Key takeaways:

- “Luck meets preparation”, as the U.S. several years long plan to build up crypto mining infrastructure pays off.

- At the moment, the U.S. accounts for 17% of all Bitcoin miners, up more than 150% year-over-year

- Chinese dominance in the space has seen a sharp decline even before the crackdowns, recording a 75.5% decline from September 2019

Chinese crackdowns on Bitcoin mining operations across the country have forced many miners to search for a new home. Over the recent months, the United States is emerging as the most likely destination for Bitcoin miners, as the abundance of renewable energy sources and cheap gas prices makes mining in the country very enticing.

Why are Bitcoin miners choosing North America?

Throughout North America and particularly in the U.S., access to cheap energy and especially the ability to choose a myriad of renewable energy sources is making miners fleeing China very interested in moving over. But cheap electricity prices is far from the only reason why miners are choosing the U.S.

According to CBCB, over the past few years, the infrastructure necessary to host crypto mining operations was being built, without a guarantee that an eventual exodus of Chinese miners was ever going to materialize. Now that this has actually happened, the U.S.’s gamble paid off big time.

“500,000 formerly Chinese miner rigs are looking for homes in the U.S. If they are deployed, it would mean North America would have closer to 40% of global hashrate by the end of 2022.”

– Fred Thiel, CEO of Marathon Digital

A big increase in the number of mining operations over the U.S. has already been noticed, even before the Chinese crackdowns came into effect. Several U.S.-based companies focused on crypto mining were building new centers of operations and preparing for the eventual bull run, during the sol-called crypto winter. When the bullish market trend started last year, they were prepared.

Mining relocation away from China will make Bitcoin more environmentally friendly and more decentralized

Moving Bitcoin’s computational power away from China, which heavily relies on the use of fossil fuels to power its rapidly growing economy will be a “net positive overall,” said Nic Carter of Castle Island Ventures. Other countries have access to cheaper electricity and more renewable energy resources.

The U.S. and Canada have a lot of advantages when compared to China, particularly when it comes to political and jurisdictional stability. In this sense, Chinese authorities always presented a looming danger for crypto miners that were living under the totalitarian regime. We saw this danger manifest into real action when the prosecution of crypto mining operations started.

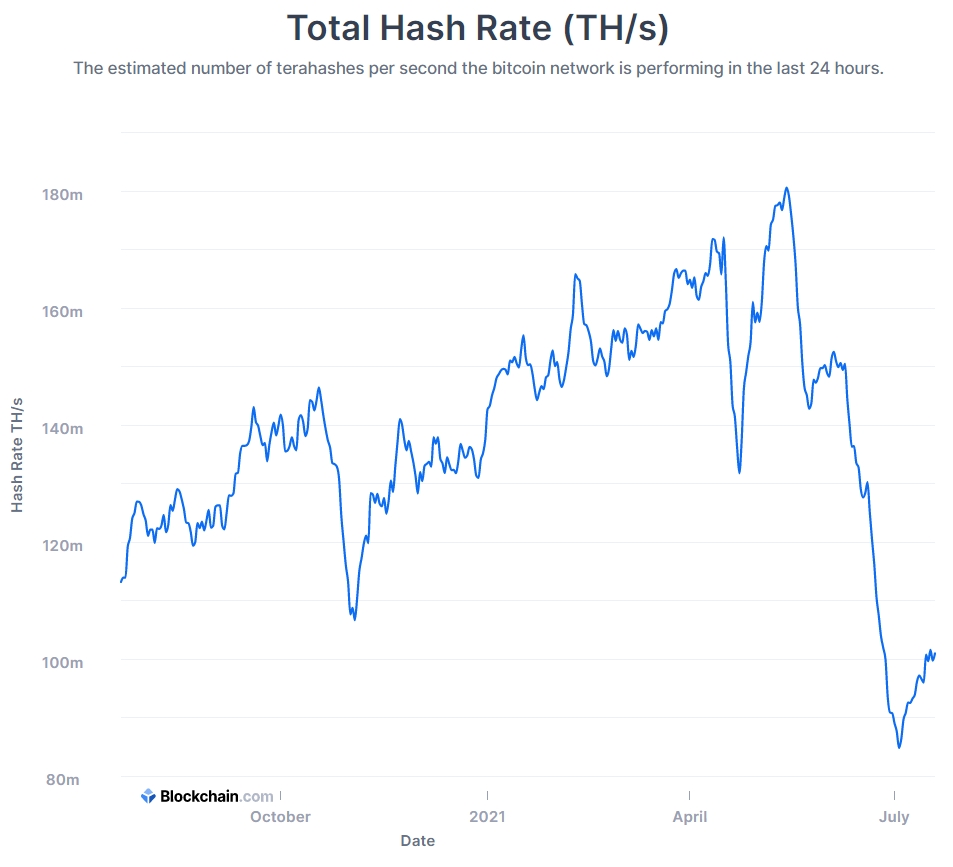

While the actions of Beijing officials heavily disrupted the crypto markets over the last few months, we can expect that the decentralization of Bitcoin mining that is currently underway will lead to a better future and bring greater stability to the network. The total hash rate dropped by more than 50% in the months following governmental crackdowns.

It was never a good idea that a single country has control over 50% of all hashrate power in the world and now the situation is quickly changing for the better, with the U.S. emerging as the biggest benefactor.