Key takeaways:

- Press release of Walmart accepting Litecoin as a payment led to a massive pump, followed by an even bigger dump when the news was found out to be fake

- After the momentary selling pressure subdued, the market started gaining momentum and is up more than 3% in the last 24 hours

- As of the time of writing, 95 out of the top 100 cryptocurrencies by market cap are trading in the green

Press release of Walmart accepting Litecoin payments (now removed) that appeared yesterday on GlobeNewswire sent the market in a momentary frenzy. Most crypto assets started approaching double-digit gains in the moments following the announcement with Litecoin leading the charge with a 35% price increase. The news was disproven in a matter of an hour as a Walmart spokesperson confirmed that “the press release was not authentic.”

While Litecoin obviously experienced the most market activity, other cryptocurrencies also responded very positively to the news. The price of Bitcoin jumped from $44,600 to $46,250 almost instantly, Ethereum gained $200 as pretty much all digital currencies have recorded the same “candle” pattern (albeit smaller) as can be seen on the Litecoin chart above. As soon as the news was labeled as fake, however, the prices began to drop and when all was said and done, most digital assets were trading below the price levels they held before the fake press release.

A bit less than 24 hours after the fabricated news went live, however, the market has recovered decently and is currently posting gains of more than 3% in the last 24-hour period. Yesterday’s news of a major retailer accepting crypto payments was somewhat reminiscent of July’s rumors of Amazon accepting Bitcoin and other top coins. Although the rumors were later proven to be incorrect, the news played a significant role in sparking more than a month-long market rally that abruptly finished with last Tuesday’s flash crash. We can hope that the latest Walmart news will have a similar effect. At press time, 95 out of 100 top cryptocurrencies by market cap are in the green.

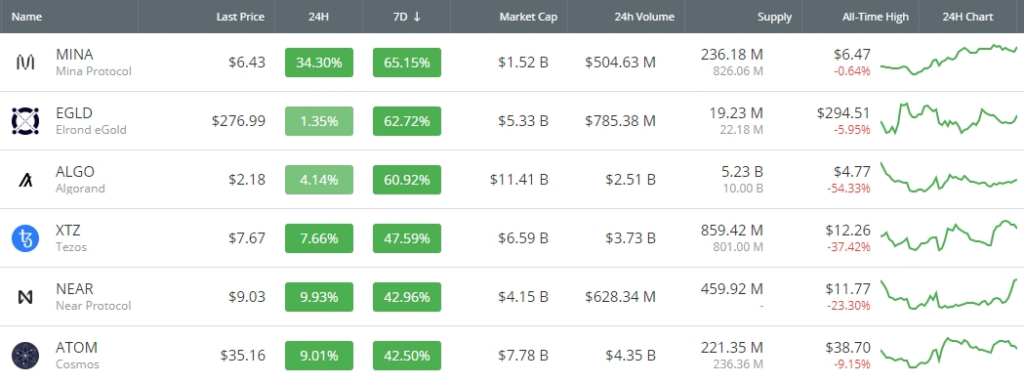

Despite the total cryptocurrency market cap currently being down more than $300 billion since its September peak with most coins struggling as of late, there are some notable exceptions. Elrond eGold, Mina Protocol, and Cosmos have all managed to reach their new respective all-time highs amidst the bearish trend, while Tezos, Algorand, and Near Protocol all recorded gains of more than 40% over the last seven days.