Voltage Finance (VOLT) surged by an unprecedented 115% over the past 24 hours following the announcement that it was going to be listed on the MEXC Global exchange. The announcement caused VOLT to surge from a low of $0.0005 to reach as high as $0.00128 during the peak of the spike. The coin has since dropped to $0.0011, but it looks like it might continue to explode throughout the week.

In total, VOLT is now up by a whopping 258% over the past week and an enormous 500% over the past month. The cryptocurrency now has a market cap value of over $10 million as it starts to climb the rankings.

Voltage Finance is a DeFi protocol that provides a secure and transparent method for users to earn a passive income through yield farming and providing liquidity. The protocol is built on top of the Fuse Network, allowing it to take advantage of fast and cheap transactions – leaving users with higher rewards from yield-farming.

Through the platform, users can take advantage of its staking/liquidity pools and token swaps to receive a yield on their deposits. By depositing assets into the liquidity pool, users are entitled to their share of the 0.3% trading fees alongside the yield farming returns – which is paid in VOLT tokens.

The project is backed by high-profile venture capitalists, raising $2.3 million from major institutional investors in December, with another round of fundraising bringing the total to $3.4 million. Some of the venture capitalists that invested in the project include Genesis Block Ventures, Spark Capital, and Sheesha Finance.

The entire idea behind the project was to make DeFi accessible to the mass market through an intuitive and easy-to-use consumer-facing VOLT App. The app was released earlier this month, providing seamless DeFi access for users.

Today’s price surge was largely a result of VOLT being added to the MEXC Global exchange, one of the industry’s most respected CEXs. The exchange is available in over 200 countries and can boast a user base of around 6 million people. As soon as the token was added to the exchange, the token started to skyrocket to produce the 115% price surge seen today.

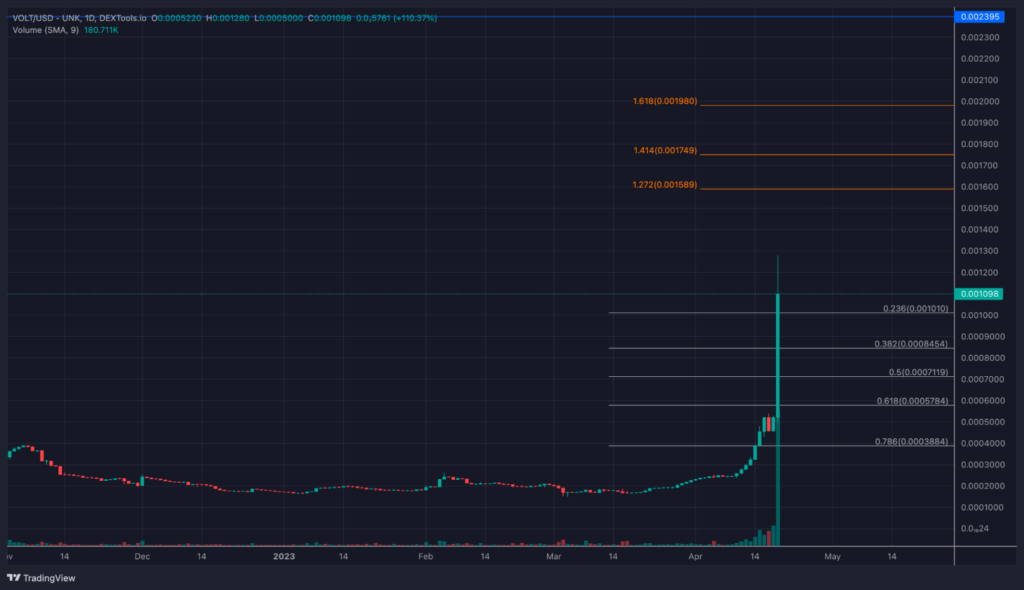

With the market surging, let us take a closer look at the charts and see the potential support and resistance areas moving forward.

Voltage Finance Coin Price Analysis

What has been going on?

Starting with the long-term chart, we can see that VOLT has been on a consistent downtrend for the majority of the past year – similar to the entire cryptocurrency market. The coin continued its downtrend until finding support at $0.00015 in March 2023. From there, VOLT started to bounce higher as it quickly recovered above $0.0002 by the beginning of April.

The bulk of the recent market explosion didn’t occur until the second week of April 2023. The coin started to push higher on April 10th as it broke the resistance at $0.00025, and it continued to push higher through the following weeks to reach $0.0005 a few days ago.

Moving onto the shorter-term charts, we can see that today’s price explosion allowed VOLT to surge to new highs not seen since May 2022 – allowing it to set fresh 11-month highs. During the surge, the coin blew past resistance at $0.0006, $0.0008, and $0.001 to reach as high as $0.00128 during the explosion. The coin has dropped slightly from today’s highs but is still looking very strong as it sits around $0.00011

VOLT Price Short Term Prediction: HYPER BULLISH

The short-term outlook for VOLT is hyper-bullish after today’s 100+% price explosion. The market would now need to drop beneath the support at $0.0006 to turn neutral and would have to continue beneath the support at $0.0003 to be in danger of turning bearish in the short term.

Looking ahead, if the buyers can take out today’s highs of $0.00128, the first level of higher resistance lies at $0.0014. This is followed by resistance at $0.00159 (1.272 Fib Extension), $0.00175 (1.414 Fib Extension), $0.0018, and $0.002 (1.618 Fib Extension).

If the buyers can successfully push VOLT even further beyond $0.002, added resistance lies at $0.0022, $0.0024 (April 2022 support), $0.0026, and $0.003.

Where Is The Support Toward The Downside?

On the other side, a retracement is a likely event, given the parabolic nature of today’s price surge. If the sellers do start to push VOLT lower, the first level of support is expected at $0.001 (.236 Fib Retracement). This is followed by support at $0.00085 (.382 Fib Retracement), $0.00072 (.5 Fib Retracement), and $0.000578 (.618 Fib Retracement).

Beneath this, added support lies at $0.0004 and $0.00023.

Overall, today’s market explosion from VOLT Finance has put the coin back into the minds of traders across the industry. With the launch of its new application and the new listing on the MEXC Global exchange, we can expect VOLT to continue its unprecedented growth over the coming weeks.