Key takeaways:

- Bitcoin gained 13% today and came within striking distance of breaking $44,000

- 98 out of the top 100 digital assets in terms of market cap have been trading in the green zone in the last 24 hours

- Several prominent members of the crypto community caution investors from being too optimistic

Bitcoin rallies to $43,700 and sparks a broader market rally

The rollercoaster of big price swings continues. Today, the market underwent a massive rally that pushed the total crypto market cap up by 9.36% to $1.96 trillion at press time.

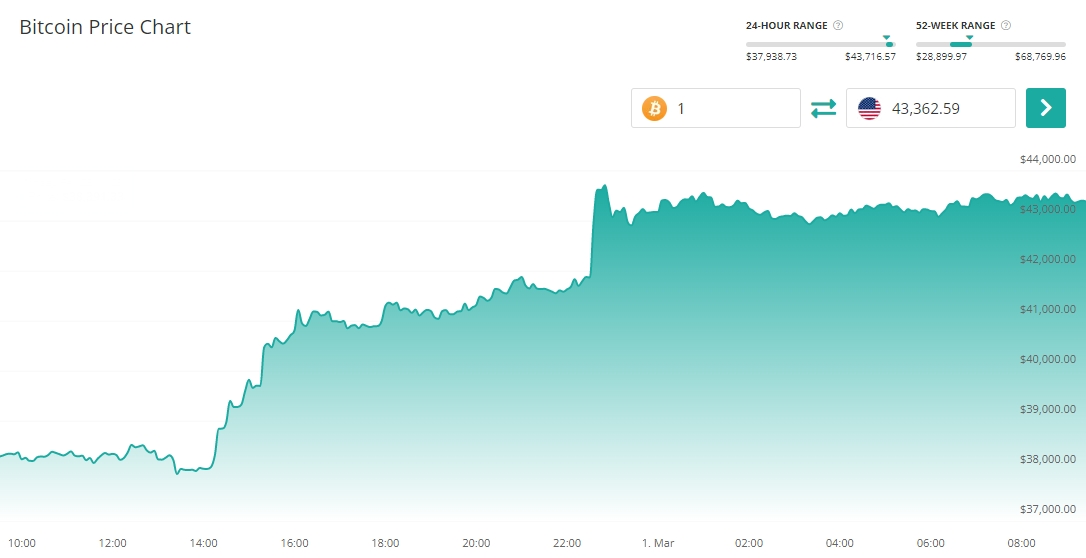

After initially losing over 10% last Thursday on the news of Russia attacking Ukraine, Bitcoin quickly recuperated much of its losses the following day and continued to trade in a relatively tight range around the $39,000 mark in subsequent days. Today, however, the world’s largest crypto catapulted to as high as $43,717, before dropping back to $43,362 at the time of this writing.

Bitcoin’s impressive performance sparked the broader market rally. Overall, 98 out of the top 100 digital assets have been trading in the green zone over the past 24 hours. Ethereum came tantalizingly close to breaching the $3,000 mark after gaining 10%, while Terra and Near Protocol impressed with roughly 20% gains. BNB, Avalanche, and Cosmos were among the biggest benefactors of today’s rally, with each of them being up more than 10%.

Whale accumulation is likely not the reason behind the surging market prices

Blockchain analytics firm Glassnode tweeted that today’s markedly bullish market activity could hardly have been triggered by whales accumulating Bitcoin.

In a separate Twitter thread, Glassnode noted that the Bitcoin network settled nearly $9 billion in “change-adjusted volume within a single block,” and added that “there has been a peak of only $225M in $BTC value withdrawn from all exchanges we track in this time period.” Glassnode believes that the large discrepancy resulted from “internal exchange wallet reshuffling.”

While the market surge is certainly a welcome sight, several prominent voices in the crypto community caution investors from being too optimistic. Entrepreneur, crypto investors, and podcast host Anthony Pompliano hit the nail on the head with the following statement:

“There has been a global pandemic, economic recession, government lockdowns, 40-year high inflation, a war in Europe, and much more over the last 2 years. Humans can’t predict the future well. Prepare accordingly.”

Well-regarded crypto trader and blockchain analyst Pentoshi echoed the above sentiment in today’s Twitter post. He noted that given the economic uncertainty and everything that is happening right now, a “day to day approach is bet.”