Key takeaways:

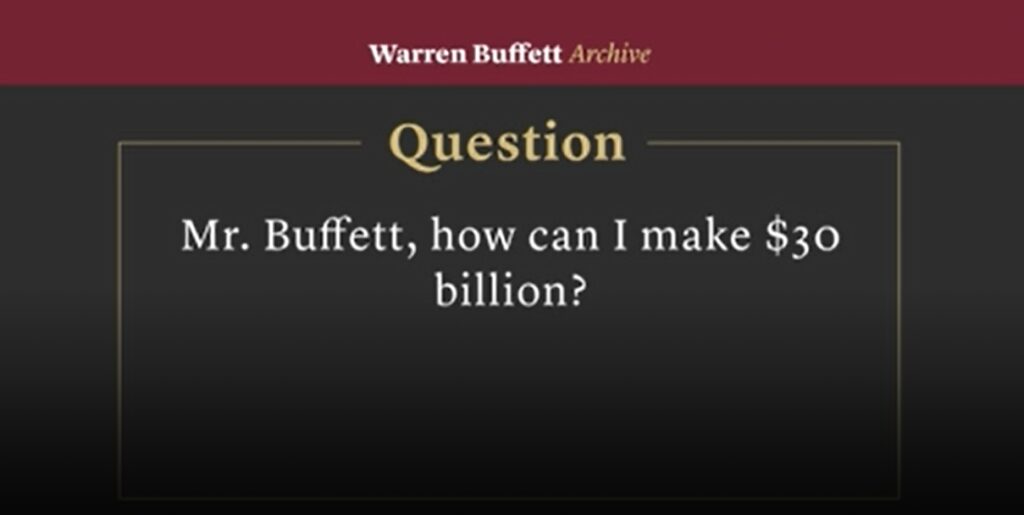

- During the 1999 Q&A session, long-time CEO of Berkshire Hathaway Warren Buffett was asked how would he make $30 billion if he was just starting out

- In his response, Buffett highlighted the importance of compounding interests and making investment decisions according to the size of a portfolio

- His advice is applicable to crypto markets as well as picking the right projects and the ability to identify good buying opportunities is essential

Every year, the CEO of Berkshire Hathaway Warren Buffett and the company’s vice chairman Charlie Munger answer various questions for five hours as a part of Berkshire’s annual meetings. At the height of the internet bubble in 1999, Buffett was asked how to make $30 billion.

All about compounding interests

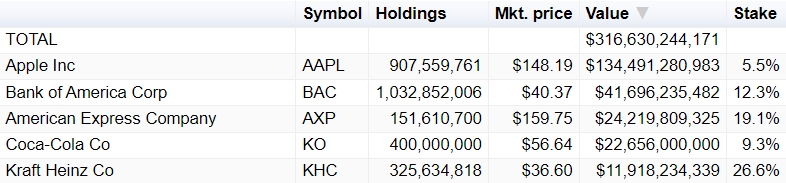

Buffett is easily one of the richest individuals in the world. His Nebraska-based company Berkshire Hathaway owns shares of some of the biggest companies across a multitude of different industries. Currently, the multinational conglomerate holding company’s publicly disclosed total assets amount to a staggering $873 billion.

The “Oracle of Omaha” approached the question by first highlighting the importance of starting early and taking full advantage of the effect of compounding interests, which are every investor’s best friend.

“Start early. I started building this little snowball at the top of a very long hill. The trick to having a very long hill is either starting very young or living to be very old.”

Despite the fact that 69-year old Buffett’s net worth in 1999 was already $30 billion, he tried to put himself in the shoes of someone younger and much less wealthy to give the best advice possible.

If he had only $10,000 to his name and just finished college, he would be looking to invest diversify his investments into smaller sums and put his funds in pursuing buying shares of smaller companies. Buffet pointed out that finding high-value investments is more likely when investing in smaller companies since the market regularly assigns an incorrect value to smaller companies.

“I probably would focus on smaller companies because I would be working with smaller sums and there’s more chance that something is overlooked in that arena.”

The situation is somewhat similar if we try to draw a parallel between investing in the stock market and investing in the cryptocurrency sector. Bitcoin and Ethereum are less likely to go as much in value as some other lesser-known projects. However, there is an added caveat that the crypto industry as a whole is still very young and even the biggest names are probably far away from reaching their full earning potential.

Trust your instincts and rely on your own knowledge

Additionally, Buffett explained that relying on your own judgment and knowledge is the only way to succeed since you can’t expect other people to know what you are talking about. That said, acknowledging your own shortcomings and having the ability to admit that you don’t know everything is just as important.

“If you asked me to trade away a very significant percentage of my net worth either for some extra years on my life or being able to do during those years what I want to do, I’d do it in a second.”

Being blinded to chasing wealth is a detriment and will ultimately lead to a sad existence. Buffet also added that having as much money as he does is “incomprehensible” and it doesn’t change your day-to-day living experience.

In this regard, the 90-year old leads by example as he is one of the biggest philanthropists in the world. He is committed to giving away 99% of his wealth by the time of his death.

Buffett is currently 9th on Bloomberg’s Billionaire Index with a net worth of $104 billion.

Use dollar-cost averaging strategy if you are just starting out

If you are just starting out in stock market trading or cryptocurrency investing for that matter and you lack the time to learn about all the ins and outs of advanced trading strategies, it is best to turn to the old and faithful dollar-cost averaging (DCA) method.

Time and time again, DCA has proven to be one of the best investment methods since it requires a modest time investment and is relatively easy to execute. The DCA dictates an approach of dividing the funds allocated for investment into roughly equal amounts and making buying or selling orders in predetermined time intervals.

This approach protects amateur investors from making irrational and consequently costly decisions and at the same time offers a great advantage over more advanced strategies, since “buying the dip” can be much less stressful and easier to do when following a predetermined system.

Binance is a great option whether you are just starting out your cryptocurrency trading journey and looking for the best platform to use simple investing methods such as DCA and “buy and hold”, or you are a crypto trading veteran looking to use more advanced options such as liquid swaps, staking products and futures options.