Key takeaways:

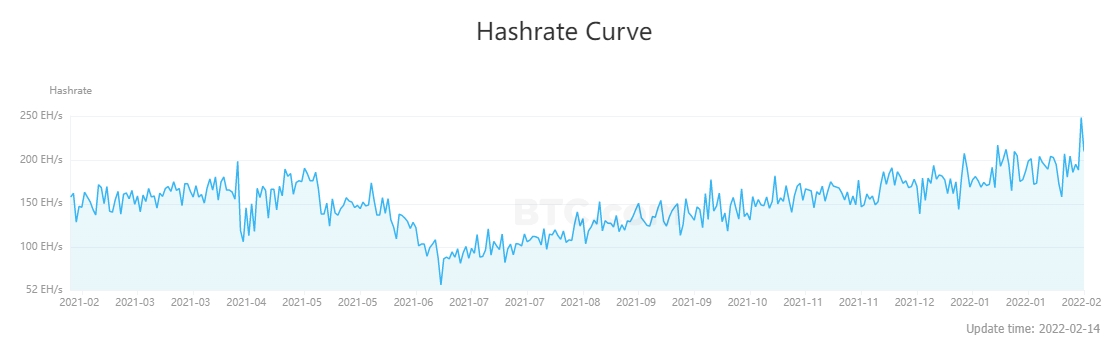

- The Bitcoin network recorded a new all-time high of 248 EH/s on February 12, 2022, surpassing the previous record set on January 13, 2022, by roughly 15%.

- The network’s hashrate is based on the computation power of Bitcoin miners participating in the process of securing the blockchain platform

- The political tension in Kazakhstan and Russia, the homes of the world’s second and third-largest mining operations, could see Bitcoin miners move to NA in bigger numbers

Hashrate jumps to 248 EH/s, further ensuring security of the Bitcoin network

On Saturday, the Bitcoin network’s hashrate reached its highest value to date. In a single day, the computational capabilities of the world’s largest Proof-of-Work (PoW) blockchain platform jumped from 188.4 exahashes per second (EH/s) to 248.1 EH/s.

In essence, hashrate is a measure of the Bitcoin network’s security based on the global computational output of cryptocurrency miners participating in the process of maintaining the network. According to data from Cambridge Bitcoin Electricity Consumption Index (CBECI), the US accounts for a 35% share of the global hashrate, ahead of Kazakhstan’s 18% and Russia’s 11%.

In the first half of last year, the hashrate dropped to its multiyear low after the Beijing authorities cracked down on its cryptocurrency mining industry. At the time, China accounted for roughly 70% of all hashrate production. The clampdown that ensued saw the Bitcoin hashrate drop from May’s peak of 190.5 EH/s to a two-year low of 57.4 EH/s on June 27. Since then, China-based miners have found a new home in various mining hubs across the world, with the biggest share going to the US due to low electricity costs and readily available infrastructure.

The ongoing political tensions in Kazakhstan and Russia could contribute to large fluctuations in the Bitcoin hashrate going forward. Kazakhstan recently cut off the supply of electricity to crypto miners following civil unrest in the country, while Russia’s upcoming cryptocurrency legislation and tensions with Ukraine could have a significant impact on the country’s crypto mining industry. In response to the growing uncertainty, we could see more Bitcoin mining operations elect to move to the North America region in the near future.