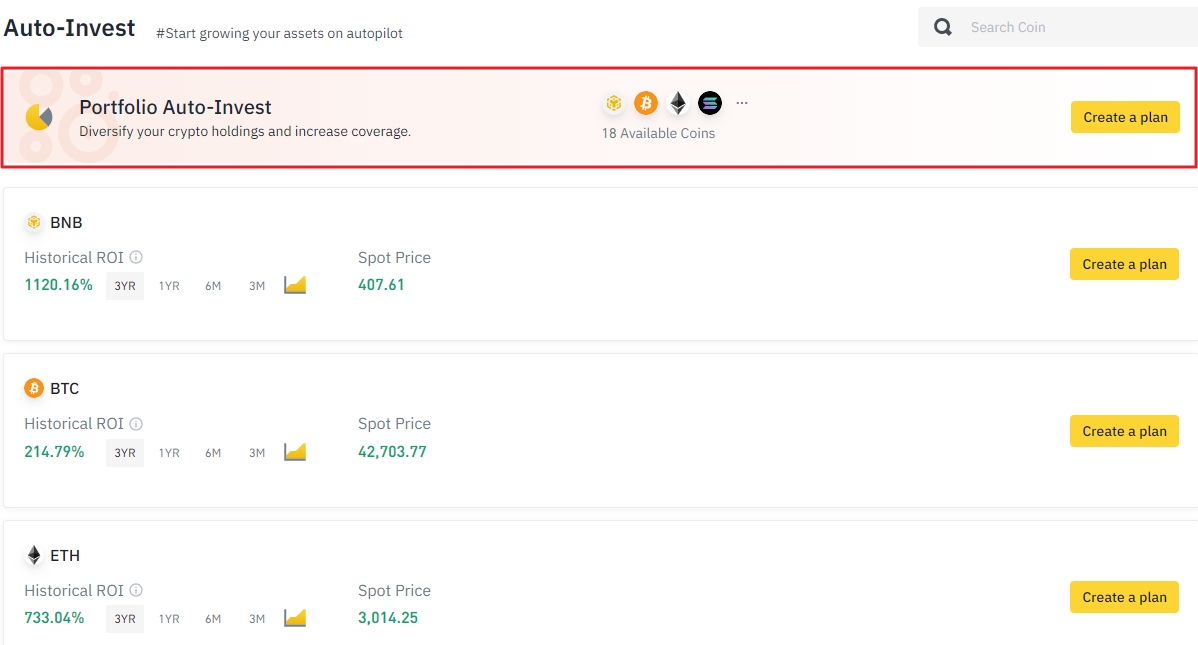

Step 1: The Auto-Invest menu offers immediate access to 18 of the most popular digital currencies and corresponding customizable single-coin investment plans. We’ll cover the multiple-coin Portfolio Plan in our guide. It is worth noting that the process between single and multiple-coin Plans is very similar. Click on “Create a plan” to start.

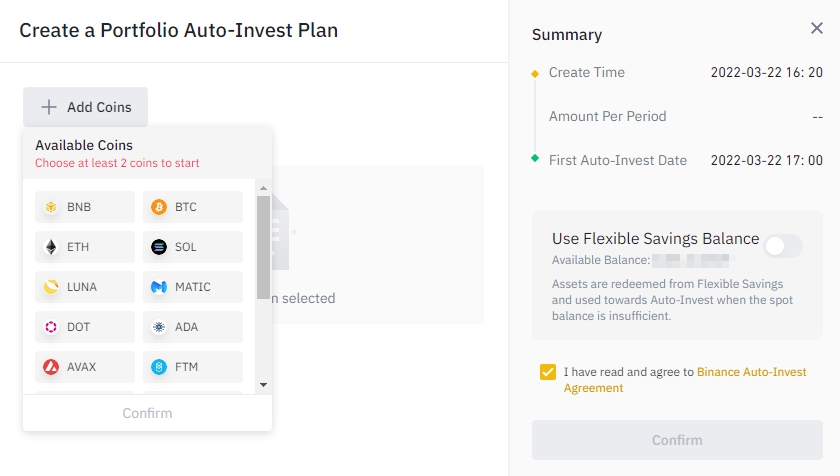

Step 2: You must choose at least 2 coins to create a Portfolio Plan. However, you can select up to 10 different currencies if you prefer more diversity.

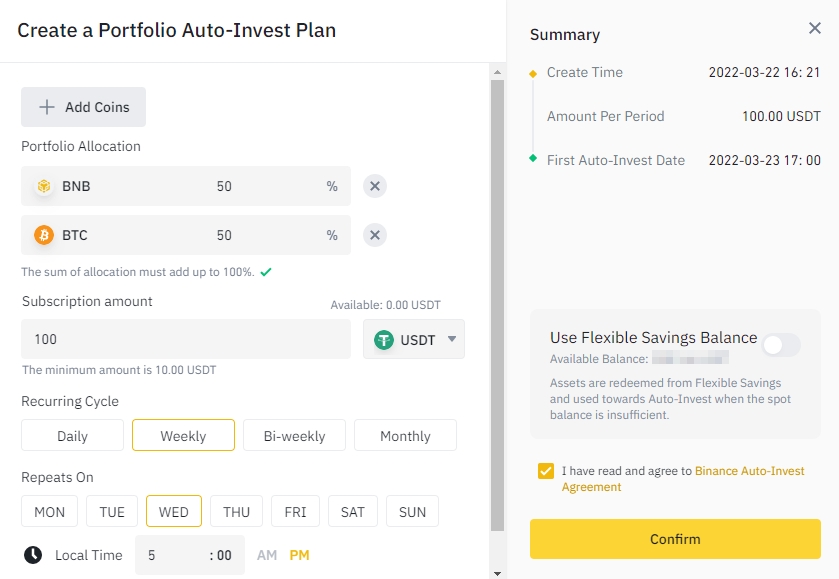

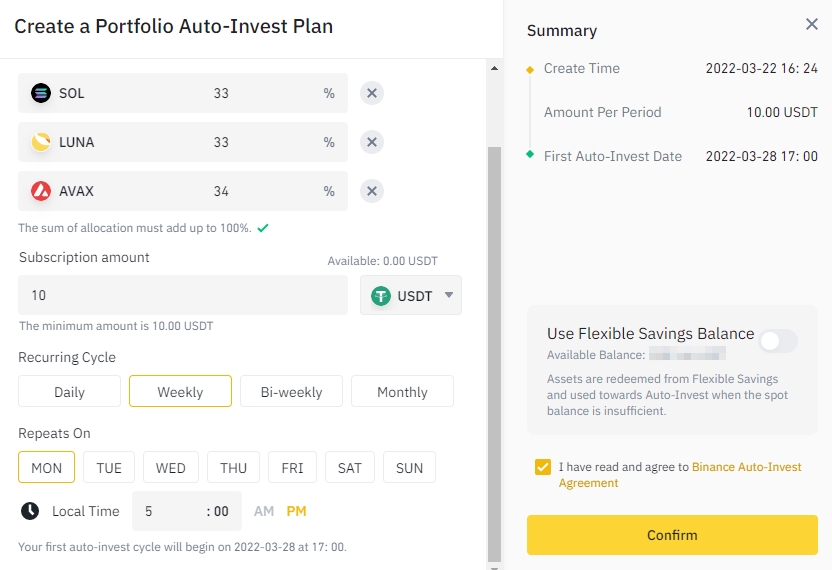

Step 3: We’ve decided to pick BNB and Bitcoin in our example and allocated 50% of our recurrent investment to both currencies. As you can see from the image below, we’ll be investing 100 USDT every week at 5 PM local time. If you want, you can use your Flexible Saving balance to complement your spot funds when making scheduled buys. Click “Confirm” to create the Plan.

That’s it, our BNB-BTC Auto-Invest plan has been successfully created. As mentioned above, you can choose to add more than 2 cryptocurrencies to a single plan. Not only that, there is no maximum limit to the number of Auto-Invest plans you can subscribe to. In our next example, we’ll create a DeFi-focused portfolio consisting of roughly equal allocations of Avalanche, Terra, and Solana.

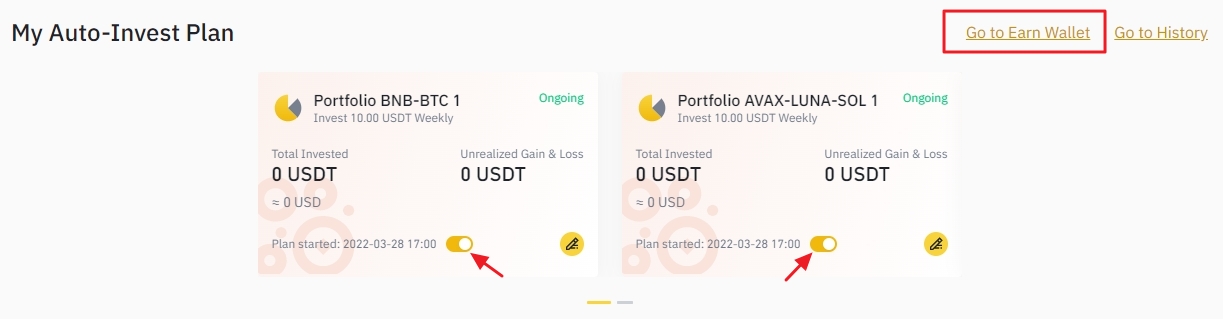

With the two plans open, let’s take a look at how to manage open Auto-Invest plans and how to keep on top of our profits and losses.

Managing opened Portfolio Plans

Users can easily pause and resume their active Portfolio Plans directly from the Auto-Invest dashboard thanks to a small toggle located at the bottom of each active Plan. Additional management tools and an overview of each Plan’s financial performance are available in the “Earn Wallet” under the “Auto-Invest” tab.

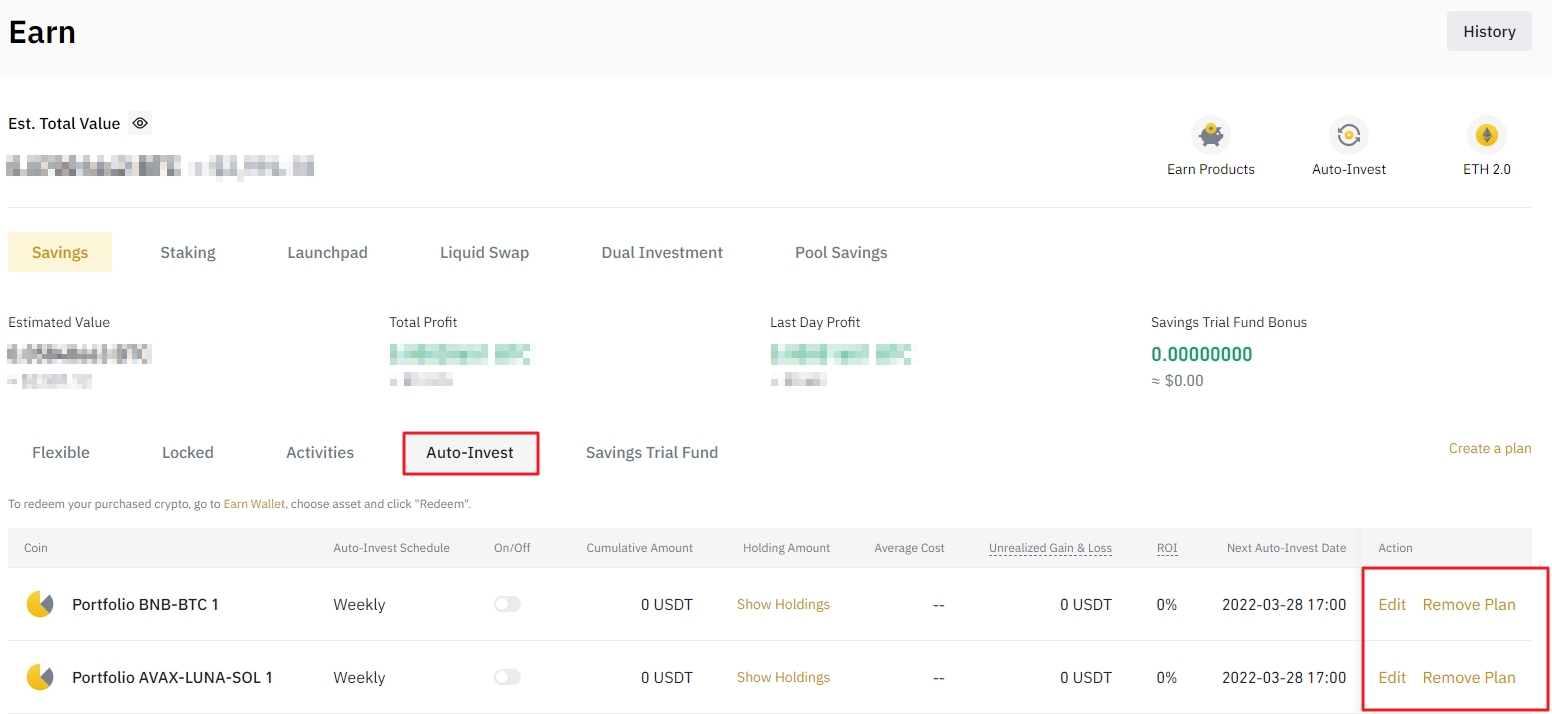

The Earn Wallet section can be accessed directly from the Binance homepage, or through the link located above the active Auto-Invest plans. Once in the Earn Wallet, you can quickly see the Profit and Loss of each active Plan as well as the corresponding return on investment (ROI) each plan has generated.

To customize or terminate a subscription, click on either the “Edit” or “Remove Plan” option located on the right side of the screen. From the menu, you can customize active plans by changing the coins’ weightings, adding new assets to a plan, changing the plan’s schedule, and more.

It is worth noting that while Plans can be paused directly from the Auto-Invest dashboard, they can only be removed through the Earn Wallet menu.

Final thoughts

Binance Auto-Invest allows investors to execute dollar-cost averaging strategies using BUSD and USDT to buy Bitcoin and other digital assets with minimum effort and high precision thanks to a plethora of portfolio customization options. Also, the direct integration with Binance’s suite of savings solutions lets users automatically generate passive income with their deposited funds, which makes Binance’s offering all the more attractive to cryptocurrency investors.