Key takeaways:

- Bitcoin network celebrates 13 years since the first BTC block was mined and the first transaction sent

- Bitcoin was conceived as a digital antidote to the money printing fiat systems and remains one of the more viable alternatives to traditional financial systems to this day

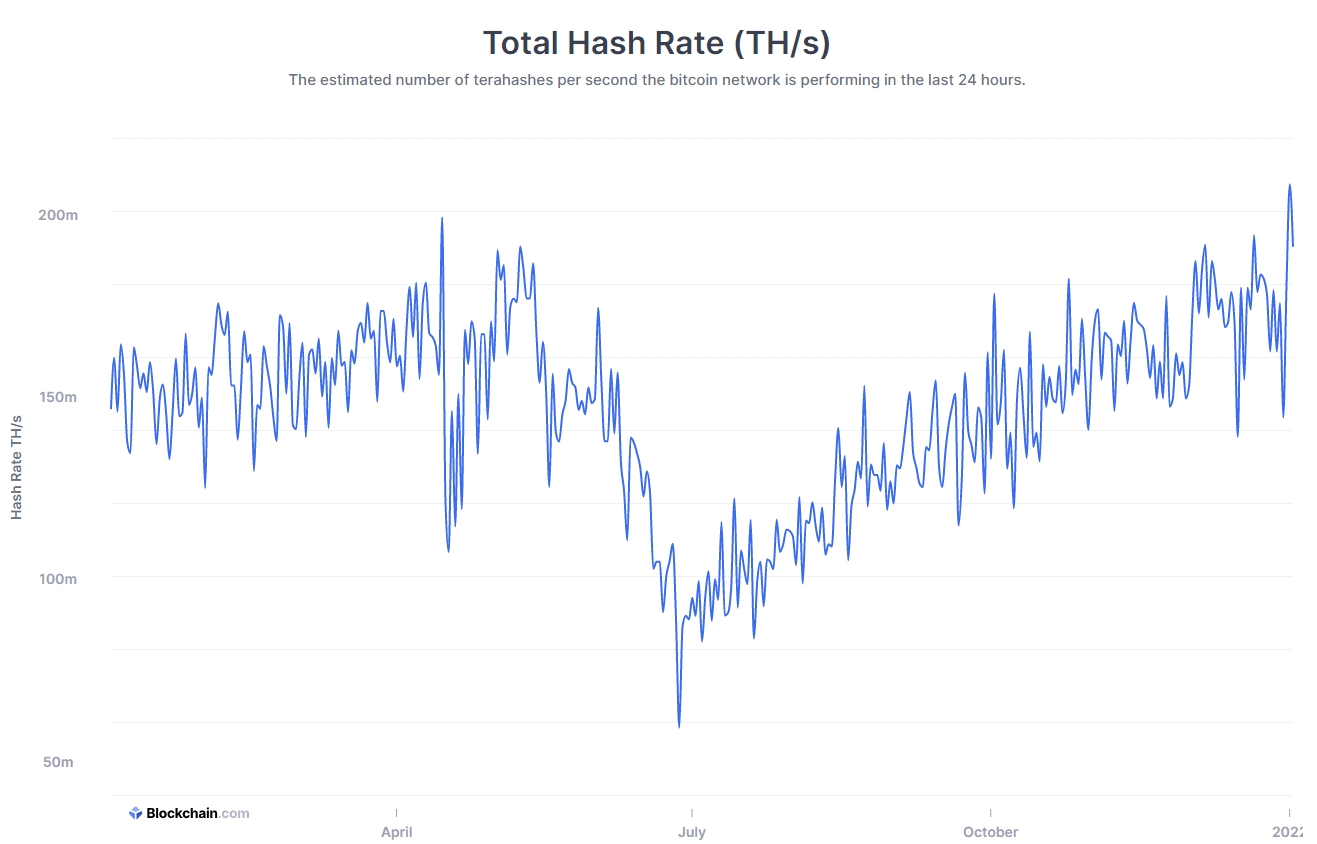

- The Bitcoin hash rate hit a new ATH on January 1, showcasing the network’s resiliency and growing activity

- Bitcoin massively outperformed other major asset classes in 2021

On January 3, 2009, the first, so-called “genesis block” of the Bitcoin network was mined by Bitcoin’s pseudonymous creator Satoshi Nakamoto. The mining reward for the completion of the first block was 50 BTC. In the 13 years and three halving events since its inception, Bitcoin has grown from complete obscurity to become one of the most widely recognized financial instruments in modern history.

Bitcoin turns 13, the anti-establishment message lives on

The first Bitcoin was mined roughly two months after the Bitcoin whitepaper was published on October 31, 2008. At the time, it was virtually impossible to envision the massive surge in popularity and value appreciation that the first cryptographic digital currency would undergo in such a short period of time.

The identity of Satoshi Nakamoto remains a mystery to this day. While there are many theories about the creator of Bitcoin – some believe he died shortly after Bitcoin was created, while others are convinced that it was never a single person that conceived Bitcoin but rather a group of software engineers and mathematicians driven by contempt towards the modern monetary system.

American cryptographer Hal Finney was the recipient of the first BTC transaction, which was sent 10 days after the Bitcoin blockchain went live. Satoshi, who sent 10 BTC to Finney, included a message in the transaction that reads “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” The short message consists of the date and headline of The Times’ news article and, in no uncertain terms, criticizes governments and banks for their actions in the aftermath of the financial crisis of 2008.

While Bitcoin has attracted numerous high-profile corporate investors over the years, its anti-establishment nature lives on. Bitcoin’s artificially set maximum coin supply and decentralized nature of the network are the main reasons why many investors and people from all walks of life perceive the world’s oldest crypto as the main antidote to the bloated and inherently inflationary monetary system of fiat currencies.

Bitcoin hash rate hits a new all-time high at the turn of the year, crypto was the best performing asset class of 2021

Bitcoin is celebrating its 13th birthday with an all-time high hash rate – on Saturday, the hash rate hit a new peak of 207.5 exahashes per second (EH/s), which marks the network’s complete recovery in just 8 months since Beijing authorities began their extensive operation of shutting down crypto mining facilities within China back in May of 2021.

Bitcoin hash rate has completely recovered from China’s mining crackdowns and hit a new ATH on the first day of 2022. Image source: Blockchain.com

The Bitcoin hash rate is based on the computational power of crypto miners participating in the process of securing the network and is widely regarded as one of the better measures of the Bitcoin network’s activity and healthiness. For a more detailed overview of the Bitcoin network and major market events that shaped 2021, click here.

A former institutional investor with 25 years of experience in financial markets, who goes by the moniker of PlanB@100trillionUSD on Twitter, recently shared how different asset classes as a whole performed throughout 2021 and compared the results to Bitcoin.

Bitcoin significantly outperformed all major asset classes, despite having a relatively bad finish to the year. Perhaps most surprising is the fact that Bitcoin performed vastly better than gold, despite the growing concerns related to inflation rates hitting multi-year highs. The narrative of Bitcoin being a better inflation hedge than precious metals has started picking up steam last year as investors have become increasingly more comfortable choosing digital assets over gold for inflation hedging purposes.

The world’s largest crypto has been consolidating below the $50,000 mark and changing hands in a relatively tight range over the past week, which in turn leaves it with a lot of room to grow in the coming weeks.