Cryptocurrency loans can be a great method to attain additional funds, which can be used to increase your spot portfolio, engage in futures and margin trading, or earn high APY by staking borrowed crypto. In this article, we will focus on the main benefits of Binance Loans and discuss what you should consider before taking out a crypto loan.

An introduction to Binance Loans

Binance Loans is a unique financial service that allows users to borrow crypto funds by using their existing holdings as collateral. While the crypto-oriented service is in principle very similar to traditional loan offerings, it differs in several important ways. For starters, Binance doesn’t require its users to provide a credit score and charges very competitive rates of 0.025% to 0.040% per day on borrowed funds. Keep in mind that the interest rates can be further slashed by using the Loans Staking option and by increasing the VIP tier. We will discuss both in more detail in the following sections. Moreover, short loan terms, spanning from 7 to 180 days, provide a degree of flexibility that is usually lacking in traditional offerings.

The main benefits of Binance Loans

Here are seven reasons why borrowing crypto through Binance Loans is one of the best ways to obtain extra crypto capital in the industry.

1. Wide range of supported crypto assets

Through Binance Loans, users can borrow more than 60 different crypto assets by staking over 25 types of digital currencies as collateral. Users can pick between larger market cap coins such as Bitcoin and Ethereum, smaller altcoins such as Filecoin and Kava, and even stablecoins.

2. Transparent and competitive fee structure

Transparency when it comes to the fee structure is another pro of Binance’s Loan offering. In addition to hourly and daily interest rates, total interest and repayment amounts are prominently displayed on the Crypto Loans page, which ensures users are intimately familiar with the terms of their loan agreement.

3. Loans Staking

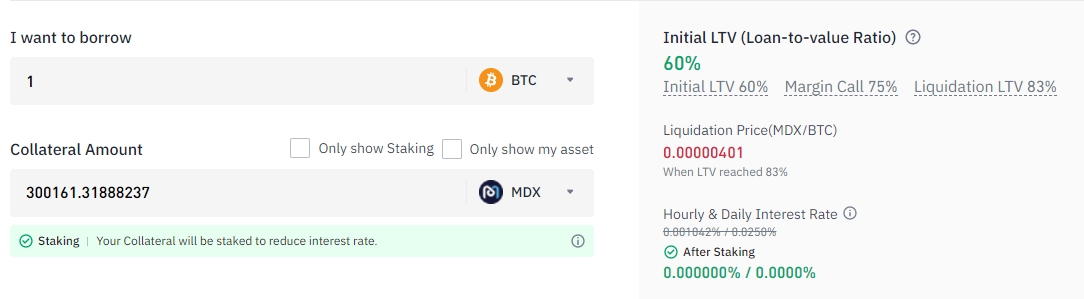

Binance leverages economic benefits generated by crypto staking to offset some of the interest on borrowed funds. The exchange achieves this feat by transferring supported types of collateral to a special wallet to support the operation of the blockchain network. This means that users that use currencies that support staking as collateral pay lower interest rates on their loans. In some cases, users pay zero fees on borrowed crypto.

When supplying MDX as collateral to borrow Bitcoin, for instance, users pay no interest on their borrowed funds. Other collateral cryptocurrencies that can be used for staking purposes at present time include CAKE, CTSI, DOT, KSM, NEAR, and SOL.

4. Crypto Loans’ BNB holdings count toward the calculation of Daily BNB Balance

Last year, Binance revamped its Daily BNB Balance calculations to include Crypto Loans BNB holdings in its hourly snapshots of users’ BNB balances. This allows users to stake their BNB as collateral to borrow other cryptocurrencies while retaining the eligibility for BNB-related benefits such as discounted trading fees and the ability to participate in Launchpad public sale events.

5. Flexible loan terms

Binance provides access to five different loan terms, spanning in length between 7 and 180 days. Given that the max loan term caps at just half a year, Binance’s loan offering is best suited for shorter-term liquidity boosts.

6. Maximum loanable limits are adjusted based on market conditions

Given the relatively high volatility of crypto markets, Binance regularly adjusts maximum loanable limits to reflect the market conditions. For instance, the maximum BTC loan limit at press time was roughly 46.5 BTC. You can check the up-to-date rates on the Crypto Loans page.

7. Internal risk management

Users are given ample tools to manage their active loans and to make sure their loan-to-value (LTV) ratio doesn’t rise beyond liquidations limits. Internal risk management is a big component of Binance Loans. For more information about how to borrow crypto, manage loans, adjust LTV, avoid margin calls, and more, check our step-by-step guide to Binance Loans.

Things to consider before borrowing from Binance Loans

Before borrowing funds to engage in various crypto-related investment activities, such as margin trading BTC or staking borrowed BNB, for instance, we advise you to first invest a bit of time and effort into the following topics.

Familiarize yourself with the VIP system

Binance’s platform-wide VIP system makes it possible to pay less on borrowed crypto assets. Not only that, the tiered rewards program affects virtually all aspects of using Binance, spanning from the spot, margin, and futures trading fees to withdrawal costs, and more. Binance follows a simple principle when it comes to its rewards program: the higher the VIP status, the lower the fees. Click here for a complete overview of the VIP system.

DYOR on assets you would like to borrow or use as collateral

At this point, we would like to caution you against using cryptocurrencies you have no knowledge of. Sure, using a part of your crypto portfolio to borrow a digital asset you suspect has great potential sounds great in theory, but can often lead to more trouble than its worth. Make sure to do your own research and stick to bigger market cap cryptos if you lack extensive knowledge about the crypto you would like to borrow.

The bottom line

Binance Loans provides a seamless method to boost your short-term liquidity so you can pursue crypto trading and other lucrative opportunities in the space with borrowed funds. If at all possible, make sure to take advantage of the loan staking feature and the VIP benefits to gain access to additional crypto capital at a minimal cost.

However, using Binance Loans doesn’t come without risks. Be careful to not borrow beyond your financial capabilities and refrain from using crypto assets you are not familiar with. Hopefully, this article served as a solid introduction to Binance Loans and will help you decide whether you should give crypto loans a try.