Key takeaways:

- The total cryptocurrency market cap increased almost 10% in the last 24 hours, erasing much of yesterday’s losses in the process

- LUNA turned out to be the most resilient top 50 coin in the last 72 hours, having gained over 25%

- According to blockchain analyst Willy Woo, large price fluctuations are to be expected given Bitcoin’s “risk-on safe haven” status

Bitcoin tops $39,000 on the tailwind of 10% gains

The cryptocurrency market performed a pronounced zig-zag movement in the last 24 hours. The majority of digital assets followed in the footsteps of Bitcoin, which dropped more than 10% yesterday only to bounce back over its Thursday highs.

Bitcoin Mimics Stocks And Losses Over 10% As Russia Launches ‘Special Military Operation’ in Ukraine

As Russia announced its “special military operation” in Ukraine, the price of Bitcoin dropped to $34,400 in a matter of hours. However, the world’s largest cryptocurrency erased all of its losses in subsequent hours.

Other top 10 cryptos, including Ethereum, Solana, Cardano, and Avalanche followed the same pattern – losing over 10% yesterday, only to regain lost ground on the next day.

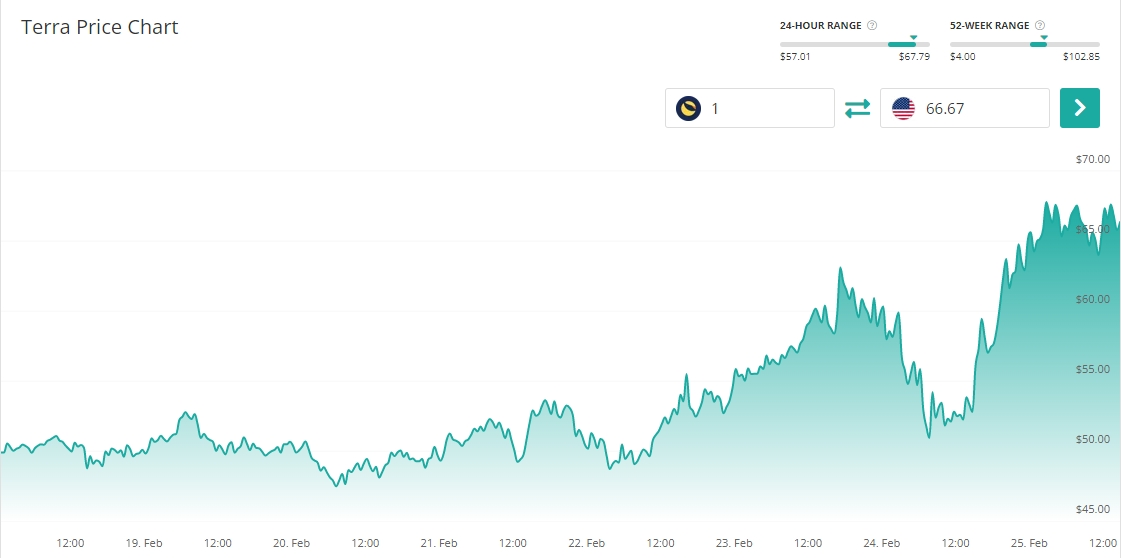

The notable exception was Terra’s LUNA. The native token of the second-largest DeFi platform in terms of the total value locked in decentralized applications running on its rails was showed a great deal of resiliency in the last 48 hours. As a result, LUNA currently tops the list of the largest daily gainers in the top 50 with over 20% gains. LUNA’s stellar market performance is in large part linked to Wednesday’s announcement of the $1 billion UST reserve fund, which solidified Terra as the leading algorithmic stablecoin operator in the industry.

Bitcoin’s role as a safe haven asset gets questioned

Despite the quick recovery in the value of the majority of digital assets, the discussion arose about Bitcoin’s role as a reserve asset. Among others, Peter Schiff, a prominent Bitcoin critic and a big proponent of gold, and Bloomberg’s Emily Nicolle, wrote about Bitcoin’s poor performance in light of Russia’s attack on Ukraine.

However, it wasn’t long before the price of gold faltered and Bitcoin began picking up momentum. Talking on the subject of safe havens, blockchain analyst Willy Woo explained his view on the current role of Bitcoin on Twitter.

While large price fluctuations are certainly problematic, they are bound to get less volatile as the adoption picks up. Meanwhile, Bitcoin’s rally in light of economic uncertainty instills a great deal of confidence in the world’s oldest crypto.