The Quantum Financial System (QFS) is the name for a theory that stipulates the global financial infrastructure will be migrated to a new system based on cutting-edge technologies such as quantum computing, artificial intelligence, and blockchain.

It’s important to make it clear that the Quantum Financial System theory is not based on any officially recognized or public financial system. Also, the evidence suggesting that such a system is actually being established is tenuous at best.

In this article, we are going to examine the current state of the Quantum Financial System and look into when we might see its real-world application.

Key takeaways:

- The Quantum Financial System (QFS) is theorized to be a new financial system utilizing quantum technology, yet it lacks official recognition and substantive evidence for its existence.

- The QFS proposes to revolutionize banking and monetary transactions by replacing traditional systems with AI, quantum computing, and blockchain technologies.

- Financial institutions are exploring quantum computing to enhance efficiency in tasks like asset classification, fraud detection, and risk management.

- As of now, no bank uses a system resembling the QFS, but some are investing in quantum computing, with blockchain technology also seeing increasing interest.

- Quantum technology in finance could vastly improve computational power and security, but faces challenges such as high costs and the need for specialized skills.

What is the Quantum Financial System (QFS)?

QFS can best be described as a conspiracy theory that suggests a new quantum technology-based system will be established to replace the existing global financial system. According to the QFS theory, the system will result in fundamental changes to the way banking and monetary transactions function.

However, theories about how the Quantum Financial System will be implemented from a technical perspective lack detail and are largely based on speculation. The general consensus is that QFS will replace current major financial systems such as SWIFT by leveraging the capabilities of artificial intelligence, quantum computing, and blockchain.

According to research from IBM, financial institutions are already exploring how quantum computing could help them perform highly complex financial calculations at drastically increased speeds. In addition to competing in the markets, quantum technology can also help companies be more efficient in compliance and risk management, per IBM:

“Several types of challenges face financial services firms that quantum computing may address. These challenges include the classification and selection of assets, customers, and vendors by default risk, as well as the detection of fraud, money laundering, or other criminal activities by finding complex variable relations.”

In markets where milliseconds can make a crucial difference, being the first to take advantage of quantum computing could translate to huge profits.

Theoretically, the QFS has the potential to transform our monetary interactions significantly. The Quantum Financial System aims to manage all transactions through a sophisticated AI system, which would eliminate the necessity for banks and financial institutions to act as intermediaries in transaction handling.

An additional noteworthy attribute of the QFS is its purported resistance to encryption breaking by quantum computers. This feature gains importance because quantum computers, owing to their vast computational capabilities and innovative processing techniques, have the potential to break existing forms of encryption entirely. This could lead to a complete redefinition of how data is secured in the digital realm.

Do banks use the Quantum Financial System?

Currently, no bank is using a payment or financial system that matches the properties described by the Quantum Financial System theory. However, some of the world’s largest banks, including JPMorgan and Goldman Sachs, have made investments in quantum computing research. For example, Goldman Sachs researchers are exploring how quantum computing could be used to price financial instruments more quickly and efficiently.

One common aspect of the Quantum Financial System and related theories is blockchain technology. Compared to quantum computing, blockchain technology is already mature enough to be used in commercial applications, although its adoption has been relatively limited thus far.

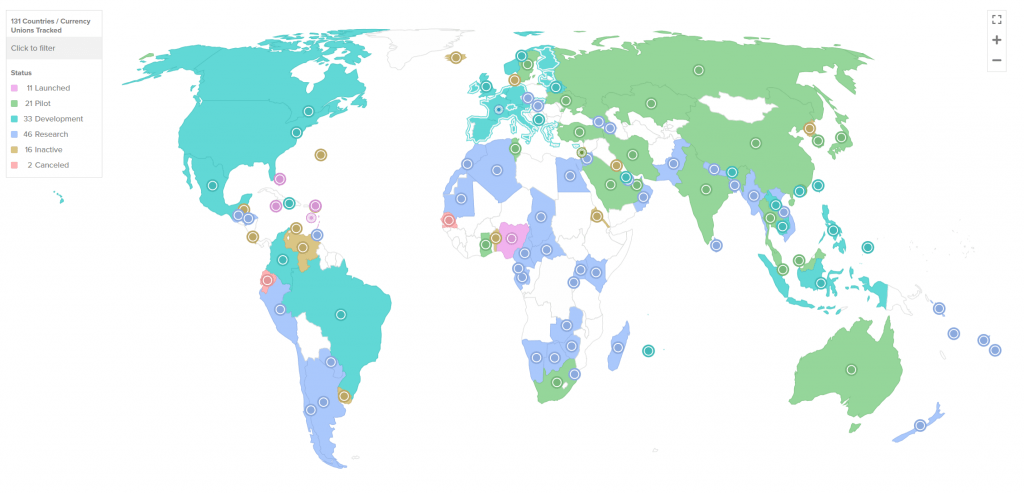

Still, many central banks around the world are exploring how blockchain technology could be used as the basis for central digital bank currencies, or CBDCs. These would be fully digital fiat currencies that could be transferred more efficiently and potentially be accessible to a wider group of people.

According to the Atlantic Council, around 130 countries are exploring a CBDC, although only 11 programs have been officially launched so far. Most CBDC projects are currently in the research or development phases.

Map showing countries where the central bank has either launched or is exploring a central bank digital currency (CBDC). Image source: Atlantic Council

When will the Quantum Financial System launch?

There is no set timeframe for the launch of the Quantum Financial System. In fact, it’s not even clear if any private or public entities are actively engaged in developing a practical implementation of the QFS.

However, it is noteworthy that financial institutions are actively involved in individual components of the QFS. Many banks and other corporations are working on ways to use quantum computing systems, implementing AI models, and employing blockchain technology to enhance the security of financial transactions.

Quantum computing technology is not mature enough to be used on a wide scale in commercial applications. Per IBM, quantum computing is still “a few years away from having a huge impact on the financial services industry.” However, the sheer increase in performance that quantum computing promises means that many of the leading financial institutions are already investing resources into researching how they can benefit the most from this technological breakthrough.

Despite the infancy of quantum computing, we have been seeing meaningfull improvements in this technology lately. Notably, Google has introduced their Willow quantum chip, which exponentially reduces errors as the number of qubits increases. This is a major step towards adressing a critical challenge in quantum error correction, which researches have been trying to fix for the past 3 decades.

As a show of its power, the Willow chip was able to perform the RCS (random circuit sampling) benchmark in under five minutes. To compare, this same computation would take 10 septilion (10 to the power of 24) years for current computers to complete.

Willow performed benchmark task, random circuit sampling, in under 5 minutes that would take the world's fastest supercomputer 10 septillion years – longer than the age of the universe. Click the link to learn more about Willow: https://t.co/LzVcei6y90 #QuantumAI pic.twitter.com/3mpw4g4Mu1

— Google Quantum AI (@GoogleQuantumAI) December 18, 2024

Can I invest in the Quantum Financial System?

The Quantum Financial System is not a clearly defined concept, so it’s difficult to say which investments could benefit from such a technology becoming commonplace. Potentially, you could get some exposure to the benefits of quantum computing in the financial industry by investing in financial industry companies that have made investments into quantum computing research—examples include JPMorgan and Goldman Sachs.

Some members of the cryptocurrency community claim that cryptocurrencies that are compliant with the ISO 20022 standard will be utilized within the QFS.

ISO 20022 is a global standard for financial messaging, serving as a universal framework for the exchange of electronic information between financial institutions and international payment systems such as SWIFT. This standard establishes a shared language and structure to enable efficient communication in the world of finance. Examples of ISO 20022-compliant cryptocurrencies include XRP, Stellar, Quant, and Algorand. Here’s the full list of ISO 20022-compliant cryptos:

- XRP (XRP)

- Cardano (ADA)

- Quant (QNT)

- Algorand (ALGO)

- Stellar (XLM)

- Hedera HashGraph (HBAR)

- IOTA (MIOTA)

- XDC Network (XDC)

Please keep in mind that there is very little actual evidence that cryptocurrencies that are compliant with ISO 20022 are planned to have an important role in a future global financial system. Such theories are usually largely based on speculation, and we don’t recommend making any investments based on them.

What are the benefits and drawbacks of using quantum technologies in finance?

New technologies introduce don’t only bring opportunities, but risks as well. Let’s quickly summarize some of the main benefits and drawbacks of uisng quantum technologies in a financial industry context.

The benefits of quantum technologies in finance

- A significant increase in computational power would allow tasks like risk management, portfolio optimization, and trading strategy simulation to be performed much faster, even if a very large data set is being used.

- Quantum computing technology could bring huge improvements to quantitative modeling, allowing models to implement a larger number of variables and more complex relationships between variables.

- Quantum computing technology could make high-frequency strategies even more efficient, allowing large amounts of data to be processed quickly and used to execute trades.

- Potentially, quantum computers could implement more powerful forms of cryptography that would improve the safety of sensitive financial information.

- Quantum algorithms could accelerate option pricing models, leading to faster and more precise valuation of financial derivatives.

The drawbacks of quantum technologies in finance

- Before the technology matures, quantum computers are likely to be very limited in number and extremely expensive.

- There is a lack of standardized algorithms that can take full advantage of quantum computers.

- Creating production-ready systems that utilize quantum computing would likely require financial institutions to hire large numbers of highly-qualified developers and researchers.

The bottom line

The Quantum Financial System, as a concept, is mostly discussed by various conspiracy theories proposing its potential to supplant existing financial systems and eradicate banks as intermediaries, replacing them with AI to oversee transactions. Although this notion may sound intriguing, there is currently no credible evidence to suggest that anyone is actually trying to implement such a system.

While the QFS itself remains uncertain, the integration of quantum technologies into the financial sector presents notable advantages and is something that will likely become commonplace in the future when quantum computing technology matures.

One company that’s often mentioned in discussions around Quantum Financial Systems is Ripple. If you want to learn more about this promising fintech company, make sure to check out our article discussing Ripple’s potential IPO.