Crypto leverage trading lets traders increase their exposure to the markets by borrowing capital to magnify their trading results without actually obtaining digital assets. While the trading practice has historically been an exclusive feature of traditional markets, it has recently found its way into crypto. Binance Futures is one of the leading offerings in the industry. It boasts the sector’s largest trading volume, a wide array of supported digital assets, and a competitive fee structure.

Here’s a quick breakdown of Binance’s Futures trading offering:

Pros of Binance Futures:

- Profit from market fluctuations without buying and selling digital assets

- Trade more than 500 trading pairs

- Short and long cryptocurrencies with up to 125x leverage

- Zero slippage

- Low fee structure, BNB and BUSD grant additional discounts

Cons of Binance Futures:

- Requires extensive knowledge of the markets and a hands-on approach

- More complicated than spot trading

Trading crypto with leverage on Binance

In addition to the market’s most comprehensive spot trading offering, Binance allows traders to engage in leverage trading via its Futures and Margin services. The main difference between the two is in their inherent structure. Binance Margin trading lets traders borrow funds to bolster their ability to buy and sell crypto in the spot market. For more information about Binance Margin trading, read our in-depth review.

Binance Margin – Amplify Your Trading Results and Earn ‘Friday Funday’ Rewards

Binance Futures, on the other hand, lets traders gain exposure to the crypto markets by entering into an agreement to purchase or sell a digital asset at before determined price and time in the future – thus the name Binance Futures. If you believe the price of Bitcoin, for example, will increase in the future, you can take a long position. On the other hand, if you think its price will drop, you can obtain a short position.

Traders can trade with up to 125x leverage on Binance Futures. In practice, this means that traders can enter a position worth 12.5 BTC by committing only 0.1 BTC. However, there is a tradeoff – the higher the leverage, the greater the risk.

Top 5 benefits of trading futures contracts with Binance

Here are some of the main advantages of Binance’s Futures trading platform:

- Industry’s leading liquidity and trading volume – Binance’s futures trading platform boasts the highest number of active users and high liquidity across hundreds of trading pairs.

- Zero slippage and high capital efficiency – Thanks to high liquidity and the industry’s highest trading volume, Binance Futures traders can execute orders with virtually no slippage and high precision.

- Up to 125x leverage – The high leverage allows traders to amplify their results and to efficiently hedge their positions, even with limited access to capital.

- Portfolio diversification – Binance Futures lets users easily diversify their investment, allowing them to gain exposure to markets without having to own actual assets.

- Low fee structure – Binance boasts very low Futures trading fees, which can be further lowered simply by onboarding BNB or BUSD into your Futures account.

Disclaimer: Futures trading, especially with high leverage, can be very risky and makes the margin of error when entering and exiting positions extremely slim. Do your own research and never invest more than you are willing to lose.

Supported assets

Binance Futures supports over 500 trading pairs in two different margined contracts – USD-Margined Futures (USD-M) and Coin-Margined Futures (COIN-M). The massive catalog of trading pairs allows users to speculate on the future value of major coins, such as Bitcoin and Ethereum, DeFi coins, DAOs, and even meme coins, like Dogecoin and Shiba Inu.

Here’s an alphabetically ordered list of tokens you can long and short on Binance with up to 125x leverage:

- 0x (ZRX)

- Aave (AAVE)

- Algorand (ALGO)

- Akropolis (AKRO)

- Aragon (ANT)

- Audius (AUDIO)

- Axie Infinity (AXS)

- Balancer (BAL)

- Bakery Swap (BAKE)

- Band Protocol (BAND)

- BNB (BNB)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- BitTorrent (BTT)

- Bluezelle (BLZ)

- BzX Protocol (BZRX)

- Cardano (ADA)

- Celo (CELO)

- ChainLink (LINK)

- Coin98 (C98)

- Compound (COMP)

- Cosmos (ATOM)

- Coti (COTI)

- Curve DAO Token (CRV)

- Dash (DASH)

- Defi (DEFI)

- DFI.Money (YFII)

- Dogecoin (DOGE)

- Elrond (EGLD)

- EOS (EOS)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- ICON (ICX)

- iExec RLC (RLC)

- IOST (IOST)

- IOTA (IOTA)

- Kava.io (KAVA)

- Kyber Network (KNC)

- Litecoin (LTC)

- Maker (MKR)

- Monero (XMR)

- Neo (NEO)

- OMG Network (OMG)

- Ontology (ONT)

- Polkadot (DOT)

- Qtum (QTUM)

- XRP (XRP)

- Serum (SRM)

- Shiba Inu (SHIB)

- Solana (SOL)

- Sp8de (SPX)

- Storj (STORJ)

- SushiSwap (SUSHI)

- Stellar (XLM)

- Tellor (TRB)

- Tezos (XTZ)

- THETA (THETA)

- THORChain (RUNE)

- TRON (TRX)

- Uniswap (UNI)

- USD Tether (USDT)

- VeChain(VET)

- WAVES (WAVES)

- yearn.finance (YFI)

- Zcash (ZEC)

- Zilliqa (ZIL)

For a complete and up-to-date list of supported tokens, click here.

What are USD-M and COIN-M Futures?

Binance provides two different types of futures products – USD (USD-M) and Coin-margined (COIN-M) products.

COIN-M Futures are denominated and settled in cryptocurrencies and don’t require traders to hold stablecoin as collateral. COIN-M contracts are particularly convenient for cryptocurrency holders who can speculate on the performance of crypto assets without having to convert their holdings into USD-pegged stablecoins.

USD-M Futures are denominated and settled in stablecoins, including USDT and BUSD. The main advantage of USD-M contracts is that it allows users to monitor their performance in fiat-pegged digital currencies, offering a more intuitive trading experience for the majority of traders.

Types of Futures contracts

The premise of Futures trading is the ability to speculate on the future price of an asset without actually having to buy or sell the asset itself. In short, futures contracts bind involved parties into an agreement based on the expiration date and a predetermined price of an underlying asset. Binance offers two types of Futures contracts:

- Traditional Futures contract – an agreement to purchase or sell a digital currency at a predetermined price and before agreed upon time in the future. Binance offers Futures contracts with quarterly and bi-quarterly expiration dates.

- Perpetual Futures contract – an agreement without an expiry date, meaning that traders can hold their position open as long as they continue to pay the maintenance margin and have enough collateral in the Futures account.

Keep in mind that both types of Futures contracts can be liquidated if the amount of collateral in the user’s account is insufficient to keep the positions open.

Types of Futures orders

Binance’s Futures trading can most easily be accessed through the “Derivatives” drop-down menu from the Binance homepage.

To access different types of trading orders, you must navigate to the right side of the screen in the Futures trading view (see screenshot below).

Binance currently supports the following Futures order types:

- Limit Order is placed when the value of an asset reaches a predetermined price, allowing traders to buy at a lower price or sell at a higher price than the asset’s current value.

- Market Order is executed immediately at the closest available price to the one set by the user.

- Stop-Limit Order allows traders to set up a conditional order that is executed after a predetermined stop price has been reached.

- Stop Market Order is triggered after a before set stop price has been reached, after which it executes a market order.

- Trailing Stop Order allows positions to remain open for as long as the underlying asset’s price is moving in the trader’s favor.

- Post Only Order is immediately recorded in the order book once it’s placed but is executed at a later time.

- Limit TP/SL Order (Strategy Order) allows traders to set up a stop-loss/take-profit price before opening a position.

To read more about each of the order types supported on Binance, click here.

Binance Futures fee structure

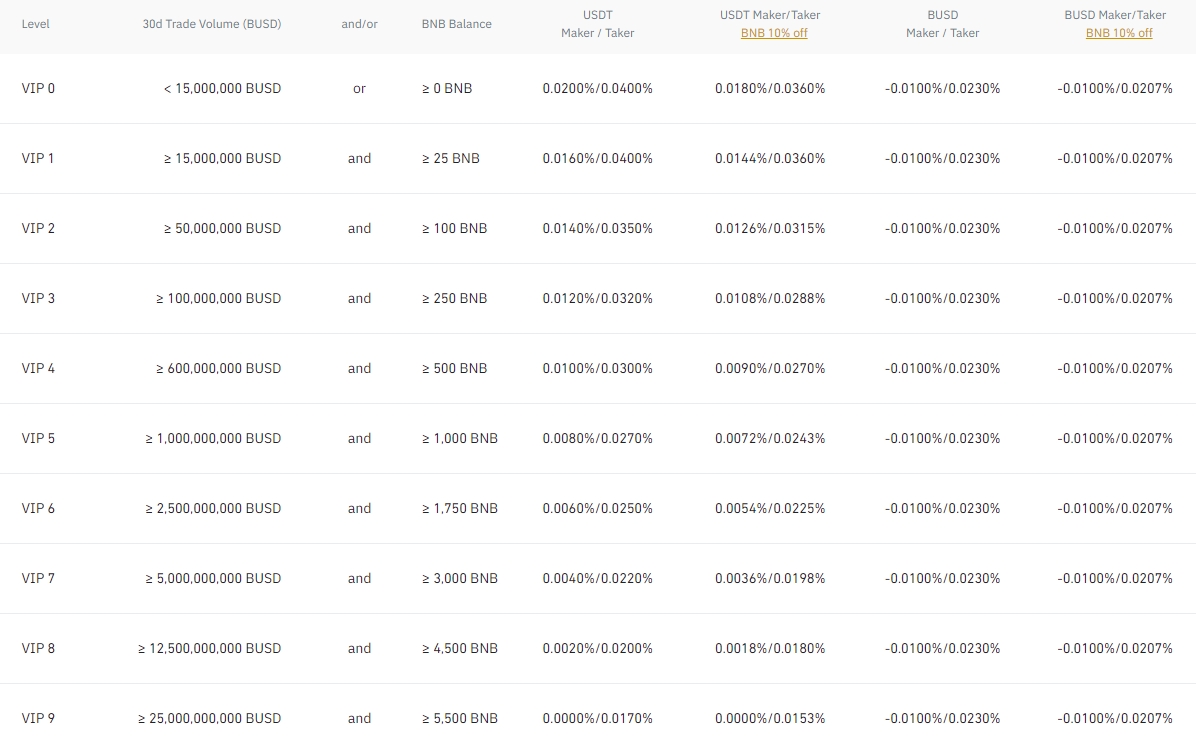

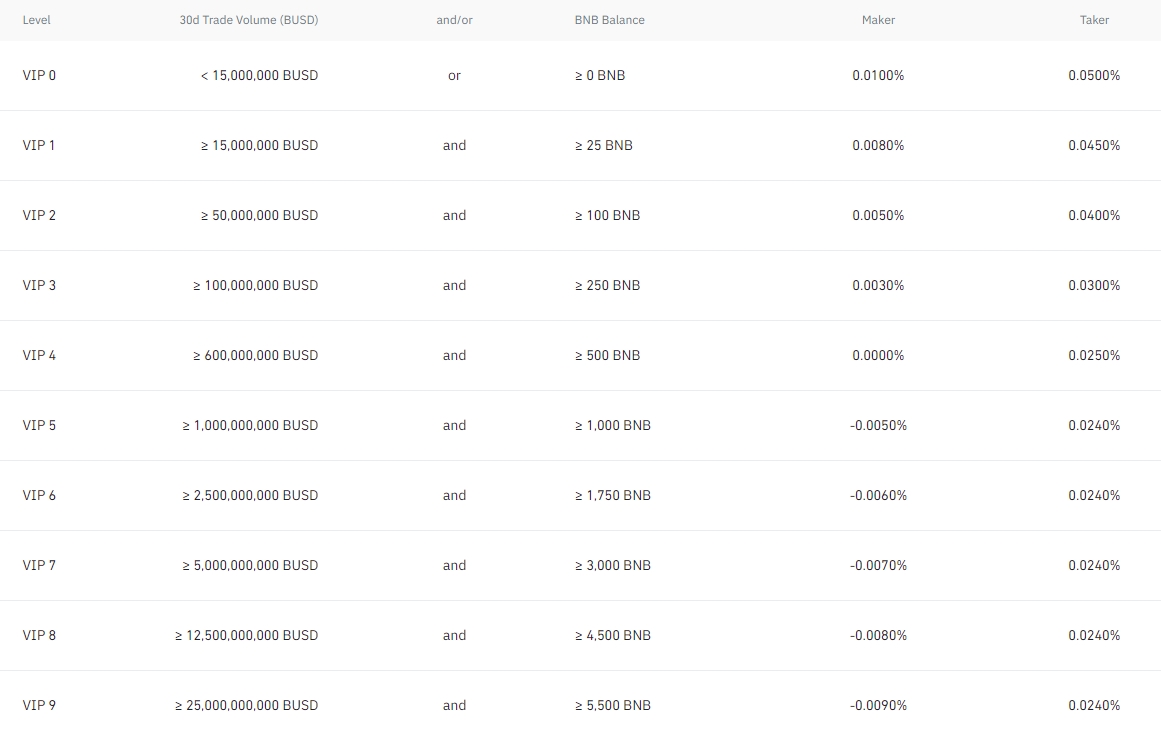

Binance offers a very competitive pricing structure when it comes to fees associated with Futures trading. Additionally, the exchange offers up to 10% off Futures trading fees for BNB holders.

Binance charges “Maker” and “Taker” fees, which are less expensive for BNB and BUSD holders. For reference, Binance defines Taker as an order that trades at a market price, and Maker as an order that trades at a limited price.

Binance’s VIP program provides Futures traders an opportunity to lower their fees by depositing BNB into their Futures accounts.

For a complete overview of Binance’s fee structure, including spot trading costs and coin-specific margin borrow interest, click here.

Liquidity

Given its immense global reach, it is no surprise that Binance’s Futures trading platform boasts more than 28 million active users, who are able to speculate on prices of numerous coins at virtually zero slippage.

Slippage is a common occurrence in high volatility markets that don’t possess high liquidity, which leads to orders not being able to be filled in their entirety at the predetermined price.

Thanks to high liquidity, Futures traders using Binance can rest assured their positions won’t suffer from slippage and will deliver maximum capital efficiency no matter the underlying digital asset.

Trading Volume

Binance is the industry leader in terms of Future contracts trading volume. Throughout 2021, the exchange facilitated a mind-blowing $7.7 trillion in Futures volume. During the most active trading day, the Futures marketplace generated $76 billion in a 24-hour period.

According to data curated by CoinCodex, Binance Futures cleared $57.1 billion worth of Futures orders on February 22, coming out ahead of the second-placed OKX by more than $35 billion.

To follow Binance’s trading data, including the long/short ratios and the taker buy/sell volume in real-time, click here.

Binance Futures safety measures – $300M Insurance Fund, auto-deleveraging, and more

Given the high volatility associated with futures leverage trading, Binance has allocated $300 million to ensure a seamless operation of the platform and to make sure profitable traders are compensated in full. Read more about the Insurance Fund here.

If extreme market circumstances arise, which would deplete the Insurance Fund faster than it could be replenished, Binance can make use of the Auto-deleveraging failsafe. In short, the auto-deleveraging mechanism makes profitable traders part ways with some of their profits to cover the losses of unprofitable traders in order to keep the platform sufficiently liquid at all times.

Additionally, Binance employs several security measures designed to bolster the platform’s security and decrease the potential for its users to end up with their crypto funds being stolen. Know Your Customer (KYC), 2-factor authentication (2FA), and Anti-Phishing Code are some of the security features that ensure the platform’s resilience against malicious actors.

Support for multiple languages

Binance lets cryptocurrency investors select their native language to make Futures trading a more approachable experience to a broader range of cryptocurrency enthusiasts. In total, the platform supports 17 languages, ensuring that the vast majority of users can use the platform in their native tongue.

Binance’s Futures offering is translated into virtually all of the world’s most spoken languages, including English, Spanish, Traditional Chinese, Portuguese, French, Korean, and Japanese.

Final thoughts

Trading futures on Binance is a relatively simple and straightforward experience thanks to an easy-to-use interface and multilingual support. Additionally, the wide range of supported trading pairs, competitive fee rates, and high liquidity, make Binance arguably the best futures trading platform in the industry.

As is always the case when leverage trading, make sure to practice risk mitigation techniques and don’t invest funds you can’t afford to lose. To learn more about Binance Futures, and the soundest trading techniques, check out Binance Futures FAQ.