Ford stock could reach the $100 price level if the company manages to capture a significant EV market share and increases its production. Even then, the $100 price milestone would be difficult to reach, as the stock would have to trade nearly three times above its late 1990s all-time high.

The Ford Motor Company (NYSE: F) is one of the world’s most prominent vehicle manufacturers, employing more than a 190,000-strong workforce across the world. Ford has recently been investing heavily in electric vehicles and has seen a great deal of market success, trailing only Tesla as the most popular EV manufacturer in the US.

In this article, we are going to examine the main catalysts that could help fuel a Ford stock rally and the main obstacles standing in the way of the Ford stock reaching $100.

Factors that could help Ford stock reach $100

There are several growth catalysts that could help Ford’s stock reach the $100 milestone. For starters, Ford has been increasing its EV market share in recent years, thanks to a revamped product lineup and the increase in the units shipped. In addition, Ford’s stock historically traded as much as +133% above its current price, which suggests that Ford has a lot of potential. That said, let’s examine each of these factors in more detail in the sections that follow.

Increase in the sale of electric vehicles (EVs)

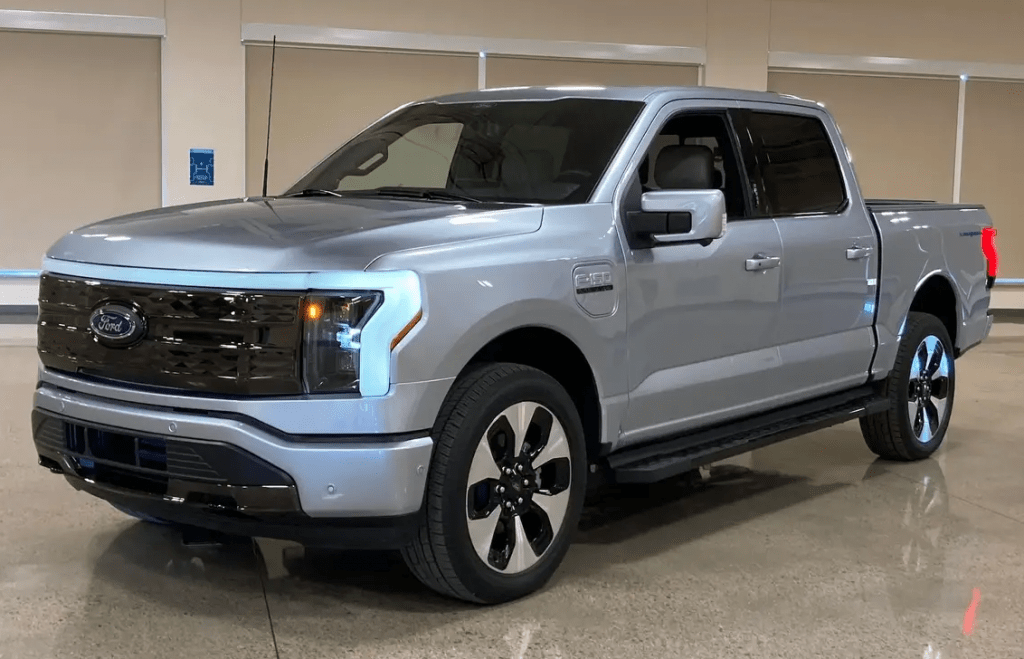

According to Ford’s Q1 2024 sales release for the US, Ford sold 20,223 EVs in the first quarter of the year, making it the second largest EV brand in the US in terms of number of sales. Notably, the company sold 7,743 F-150 Lightning trucks, positioning it as the best selling electric truck in the United States.

Ford saw 42% growth in its hybrid sales in Q1, selling 38,421 vehicles. The company says it expects to continue seeing growth in its hybrid sales as new versions of hybrid F-150 trucks make their way to dealerships.

New product lineup

Ford has always been known for its lineup of pickup trucks, led by the iconic F-150. Ford decided to leverage the popularity of the F-150 model and created the F-150 Lightning, an electric-powered alternative to the traditional truck. Ford buyers have apparently been very happy with the new F-150, as they have been selling very well and even cracked the list of the 10 most sold EV vehicles in the US.

By year’s end, the company is targeting an annual rate of return of 150,000 units for the F-150 Lighting and 210,000 units for the Mustang Mach-E, another electric SUV in Ford’s lineup.

Beyond the F-150 Lighting, Ford’s overall focus on light trucks is more apparent than ever. Out of 475,906 vehicles sold in Q3 2023, only 14,022 were cars, with SUVs and Trucks accounting for the remainder of units.

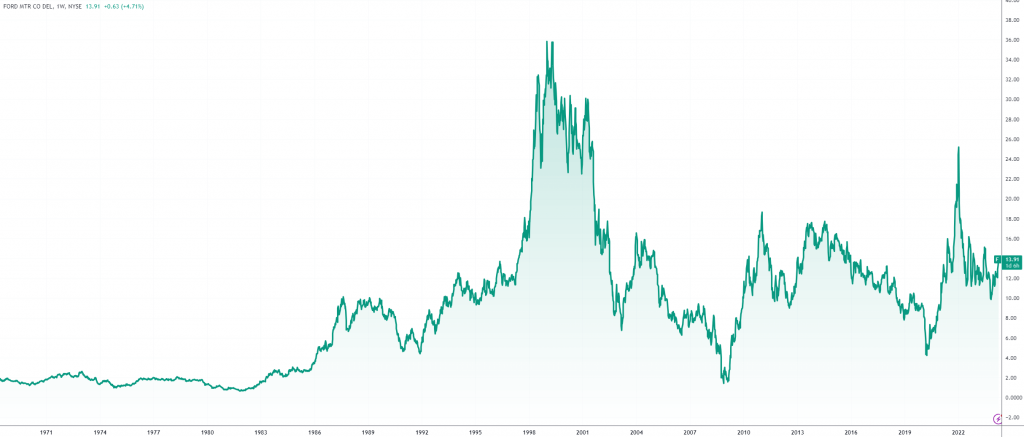

Historical stock price trends

At the time of writing, Ford is trading at roughly $13.9 per share, up more than +14% since the start of the year. While the stock has been performing well recently, it is trading far removed from its all-time high of more than $35, which it reached in late 1999.

If Ford manages to maintain its strong position in the US market and potentially expand its presence in the emerging markets for EV vehicles globally, the price of Ford stock could see a massive rally.

Ford’s market cap currently stands at $55.5 billion. At $100 per share, Ford’s market cap would stand at just shy of $400 billion. Meanwhile, the market cap of Ford’s main competitor, Tesla, is $840 billion. Given the number of produced units and plans to increase vehicle production even further in the coming months and years, it seems quite plausible that Ford could reach $100 in the future.

Factors that could prevent Ford stock from reaching $100

The main obstacles in Ford’s journey to $100 lie in the increasingly strong competition in the EV market, decreasing sales in China, one of the most important markets in the world, and Ford’s relatively poor stock market performance in the last two decades, which could in part be a result of the above-average dividend yield.

Strong competition in the EV market

Virtually all car makers have poured a significant amount of resources into building and developing their own electric vehicles in hopes of claiming a share of the EV market, the most important battleground that will ultimately determine who the largest companies in the automotive industry will be.

So far, Ford has been quite successful in the EV space, managing to claim the second spot in the US in terms of EVs sold, behind Tesla. However, Chinese manufacturers like NIO and BYD, European automotive staples like Volkswagen, BMW, and Renault, as well as Japanese-based Toyota and Mitsubishi, are all developing their own EV products and technologies, which could cause Ford to lose a part of its EV market share going forward.

Decreasing sales in China

While EVs are clearly the future, internal combustion vehicles still account for the majority of vehicle sales – and that will likely remain the same for the foreseeable future. According to a 2021 report from the New York Times, “EVs could make up 25% of new vehicle sales by 2035,” and as much as 60% by 2050.

In the meantime, Ford’s traditional vehicle sales in China have been plummeting for the last couple of years. After hitting an all-time peak of 1.3 million units in 2016, Ford’s sales dropped to 600,000 in 2021 and slipped to 500,000 in 2022. According to a spokesman for Ford Motor China, the company will respond to the falling sales by reducing costs “in all areas”. “We can only win through a lean and agile organization. These actions are necessary for us to build a healthier and more sustainable business in China,” the spokesperson said.

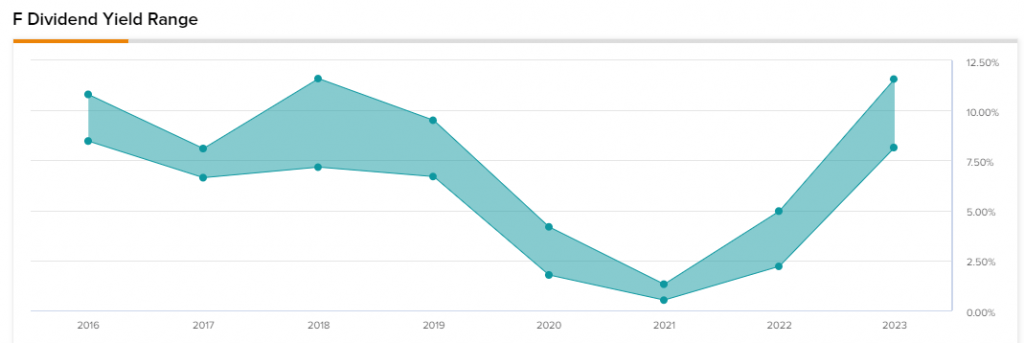

High dividend yield

Historically speaking, Ford stock has had one of the highest dividend yields out of the S&P 500 stocks. The dividend yield range reached as high as 11.6% in the past couple of years, which is considerably more than the S&P 500’s long-term average dividend yield of 1.85%.

High yield rates are usually an indicator of a company’s profitability. However, a very high yield rate can result in lower stock prices, as a large part of earnings is allocated to reward shareholders instead of them being invested in R&D, manufacturing facilities, and other business elements that could increase profitability in the long term at the expense of short-term profits.

Ford stock forecast for 2023-2024

According to an algorithmic prediction by CoinCodex, Ford’s stock is anticipated to show strong performance in the latter half of 2024, breaking past the $20 mark in December after a rally beginning in October. The peak of this upward trend is expected in late January 2025, reaching a price of $28.9 before potentially revisiting the $20 price level.

It’s important to remember that these algorithmic forecasts on CoinCodex are based purely on historical price data and current market conditions. They do not incorporate any fundamental analysis of the stock or consider the impact of real-world events.

12-month Ford stock forecast. Source: CoinCodex

So, will Ford stock reach $100?

Ford stock certainly has the potential to reach $100 in the future, thanks to the company’s impressive EV sales and a focus on slashing production costs. However, whether the $100 price target will be reached is dependent on multiple factors, like Ford’s success in claiming a bigger EV market share globally and recovery in traditional vehicle sales in China, which are impossible to predict with certainty at this point in time.

If you are looking for long-term investment opportunities, you could consider investing in the best cryptocurrencies to hold for the long term, which includes Bitcoin, Ethereum, and other staples that could generate stable returns over longer periods of time.