Rivian is one of the most promising electric vehicles (EV) manufacturers in the world, with a vision to create sustainable and innovative vehicles for various segments of the market. The company has already launched two models, the R1T pickup truck and the R1S SUV, and has a partnership with Amazon to produce electric delivery vans. Rivian went public at $78 per share in November 2021.

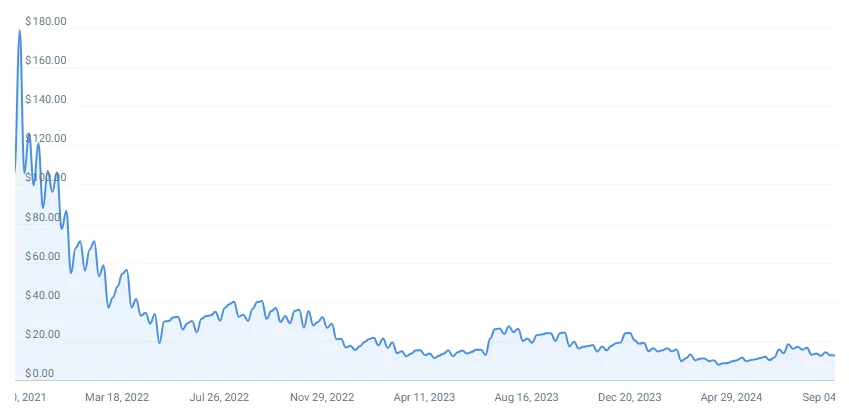

However, since then, the stock has been on a downward trend, losing more than 90% of its value from its peak.

Let’s explore Rivian’s stock price predictions for 2040 and 2050, as well as factors that could influence Rivian’s future performance and valuation.

Key takeaways:

- We’ve examined three possible growth scenarios, each with a different annual growth rate: 5% yearly growth, historical S&P 500 ROI (11.8%), and historical Nasdaq-100 ROI (17.5%).

- Rivian stock price prediction for 2040 ranges from $29 to $175, depending on the market index used as a benchmark.

- The Rivian price prediction for 2050 falls between $47 to $876, based on the same projections

- Rivian stock has been underperforming the market since its IPO, losing more than 90% of its value from its peak.

- The company faces stiff competition from other electric vehicle makers, such as Tesla, Ford, and GM, as well as regulatory and supply chain challenges.

- Rivian has some potential catalysts for growth, such as expanding its production capacity, launching new models, and increasing its market share in the US and abroad.

Here’s an overview of Rivian Stock’s price prediction under different growth scenarios.

| 2025 | 2030 | 2040 | 2050 | |

| RIVN Stock Forecast ( 5% yearly growth ) | $13.89 | $17.73 | $28.88 | $47.04 |

| RIVN Stock Forecast ( S&P 500 historical 11.8% ROI) | $14.79 | $25.84 | $78.82 | $240.46 |

| RIVN Stock Forecast ( NASDAQ historical 17.5% ROI) | $15.55 | $34.82 | $174.65 | $876.08 |

Rivian stock price history

Rivian stock debuted on the Nasdaq on November 10, 2021, at an initial price of $78 per share, valuing the company at $66.5 billion. The stock soared on its first day of trading, reaching a high of $129.85, making the company one of the most valuable US automakers by market capitalization, surpassing Ford and GM.

However, the euphoria was short-lived, as the stock started to decline shortly after amid concerns over the company’s valuation, and competition.

The stock reached its lowest price so far on April 23, 2023, when it hit $12.2, which is a massive decline compared to the value from its peak.

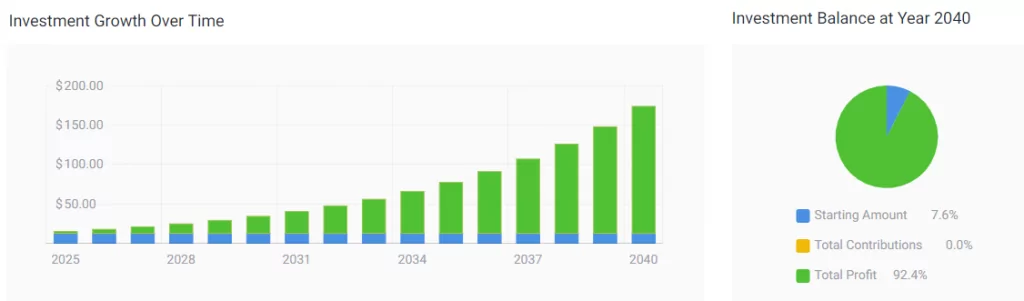

Rivian stock price prediction for 2040

To make a Rivian stock price prediction for 2040, we use three different scenarios, based on different assumptions and benchmarks. Using these scenarios, we can calculate the Rivian stock price prediction for 2040, based on the current price of $13.23, using CoinCodex’s profit calculator, which helps you calculate your future profits based on your starting investment.

The first scenario is based on a constant annual growth rate of 5%, which is the average annual growth rate of the US GDP from 1957. Using this, if Rivian stock grows by 5% every year for the next 18 years, starting from its current price of 23.21, it will reach a price of $28.88 in 2040.

The second scenario assumes that Rivian stock follows the historical average annual return of the S&P 500, which is 11.8% per year since 1957. So let’s assume that the stock grows at this rate for the next 18 years, the RIVN stock price would be $78.82 by 2040.

The third scenario follows the historical average annual return of the NASDAQ-100, which is an index that tracks the performance of the 100 largest US companies in the technology sector, and has a return of 17.5%. This projects a price of $174.65 by 2040, which would be 13 times higher than its current price.

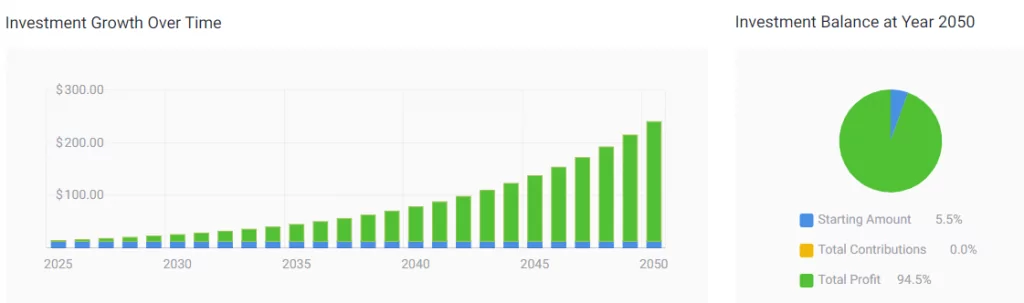

RIVN stock price prediction for 2050

Using the same scenarios and assumptions as we did for 2040, we can also forecast some scenarios for the RIVN stock in 2050.

Rivian stock would be trading at $47.04 in 2050 if it grows at a 5% annual growth rate until 2050.

Based on the historical yearly average of the S&P 500 index, which is 11.8% per year, the stock would be valued at $240.46 in the year 2050.

If it grows at the same rate as the NASDAQ-100 (17.5% per year) for 28 years, the stock would be priced at $876.08 by 2050.

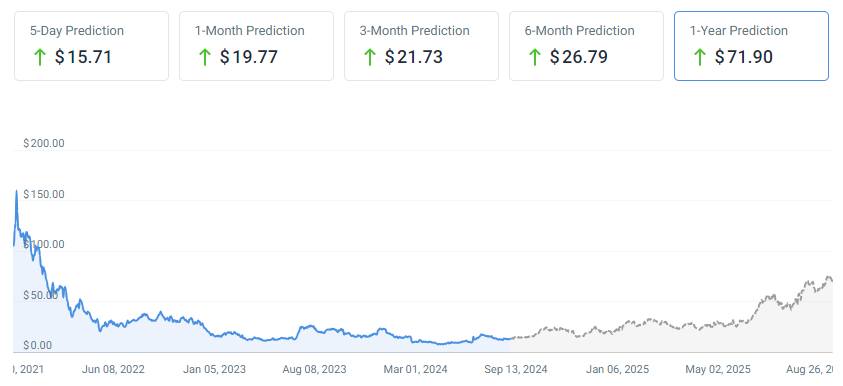

RIVN stock price forecast for 2024–2025

According to our recent forecasts, Rivian’s stock price is expected to increase by 423% by mid-2025, reaching $71.90 per share. This indicates that Rivian’s shares might face a surge next year despite the fact that the electric vehicle market is growing more competitive.

What’s next for Rivian? Potential catalysts for growth

Rivian is not resting on its laurels after launching its first two products, the R1T pickup and the R1S SUV, which have received rave reviews from customers and critics alike. The electric vehicle startup has ambitious plans to expand its production and global presence in the next few years. Here are some of the highlights:

Expanding its production capacity: Rivian currently has one factory in Illinois, which currently manufactures up to 150,000 vehicles per year. The company disclosed plans to build a second factory in Georgia, which could increase its production by another 200,000 vehicles per year, and also intends to expand its presence in Europe and Asia, where it could tap into the growing demand for EVs.

Launching new models: The company has already launched two models, the R1T and the R1S, which have received positive reviews and strong pre-orders. Rivian also has a contract with Amazon to produce 100,000 electric delivery vans by 2030. It also plans to launch more models in the future, such as a smaller SUV, a rally car, and a six-seater truck. These new models could diversify Rivian’s product portfolio and attract more customers.

Increasing its market share: Rivian is one of the leading players in the EV industry, especially in the niche segment of adventure vehicles. The company has a loyal fan base and a strong brand identity, which could help it gain more market share in the US and abroad. Rivian also has a competitive advantage in terms of its innovative “skateboard” platform, which allows it to create different types of vehicles with the same chassis and battery pack.

Improving its profitability and cash flow: Rivian is still a loss-making company, as it invests heavily in research and development, production, and marketing. The company reported a net loss of $2.8 billion in 2021, according to CNBC, and expects to lose more money in the next few years. However, Rivian hopes to achieve profitability and positive cash flow by 2025 as it ramps up its sales and reduces its costs.

Bottom Line

Investing in Rivian stock is not a simple decision, as it involves a lot of uncertainty and volatility. The price predictions provided earlier are based on hypothetical scenarios and assumptions and not on the actual performance of the company, as the stock could grow or decline in the long term, depending on the market conditions and sentimentIf you are interested in investing in Rivian, you can find more information in our article on how to buy Rivian stock. To read more about long-term stock price forecasts, check how much higher Tesla could reach by 2040 and 2050.