Key takeaways

- Binance Research has reported that cryptocurrencies have attracted more institutional interest in Q3 2023, despite the global crypto market cap falling -8.6% QoQ

- DeFi TVL dropped in Q3 and total NFT sales continued to fall, while GameFi development remained relatively constant

- Overall, Q3 was a risk-off market for investors as TradFi rates rose, while institutions grew increasingly bullish following more clarity provided by regulators in the United States

Binance’s Market Pulse reveals key performance metrics for the global crypto market

Binance Research has released its Market Pulse report, revealing key statistics that shed more light on the state of the crypto markets.

The global crypto market capitalization fell -8.6% in Q3, which may have been driven by the continuation of the Federal Reserve’s high-interest rate policy. While the total market cap has dropped, crypto adoption among institutional investors has picked up — Deustche Bank, PayPal, Grab, and Sony each revealed fresh Web3 initiatives.

Bitcoin (BTC) market cap, which currently represents 52.31% of the global market capitalization, was buoyed by bullish news regarding several ETF applications at the beginning of the quarter and Grayscale’s legal victory.

Other strong performances included XRP, Solana (SOL) and Toncoin (TON). XRP surged following the effective conclusion of its 3-year court case against the Securities and Exchange Commission (SEC), Solana benefited from its new partnerships with Visa and Shopify, while TON gained steam following the integration of TONWallet with Telegram.

Binance Research noted that these rallies have helped to improve the global crypto market capitalization during a period of relative stagnation for the wider industry.

Global crypto market capitalization fell -8.6% QoQ

Project fundraising reaches new lows while total active developers also declines

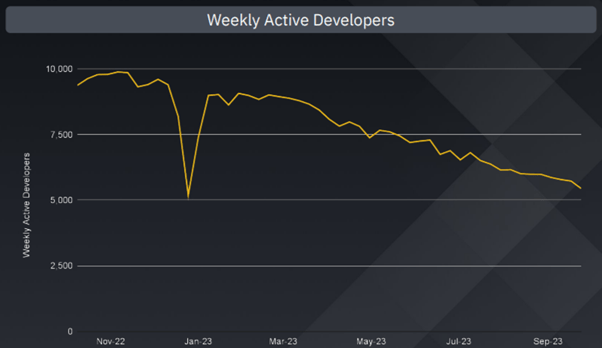

Overall, developer activity has dropped over the course of the year, with a decline that initially began back in January. In Q3, the number of weekly active developers dropped to a yearly low. Some projects, however, saw a major increase in active developers — Chainlink, for example, saw a 363% increase to weekly active developers.

Fundraising, on the other hand, reached its lowest point since Q4 2020. The total amount raised was $1.725bn, down -21% QoQ. September also recorded the lowest amount raised out of any month in the past year, recording $505.7m across the industry.

The decline in fundraising and developer activity may indicate that there is a lower level of project launches market wide. Infrastructure projects were the most heavily invested during Q3, but overall infrastructure saw a decline. GameFi and DeFi investment rose, while NFTs and CeFi projects raised less funds than in Q2.

The number of weekly active developers has been in a consistent downtrend since the beginning of the year

On-chain activity falters with some notable exceptions

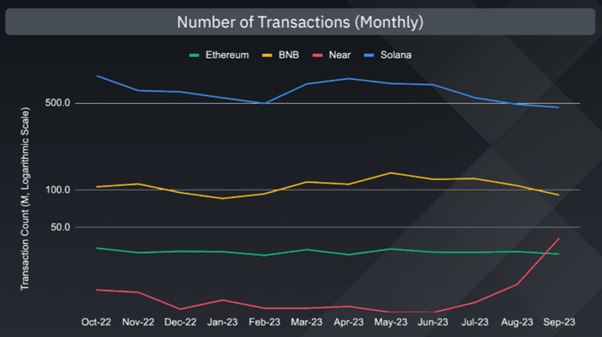

The number of active wallet address on Layer-1 blockchains fell in Q3, indicating that there are fewer total users in Web3 than earlier in the year. BNB Chain saw the biggest drop-off in activity when measuring active wallets, while NEAR saw a major spike in August and September.

NEAR also recorded a +120% increase to the total number of transactions on its Layer-1 chain in Q3, and even overtook Ethereum for total transactions in September. Ethereum’s total number of transactions has remained relatively constant throughout the year, while Solana saw the biggest drop-off in Q3.

Total number of transactions for selected layer-1 blockchains

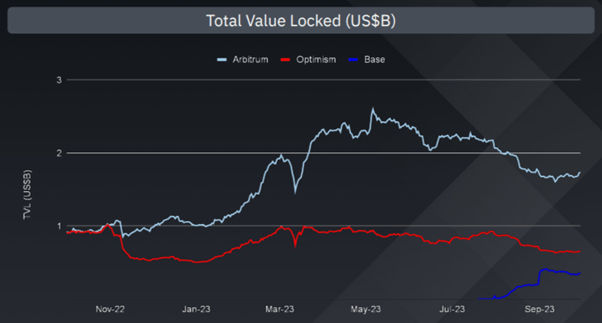

For Layer-2 blockchains, Base’s mainnet launch in August meant that it was the highest-gaining chain in terms of activity. Base now has approximately as many active wallets as Optimism, despite its total value locked (TVL) remaining someway below both Optimism and Arbitrum at this moment in time.

Optimism and Arbitrum both saw a decline in TVL in Q3, with Arbitrum seeing a slight uptick in September after a consistent slide through July and August. TVL for Optimism, meanwhile, remained relatively constant throughout the quarter. Both Optimism and Arbitrum have seen positive inflows to TVL year-to-date.

Total value locked for selected layer-2 blockchains

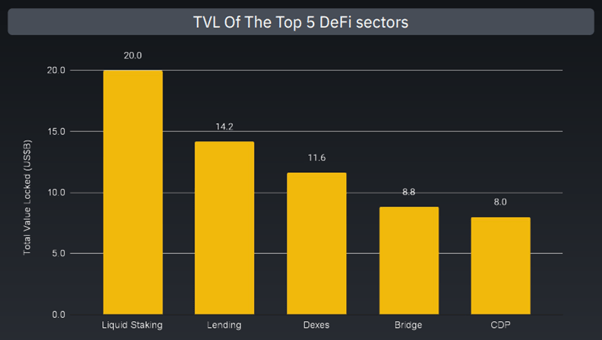

DeFi: Liquid Staking remains top while lending protocols overtake DEXs

Liquid staking remains the top DeFi sector when measuring TVL. Platforms such as Lido and Rocket Pool benefited from Ethereum’s Shanghai upgrade, as long-term Ethereum validators could now unstake their ETH.

Liquid staking unlocks liquidity while still providing yield, and has therefore become a popular option for Ethereum stakers. However, Lido is approaching the 33% cap for total number of ETH staked in the proof-of-stake consensus mechanism, which has led to increased concerns over the level of centralization for the Ethereum blockchain.

Lending protocols overtook DEXs as the second-biggest DeFi sector by TVL in Q3. Lending rose by 1.3% QoQ, while DEXs saw a 24.6% decline with Velodrome and Balancer contributing to the drop.

Overall, DeFi TVL dropped -13.1% QoQ. This may have been driven by rising rates for US government bonds, as the rates rose higher than can be found in leading DeFi platforms. Another contributing factor may have been the risk-off environment for crypto investing more broadly speaking, owing to the slowdown in positive price action from Q1 and Q2.

Top 5 DeFi sectors by total value locked (TVL)

NFT sales dropped, GameFi given room to grow

The total number of quarterly NFT sales dropped to its 3-year low in Q3. NFT sales have been on a consistent downtrend since February, which is partly due to falling floor prices for NFTs themselves and partly due to the value of ETH being marginally down since February.

The Ethereum blockchain still dominates NFT market share, with more than 50% of the total number of NFTs being traded on Ethereum-based marketplaces. Ethereum also increased its market share for NFT trading in Q3, with Solana, BNB Chain, ImmutableX, and Flow also gaining share over every other blockchain.

NFT sales by month, October 2022 — September 2023

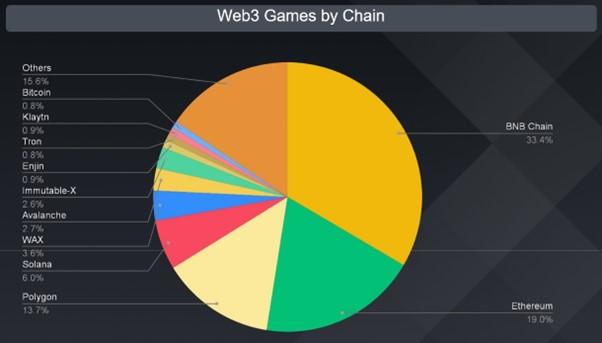

Binance Research stated that GameFi remains in its early stages of development as a sector of blockchain technology. The total number of gaming platforms that entered into their Alpha or Beta stage of development saw a marginal increase QoQ, but the sector also saw more cancelled games than in Q2.

In July, Google changed its advertising policy to enable GameFi platforms to promote themselves as long as the platforms contain certain characteristics. Among those characteristics include the promotion of NFTs as in-game assets, with Google still voicing concerns over the promotion of native cryptocurrencies or gambling products.

It is thought that Google lifting its embargo on GameFi advertising could encourage broader adoption of the sector while also helping existing projects to expand their user base. Web3 gaming is still predominantly based on web browsers, but there was a notable increase of 5.6% QoQ for mobile-based titles.

Web3 games by status, showing the percentage of total projects in different stages of their development

Bottom line: Price appreciation slows and institutional interest grows

The Q3 market report from Binance Research revealed some important developments for the wider crypto industry. Prices dropped QoQ which led to a decline in the global market cap, but there was a marked increase to institutional interest in the sector during the same time frame.

Grayscale and XRP achieved major successes in their long-term legal battles, helping to provide more regulatory clarity for investors and businesses alike. Other major success stories include Google lifting its embargo on advertising restrictions for GameFi after it had previously banned all crypto advertising back in 2017.

While there has been a reduction in total funds raised and total active developers, these statistics also reached their lowest point in Q4 2020 shortly before a major period of price appreciation took place for the crypto markets, and fundraising regularly reaches highs during more euphoric market conditions.

Heightened institutional interest can be seen as the defining story from the market research report. The SEC lost its court case against XRP and Grayscale, and received applications from several leading financial institutions seeking to gain approval for cryptocurrency ETFs. This shows that there has been a shift in investor sentiment following fresh regulatory clarity.