Key takeaways:

- Binance Margin is an important tool with a number of features designed to help crypto traders earn additional profit

- With Binance Margin, traders with limited capital can increase their positions and consequently improve the amount of profit they can make

- There are two major types of Binance Margin trading, and they offer users options in terms of risk management

- There are many benefits of Margin trading with Binance, including multi-asset collateral, a variety of trading pairs, as well as a well-secured platform, and a safe trading experience

Binance is the world’s number-one cryptocurrency exchange with the highest trading volume. The crypto exchange platform, which was launched in 2017, has grown to earn its place as the go-to place for trading cryptocurrencies, holding digital assets, learning how to manage market fluctuations, and earning passive income from crypto, all thanks to its variety of trading tools and strategies. Binance maintains its topmost position because of the variety of products and services it offers to the teeming population of crypto users and investors.

On Binance, users enjoy multiple trading platforms like P2P, Futures, Spot, and Margin trading. Binance is a top pick for many crypto traders thanks to its user-friendly platform, low trading fees, zero trading fee on Bitcoin trading pairs, leveraged tokens, high transaction speed, security, and more. The Binance Margin Trading is another feature that has endeared users to the Binance platform.

What you should know about the Binance Margin

Binance Margin Trading is a feature on Binance that is used by users to leverage trading accounts and have more cash to trade with than their initial deposit. Basically, the Binance Margin allows users to borrow extra cash from Binance to increase their positions and stand a chance of earning more.

To access Binance Margin Trading in a Web browser, users have to hover over the Trade button and click on Margin. On the Binance App, users will need to click on Wallet, and then Margin. Before you start trading on Margin for the first time, you have to answer the quiz questions correctly, which is normally not a big deal. It is basically aimed at acquainting the first-time user with Margin Trading in order to reduce the number of errors and minimize risk too.

Types of Binance Margin Trading

Binance has two major types of margin trading; the Cross and Isolated Margin. Let’s take a closer look at both types of margin before diving further into the platform’s features.

Cross Margin

In Cross Margin, the user’s entire account balance is used for trading. It runs across all trading positions, which comprises the entire money on the trading account and the Spot Wallet. This means that, when the money in the trading account is exhausted, a user who uses Cross Margin automatically gives an authorization that money available in other accounts should be used to fund the trade and keep it going.

The advantage of Cross Margin is that Profit from one position can be used to support other trading positions that are close to liquidation. It is worthy to note that traders who use Cross Margin stands the risk of losing the entire fund in their account if liquidation occurs. To prevent this, the trader needs to keep adding money to the account when trades are not yielding returns.

Isolated Margin

Unlike in Cross Margin trading, the Isolated Margin places a restriction on the funds that can be used to trade and limits it to only funds available in the trading position. This means that when there is no more fund, only the trading positions can be liquidated. The strength of Isolated Margin lies in giving traders the power to manage their risks by restricting them to a particular trading position. This invariably means that in the eventuality of liquidation, only the fund available in that particular trading position will be lost.

Features of Binance Margin Trading

The beauty of Binance margin trading lies in the number of features it offers and its accompanying benefits. Here is a summary of the features of the Binance Margin Trading platform:

Total Balance

This is the sum total of all the financial assets in the user’s account, including the initial deposit sum, all the margin given by Binance, and all the trading positions. The amount of profit made influences the movement of the total balance. More profit means an increase in the total balance, and a loss results in a decrease.

Total Debt

This refers to the amount of extra cash the customer borrowed from Binance to trade. The total debt changes based on how much money is placed in it. A user can choose to borrow more money from Binance or put in cash.

Account Equity

This is the total balance in a customer’s account minus his/her total debt. It is a true reflection of what the customer has as equity in their Binance account.

Profit and Loss

This is the amount of gain a user has made or the losses incurred in the course of trading. It keeps you updated with your progress in Binance Margin and can serve as a guide to safe trading.

Your Margin Level

The Margin Level is a very important feature represented by a number given by Binance. This number indicates how well or poorly you are faring on Binance Margin Trading. The figure can rise up to 999.00 or drop to as low as 1.3. The higher it is, the lesser risk the account is facing.

When the Margin Level reduces to 1.3, Binance alerts the user about low funds in his/her account. At that point, Binance cannot keep lending the user more money and may choose to liquidate some of his/her positions to pay back previous debt. When it gets to 1.1, Binance liquidates all the trading positions and automatically sells them off.

Guide on How to Trade using Binance Margin (Entering a Trade)

To begin trading, there must be money to trade with. The money can be borrowed or moved from the Spot wallet to the trading account. You can, for instance, sell your BTC for USDT, or vice versa, and send the proceeds to the margin wallet.

To begin trading using Binance Margin, choose the type of margin you wish to trade with – either Cross or Isolated Margin. After choosing the coin you want to trade with, proceed by selecting your leverage position and pick a method of trading (Normal, Auto Borrow, Auto Repay). Continue by placing an order and set the Stop Loss and Stop Limit (The Average True Range (ATR) can serve as a guide). After you’ve entered all of the order’s parameters, execute the trade.

Note on leverage levels: (3x, 5x, 10x, 20x etc) indicate the percentage of fund a user can borrow and the profit or loss it can accrue. 3x means the trader can borrow 2x of the fund to trade with, 5x= 4x, 10x=9x, etc. That means a trader that has $100 in his margin account and chooses 3x leverage can borrow an additional $200 to trade with. This also means that the trader is making 3x profit and vice versa.

Note on order types (Normal, Auto Borrow and Auto Repay): Normal means you are not trading on Margin. It implies that the user is trading with the money in his/her account. The Borrow feature gives the user the option of borrowing a digital asset to trade with, and this loan can be paid back via the Repay Icon.

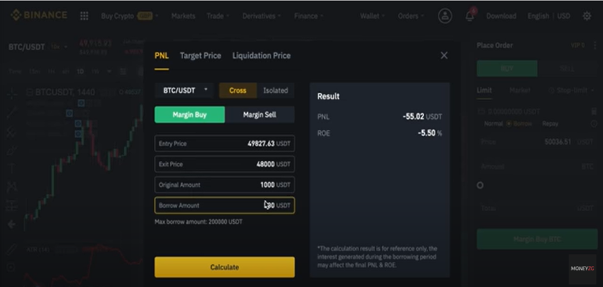

It is recommendable to use the Calculator Icon available on the margin account to have an idea of how the margin will affect the trade before buying.

The Entry Price indicates the price of the Coin, the Exit Price is the Price where the trader wishes to close the trading position, the Original Amount is the initial deposit the trader, has and the Borrow Amount is the amount the trader borrows from Binance. The Calculator tabulates the Profit and Loss a trader can make if he chooses to trade with a particular Entry Price, Exit Price, Original Amount, and Borrow Amount. The Calculator does the same calculation for Target Price and Liquidation Price.

Placing Orders

To place an order, go to margin on your Binance App or web browser and then choose a coin to trade with. Continue by selecting Isolated or Cross Margin. After that, set leverage and click on Long or Short and enter and enter the price of the coin at the time. Click on the amount and input a particular amount of funds you want to trade with, based on a specified risk percentage, then click on Margin Buy. For Example, it could be 2%, 4%, 10% etc. Higher risk means a higher potential profit and vice versa.

Using the Average True Range (ATR) to set Stop Loss

The ATR is a technical indicator on the chart that shows how volatile an asset could be. It is used by traders to set Stop Loss (SL). Every coin has its ATR. For instance, if the ATR for Bitcoin is $2500 and the price of Bitcoin is $50,000, $50,000 minus $2,500 equals $47,500. This implies that if a day trader chooses to use the ATR to set SL, he will place his SL at $47,500. Below is a picture of the ATR on the chart.

Stop Loss and Stop Limit

The Stop Loss and Stop Limit are predetermined automated tools used by traders to control the amount of loss they incur in a trade. A Stop Loss Order is a command that is used to sell digital assets once it reaches a particular price. For instance, a trader who buys BTC for $49,000 can set a Stop Loss at $48,000 to control the amount of loss he/she can suffer if the price of BTC dips. This market order will be automatically executed once BTC hits $48,000 to prevent further loss.

A Stop Limit is a feature that refines the Stop Loss, it gives the trader greater control as he can launch an order that buys/sell a digital asset at a particular price or above it, thereby giving a range. The advantage is that traders can enjoy more profit if the price of the coin goes up above a specific price, unlike Stop Loss, where it can only buy/sell at a specific price.

Setting Stop Loss and Take Profit

To activate the Stop Loss prompt and automatically take Profit on Binance Margin Trading, go to margin on your Binance App or web browser and choose a coin to trade with. Proceed by selecting the Isolated or Cross Margin method and set your leverage level. Continue by selecting Long or Short options and then click on the Sell tab. Click on Stop and Input price ( for instance, you may choose to use the price of the coin minus the ATR at the moment). Click on the limit and input the desired price. To finalize your order, click on Sell *asset name* (for the purposes of this article, we’ve used BTC).

Why Should You Use Binance For Margin Trading?

As mentioned in the introductory part, Binance is one of the biggest and most popular cryptocurrency exchanges in the world. In fact, it is often regarded as the best exchange based on acceptable standards. But why should you rely on Binance for Margin trading?

Here are some of the most important reasons to use Binance for margin trading:

- Through lending funds, users who do not have enough money can equally trade and make profits.

- Binance offers a wide variety of margin trading pairs

- Binance is well-secured and serves as a safe haven for crypto trading

- Binance offers relatively low trading fees

- Binance offers multi-asset collateral

- Binance permits users to place orders that have a higher value than their capital

- Binance Margin offers a viable avenue for traders to maximize profit and earn passive income in crypto.

Rounding Up

Binance Margin Trading is a unique feature that makes it possible for users to borrow extra cash to trade with and make more profit. It is a great avenue for traders who are limited by capital to take advantage of Binance and make passive income in crypto.

Binance Margin Trading is one of the top tools offered by Binance. It has enough helpful features for traders who are strategic but have limited funds to trade. Thanks to its Stop Loss and Take Profit feature, it also minimizes risks.