As the smoke slowly clears in the aftermath of yesterday’s cryptocurrency market flash crash, which saw Bitcoin dip to the $43,000 price level and Ethereum falling below $3,200, it has become more obvious what contributed to the sudden and unexpected market drop. The rapid price downturn caused a major cascading effect that left 333,000 trading accounts and $3.54 billion worth of trading positions ‘liquidated’ in its wake.

The so-called ‘long’ positions are used by traders to essentially bet on a price of a certain asset to increase. In contrast, ‘shorts’ are bets on the price decrease.

According to data accumulated by CryptoDiffer, $1.246B worth of long positions were liquidated on the ByBit platform, followed by Huobi and Binance with $859M and $715M respectively. Bitcoin liquidations accounted for the biggest share with $1.4B, followed by Ethereum and XRP positions with $928M and $223M respectively.

Prominent cryptocurrency analysts Willy Woo and crypto quant trader Sam Trabucco have both pointed out in their respective Twitter feeds, how the most recent flash crash was eerily similar to the events following the previous market high earlier in the year. On both occasions, the market crashes were caused by deleveraging and overreaction of the derivatives marketplace. In a Twitter thread, Trabucco showed the correlation between the most recent crash and the ones that followed BTC’s ATH in April and the one that happened in May, after BTC had recovered to $50,000.

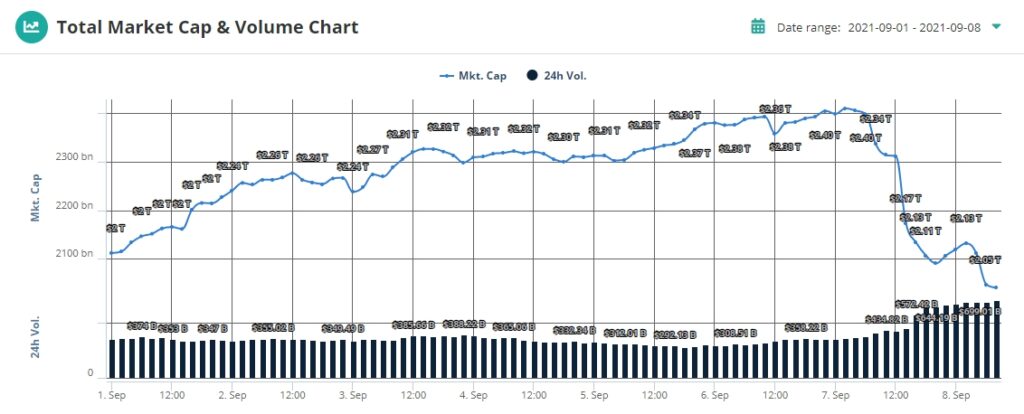

Almost a $400 billion drop in the span of 30 hours

The severity of yesterday’s market action is especially apparent when looking at the chart of the total cryptocurrency market cap. On Tuesday, the market cap reached a peak value of $2.41T. Then the madness ensued, which saw the total market valuation drop to $2.09T, recovering a bit, and then continue the slide to $2.04T at the time of this writing.

On a positive note, the current cumulative market value is essentially the same as it was in late August, which shows just how quickly the market has grown by close to $400 billion. One could even say that the drop and subsequent price consolidation were to be somewhat expected. Since there was no fundamental reason for the sudden decrease in the value of digital tokens, we can somewhat safely assume that the prices will recover in the near future. This sentiment is echoed by Willy Woo, who is convinced that the BTC flash crash means we are getting “cheap coins.”

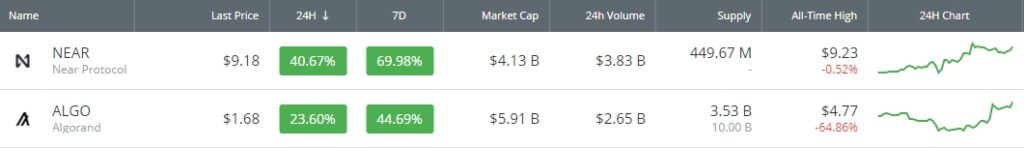

Despite the negative trading trend permeating the market, there were some standouts among the top 100 largest cryptos by market cap. Near Protocol’s NEAR token and Algorand’s ALGO have both managed to successfully defy the negative trend and posted high double-digit gains over the last 24 hours.