As they say, every beginning is difficult, but in this article, we share with you some useful tips that will make your entry into the world of cryptocurrency smoother. Following these pieces of advice, you are more likely to avoid the most common beginner mistakes and become a confident cryptocurrency investor in no time. Since we learn best by doing it, we recommend the hands-on approach.

Begin at the beginning: Purchasing some Bitcoin is arguably the best bet

While the general rule is not to invest more that you can afford to lose in high-risk assets, which crypto naturally is, we advise that you start even smaller by investing just a tiny portion of your free capital. Absolutely no need to go to extremes, few tens or hundreds of USD or EUR will be enough to begin with. The purpose of your first purchase should be familiarizing yourself with basic concepts and tools, not necessarily turning in a huge profit!

There are currently more than 5,000 different cryptocurrencies, so picking the right one for your first investment can be a hard task. Although opinions differ, we believe that becoming the owner of some of the world’s first cryptocurrency – Bitcoin, is the safest way to dive in, since Bitcoin (BTC) has been around since 2009 and has the most advanced infrastructure. There are many ways of obtaining Bitcoin, so you have the freedom to pick up the one it suits you the most.

Determine the place where you will buy your Bitcoin

If you would like to make an online purchase, there are cryptocurrency exchanges that act as a fiat-crypto outlets, such as he Binance, Coinbase, OKEx and eToro. For this you will only have to create an account and follow their registration procedure. An identification will be necessary to confirm your account. An alternative for urban people are Bitcoin ATMs. You introduce some fiat currency and scan your mobile wallet QR code in order to receive the purchased Bitcoins. But beware, acquisition of BTC at a Bitcoin ATM tends to be associated with very high fees.

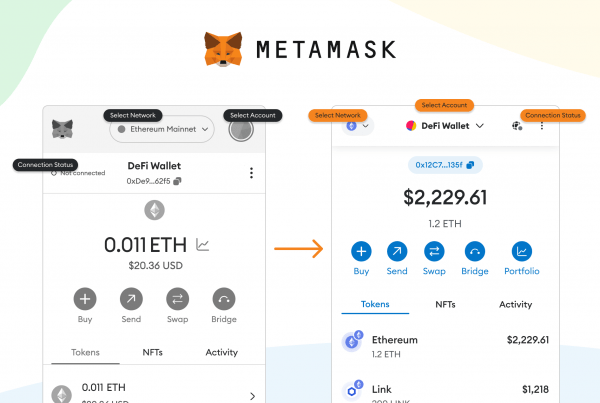

Download a wallet

Once you buy Bitcoin, your digital asset will need to be kept in a place. While some exchanges offer integrated online wallets, you should never keep large sums of cryptocurrency in there. There is a saying within the community that goes along the lines: “Not your keys, not your crypto”, implying that as long as you are not the one in possession of the private wallet keys, you are technically not the owner of the coins kept in the said wallet. For less experienced a good choice is Bread mobile wallet or the Exodus desktop wallet, which are both simple to operate. As you make bigger investments into crypto, it is recommended that you get a hardware crypto wallet, such as Ledger or Trezor to enhance the security of your crypto holdings.

Your second, third and later investments

As you may have heard cryptocurrencies tend to be very volatile. It is frequently that cryptocurrencies, especially those with smaller market capitalizations, surge up or plunge down by 50% or even more in less than a day. If you would like to diminish the effect of these fluctuations in the price of crypto, we recommend using the dollar cost averaging strategy. This method is best described by investing on a regular basis independent on the crypto’s price at the time; for instance, investing $100 into Bitcoin every month.

Additionally, it is not recommended that you put all your money into just one cryptocurrency. You should diversify in order to build a dispersed and balanced portfolio. In order to do so, you will need to steer away from isolated Bitcoin investments and turn to other cryptocurrencies.

Look at other options: Purchasing some Altcoins

There are plenty other cryptocurrencies you can buy. As we already mentioned before, more than0 5,000 cryptocurrencies have been launched since the release of Bitcoin to the public in January 2009, the majority of which saw only average success. For all cryptocurrencies, which are not Bitcoin, we use the term altcoins. The total valuation of their markets (i.e. total market capitalization) may differ from billions of dollars to considerably smaller. This are some of the most popular altcoins:

- Ethereum (ETH)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Binance Coin (BNB)

- ChainLink (LINK)

- Maker (MKR)

- Uniswap (UNI)

Since the prices of the altcoins are prone to even greater fluctuations, they are usually seen as a riskier investment compared to Bitcoin. To determine which altcoin suits you the most, you will need to do your own research. Our weekly article Top three coins to watch this week might aid you in narrowing down the selection. In addition, we recommend reading our Beginner’s Guide to Cryptocurrency Research. We also recommend following the news that might influence the price of these assets, if big money is involved.

Stay Up to Date by Following reliable News Sources

Staying up-to-date is crucial in the cryptocurrency, where things alter every day. Some of the most popular outlets for crypto related news include Coindesk, Cointelegraph and CoinCodex news page. You can also subscribe to some of the numerous channels relevant to the cryptocurrency and follow your favourite commentators on social media sites like Twitter and Reddit.

Once you become more invested into a project, we recommend following their official blog page and other social media sites. Checking the coin’s social stats is a good indicator of the project’s ability to grow a community and reach even more people. On CoinCheckup, you can see the community size in the Analysis tab for each of the coins under the Brand awareness/Buzz section.

When holding gets boring, you can start trading

Even though the “buy and hold” strategy is the one that the majority will follow, since with active trading you can rapidly generate losses, trading is still appealing to many cryptocurrency investors. Once you came to the stage when just holding crypto doesn’t give you enough thrill anymore, you can start investigating advanced trading options. Binance is the most popular centralized exchange for trading cryptocurrency. Exchanges can offer spot trading cryptocurrency derivatives trading, or both.

Crypto derivates provide more options and lower fees, so they are becoming increasingly popular. Some platforms also provide crypto leveraged trading, which allows you to turn in a profit on the slightest price movements. But watch out, as every rose has its thorns, leverage trading is associate with extremely high risks, as the price can also go the other way you predicted.

Conclusion

Cryptocurrencies emerged as an important alternative to conventional investment products. The cryptocurrency markets are still very young, so the regulations around them and technical characteristics are still changing fast. However, this also means that there are still plenty of good investment opportunities within the space. You can go for the short time or long-term investments; you are free to explore and find your own way to success. That probably will not go without wrong decisions, missed chances and insecurity, but you know, if there is no pain, there is no gain. Most important is, that you will enjoy the process, and you will become a pro in cryptocurrencies in no time.