Key Takeaways

- Stablecoins are important in the crypto market and they come in different classes and offer several benefits

- It is possible to buy stablecoins with credit cards

- Binance is one of the best places to buy stablecoins

- In five simple steps, you can buy stablecoins from Binance with your credit card

Stablecoins are very important in the cryptocurrency market. They offer a high level of stability in a market that is notoriously volatile. They also bring liquidity and volume to the market. Stablecoins also allow traders to move fast in the crypto market, serving as media to move assets quickly and easily. Regardless of your experience or position in the market, there are many benefits you can derive from stablecoins.

Are you planning to buy stablecoins anytime soon? Do you know you can do that with a credit card? Yes, credit cards serve as one of the major payment methods to buy crypto, along with fiat deposits and e-wallets. For most people, credit cards offer the easiest path to owning cryptocurrencies, including stablecoins.

To ensure that this article is as helpful as possible, we will discuss some of the most important things you need to know about stablecoins before providing a detailed guide on how you can buy them with credit cards in five simple steps.

What Are Stablecoins?

Stablecoins are a class of cryptocurrencies that have their values tied to an outside asset for the sake of stability. Unlike unpegged cryptocurrencies like Bitcoin and Ethereum, stablecoins are designed to offer price stability. A stablecoin can be pegged against a fiat currency like the U.S. dollar, a reserve commodity like Gold, or another high-value cryptocurrency.

Stablecoins maintain price stability because they are backed by the specific asset they are tied to. When an organization issues a stablecoin, for instance, it is required to set up a reserve at a financial institution to hold the underlying asset. The value of the stablecoin issued is not expected to surpass the value of the asset kept in reserve. This helps to keep the price of the stablecoin relatively stable.

The 4 Types of Stablecoins

Stablecoins are of different types, though they share the same fundamental principle. There are four different types of stablecoins and we will briefly explain them right away:

Commodity Backed Stablecoins

As the name suggests, commodity-backed stablecoins are cryptocurrencies pegged against a commodity or physical assets such as gold and other acceptable precious metals, oil, and real estate. Of course, gold is the most collateralized commodity in this asset class. Examples of commodity-backed stablecoins are Tether Gold (XAUT) and Pax Gold (PAXG).

Fiat Collateralized Stablecoins

Fiat collateralized stablecoins are cryptocurrencies that are pegged against fiat currencies like the U.S. dollar and Euro. It is the most popular class of stablecoins. The U.S. dollar is also the most collateralized fiat currency in the crypto universe. Some examples of this type of stablecoins are Tether (USDT), TrueUSD (TUSD), and Binance USD (BUSD).

Algorithmic Stablecoins

Algorithmic stablecoins are stablecoins that are not particularly pegged to any asset class, rather, their price stability results from the use of specialized algorithms and smart contracts. An algorithm stablecoin tracks the price of a fiat currency, though it is not backed by the currency. The system automatically manages the circulatory supply of the stablecoin in response to price changes.

Cryptocurrency Backed Stablecoins

As the name clearly suggests, these are stablecoins that are pegged against other cryptocurrencies. In other words, these stablecoins are backed by other cryptocurrencies. In most cases, this class of stablecoins are not dependent on central issuers. Rather, the system employs smart contracts and depends on individual users to put their cryptocurrencies into the smart contract (as collateral) to generate stablecoins and then return the stablecoins to the original smart contract to withdraw the same collateral amount at any given time.

The Main Benefits of Stablecoins

As mentioned in the introductory part of this post, stablecoins are incredibly helpful and beneficial in the cryptocurrency universe. Here are some of the prominent benefits they offer:

Price Stability in a Volatile Market

The first and most obvious benefit offered by stablecoins is price stability in a rather volatile market. As we all know, cryptocurrencies are generally volatile and rightly considered risky. Stablecoins bring price stability, which helps many traders to manage risks.

Quick and Easy Way to Trade and Move Assets within the Crypto Market

Stablecoins help active traders and investors to make quick moves when the need arises. Since their value can neither rise nor drop suddenly, traders can use them to move assets easily and complete trades faster without wasting days trying to deposit fiat currencies. It offers improved convenience and flexibility.

Interest-Yielding Assets

Stablecoins are incredibly beneficial to users who intend to earn interest with their crypto investment. While they can’t gain value quickly like volatile assets, they yield reasonable interest when used for lending and staking activities. With Binance, for instance, traders can buy Binance USD and generate compound interest through Binance Earn. There are several other ways to generate interest and passive income from stablecoins.

Top 3 Most Popular Stablecoins

Are you considering buying stablecoins anytime soon? Then you need to know the popular ones that are considered reliable. Here are three of the most popular stablecoins:

Tether (USDT)

Tether is undoubtedly the most popular stablecoin. It is pegged against the U.S. dollar, so the price is approximately $1 at all times. Its market cap stands at $66.90 Billion at the time of writing.

Binance USD (BUSD)

Binance USD is among the most popular stablecoins. It is also pegged against the U.S. dollar and its market cap stands at $17.55 Billion at the time of writing.

USD Coin (USDC)

USD Coin is another incredibly popular stablecoin pegged against the U.S. dollar, also. Its market capitalization at the time of writing was $55.86 billion.

How to Buy Stablecoins on Binance in Five Simple Steps

Are you willing and ready to start buying stablecoins with your credit card? Binance is one of the best platforms to do that. The processes are simple and straightforward.

Here are just five steps you can take to purchase any of the popular stablecoins with your credit card:

Step 1

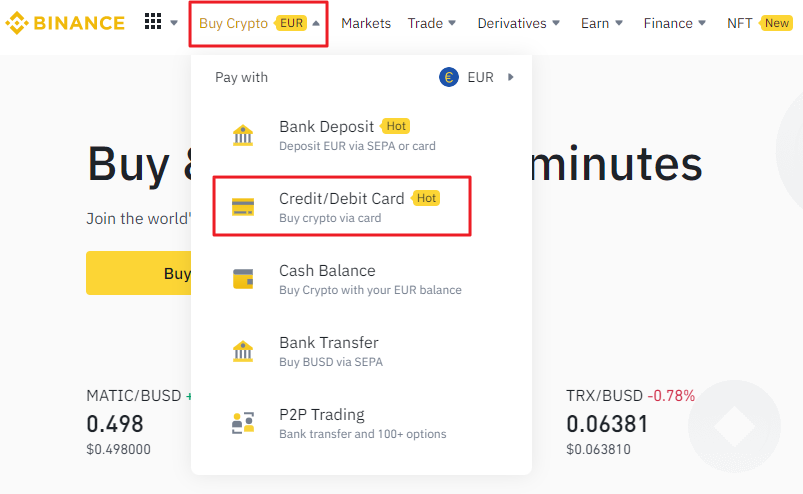

Log in to your Binance Account. Click [Buy Crypto] and select [Credit/Debit Card].

Step 2

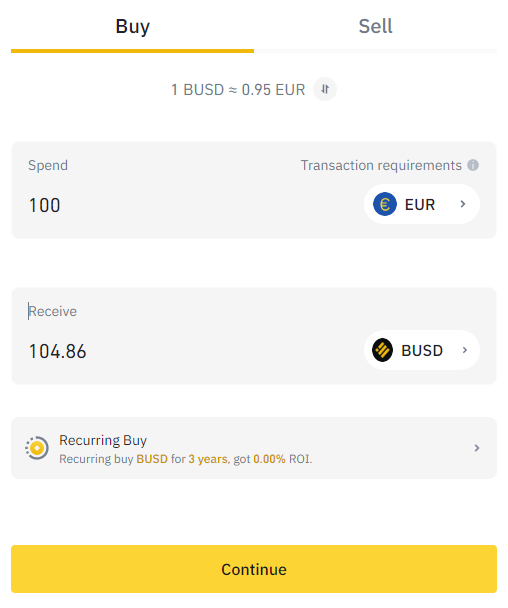

Choose the fiat currency you intend to buy stablecoin with (could be the US dollar, Euro, or other supported currencies. Enter the amount you wish to spend – the system will automatically calculate and display the amount of crypto you will get.

Step 3

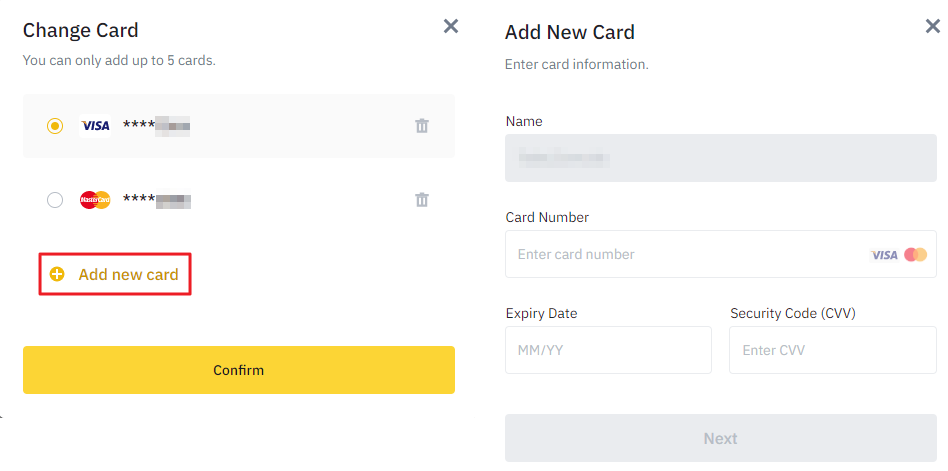

Select one of your existing credit card options, or click [Add New Card], then enter the credit card details. (Note that you can only pay with a credit card in your name). Enter your billing address and click [Add Card].

Step 4

Check your payment details carefully to confirm that everything is in order, then click [Confirm].

Step 5

The system will redirect you to your bank’s OPT Transaction Page. Verify your payment.

Wrapping Up

Stablecoins can be helpful in many ways and you can buy them with a credit card. As the biggest cryptocurrency exchange, Binance makes it easy for anyone to buy crypto with a credit card. You can also choose to buy crypto with a cash balance using EUR or any other supported fiat currency, or deposit your local currency through a bank transfer or using a third-party payment processor.

FAQs

Q: Can I link more than one bank card to my Binance account?

A: Yes, on Binance, you can link as many as five bank cards to your account.

Q: What type of Credit Cards are supported by Binance?

A: Binance generally supports Visa and MasterCard payments. However, your country/region may determine the acceptable cards you can use.

Q: If my purchase fails, will I get a full refund?

A: Yes, you will get back the full amount you paid if your purchase fails. No charge or fee is applied.

Q: After buying stablecoin with a credit card, where can I find them?

A: You will find your purchased stablecoin in your wallet. Just go to [Wallet], then click [Overview]. You will see if the stablecoin has arrived.

Q: Can I check my purchase history at any time?

A: Yes, you can always check your purchase history to be sure that transactions are completed. Simply click [Orders], then [Buy Crypto History], and your order history will be displayed.