For the first time in history, we have two competing (or indeed, collaborating) financial systems – DeFi (Decentralised Finance), made possible through crypto processing gateways, and TradFi (Traditional Finance) that relies on standard, centralised fiat processing.

One of the most prominent debates when these systems are compared is security, which is a paramount concern for both industry stakeholders and consumers alike.

So, which of these systems has the edge in ensuring the safety of assets and transactions?

Through a comprehensive exploration of both realms, we seek to discern if the innovative blockchain truly offers a more secure alternative to the age-old traditional finance system.

TradFi – Security

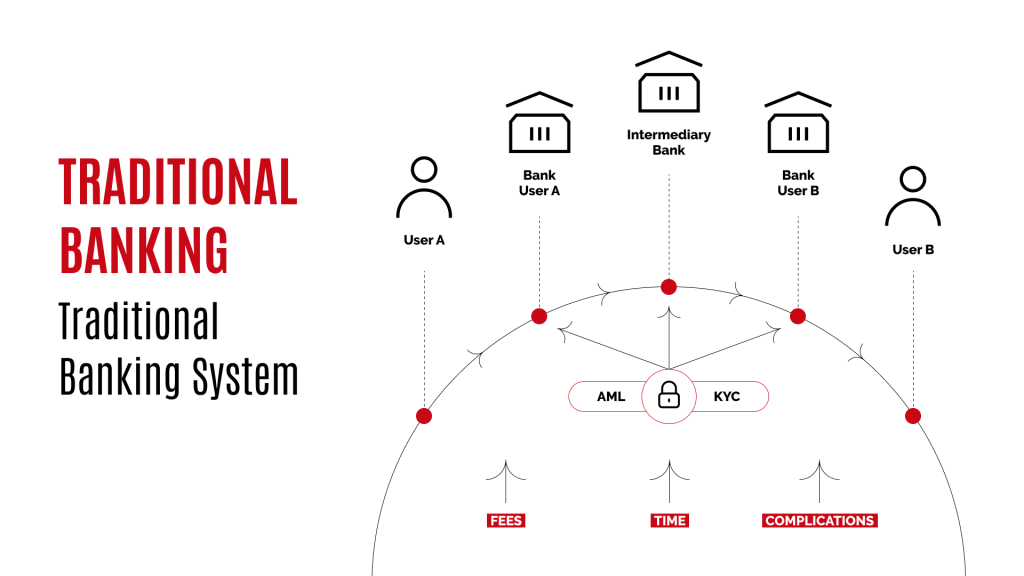

Traditional finance, often referred to as the legacy financial system or TradFi, is built upon centralised institutions like banks, credit card companies, and stock exchanges. In terms of security, these organisations are fortified with specific layers that have developed throughout the long history of traditional finance. Let’s take a look.

Firstly, there’s physical security. Even as far back as ancient Mesopotamia, fortified temples served as repositories for valuables and grain. Indeed, sometimes the old ways work best – bank vaults, armoured vehicles, and security personnel all serve as effective deterrents against would-be bank robbers.

Then comes the second layer of security – deposit insurance. The idea of deposit insurance was discussed in the U.S. from the late 19th century. However, it wasn’t until the Great Depression in the 1930s that these discussions gained significant traction. After the stock market crash in 1929, a series of bank runs ensued, leading to widespread bank failures. In response, the U.S. government established the Federal Deposit Insurance Corporation (FDIC) in 1933 as part of the Banking Act. The FDIC insured bank deposits up to a certain amount (which has since been periodically adjusted) and was funded by premiums paid by the member banks.

Lastly comes digital security. As banking evolved from the introduction of ATMs in the 1960s and 1970s to online and mobile banking in the late 20th and early 21st centuries, the necessity for robust digital security measures became paramount. To counter threats ranging from data interception and phishing to advanced cyberattacks, banks implemented various security mechanisms. These include SSL encryption, multi-factor authentication, biometric verification, and AI-driven anomaly detection. The ever-evolving landscape of cyber threats pushes the banking sector to continuously innovate, ensuring the safety of customer data and funds in the digital age.

We also shouldn’t forget that these institutions are heavily regulated, requiring them to adhere to specific standards and undergo periodic reviews. This somewhat counteracts one of the frequent consequences of centralisation – corruption.

However, this is by no means a watertight system in terms of its security. After all, the traditional financial system grapples with a myriad of security challenges.

- Physical Thefts and Bank Robberies: Even in our digital age, the threat of physical thefts, especially bank robberies, remains real and palpable.

- Forgery and Counterfeit Currency: The production and use of counterfeit currency pose significant risks, potentially undermining the trust in physical money.

- Cheque Alterations: With the continued use of cheques in some regions, alterations can lead to unauthorised transactions and significant losses.

- Insider Threats: Employees with privileged access can misuse their positions, leading to unauthorised actions or data breaches.

- Data Breaches: Even before the rise of digital banking, data breaches have always been a concern. These breaches can result in identity theft and unauthorised transactions.

So, can these vulnerabilities be mitigated? A competing system claims to have the answers.

DeFi – Security

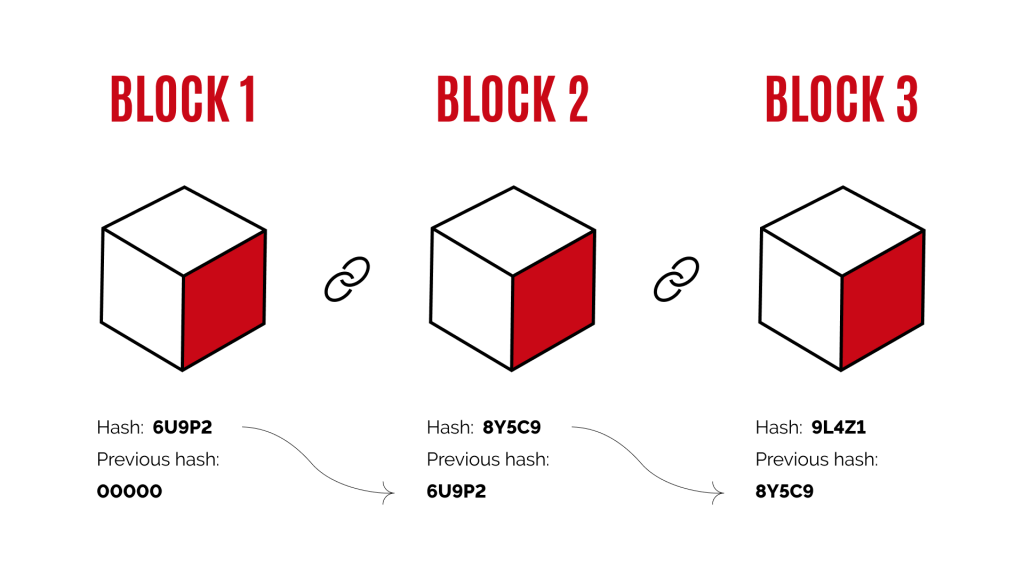

Blockchain technology, commonly associated with cryptocurrencies, is predicated on a decentralised architecture, contrasting with the centralised nature of traditional finance. At its core, security in blockchain is underscored by cryptographic principles, consensus algorithms, and distributed ledgers, representing a paradigm shift from conventional financial systems. Let’s delve deeper.

Firstly, we should consider the security-related benefits of a ‘decentralised’ blockchain, wherein transaction data is not stored on a single server or database but is instead distributed across a vast network of computers, often referred to as nodes. Each node maintains a copy of the entire ledger, ensuring data redundancy. In a centralised system, if the primary server is compromised or fails, the entire system is vulnerable. However, in a blockchain, even if one or several nodes are attacked or go offline, the system as a whole remains functional and secure. This distributed nature eliminates the traditional “single point of failure” responsible for data breaches and unauthorised transactions within the traditional banking system, making blockchains resilient against both technical failures and malicious attacks.

Then, there are the benefits associated with cryptography. Each transaction made on the blockchain is encrypted using sophisticated cryptographic algorithms, turning transactional data into complex codes that are nearly impossible to decipher without the corresponding decryption key. This encryption ensures data integrity, as any minor change in the transaction data would produce a drastically different cryptographic result, making tampering evident.

Beyond just encryption, blockchains utilise digital signatures, a cryptographic tool. When a user initiates a transaction, it is signed with their private key, a unique cryptographic identifier. Others in the network can then use the initiator’s public key to verify the transaction’s authenticity and ensure it hasn’t been altered in transit. This dual mechanism of encryption and digital signatures not only safeguards data integrity but also provides robust authentication, ensuring that transactions are genuine and traceable back to their origin.

And lastly, there’s the transparency element. At their core, the consensus mechanisms of the blockchain dictate how transactions are verified and how new blocks are added to the chain, ensuring that all participants agree on a single version of the truth. Such a level of transparency makes it incredibly difficult to ‘trick’ the system, thereby deterring bad actors.

Comparing the Two

Now that we’ve managed to get our heads around the security-related elements of each system, let’s compare some competing themes of each system, with the intent of crowning a winner.

Centralisation vs. Decentralisation

Centralisation in traditional finance concentrates operations and data within specific entities like banks or regulatory bodies, offering streamlined decision-making and oversight but exposing the system to vulnerabilities like single points of failure from cyberattacks, institutional collapses, or insider threats.

In contrast, the blockchain’s decentralised framework disperses operations across numerous nodes, providing resilience against many conventional threats but introducing its own challenges, such as potential network forks and the risk of 51% attacks where majority control could compromise the system’s integrity. This dichotomy highlights the trade-offs between centralised efficiency and decentralised robustness in the financial realm.

The Human Element

The traditional financial landscape, with its intricate web of human-managed operations and decisions, has been historically susceptible to errors, intentional fraud, and various forms of misconduct, often culminating in substantial financial damages. Blockchain, with its algorithmic and automated approach, notably diminishes this human involvement, especially in transaction verifications, thus mitigating many associated risks. However, it’s not entirely foolproof.

The decentralised ecosystem, though robust, faces challenges from flawed smart contract codes, which, once deployed, can be exploited. Additionally, the secure custody of cryptographic keys (a crucial component of blockchain operations) often lies with the end-users, who may not always exercise the necessary caution, leading to loss or theft.

Regulation and Oversight

Traditional finance’s highly regulated landscape allows for stringent checks and oversight, offering protections to consumers and holding institutions accountable for malpractices. While critics argue these regulations can stifle innovation or become cumbersome, the framework provides a safety net for consumers, ensuring they have legal recourse in the event of disputes.

On the other hand, the nascent blockchain industry, being a relatively recent phenomenon, lacks comprehensive global regulations. While this has spurred innovation and allowed for rapid growth, it also means that DeFi participants may find themselves without a safety net in certain situations.

However, as the industry matures, regulations will inevitably evolve to strike a balance between protection and innovation. Recent regulations such as MiCA have been successful in establishing a unified stance on cryptocurrencies in Europe, and we expect to see similar regulatory endeavours in the near future.

Concluding Thoughts

When weighing the merits of security in DeFi against TradFi, it becomes apparent that both systems come with their unique strengths and vulnerabilities.

Blockchain’s decentralised, cryptographic, and transparent nature undeniably offers robust safeguards against many of the security challenges encountered in the traditional financial system. However, its relative infancy as an industry and lack of comprehensive regulations pose certain risks.

Conversely, the tried-and-tested traditional finance infrastructure, with its layers of physical, digital, and regulatory protections, stands as a testament to the resilience and adaptability of centralised systems, even as it grapples with its own set of challenges.

Ultimately, as technology continues to evolve and the lines between DeFi and TradFi blur, we might find that the future of finance lies not in a contest between the two but in a symbiotic merger, leveraging the strengths of both worlds to build a safer, more inclusive financial ecosystem for all.

Indeed, this is where the crypto processing gateway comes in – a system that serves the hybrid world, offering quick, secure transactions on the blockchain while maintaining principles of AML and transaction monitoring native to TradFi. Should your business wish to onboard such a solution to reap the benefits of both worlds, one such solution is CryptoProcessing.com, the largest crypto payments gateway in terms of transaction volume.

Head on over to their site to learn more and book a free consultation with a member of their sales team today.