Last week the cryptocurrency markets bled out another $40 billion, resulting in a drop of the total market capitalization of the sector from $870 billion to a bit less than $830 billion. BNB, ADA, DOGE and MATIC all lost more than 10% last week and these are only the coins that are in the crypto Top 10. Many more coins outside the Top 10 also ended the week deep in the red numbers. Nevertheless, as any other week, there are also coins that ended the week in the green. For ours Top 3 Coins to watch article, we have tried to correctly identify three such “gainers” of this week.

3. Celo (CELO)

Celo is a proof-of-stake blockchain platform that aims to push DeFi functionality and services to mass adoption. Because more people own phones than computers Celo focuses on developing a platform that is mobile device friendly. In addition, Celo puts a lot of emphasise on maintaining a very low transaction costs and maintaining sufficient scalability to facilitate higher throughput in the future. CELO, which is the platform’s native token can be used for staking but also functions as the project’s governance token. In addition, the Celo platform boasts with several stablecoins pegged to the price of various fiat currencies.

Celo integrates with LayerZero, the omnichain interoperability protocol

The Celo blockchain is an EVM-compatible blockchain, which means that developers that have built their dApps on Ethereum or other EVM-compatible blockchain could easily migrate to Celo and vice versa. However, since December 8, when Celo integrated LayerZero, Celo users can seamlessly access with dApps and liquidity from 13 other EVM-compatible blockchain and several more non-EVM compatible platforms.

The LayerZero is an omnichain interoperability protocol that allows for a user-friendly access to dApps across DeFi, NFTs, gaming, etc. by leveraging a low-level communication protocol. Furthermore, accessing these applications is has proven to be much safer with LayerZero as compared to usually used bridging solutions, which have often been exploited, resulting in a large hole in their digital wallets of its users. Through LayerZero Celo will be able to access a much larger userbase and channel in from a much larger pool of liquidity.

2. Toncoin (TON)

Toncoin (TON) is the native cryptocurrency of The Open Network (TON), a decentralized Layer 1 blockchain network previously known under the name of Telegram Open Network. While TON started out in 2018 as a proof-of-stake blockchain designed by the Durov brothers, the founders of Telegram Messenger, the development of the project has later been handed over to the open TON Community. TON is designed for lightning-fast transactions and known for its ultra-low cost and user-friendliness. A unique feature of TON is that the community can alter information in an existing block, allowing them to nullify unlawful transactions and protect the network from a potential 51% attack.

TON holders will soon be able to purchase anonymous phone numbers

The TON team has recently unveiled a new feature, which will allow Telegram users to purchase anonymous phone numbers with their Toncoins. In one of the recent updates the Telegram developers enabled users to create a Telegram account without a SIM card and log in using blockchain-powered anonymous numbers available on the Fragment platform. The feature is part of the team’s push for “ultimate privacy”.

The anonymous telephone numbers with a prefix +888 will be available as collectables on the Fragment platform, much like the Collectible usernames, which were launched by TON in November. Collectible usernames with less than 5 characters turned out to be a major success – do you think that anonymous telephone numbers will sell out as well?

While many of the most popular cryptos lost value last week, TON rallied up by more than 25% last week. In addition, the network’s native crypto, which is currently changing hands at a price of $2.60 per coin, is up by almost 45% in the last month and more than 73% in the last three months. With such clear long-term uptrend, it is only a matter of time when TON breaks above $3.

1. Ethereum (ETH)

Ethereum is an open source blockchain that pioneered smart contract functionality in 2015. The decentralized network operates in a fast, immutable, and trustless manner. Ether (ETH), which is currently the second-largest cryptocurrency by market capitalization, is Ethereum’s native asset. Although it can also be used as a medium for the transfer of value between different Ethereum addresses, it is more commonly used to execute various smart contracts. The Ethereum blockchain has enabled several blockchain-powered innovations, including ICOs, DeFi, NFTs, and DAOs. The Ethereum blockchain also hosts countless ERC20 tokens with different utilities – these include Exchange tokens (OKB, HT, UNI), DeFi tokens (LINK, MKR, COMP, SNX, etc.) and several stablecoins such as USDC, DAI, TUSD, and USDT. In September 2022 Ethereum network has completed The Merge and thereby transitioned from a Proof-of-Work to a Proof-of-Stake blockchain.

Shanghai update, which will enable unstaking ETH, is set to hit the mainnet in March 2023

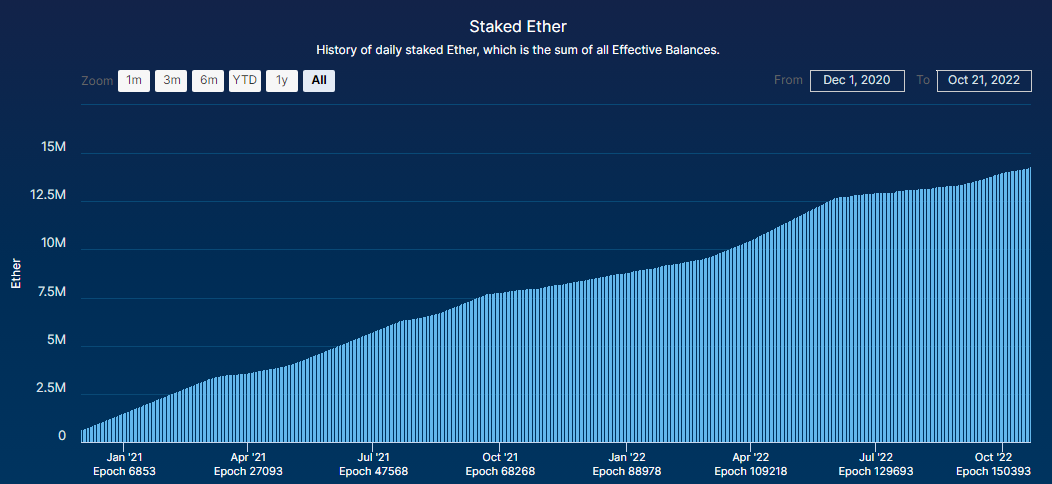

Ethereum developers have recently reached an agreement on the roadmap for future network updates and highlighted March 2023 as the target date for the Shanghai update. Shanghai, which will be the first major update and hard fork of the Ethereum blockchain after The Merge in September, will implement the EIP-4895 proposal, which will allow ETH stakers to unstake or withdraw their locked ETH. In addition, the developers are also aiming to include a set of improvements to the Ethereum Virtual Machine and implementation of the EVM Object Format (EOF) in the Shanghai upgrade. However, this improvements are considered secondary with the primary focus being on withdrawals of staked ETH. Let’s remember that the first deposits to the ETH staking contract were enabled already in December 2020, meaning that the pioneering participants in the Ethereum’s new consensus layer have already had their coins locked away for more than two years. Furthermore, there are currently more than $18 billion worth of ETH locked in the Beacon Deposit Contracts.

As seen in the graph above, the amount of staked ETH has been raising almost linearly since first ETH stakers were onboarded in December 2020. This leads us to believe that enabling ETH withdrawals will only hamper further growth of the amount of staked ETH at the very beginning, because some stakers have the need to access that liquidity and will decide to withdraw, while it will have no significant effect in the long run. In addition, Ethereum developers are prepping to deploy another major scalability-focused upgrade in the Fall of 2023.