Bulls had the upper hand in the last 24 hours of trading action in the crypto markets. With an over 5% increase in market cap value, the cumulative value of crypto assets manages to break through the $2 trillion mark after falling to $1.82T on September 21. Virtually all coins in the crypto top 100 by market cap are trading in the green zone, with several projects posting high double-digit gains.

Avalanche (AVAX) reaches a new all-time high just shy of the $80 mark

After a few rocky days, Avalanche has rallied to a new ATH price of $79.48 on a 21% gain, before retracing to $76 at the time of this writing. Zooming out and looking at the 3M AVAX chart shows how much success the crypto has enjoyed in the last 40 days, after experiencing a prolonged period of sideways trading action. AVAX is now the 11th largest crypto with a $17.36B market cap value at press time.

Avalanche rally coincides with the announcement of the Avalanche Rush incentive program on August 18, which guaranteed $180 million worth of AVAX to boost the decentralized finance (DeFi) ecosystem. The program has attracted some of the biggest names in the DeFi sector, including Aave and Curve, to launch versions of their protocols on the Avalance platform. The market responded to the news with extreme optimism, quadrupling the value of AVAX in a little over a month-long period. For a more detailed look at AVAX and its future potential, you can check out our latest weekly edition of Top 3 Coins to Watch.

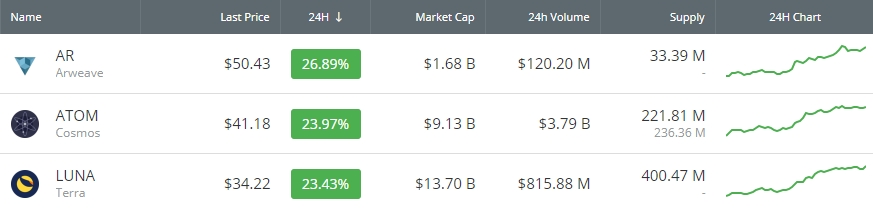

Arweave (AR), Cosmos (ATOM), and Terra (LUNA) are the biggest gainers in the Top 100

The top spot on the list of biggest gainers among the cryptocurrency top 100 largest coins by market cap belongs to Arweave, which is a decentralized cloud storage protocol. Arweave uses Proof-of-Access (PoA) and so-called Blockweave technology to build a decentralized network of connected storage devices, which provides a high level of data replication and security without the need for a middleman. The price of AR has increased by more than 26% today, and more than 100-fold since Arweave’s AR token started trading in May 2020.

A similar thing can be said for today’s third-biggest gainer, LUNA, which has started trading in August 2020 and has since grown 150-fold. In the last 24 hours, LUNA has reversed the negative week-long trend, which saw the crypto lose 35% of its volume, by recording a very healthy 23% price increase.

Cosmos, a Proof-of-Stake (PoS) decentralized interoperability blockchain, has experienced rollercoaster-type price swings over the last week. After reaching a weekly peak value and ATH of $44.31 on September 20, the price of ATOM dipped below $30, a more than 30% drop. In the last 24 hours, however, ATOM recovered much of its losses and is now just 7% away from its ATH.

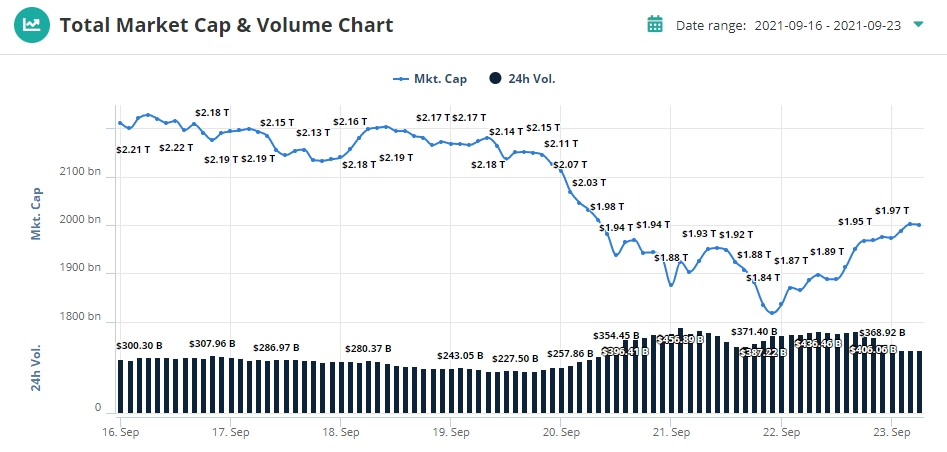

Crypto market cap is back above $2T, while Bitcoin climbs over $44,000

Following a market drop, which saw the total capitalization value slip by almost $400 billion, from $2.21 trillion on September 16 to $1.82T on September 21, the recent uptick pushes the cumulative value of crypto assets just above the $2T mark.

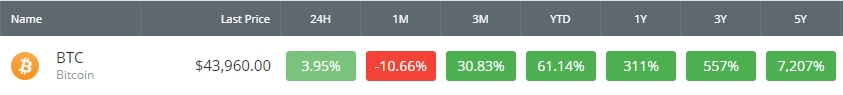

Bitcoin has momentarily dipped below the $40,000 level on September 22, for the first time since the beginning of August. It wasn’t for long though, as the world’s largest crypto quickly regained some of its lost value and is trading at $44,100 at press time. Although the current market trend, which started on September 7, following a severe flash crash that wiped almost $400 billion in the span of hours, might instill feelings of disappointment, it might be a good idea to take a look at BTC’s long-term performance for a quick refresher.

When the market sours, it is easy to forget how far the world’s biggest crypto has come in just a few short years. Compared to most traditional investment opportunities, BTC is still offering tremendous upside. For reference, the S&P 500 index, which is widely regarded as a hallmark of market efficiency, has increased by 18% year-to-date (YTD), and 103% in the last five-year period.