Key takeaways:

- LUNA has lost over 50% of its value since Monday and dropped close to its one year low

- The sudden price decrease has broken UST’s dollar peg, with the stablecoin’s price falling to as low as the $0.60 range

- LFG has deployed 42,500 BTC from the UST Reserve Fund to help stabilize and maintain UST’s peg

Crypto market pullback continues

The bloodbath in the cryptocurrency markets continues into Tuesday as the bears retain the upper hand. After falling to its year-to-date low yesterday, Bitcoin shed another 4.7% of its value in the last 24 hours. The world’s largest crypto momentarily dipped below the important psychological support level of $30,000 earlier today but has since recovered a bit of its losses and is now trading in the $31,000 to $32,000 range.

Similar to Bitcoin, other major cryptocurrencies are also showing significant losses in the 24-hour and 7-day range. In fact, apart from TRON, Zilliqa, and Waves, all other top 100 cryptocurrencies have been trading in the red zone in the past week. Major altcoins like Ethereum, BNB, XRP, Solana, and Avalanche are all showing double-digit losses.

However, no other major cryptocurrency has suffered more than Terra’s LUNA, which saw over a 60% price decrease in the last 7 days. To make things worse, the primary token of Terra’s DeFi ecosystem lost over 50% of its value since yesterday alone.

LUNA was trading mostly in line with other digital assets on Monday, changing hands down roughly 15% for the day but still retaining its position above the $60 mark. This changed on Tuesday. LUNA saw a sharp price decline that eradicated 58% of its value in a matter of 15 hours and had seen the token bottom out at $25 (the lowest point since September 2021). In the next couple of hours, LUNA recovered some of its losses and rose above the $31 price point by press time.

Selling pressure shakes the US Dollar peg of the largest algorithmic stablecoin

The massive drop in the price of LUNA pushed the token outside the list of the 10 largest cryptocurrencies by market cap, a position it held for the better part of the past year. While LUNA dropping to the 13th spot might hold some sentimental value for certain investors, the sudden price drop gave way to a much more pressing issue – a bank run scenario that negatively affected the USD peg of the Terra ecosystem’s largest stablecoin TerraUSD (UST).

UST is the world’s largest algorithmic stablecoin, overtaking BUSD as the third largest market cap stable digital currency earlier this year. In contrast to centralized stablecoins like BUSD, USDT, and USDC, which are designed to maintain their USD peg with cash and highly liquid asset reserves, UST maintains its peg via a process called arbitrage. In practice, this means that the Terra protocol incentivizes users to burn LUNA tokens to mint new UST when the stablecoin’s supply is low, and burn UST to mint LUNA when the supply is high.

In light of LUNA’s notable negative price movement, UST lost nearly 40% of its value earlier today, before retracing to the $0.90 zone. It is worth noting that the stablecoin’s peg still hasn’t stabilized by the time of this writing.

Luna Foundation Guard moves 42,500 BTC to protect the UST stablecoin peg

The team behind the Terra network has long been aware that sudden fluctuations in the price of LUNA could lead to UST having problems retaining its 1:1 USD peg. For this reason, Bitcoin-denominated UST Reserve Fund was launched by Luna Foundation Guard earlier this year, which was supposed to act as a buffer against unexpected market volatility.

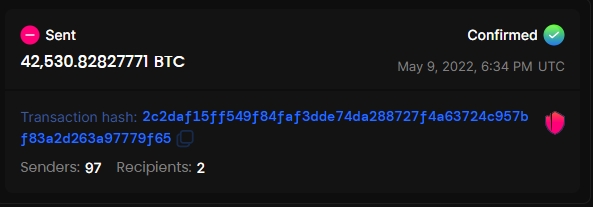

Yesterday, the team deployed 42,530 BTC from the Reserve Fund to help maintain the liquidity necessary to stabilize and help maintain the UST peg. According to speculation from some users, the funds were sent to cryptocurrency exchanges OKX and Binance.

It is worth noting that the blockchain address holding BTC reserve funds has been completely emptied out. However, LFG still has access to about $100 million in additional crypto reserve funds in the form of AVAX, LUNA, and UST deposits.