After a period of stormy weather on the cryptocurrency markets we are now in what seems to be the calm after the storm. Most of the investors are uncertain whether the recent dip was just a bear trap, and the market will soon continue following the upward trend, or just a sneak-peak of what is about to come as we dive towards finding an even lower bottom. While the total capitalization of the cryptocurrency market managed to climb above $1.75 trillion on several occasions throughout the previous week, the total market cap only increased by mere 3.6% ($1.43 trillion at the beginning of the week as compared to $1.48 trillion on Sunday, May 30). However, the coins and tokens featured in our this week’s selection of Top 3 coins to watch are less likely to trade sideways, as mainnet deployments, upgrade rollouts and other important events put these projects in the centre of the crypto community’s attention.

1. Binance Coin (BNB)

Binance Coin (BNB) originally launched in 2017 as an ERC-20 token sold through an initial coin offering (ICO). In April 2019, the Binance Chain went online, and all the ERC-20 tokens were replaced with the BNB coin, which became the native cryptocurrency of the new blockchain. Binance Chain is still completely centralized, with Binance having complete control of block management. Binance users who utilize BNB to pay for trading, withdrawal and listing fees can enjoy significant discounts. While this used to be pretty much the only use case of BNB, the coin has a far greater utility now as it allows users to pay for gas fees, stake BNB, as well as participate in DeFi, liquidity pools, DEX trading and earn token airdrops from projects featured in the Binance Launchpad. Every quarter, Binance burns a portion of their BNB holdings as their goal is to cut down the maximum BNB supply from 200 million to 100 million.

It is About Time for Another Launchpad or Launchpool Project

As already mentioned, BNB’s use cases expand far beyond just trading fee discounts. Launchpad, for example, is Binance’s IEO platform on which they launch new projects and Binance users will get a portion of the token’s distribution amount based on their BNB holdings. Launchpool, on the other hand, is used to launch new or propel existing projects through token farming. By committing different assets to the pool (usually BNB and BUSD), users farm new tokens and get the rewards on a daily basis. The last project to be featured on Launchpad was FC Barcelona Fan Token and the token distribution concluded on April 21. Similar goes for Launchpool, the staking period to receive TLM tokens concluded on May 7. Holders are now eagerly awaiting new project so they can commit their BNB that are “sitting” in their Binance spot accounts. Judging by the historical frequency a new project should appear on Binance Launchpool every moment. The addition of a promising project to the Launchpool could even increase the BNB demand and boost BNB price, which has lately been in a rapid decline.

The BNB price corrected heavily in the second half of May. It dropped from the coin’s ATH of $689 on May 10 to $214 on May 23 – that is a whopping 68% decrease in less than two weeks. Since then, BNB is up by 63% and is changing hands at around $350 at press time. However, due to the lack of activity on Binance Launchpool and the news that US and German authorities are investing the exchange, BNB lost #3 spot, which it claimed for a short period of time. BNB is now again on the #4 spot by market cap, behind Tether (USDT) and just $1 billion above Cardano (ADA). Will BNB manage to reclaim the #3 spot?

2. Fetch.ai (FET)

The Fetch.ai aims to build a scalable, open access, tokenized, decentralized machine learning network by utilizing a combination of artificial intelligence, blockchain and DAG (directed acyclic graph) data structures. The blockchain operates using useful proof-of-work (uPoW) consensus algorithm. The algorithm differentiates from the classic proof-of-work the computational power that is used to secure the ledger is used to perform useful tasks for the network’s participants.

Mainnet 2 Bridge Limit to Get Doubled on June 1

The Fetch.ai team is transitioning from the FET ERC-20 token on Ethereum to a native FET token. Currently most exchanges offer ERC-20 FET tokens, which can be staked using Metamask, but the native FET tokens, which can be staked on Fetch.ai Mainnet 2, can already be accessed by swapping them for existing ERC-20 tokens through the token bridge. Initially, APY for Mainnet 2 staking will be above 70%. As more tokens get staked, the estimated APY will adjust. To grant a greater influx to the mainnet and higher staking capabilities, the token bridge transaction limit will be increased from 60 million FET to 120 million FET on June 1 at 14:00 UTC. This will be the cap until July 16, when we will see another limit increase to 250 million FET. If you are a FET holder or interested in staking FET, you should rea more about the transition and staking process here.

3. XRP (XRP)

XRP is a cryptocurrency that was launched in 2012 by Chris Larsen, Jed McCaleb and Arthur Britto. Ripple’s network uses a unique Ripple Protocol consensus algorithm (RPCA), which is neither proof-of-work nor proof-of-stake to facilitate fast and cheap transactions. The maximum supply of XRP is 100 billion coins and all the coins were created at launch. At launch 80% of the total XRP supply was given to fintech firm Opencoin, a company that was later renamed to Ripple Labs in 2015. As of today, Ripple still holds more than half of the total XRP supply. However, most of the company’s XRP holdings are locked in escrow and can only be accessed periodically. In 2020 Ripple became entangled in a lawsuit in which the U.S. SEC claims that the company sold unregistered securities. Following the lawsuit numerous regulated exchanges halted XRP trading or even delisted the coin. Ever since December 2020 the legal battle between Ripple and the SEC is one of the key factors influencing XRP price.

Ripple CEO Reveals the Company Could Go Public After the SEC Lawsuit Is Over

The recent developments and news from the courthouse indicate that the SEC does not have a very strong case against Ripple and that the cryptocurrency developer and issuer will likely be deemed the winner of this legal battle. Just recently news came out that the District Judge Sarah Netburn denied SEC’s access to Ripple’s legal memorandum, dealing another blow to the SEC. Some of the XRP holders and supporters, joined under #XRPArmy, are already expressing their optimism by calling for a lawsuit win and predicting that XRP will moon after that. In addition, Ripple CEO Brad Garlinghouse stated that the chance of Ripple becoming a publicly traded company in the future is “very high”, which could further entice the bulls. Nevertheless, Ripple must resolve the regulatory dispute first, as the securities regulator would be the one approving Ripple’s public offering.

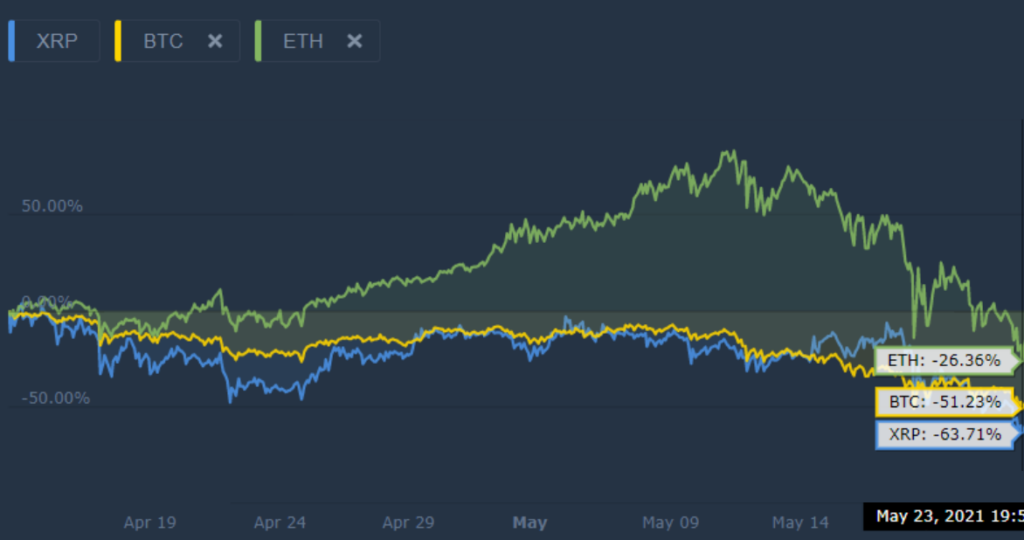

Pricewise, XRP faced a heavy correction from the cycle high of $2 (April 14) to the cycle low of $0.66 (May 23). This represents a 66% correction, which is a lot more than Ethereum’s and Bitcoin’s corrections over the same time frame.

Interestingly, XRP is the only coin apart from BCH and XLM to have never reached an ATH in the 2021 bull run. XRP ATH stands at $3.92 and dates back to Jan 4, 2018. Currently, XRP is changing hands at exactly $1.00, but it could increase if positive news keeps coming from the courthouse. In addition, users entering the market seem to love XRP due to its low nominal price in USD, low fees, and the speculative opportunity, as it could be trading at a heavily discounted price because of the lawsuit.