Key takeaways

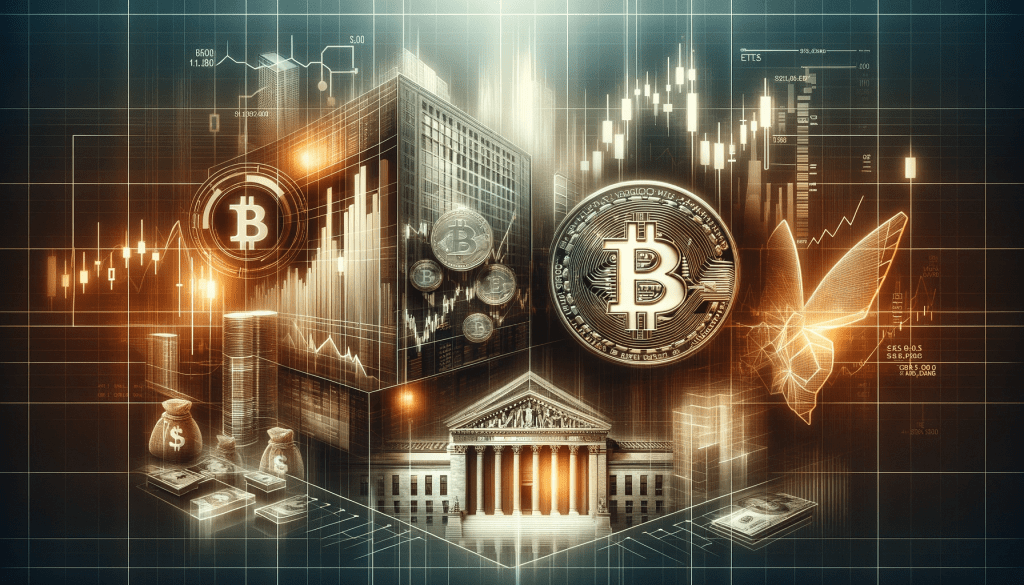

- A Bitcoin spot ETF allows investors to gain exposure to Bitcoin without owning the cryptocurrency directly, making it more accessible to a broader audience.

- Bitcoin ETFs are also more likely to attract conservative investment entities like pension funds and institutions.

- The approval of a Bitcoin spot ETF could signify increased regulatory acceptance of cryptocurrencies.

What is an ETF?

An Exchange-Traded Fund or ETF is a type of investment fund that is traded on stock exchanges, much like stocks. A Bitcoin Spot ETF tracks the actual current price (spot price) of Bitcoin, allowing investors to buy into the ETF and indirectly invest in Bitcoin without owning the cryptocurrency directly. This means you don’t have to worry about creating digital wallets or creating cryptocurrency exchange accounts. Instead, you buy shares of the ETF, which are tied to the performance of Bitcoin.

Why is a Bitcoin spot ETF important?

While Bitcoin ETFs might not immediately draw in trillions of dollars in investments, the key significance lies in opening up Bitcoin and cryptocurrency in general to a substantially larger group of investors. That will provide constant buying pressure for the years to come. Given the scarcity of Bitcoin that is embedded into its code, in the long run, it’s not hard to imagine a $1 million price tag on a single BTC.

Despite the effects of the approval on the price of Bitcoin, there are a few other advantages:

- Accessibility and Simplicity: It simplifies the process of investing in Bitcoin. Buying shares in a Bitcoin ETF is as easy as buying any stock.

- Regulated and Safer: It’s seen as safer because ETFs are regulated financial products. This offers some level of protection and legitimacy, unlike direct cryptocurrency investments that are less regulated.

- Wider Investor Appeal: A Bitcoin ETF can attract investors who are interested in cryptocurrency but are hesitant about the technicalities or risks of buying Bitcoin directly and storing it.

- Market Confidence: The approval of a Bitcoin ETF can be seen as a sign of growing acceptance of Bitcoin by regulatory authorities, which might boost investor confidence in the cryptocurrency market.

Bitcoin in retirement accounts and pension funds?

Pension funds and institutional investors are typically conservative in their investment choices, focusing on stability and long-term growth. Currently, many pension funds may be hesitant to invest directly in Bitcoin due to its volatility and the complexities involved in holding cryptocurrencies. However, they are more likely to invest in ETFs because:

- Regulation and Familiarity: ETFs are a familiar investment tool for pension funds and are regulated, making them a more comfortable choice.

- Diversification: A Bitcoin ETF allows pension funds to diversify their portfolios with a new asset class without the high risks associated with direct cryptocurrency investments.

- Ease of Investment: Pension funds can easily buy and sell ETF shares, just like stocks, without needing to manage the actual digital assets.

Paving the way for other crypto ETFs

The success of a Bitcoin ETF could set a precedent for other cryptocurrencies like Ethereum. If a Bitcoin ETF proves to be stable and profitable, it might encourage regulators to approve ETFs for other cryptocurrencies. This could open the door for more mainstream investment in a variety of digital currencies.

Conclusion

The introduction of a Bitcoin spot ETF would be a major milestone for the cryptocurrency world. It would bridge the gap between traditional investment methods and the new world of digital currencies, offering a regulated, simpler, and potentially safer investment option. This could not only increase the accessibility of Bitcoin to a broader range of investors, including large institutional ones like pension funds and institutions but also pave the way for other cryptocurrencies to gain similar acceptance.