As the cryptocurrency industry continues to mature, an increasing number of financial products that were once exclusive to the traditional finance sector are making their way into the digital currency realm. The ability to borrow funds against collateral is one of the vital aspects of a healthy and liquid monetary system, and has long been restricted to fiat users. In the past couple of years, however, numerous crypto platforms have started to provide access to crypto loans.

Binance has emerged as one of the industry leaders in assisting crypto users with their short-term liquidity needs. Binance users are able to submit their crypto assets as collateral to secure loans and use borrowed funds to boost their trading positions, earn high APY when staking, and do everything else that pertains to using digital currencies.

What are Binance Crypto Loans?

Binance Loans are a financial service that allows users to stake their crypto as collateral to engage in various cryptocurrency-related market activities. Borrowed crypto assets can be utilized to engage in spot and derivatives trading, crypto staking, liquidity farming, and much more.

Binance charges interest on borrowed funds on an hourly and daily basis. The minimum loan period is 7 days, while the longest loan period caps at 180 days. The amount of loan you can access is directly correlated with the amount of crypto you are willing to stake as collateral.

Here’s a quick overview of Binance’s Crypto Loans feature:

Pros of Binance Crypto Loans

- Spot holdings can be used as collateral to rent out extra crypto assets

- Low-interest rates and no transaction fees

- A loan can be obtained in minutes, with no paperwork required

- Debt repayment can be done in parts

- Loans can be repaid before the loan term expires to avoid unnecessary interest charges

- 60+ currencies to borrow, 25+ types of collateral

Cons of Binance Crypto Loans

- The maximum loan term duration is capped at 180 days

- Margin Call limit and Liquidation LTV are relatively close in value

- No fiat borrowing or collateral options

With the quick breakdown behind us, let’s examine Binance Crypto Loans financial service in more detail.

Benefits of using Binance Crypto Loans

Several essential properties make Binance’s loan offering stand out as one of the best in the market. They are as follows:

Fast and easy to use – Binance Loans service is highly accessible, near-instantaneous, and provides excellent transparency when it comes to interest rate fees, repayment process, and loan-to-value ratios.

Borrowed funds are yours without any strings attached – Borrowed crypto assets are deposited to your spot account. You are free to do whatever you want with them, as opposed to when using Binance Margin, which also provides the ability to borrow up to five times your collateral, but restricts the use of borrowed funds to strictly trading purposes. Additionally, you can use your loaned funds outside the Binance platform if you so choose.

Attractive interest rates and no transaction fees – Rates vary depending on assets used; however, they rarely amount to more than 0.06% per day. As an added bonus, Binance charges no fees for digital currency transactions associated with its loan service.

No credit score needed – As opposed to obtaining a loan from a bank, which requires a ton of paperwork and can be very discriminatory if your credit score is low, Binance borrows funds at the same rates to all clients. You only need crypto in your spot account to use as collateral and a verified account, and you are good to go.

Ideal for short-term liquidity needs – Binance Loans are a perfect solution for increasing your short-term exposure to crypto markets as they feature five loan terms: 7, 14, 30, 90, and 180 days.

No taxes – Since borrowing funds doesn’t require making a fiat withdrawal, you incur no taxes on your crypto assets as they are not registered as taxable events.

60+ loanable currencies, 25+ collateral assets to pick from – You can choose from a long list of supported digital currencies, including major cryptos such as Bitcoin (BTC) and Ethereum (ETH). More avid cryptocurrency users will be happy to find lesser-known altcoins, such as Curve DAO Token (CRV) and 0x (ZRX), among supported assets.

Understanding key Binance Loans terminology

If you have never used crypto loans before, you are likely to be unfamiliar with technical terms that underpin the process of using the Binance Loan service. Here are short summaries of the most important technical terms that you need to be familiar with before using Binance Loans:

- Principal – The original sum of borrowed funds. To clarify, if you borrow 1 BTC, for example, then your principal is 1 BTC.

- Collateral – An asset with which a borrower secures the repayment of a loan. If you are borrowing BTC by staking BUSD, for example, then BUSD is considered collateral.

- Loan Term – Time duration of the loan agreement. Binance offers five loan durations: 7, 14, 30, 90, and 180 days.

- Initial LTV – The ratio between the value of a loan and the value of the collateral. If you are willing to use 1 BTC as collateral at 65% LTV, for example, you can borrow crypto assets that amount up to 0.65 BTC in value. Although rates may vary, Binance is offering a 65% LTV as a rule of thumb.

- Margin Call – As everyone is well aware, crypto assets are prone to considerable price volatility. Suppose the value of your borrowed funds grows or collateral happens to lose value so that the LTV reaches a 75% ratio. In that case, a Margin Call is issued, notifying you to restructure your loan agreement by adjusting your loan-to-value ratio.

- Liquidation LTV – If you don’t act on your Margin Call and LTV reaches 83%, Binance will sell your collateral in order to pay off the debt and return the remainder of funds to your spot account.

- Interest Rate – The amount expressed in percentages that a lender charges a borrower for his lending service. Interest rates on borrowed funds on Binance accrue on an hourly and daily basis. The average daily interest rate for most coins is roughly 0.05%.

- Total Interest Amount – The total amount of interests that will accrue over your loan duration (expressed in borrowed digital currency).

- Repayment Amount – The total amount of funds (a sum of principal and total interest amount) needed to repay a loan (expressed in borrowed digital currency).

If you have additional queries about specific terms or want to observe the process of obtaining a loan in video form, check this helpful article from Binance.

Supported assets

Binance’s loan offering service supports over 60 borrowable crypto assets and more than 25 types of collateral. Here is the list of supported currencies*:

Coins you can borrow: 1INCH, AAVE, ALICE, ATOM, AXS, ADA, AKRO, BAL, BAND, BAT, BAKE, BCH, BNB, BTS, BTC, BUSD, CTSI, CRV, COMP, CHZ, CTK, DOGE, DOT, DASH, ETH, ENJ, EOS, ETC, FIL, FLM, GRT, HNT, KNC, KSM, KAVA, LTC, LINK, MTL, MANA, MATIC, MITH, NBS, NEO, ONT, RUNE, SNX, SOL, SUSHI, SXP, STORJ, THETA, UNI, USDC, USDT, VET, XLM, XMR, XRP, YFI, ZEN, ZRX

Coins you can use as collateral: ADA, AXS, BCH, BNB, BTC, BUSD, CAKE, CTSI, DAI, DODO, DOGE, DOT, DYDX, EOS, ETH, FIL, KSM, LINK, LTC, MDX, SOL, UNI, USDC, USDT, XRP

* The list of supported digital currencies is subject to change.

How to set up Binance Crypto Loans?

Now that you are armed with knowledge about the benefits and disadvantages of Binance Loans while also having an understanding of key terms such as LTV and Margin Call, you can go ahead and make a loan request.

NOTE: You have to be logged into your verified Binance account in order to use the Binance Crypto Loan service.

A step-by-step guide to Binance Crypto Loans

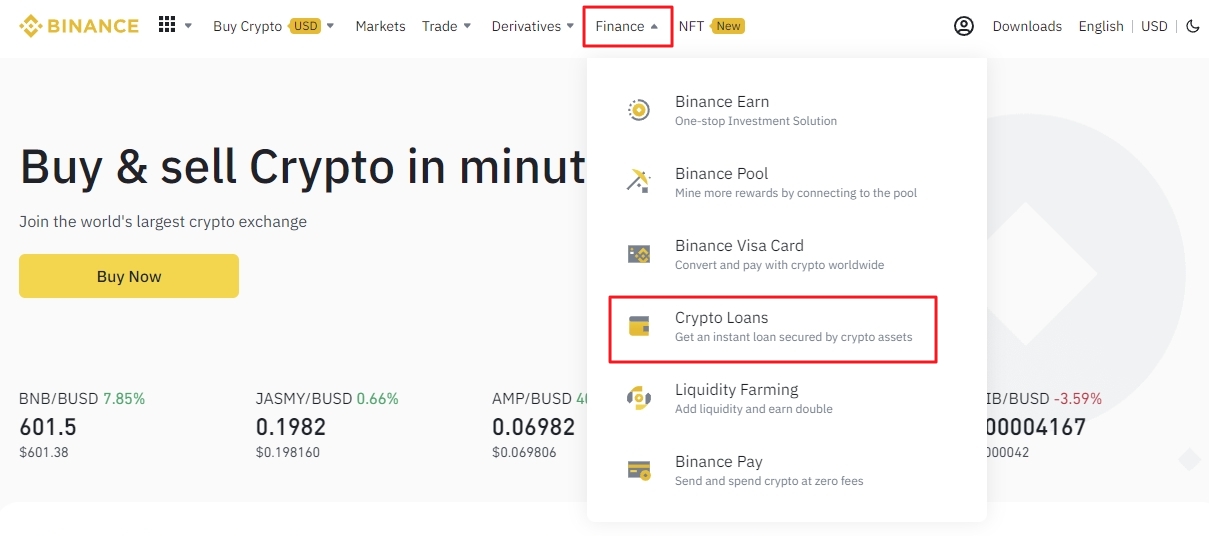

Step 1: After logging into your Binance account, select the “Crypto Loans” option from the “Finance” drop-down menu.

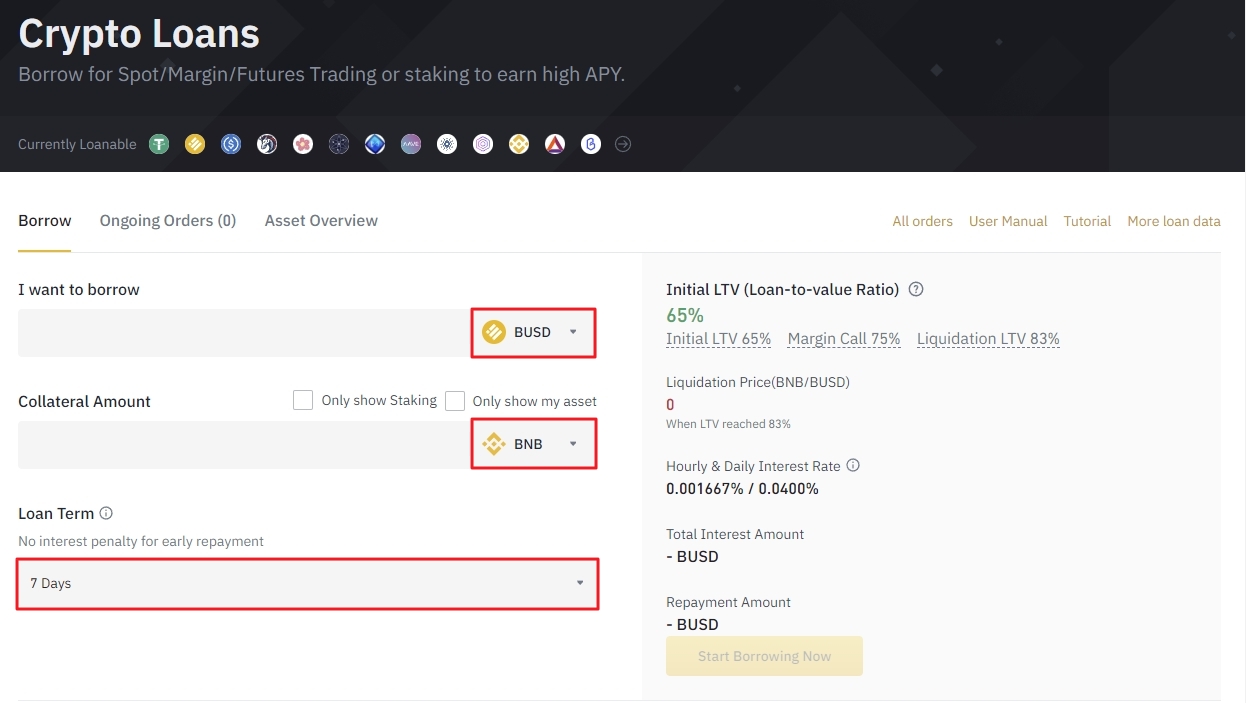

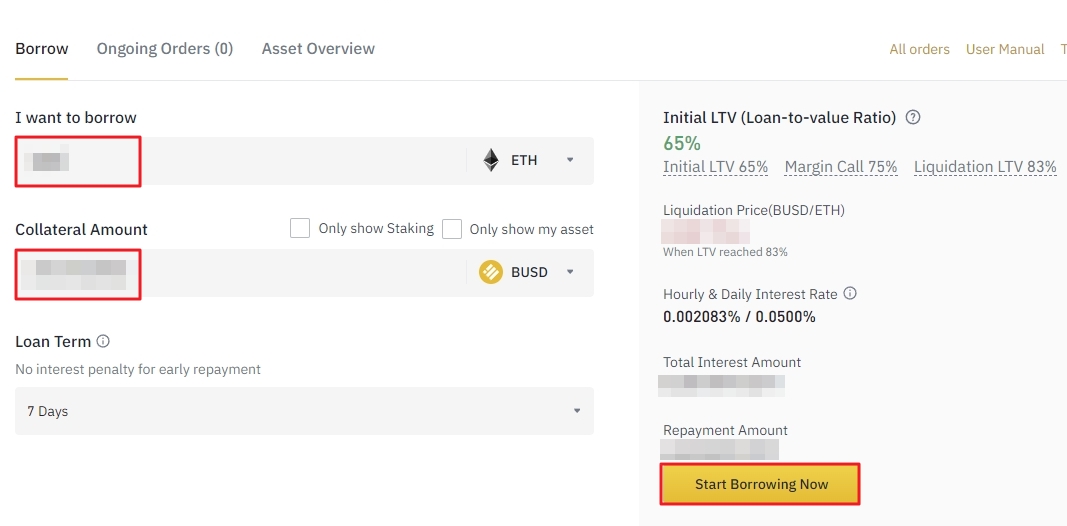

Step 2: Pick the asset you want to borrow and select the collateral currency you have access to in your spot account. Choose one of the five loan durations from the drop-down menu in the bottom-left side of the screen.

Step 3: Once you have selected the parameters of your loan agreement, entered how much funds your want to borrow, and inspected the loan order properties on the right side of the screen, you are clear to click the “Start Borrowing Now” button to proceed.

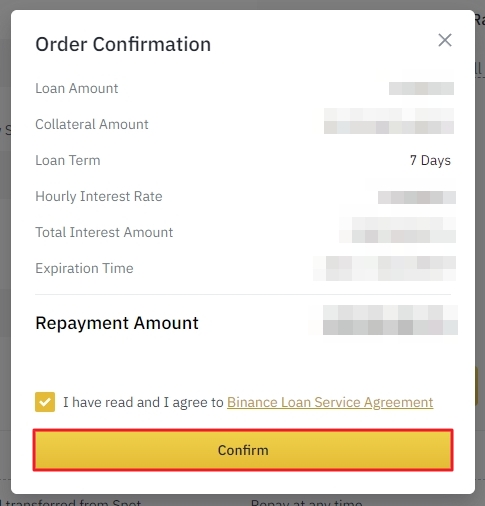

Step 4: Review the loan order confirmation pop-up, showing all characteristics of the loan deal you are about to enter. Confirm that you have read the terms and conditions of the crypto loan service and click on the “Confirm” button to borrow funds from Binance.

Congratulations, you have successfully completed the process of obtaining a loan on Binance.

Now, you are probably wondering how to manage your active loan orders and, most importantly, how to repay your debt. Check the following sections to gain a better understanding of how to utilize your loans to the fullest.

How to manage your crypto loans?

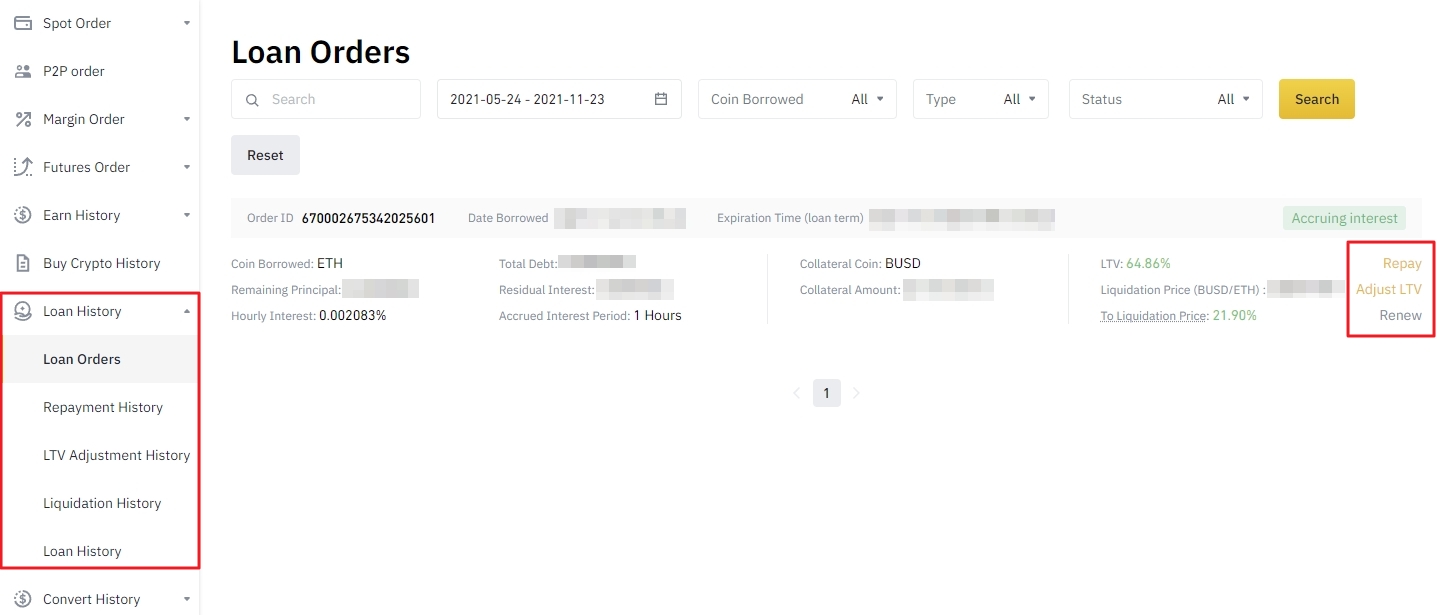

Binance provides a seamless way to organize and manage your digital currency loans from a single place. Navigate to the “Loan History” section from your account dashboard to access your active loan orders, along with a complete overview of your loan history.

Here you will find a list of your active orders under the “Loan Orders” section. The entire history of your past orders can be accessed from a dropdown menu on the left side of the screen. Also, the ability to adjust LTV, loan repayment and renewal options, can be found here.

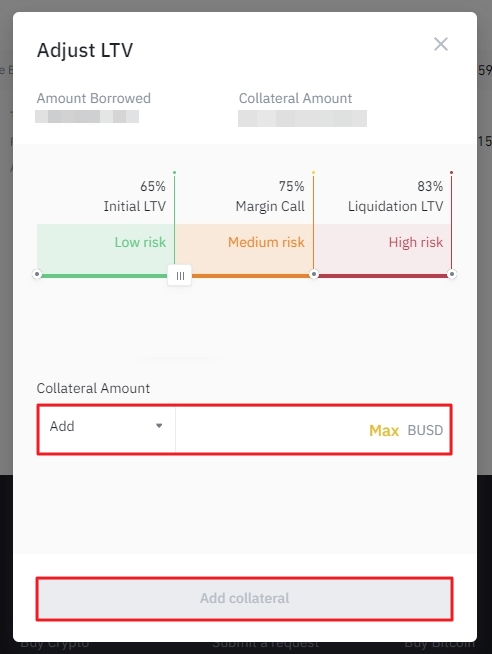

How to adjust LTV to avoid liquidation?

Suppose you receive a Margin Call (see the above section Understanding key Binance Loan terminology for more information). In that case, you can click on the “Adjust LTV” button on your active loan order to see the current loan-to-value ratio. If the ratio veers past 75%, Binance will notify you to adjust your active order by staking additional collateral or removing a part of it to realign your position to the less risky LTV ratio. If the ratio veers past 83%, your loan might get liquidated.

The process of adjusting the LTV ratio couldn’t be more straightforward. Pick from “Add” or “Remove” options and enter the amount of collateral your wish to add/remove to adjust LTV. Once done, click on the action button at the bottom.

How to repay your Binance Loan?

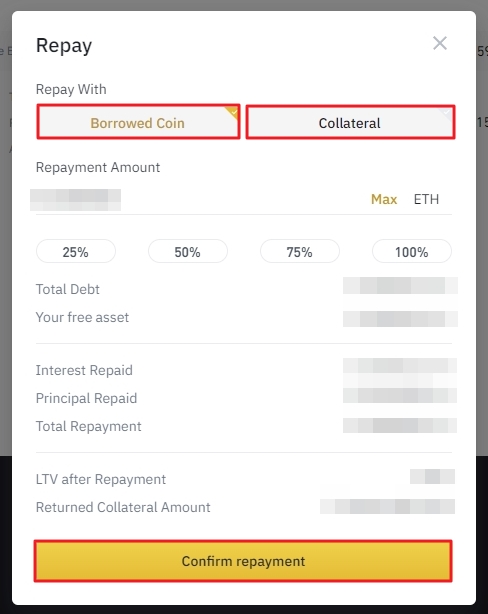

If you wish to repay your debt, you can do so by clicking on the “Repay” option on your active order listed in the loan dashboard. After that, a repay menu with several options in addition to an up-to-date overview of your active loan order appears.

You can choose to repay your crypto loan by returning borrowed coins or by paying off the total value of borrowed assets with an asset you used for collateral. The repayment amount is the same in both cases.

Additionally, you can also choose to repay only a portion of your debt. Simply enter the “Repayment Amount”, select between “Borrowed Coin” and “Collateral” options and click “Confirm repayment” to complete the process.

You can pay off your debt at any time during the duration of your order. Since interests accumulate on an hourly basis, the quicker you decide to repay, the smaller fee you will pay for borrowing.

What happens if I don’t repay my debt on time?

Binance charges three times the standard hourly interest rate on overdue loans for the first 72 hours for loans with 7-day and 14-day durations and for 168 hours when it comes to lengthier loan options.

If you fail to repay your loan in the allotted time, Binance will commence the process of loan liquidation. Do note that an additional 2% liquidation fee applies in this case.

Why do we use Binance Crypto Loans?

Binance Loans can be a great way to increase your exposure to crypto markets by gaining access to additional crypto funds by using assets that would otherwise be collecting dust in your spot wallet. Due to the unpredictable nature of crypto markets, you would probably be better served to borrow and use as collateral assets, which are less prone to significant price fluctuations, especially when deciding on longer loan terms.

Once you obtain assets from Binance, you are free to do with them whatever you want. The borrowed currencies are yours in every sense of the word. You can use them on various Binance services, such as margin trading, Binance Earn products, Launchpool offerings, and more. You can even withdraw funds from your Binance account to an external crypto wallet. Apart from paying off your debt, there are no strings attached to the funds you borrow.

Risks associated with Binance Crypto Loans

The most significant risk factor associated with using the Binance Crypto Loan service is the unpredictable nature of the crypto markets. If the value of an asset you borrowed tanks, you could find yourself struggling to repay the loan. Before renting a loan, make sure that you have access to additional funds if things go wrong and don’t rely on paying off your debt by expecting the asset you borrowed to appreciate in value.

Borrowing to engage in margin trading can be particularly risky. If you are not careful, your borrowed capital could easily be lost, along with your collateral. Refrain from making risky trades and be willing to sacrifice a bit of APY by utilizing stablecoins when staking, especially if you are a newcomer to crypto.

The bottom line

Binance Crypto Loans are particularly beneficial for investors who require additional short-term liquidity for margin trading or staking purposes. The ability to set aside a certain amount of spot balance to gain access to extra funds is an enticing proposition for experienced traders and crypto newbies alike.

Binance Crypto Loans are a great way to boost the value of your existing crypto holdings by using them to secure instantly accessible funds at low rates with no paperwork required. Remember to use the borrowed funds responsibly.