Binance Futures is an industry-leading futures trading platform, thanks to an expansive catalog of supported digital assets, high liquidity, and a wide range of features. One of the most interesting and potentially lucrative features of the Binance Futures platform–the so-called Multi-Assets mode–allows traders to share margin across USDT- and BUSD-margined contracts to lower their risk exposure and take advantage of trading fee discounts.

What is Multi-Assets Mode? Trade USDⓈ-M Futures across multiple margin assets

Multi-Assets Mode is a trading feature that lets traders pursue lucrative investment opportunities in the futures marketplace using Tether (USDT) or Binance USD (BUSD) as collateral. Sharing liquidity and margin across USDT- and BUSD-margined futures contracts gives Binance users more versatility when trading derivatives and allows them to more efficiently weather highly volatile market conditions.

Before the Multi-Assets trading features went live in 2021, Binance USDⓈ-M futures traders had to choose between supplying their collateral in either USDT or BUSD, which forced users to manage their positions margined with each respective stablecoin separately. In practice, this meant that profits made on the BTC/USDT contract, for instance, had to be withdrawn, converted to BUSD, and then used to offset potential losses accrued in BUSD-margined positions.

With Multi-Assets Mode available, traders no longer have to swap between USDT and BUSD to manage different stablecoin-collateralized USDⓈ-M Futures positions. In addition, profits made in a BTC/USDT futures position are automatically used as a margin to hedge against the losing position – for example, used to offset losses accrued in an ETH/BUSD position. This allows traders to more easily maintain margin requirements and lowers the overall potential for capitulations.

Presently, the Multi-Assets mode is available for Cross-margin positions exclusively, meaning that users of the Isolated Margin Mode cannot opt in to take advantage of the margin-sharing feature.

Benefits of using Multi-Assets Mode to trade on Binance Futures

The sharing of margin between USDT and BUSD-margined contracts introduces several advantages for Binance Futures users. Let’s take a look at the main pros of using Multi-Assets Mode on Binance.

Enhanced risk management and portfolio hedging options

Since profits made in either USDT or BUSD-margined futures positions are automatically used to offset losses accrued in USDT-M or BUSD-M positions, Binance traders using the Multi-Assets mode can lower their margin requirements across two accounts. Moreover, traders can hedge their positions easily using the Multi-Assets mode – for example, by going “short” the BTC/USDT contract while at the same retaining a “long” option on the BTC/BUSD contract.

More flexibility when opening positions

With Multi-Assets Mode enabled, traders don’t have to convert USDT to BUSD, or vice versa, to act on an investment opportunity available in either USDT or BUSD-margined futures. This allows Binance users to open USDT-M or BUSD-M positions at a moment’s notice, without going through the hoops of swapping crypto and moving it between derivatives accounts.

Arbitrage opportunities across USDT and BUSD trading pairs

Seamless access to both USDT-M and BUSD-M contracts allows traders to pursue potential arbitrage opportunities – for instance, an arbitrage trader may notice a minute price discrepancy between BTC/USDT and BTC/BUSD. In such a case, a trader could obtain BTC from a BTC/USDT contract at a lower price and sell it using the BTC/BUSD contract at a higher price to make a profit.

Advantages of trading BUSD-M Futures with Multi-Assets Mode on Binance Futures

BUSD-M Futures are a type of USD-M Futures that are quoted, collateralized, and settled in BUSD, a fully backed USD-pegged stablecoin developed and operated by Binance and Paxos. By using a stablecoin for settlements, traders can easily monitor the performance of BUSD-M futures contracts and enjoy a degree of price stability that is not present in COIN-M futures, which are denominated and settled in cryptocurrencies.

Using BUSD-M futures, traders can go long (expecting the price of a cryptocurrency to increase) or short (expecting the price of a cryptocurrency to decrease) on a number of supported digital assets. The list of supported cryptocurrencies that can be traded in BUSD perpetual contracts includes:

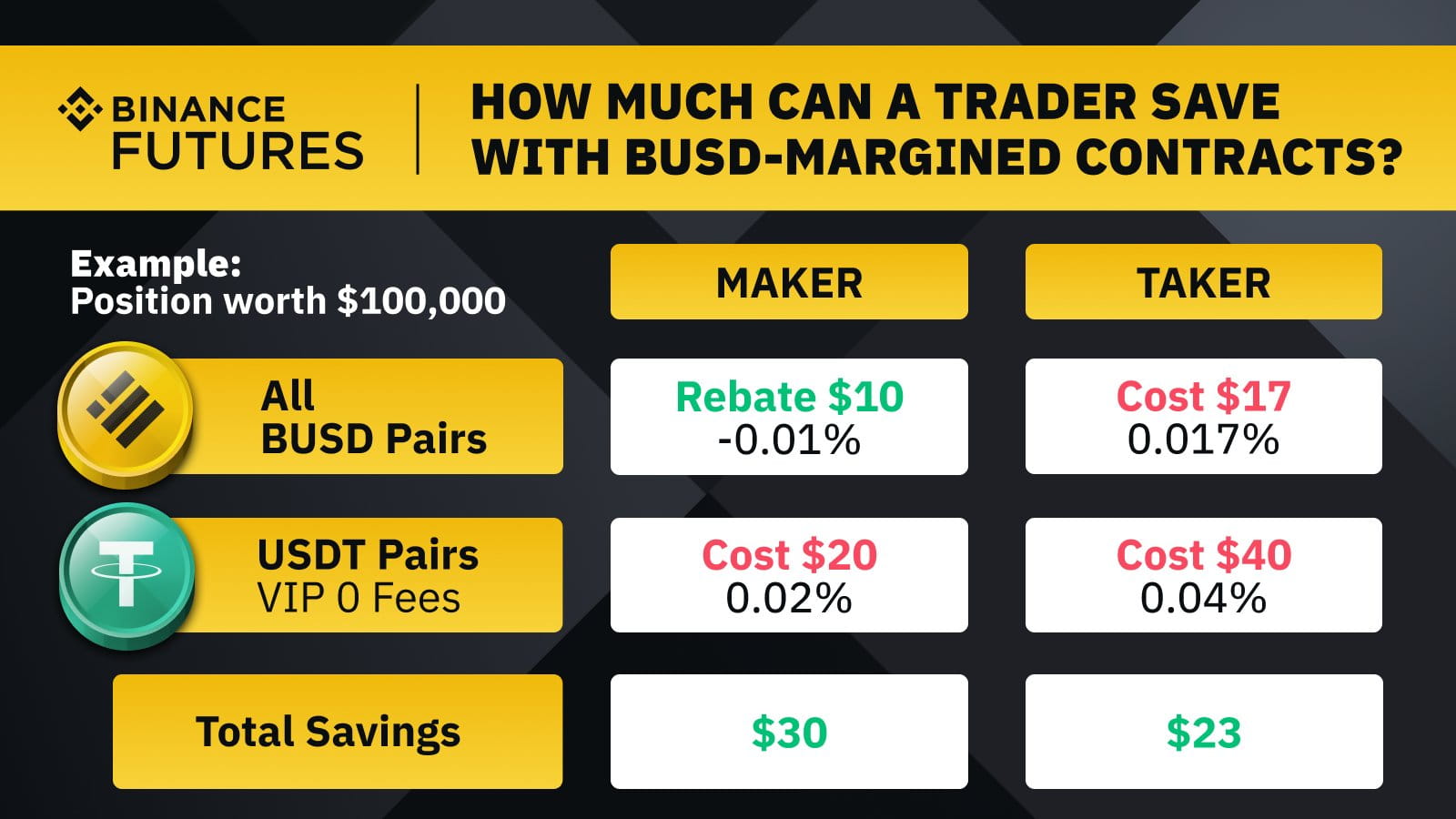

Using BUSD-margined contracts lets Binance users pay less on maker and taker fees (see the table above). The discounted fees apply to all BUSD perpetual contracts. For a complete overview of USDⓈ-M Futures trading fees and a detailed, tiered comparison between USDT and BUSD fees, click here.

In addition to a lower base fee when trading BUSD-margined contracts compared to USDT-M futures, users who enable the Multi-Assets Mode can trade USDT-M contracts without having to convert them to USDT. This lets USDT owners trade BUSD-M derivatives and save on trading fees.

As mentioned in the previous section, trading BUSD-M Futures with the Multi-Assets mode turned on allows derivatives traders to go hedge their positions by, for example, going long on a particular digital asset using a USDT-M contract, while shorting the same digital asset using a BUSD-M contract. This trading technique can come in handy for traders looking to turn short-term market trends into lucrative investment opportunities while retaining the potential upside of longer-term contracts.

A step by step guide to Multi-Assets Mode on desktop and mobile

As you could have gathered from the paragraphs above, Multi-Assets Mode presents several benefits for contract traders on Binance. If you are wondering how to opt-in and take advantage of the feature, follow our step-by-step guide for desktop and mobile Binance clients.

How to enable Multi-Assets Mode on Desktop?

Follow our guide on the Multi-Assets Mode to turn on the feature in Binance’s desktop web client.

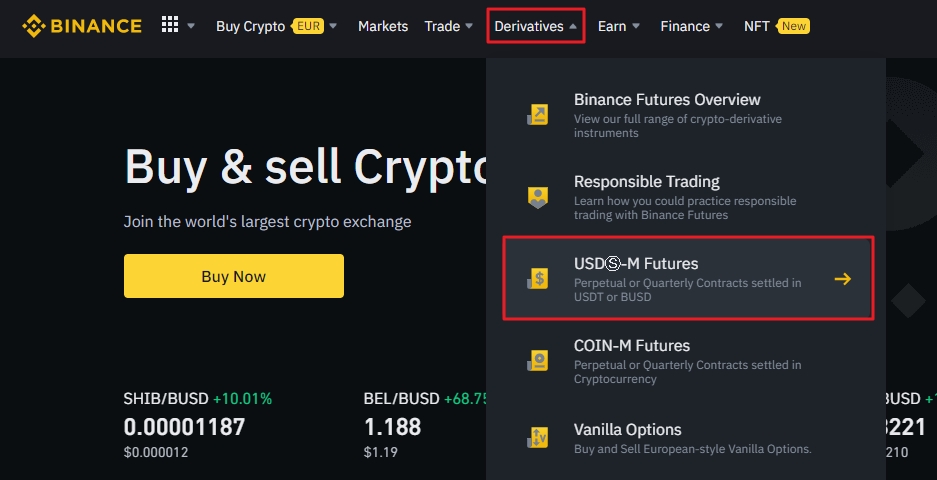

Step 1 – To turn on the Multi-Assets mode on the desktop client, go to the “Derivatives” drop-down menu on the Binance homepage and select the “USDⓈ-M Futures” option.

Step 2 – In the trading view, click on the Settings button located in the upper right corner of the screen (highlighted in red on the image below).

Step 3 – In the pop-up menu, click on “Preference”

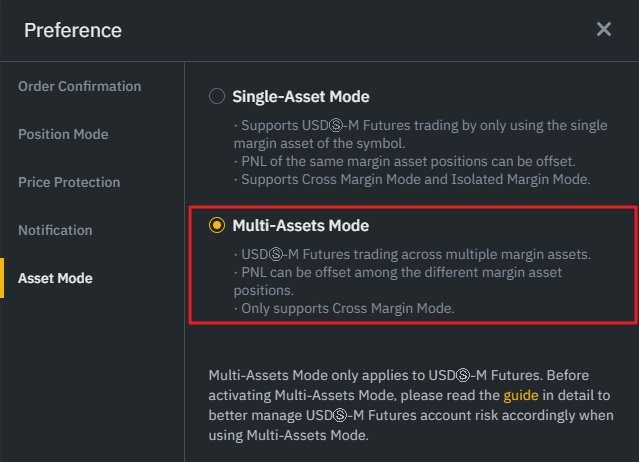

Step 4 – Navigate to the bottom of the Preferences window and click on “Asset Mode”. Now, select “Multi-Assets Mode”.

That’s it, you’ve successfully enabled the Multi-Assets mode in the desktop client.

How to enable Multi-Assets Mode on Mobile?

The process of opting in the Multi-Assets mode on the native client for Android and iOS devices is very similar to the desktop counterpart.

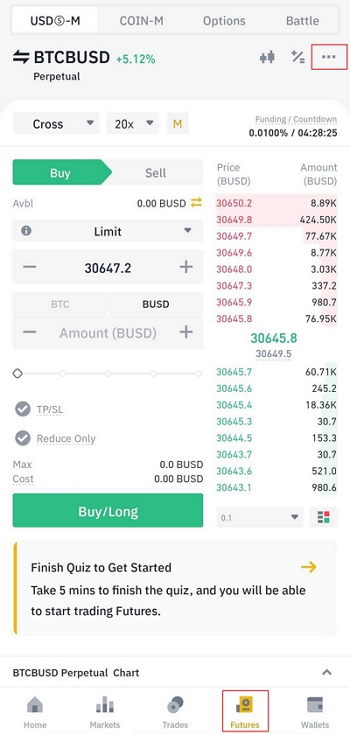

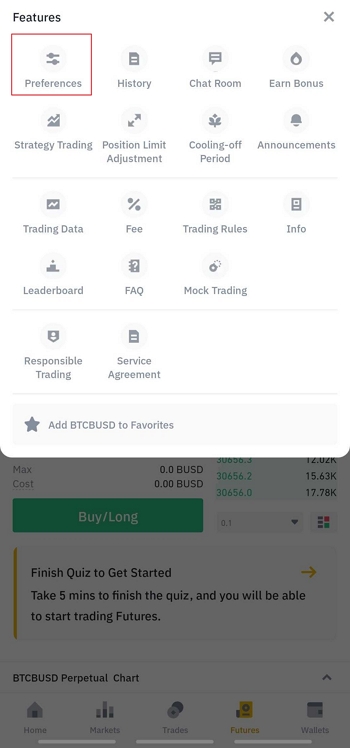

Step 1 – Navigate to the “Futures” tab in the menu at the bottom of the screen and click on the three-dotted menu in the upper right corner of the screen.

Step 2 – Click on “Preferences”.

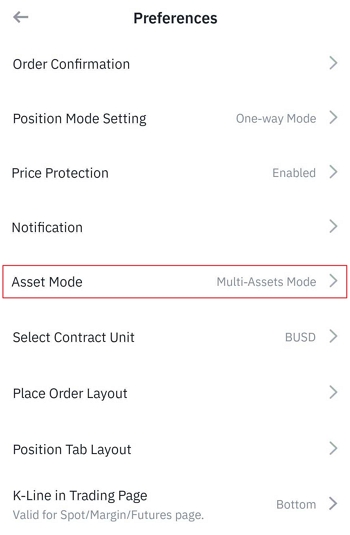

Step 3 –Navigate to the “Asset Mode” section in the preference menu.

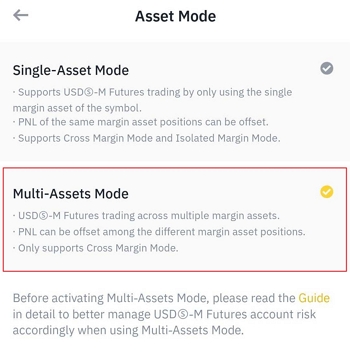

Step 4 – Now, click on “Multi-Assets Mode”.

That’s it, you’ve successfully enabled the Multi-Assets mode in the mobile application.

Final thoughts

Using the Multi-Assets mode allows Binance contract traders to take advantage of discounted trading fees, pursue investments across USDT-M and BUSD-M trading pairs without having to swap between USDT and BUSD stablecoins, and take advantage of potential arbitrage opportunities. Despite a lower risk level associated with using Multi-Assets Mode, keep in mind that derivatives trading can be highly challenging and generally requires a higher degree of investment know-how than spot trading. To learn more about Binance Futures and find out about different order types and futures contracts, click here.