Theoretically, it’s possible that Nio stock can reach $1,000. Still, this scenario is not too likely, as the Nio stock price would have to increase by more than 222x from this current price to reach $1,000.

Nio impressed investors in 2020 in 2021, when the stock displayed an incredible rally, which ultimately peaked at an all-time high price of just under $62. Since then, Nio stock has undergone a steep price correction, which reached as low as $7.56 in June of 2023. With the stock still at a deep discount compared to its all-time high, Nio is certainly worth a closer look.

We’ll explore what would need to happen for the Nio stock price to reach $1,000, and analyze the company’s key growth drivers for the future. Of course, we’ll also consider what could go wrong for Nio investors and provide a Nio stock forecast for 2023 and 2024.

Can Nio stock reach $1,000? The main factors that could help Nio grow

Nio is a China-based automotive company that specializes in EVs (electric vehicles). The company was founded in 2014 and has raised more than $5 billion from investors. Nio went public in September of 2018 through a listing on the NYSE (New York Stock Exchange).

Nio was a poor performer in the stock market after it was listed. After a tough 2019, when the stock fell as low as $1.51, the stock had a stellar 2020. Between 2019 and 2020, Nio stock increased in price by over 30x.

Nio is currently in the process of expanding to additional markets, as the company aims to have a presence in 25 different countries by 2025.

At the time of writing, Nio has a market capitalization of about $9.3 billion. For comparison, Tesla has a market capitalization of $536 billion, which is about 57.6x larger.

Now, let’s take a look at some of the key factors that could drive Nio’s growth in the coming years.

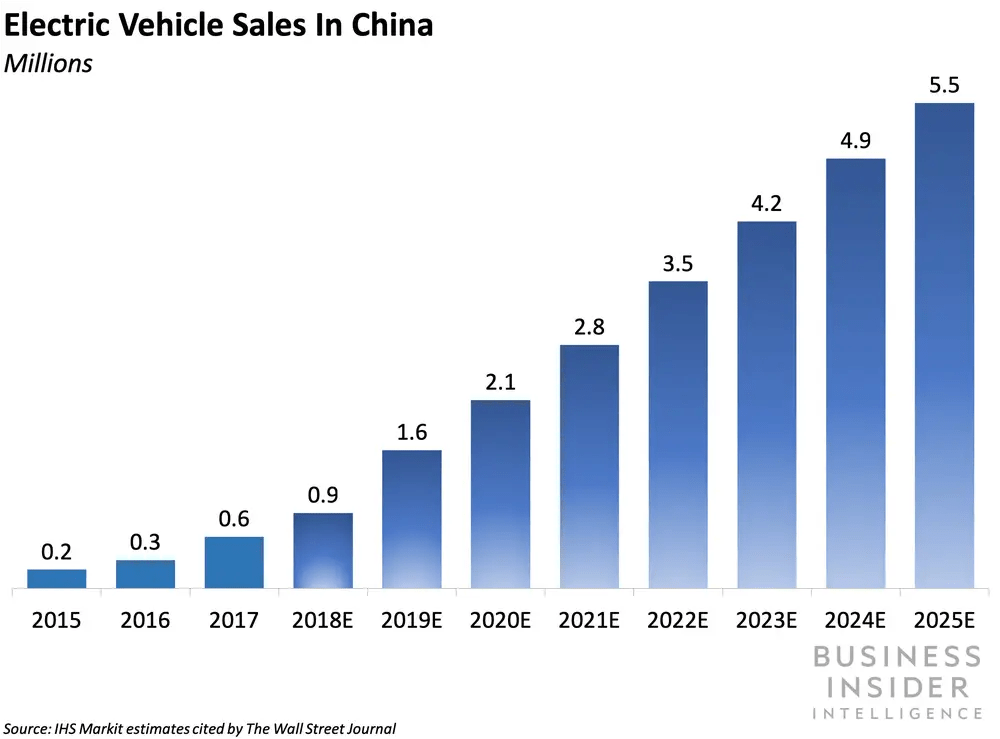

The Chinese market for electric vehicles is expanding

According to Counterpoint Research, Electric vehicles now account for one fourth of the cars sold in the Chinese market, and China was the second-fastest growing market in 2022 among the 10 biggest EV markets in the world.

China’s dedication to advancing electric vehicles has nurtured a quickly expanding sector for EV producers such as Nio. The favorable initiatives implemented by the government, including grants, charging infrastructure, and incentives related to license plates, have significantly bolstered the interest of consumers. Nio, with its attractive range of electric vehicles, is poised to profit from this advantageous market setting, potentially leading to a surge in sales and a subsequent upward trend in its stock value.

Focus on innovation

NIO has achieved acclaim for its innovative and cutting-edge EVs. The company’s emphasis on delivering an exceptional user experience through distinctive features such as state-of-the-art autonomous driving capabilities and convenient battery swapping stations has generally been met with favorable feedback.

In 2023, Nio opened an innovation center in Berlin, which hosts five distinct teams developing software used in Nio’s products. The teams will work on areas such as autonomous driving, user interface, voice assistance and other features that are expected from cutting-edge electric vehicles.

Market share expansion

NIO has been progressively expanding its presence in China’s fiercely competitive electric vehicle market. Through a rising number of vehicle deliveries, the company has showcased its capacity to secure a larger portion of the market.

The expansion of its customer base and market share has the potential to foster revenue growth and instill investor trust, ultimately propelling NIO’s stock price toward the $100 threshold.

Expansion to international markets

Nio is working on expanding its business well beyond the Chinese market. The company plans to have a presence in 25 different countries and regions by 2025, and has already made moves into markets such as Norway.

What could prevent Nio stock from reaching $1,000?

As we’ve already explained, Nio would have to grow tremendously for the stock to reach a price of $1,000. In fact, such a scenario is quite unlikely to happen. Here are the main reasons why it will be difficult for the Nio stock price to reach $1,000.

The EV market is extremely competitive

Nio has plenty of strong competitors, both domestically in China, as well as in the international markets. Major players such as BYD and Tesla already control a significant share of the electric vehicle market, and it will be difficult for Nio to take a big chunk of the market without major disruptions.

Supply chain and production difficulties

The automotive industry is often disrupted by issues with the supply chain, which can impact the ability of companies to meet their production targets. For example, semiconductor shortages have been plaguing the automotive industry in recent years, making it difficult for companies to meet consumer demand and ramp up their production of vehicles.

Changes in government policies

It’s no secret that governments across the globe have been trying to bolster the electric vehicle industry with various subsidies and incentives. However, such programs can be taken away just as quickly as they were introduced, which could lead to the business models of certain EV companies to become unsustainable.

Profitability

Although NIO has demonstrated remarkable expansion in terms of revenue, the company has not yet attained sustained profitability. Various factors, including substantial research and development expenses, heightened competition, and potential margin constraints, can impact NIO’s financial results.

For context, in 2023, Nio reported a total revenue of $7.8 billion billion but incurred a net loss of $2.9 billion. In comparison, during the same period, Tesla generated a revenue of $96.8 billion, accompanied by a net income of $15 billion.

Nio stock forecast for 2024 and 2025

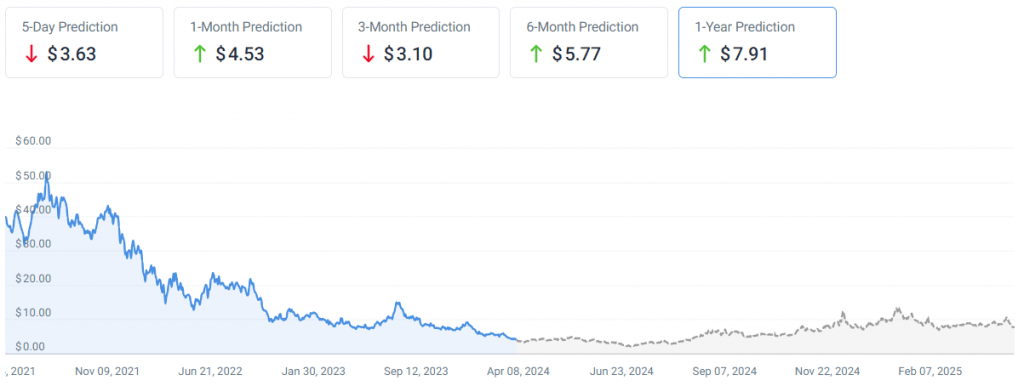

According to the Nio stock prediction on the CoinCodex platform, NIO is expected to see growth in the next 365 days. Before beginning to climb, however, Nio stock is expected to continue declining, reaching a bottom around the $2.50 price level.

In the second half of 2024, NIO is forecasted to start gaining positive momentum, ultimately piercing the $10 price level in early December. This rally is predicted to peak at a price of $13.62, which is forecasted to be reached in January of 2025. Following this peak, NIO is expected to undergo a relatively mild price correction.

The bottom line

We can conclude that it will be extremely difficult for Nio to reach a price of $1,000, as that would represent an increase of more than 15x from its all-time high price. If Nio stock traded at a price of $1,000, its market capitalization would be $1.69 trillion, which would be larger than the current market cap of Meta ($1.3 trillion) but smaller than Alphabet, NVIDIA, Apple and Microsoft.

While Nio reaching $1,000 is not an impossible scenario, there’s not much evidence that suggests Nio is headed towards becoming one of the very biggest companies in the world.