Margin trading has long been one of the most widely used trading methods in traditional finance. In recent years, the highly popular investment practice has taken hold among cryptocurrency investors as well, with Binance emerging as one of the leading players in the space. Binance’s margin trading service allows users to increase their exposure to crypto markets and speculate on numerous trading pairs’ price performances with capital supplied by a third party.

Here’s a quick overview of the main advantages and disadvantages of trading with Binance Margin:

Pros of using Binance Margin:

- Amplify your profits with borrowed funds

- Trade with leverage of up to 10x and more than 600 trading pairs

- Participate in the exclusive Funday Friday promotion

- Use your spot crypto funds as collateral to increase your market exposure

Cons of using Binance Margin:

- Riskier than regular spot trading

- Margin balance can be liquidated in its entirety if the market doesn’t move in your favor

What is Binance Margin trading?

Binance Margin trading allows users to utilize funds provided by a third party to execute leveraged trading orders with greater sums of capital than when using conventional trading methods. Generally speaking, the leveraged nature of margin trades means that traders are taking advantage of the ability to amplify their positions when trading in markets with lower volatility, which allows them to attain higher yields without sacrificing additional capital.

The third-party that provides traders with capital is usually an investment broker when it comes to forex, stock, and commodity margin trading. However, in the cryptocurrency space, the funds are typically provided by other market participants, who part ways with their crypto funds for a limited period of time in exchange for interest.

To sum up, margin traders can enlarge their trading position with borrowed funds and reap the benefits of increased exposure when the market conditions are in their favor. If the market undergoes a downturn, the user must repay the borrowed funds manually.

Binance Margin allows users to trade with leverage of up to 3x for cross margin and up to 10x for isolated margin.

To start your margin trading journey, you must first transfer funds from your spot wallet to a dedicated margin wallet. We will cover the entire process of setting up a margin account, staking collateral, and repaying debt in a step-by-step guide below.

5 benefits of using Binance Margin

Here’s a list of the five main benefits of using Binance Margin:

Increased trading profits – the most significant pro of using margin is the ability to generate larger returns when the price of digital assets is moving in your favor.

Use your funds as collateral – another advantage of using margin is the ability to stake your otherwise idle crypto funds to secure margin funds. Binance automatically executes the borrowing process on the user’s behalf.

Multi-asset collateral – Binance allows traders to use different types of collateral, for example, a combination of BTC and ETH, to borrow margin funds which can then be used to execute leveraged orders.

Up to 10x leverage – Binance allows users to engage in trading pair with leverage of up to 10x.

More flexibility when trading – Margin allows traders that have limited access to capital to take advantage of short-term trading opportunities, which would otherwise not be possible.

Disclaimer: While there are numerous benefits of using Binance Margin, keep in mind that using leveraged financial instruments increases the risk of ruin and makes the margin of error significantly slimmer when entering and exiting trades.

5 tips for better Margin trading

Here’s a list of the three tips that will help you become a better margin trader:

Understand the basic terminology – one of the most important things you can do to give yourself the highest chance of success is to learn about the terminology and dynamics of margin trading. You should have comprehensive knowledge of terms like collateral, margin funds, borrowing interest, margin call, etc. Check this helpful article from Binance Academy for more information about the subject.

Mitigate your risk with the Stop-Loss strategy – while the stop-loss strategy exists in all kinds of investment venues, its value is even more apparent when it comes to margin trading. Binance provides seamless access to stop-limit orders, which combine stop-loss elements with a limit order to mitigate the relatively high risk associated with margin trading.

Approach margin trading analytically – most investors who engage in margin trading execute trades on shorter time scales. For this reason, one’s ability to analyze charts and identify market trends is paramount to forming sound entry and exit strategies. To learn more about common technical analysis (TA) indicators, click here.

Actively monitor your margin levels – pay close attention to the margin levels of your positions to pay off a part of your loan or stake additional collateral to avoid margin calls. If prescribed margin levels are not maintained, Binance will sell a part of your margin account funds to satisfy the margin requirements.

Diversify your investment – putting all your eggs in one basket is never a good strategy, especially when trading on margin. Make sure to hedge your bets and don’t let your portfolio’s performance be determined by the market success of a single cryptocurrency.

How to use Binance’s margin trading service?

With a quick overview of Binance’s margin offering, its benefits, and a quick word of advice on how to become a better margin trader behind us, you are armed with the knowledge required to make your first margin trade on Binance. Follow our step-by-step instructions to learn how.

NOTE: You have to be logged into your verified Binance account in order to use the Binance Margin trading service.

Deposit funds into your Margin wallet

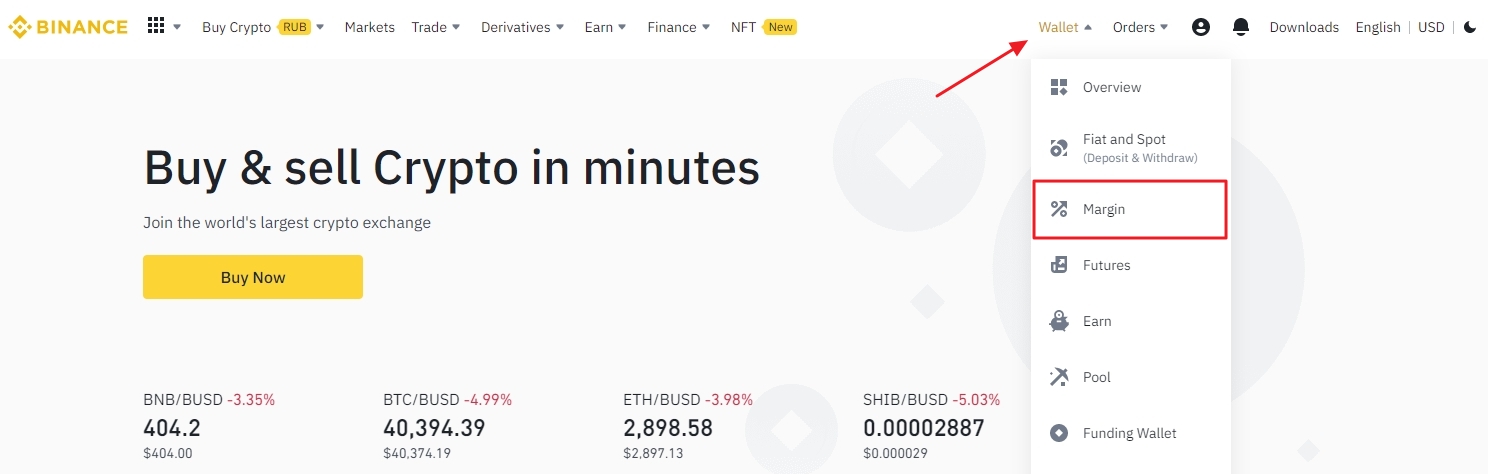

Step 1: After logging into your Binance account, select the “Margin” option from the “Wallet” drop-down menu.

Step 2: There is a trio of buttons in the top right corner of your margin dashboard. We’ll discuss “Borrow” and “Repay” options in the following sections. For now, click on “Transfer” to onboard funds to your margin wallet.

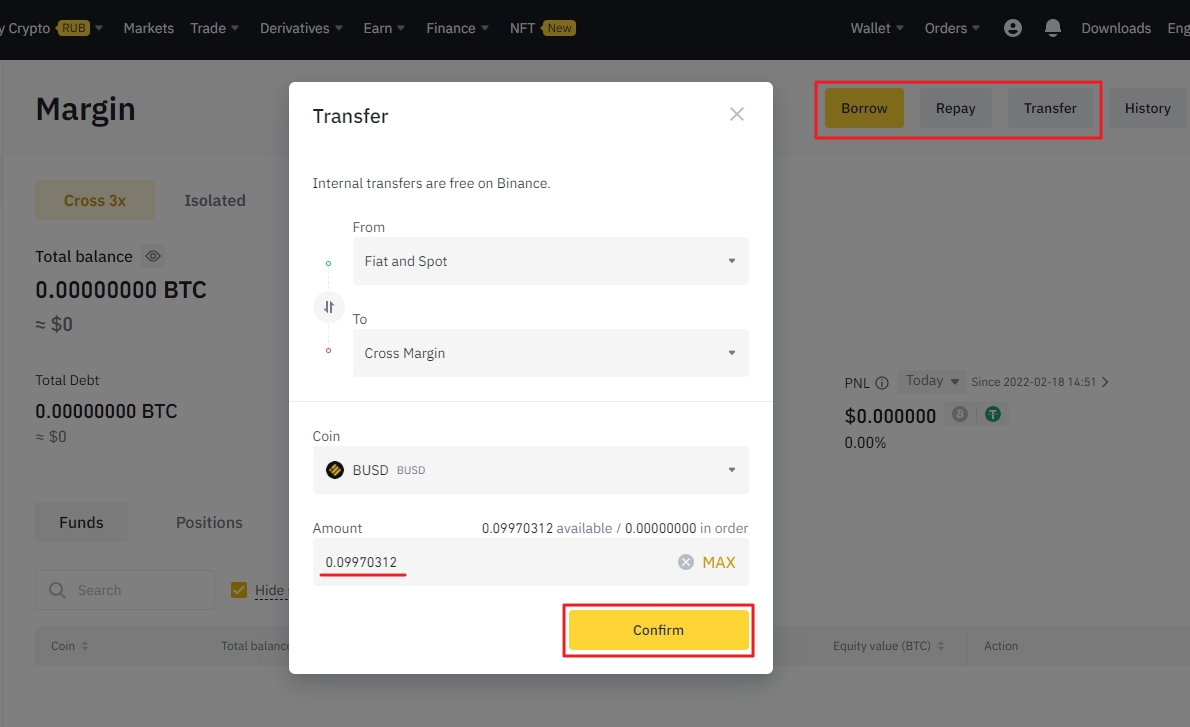

Step 3: Select where you would like your funds to be transferred from (in our case, “Fiat and Spot” wallet), and select the destination. Since we’re are preparing for margin trading, select either the “Cross Margin” or “Isolated Margin” option. After that, select the digital currency you would like to onboard and enter the desired amount. Once you click “Confirm,” the funds will be transferred to your margin account, ready to be used as collateral when margin trading.

Make a Margin trade

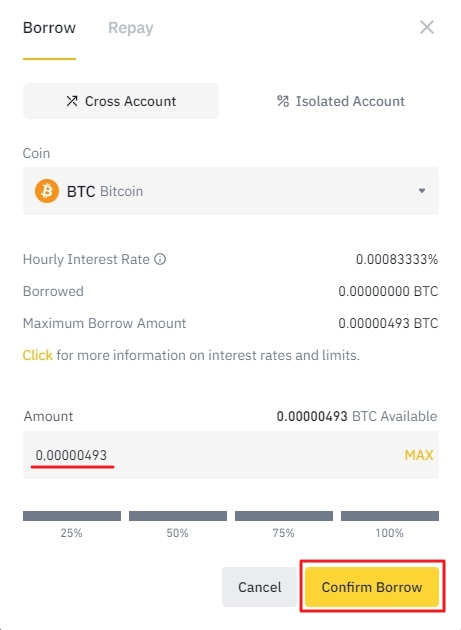

Step 1: Click on the “Borrow” button located in the top right corner of the margin dashboard. In our example, we’ll be borrowing Bitcoin for Cross margin trading. Click “Confirm Borrow” to proceed.

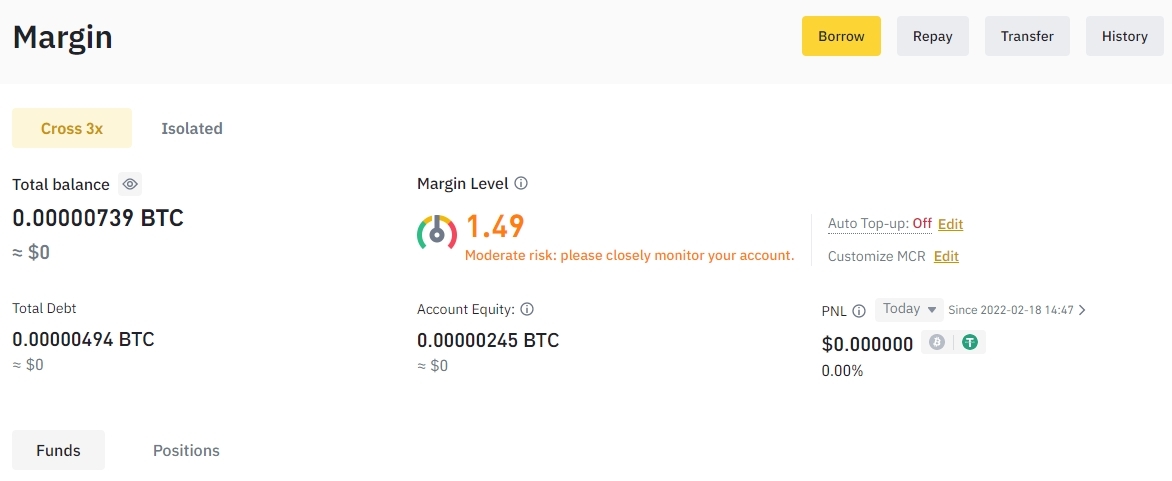

Step 2: The funds are now ready for margin trading. Keep in mind that Binance charges hourly interest on borrowed funds. You can easily access your Margin Level information, as well as the total amount of debt and a slew of account preferences, such as Auto Top-up and your open positions, in the margin dashboard. For a detailed breakdown of different margin levels, click here.

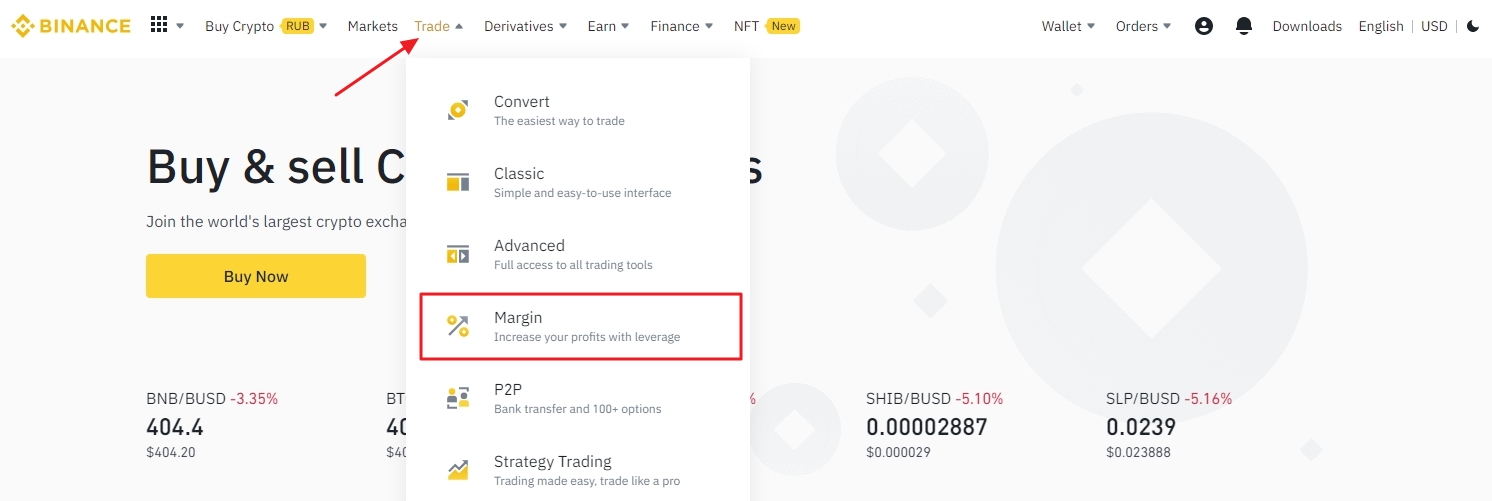

Step 3: Return to Binance’s homepage and select “Margin” from the “Trade” dropdown menu.

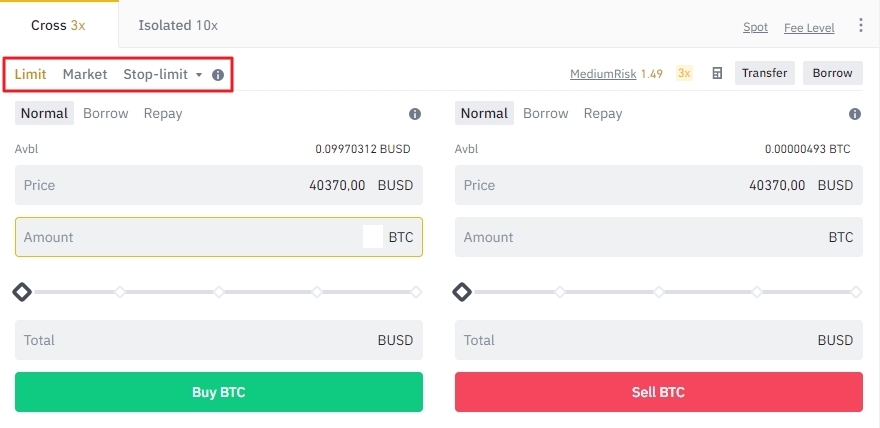

Step 4: Binance offers multiple order types – Limit, Market, Stop-Limit, and OCO – when trading with borrowed capital.

How to repay borrowed funds?

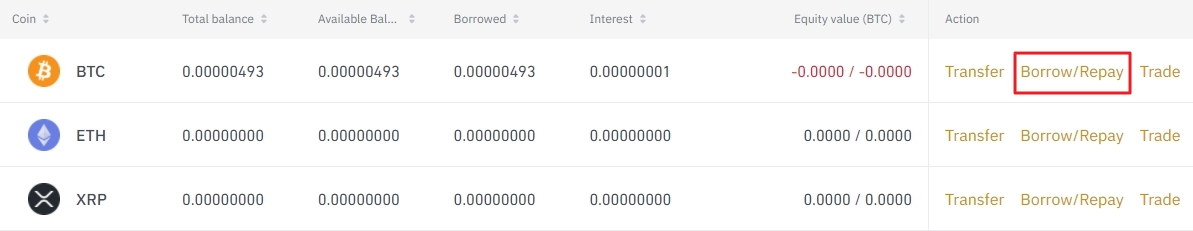

Step 1: Head to your margin wallet and scroll down to the list of your outstanding margin balances. Click on the “Borrow/Repay” link to commence the process of repaying the funds.

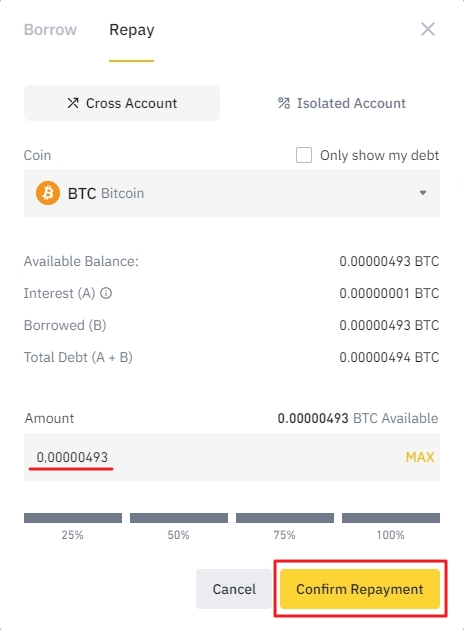

Step 2: Select the digital currency you have an outstanding debt in. You can repay the loan in full or only partially. Click “Confirm Repayment” to proceed.

The final repayment amount consists of the total amount of funds you have borrowed and the amount of interest accrued on an hourly basis.

What is the Funday Friday promotion?

Margin Friday is Binance’s exclusive promotion aimed at margin traders. As the name implies, the promotion runs every Friday and allows traders to claim a 20% bonus, based on the daily average trading volume and the amount of borrowed margin funds.

Friday Funday’s rules

The exclusive margin trading promotion started on January 14, 2022, and is slated to run each Friday. Every Friday at 00:00 UTC+8, Binance takes 20% of the income generated from Binance Margin fees in the week prior and distributes it among eligible traders based on the following formula.

A quarter of the total pool of funds is distributed on the basis of the average borrow amount, while the remaining amount is awarded to eligible users based on their average trading volumes. Binance records account snapshots volumes every Thursday.

In order to be eligible for the rewards, users must have a daily trading volume of at least 1,000 BUSD. Also, the minimum average daily amount of borrowed margin funds must not be less than 100 BUSD.

The rewards are paid out in BUSD. Traders have five days to claim their bonus before it expires. In order to trade with margin on Binance and participate in the promotional event, you must complete the KYC verification.

Why should you participate in Funday Friday?

Binance Margin – Funday Friday gives Binance traders an opportunity to win a share of the 20% Margin fee pool that is distributed each Friday to the platform’s most active margin traders. The bonus is calculated on the basis of the trader’s average daily margin trading and borrowing volume in relation to other eligible participants.

Binance provides a transparent and easily accessible Funday Friday dashboard, where margin traders can quickly gauge their past claimed rewards and see how much they stand to win each coming Friday.

Create a Binance account and grab a share of the Funday Friday prize pool.

Final Thoughts

Margin trading is arguably the middle ground between spot trading and the more hazardous Futures leverage trading – not as risky as the former but still makes traders much more susceptible to market volatility than spot trading.

Binance Margin trading allows cryptocurrency aficionados to magnify their trading positions by borrowing funds to amplify their returns with limited capital, making lucrative market opportunities accessible to a broader range of crypto traders.

Additionally, the Funday Friday promotion provides extra incentive to use Binance’s margin trading offering since it introduces a social component to an otherwise individualistic endeavor and makes each trade inherently more profitable.