Margin trading allows traders to magnify their exposure to markets by borrowing capital from a third party, usually a broker. While margin trading has been used in traditional financial circles for decades, the investing approach has recently found its way to crypto as well.

Being the largest cryptocurrency trading platform in the world, Binance is one of the premier destinations for cryptocurrency margin trading. The platform support countless crypto trading pairs, up to 10x leverage on spot margin trades, and charges low trading fees.

What is crypto margin trading?

Before exploring the main benefits of using Binance Margin in more detail, let’s first briefly touch upon the mechanics of margin trading. If you are familiar with the topic, we suggest you skip to the next section, or you can stick around for a quick refresher.

As briefly mentioned in the opening paragraphs, margin trading refers to the practice of borrowing capital from a third party, either a broker, an exchange, or any other lender, to increase exposure to markets. A person borrowing funds has to fulfill to criteria – ample collateral has to be supplied and interest on borrowed funds paid.

Once the margin trading position is closed, the borrowed funds are repaid along with interest, while a trader pockets the price discrepancy between the price an asset was bought and sold at as a profit.

Margin trading (trading spot assets with leverage) shouldn’t be confused with crypto futures trading (trading derivative contracts with leverage). To help alleviate the confusion, Binance put together a handy cheat sheet that lists the main differences between the two.

Example of crypto margin trading

Trading on margin is usually done using leverage, which determines how big of an impact market movements will have on potential profits and losses.

For the purpose of this article, let’s imagine a scenario where a trader buys 1 Bitcoin on margin using 10x leverage. Let’s take the current market rate of Bitcoin, roughly $20,000, as a baseline.

In regular spot market trading, if Bitcoin were to improve to $22,000, thus increasing by 10%, a person holding BTC would make $2,000 in profit once it was sold. Conversely, if BTC would decrease by 10%, a holder would end up losing $2,000.

Let’s use the above price movement to illustrate how margin and leverage work. Using 10x leverage with 1 BTC collateral essentially means that a trader operates in the market as if it had 10 BTC. A third party supplies the additional 9 BTC as margin.

With the spot price of BTC increasing from $20,000 to $22,000, a trader’s 10x leveraged position would increase from $200,000 to $220,000. With 9 BTC (worth $198,000) that was borrowed repaid, a trader would end up pocketing a profit of $22,000 (minus the trading fees).

However, greater susceptibility to market swings means that a trader using 10x leverage would lose its entire collateral in the event Bitcoin would lose 10%. They would be forced to supply more collateral to keep their position open, or face liquidation.

The advantages of cryptocurrency margin trading on Binance

Binance lets traders pursue crypto margin investment with more than 600 trading pairs using both cross margin and isolated margin accounts. Let’s take a closer look at some of the main features of the Binance Margin platform.

600+ trading pairs

One of the main advantages of using Binance compared to most other crypto trading platforms is the sheer number of supported coins and tokens. Another thing that separates Binance from others is the ability to trade cryptos not only against stablecoins but also against Bitcoin and several altcoins. The list of crypto/crypto trading pairings includes:

- x/BUSD (e.g., BTC/BUSD)

- x/USDT (e.g., BTC/USDT)

- x/BNB (e.g., ADA/BNB)

- x/ETH (e.g., ADA/ETH)

- x/DOGE (e.g., SHIB/DOGE)

It is worth noting that by far the most pairs eligible for margin trading are listed under BUSD and USDT trading pairs.

Robust security and risk mitigation

Binance employs a series of security measures to protect its customers from incurring excessive losses or suffering from extreme market volatility.

For starters, an Insurance Fund ensures the profits of winnings traders are always paid out in full. Moreover, the Margin Risk Fund – funded by 15% of all interest fees collected from margin borrowing – is used to cover any outstanding loans of liquidated margin accounts.

Last but not least, Binance rolled out the Margin Cooling-Off Period feature in August 2021 as another measure to encourage responsible trading on the platform. The feature allows traders to freeze their access to margin trading activity for a period of 1 day, 3 days, or 1 week.

Low borrowing fees

It shouldn’t come as any surprise that when borrowing funds for the purposes of margin trading, you have to pay interest. On Binance, fees vary by each cryptocurrency, with large market cap coins usually being cheaper to borrow than smaller, less liquid assets.

For example, the daily interest rate for Bitcoin starts at 0.008027%, while borrowing Dogecoin costs 0.020000% per day.

It is worth noting that users with a higher VIP level pay less in margin fees. For context, the highest VIP-tiered Binance users pay 60% less than non-VIP ones.

Binance is currently running a zero-fee Bitcoin promotion that covers traders’ fees across 13 different BTC trading pairs, making the platform ever more competitive in that regard. For more information, click here.

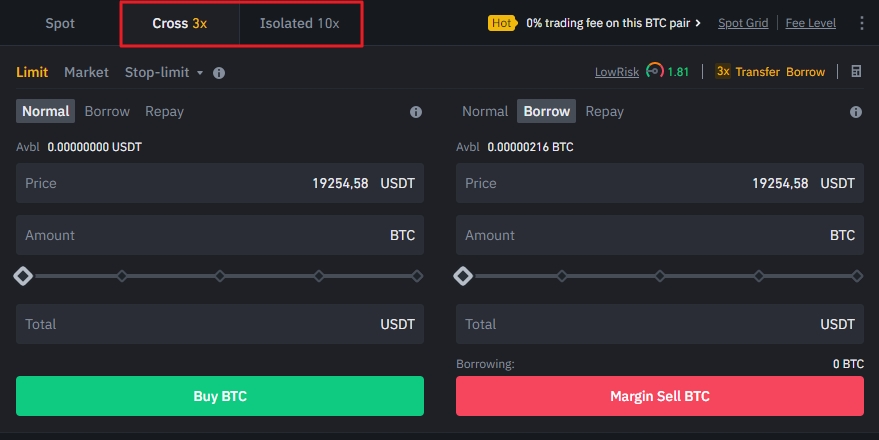

Isolated and cross-margin trading

There are two common approaches to margin trading – one that involves isolated margin, and one that involves cross-margin.

Isolated margin refers to a margined trading position that is restricted from other positions in a margin account. The benefit of isolated margin is that if a trade goes awry, the position is liquidated without impacting a trader’s other margin positions.

Cross-margin hedges the entire margin portfolio, meaning that if one margin position incurs losses, another position can be used to maintain margin requirements. The benefit of using cross-margin is that a trader can enter more positions with the same amount of collateral. However, one bad margin trade can render other positions in an account unprofitable, or in the worst case, liquidated.

Up to 10x leverage

Binance supports a maximum leverage level of 10x with Isolated margin mode enabled and a maximum of 3x leverage when using Cross-margin mode. While some platforms do offer higher leverage, it must be noted that using high leverage levels with crypto assets (or any other asset for that matter) can be extremely risky.

Using leverage can turn even the most minute price movements into highly lucrative investment opportunities. In turn, high leverage can lead to major losses. We would advise newcomers to start by using low leverage levels first, and gradually progress toward higher levels once they get comfortable.

For a better understanding of what 10x leverage entails, check the Example of crypto margin trading section above.

Wrapping up

Thanks to a broad selection of cryptocurrencies, asset pairings, robust security, and low fees, Binance Margin easily ranks among the best cryptocurrency margin trading platforms in the sector.

For more information about Binance Margin, including how to make a margin trade and repay borrowed funds, check our detailed guide.