The blockchain is revolutionizing entrenched notions of how finance works. Fintech startups cause positive disruption and promote financial inclusion in different ways. NFTuLoan is an innovative platform aiming to further this vision using modern digital assets. The platform has a straightforward operational model: Use your NFTs, including valuable and rare assets like BAYC, virtual land, domain names, and more, as collateral for loans.

For starters, Non-Fungible Tokens (NFTs) are unique digital assets that rely on blockchain encryption for traceability. The ownership of an NFT is recorded on a public blockchain, meaning everyone can verify its authenticity. Besides, each NFT is uniquely encoded, meaning that no two such tokens can be interchangeable. Therefore, it is a great way to track the value, which has made NFTs a popular tool for auctioning digital art and similar collectibles.

Jeremy Dahan currently serves as the CEO of this project. He leads a committed team of technocrats and entrepreneurs with a wealth of experience developing projects from inception to mass introduction to the global stage.

How does NFTuLoan work?

Access to credit is a major global issue. Part of the reason wealthy individuals and corporations perpetuate their existence is easy and cheap credit access. NFTuLoan exists to remedy the liquidity problems that many NFT owners face.

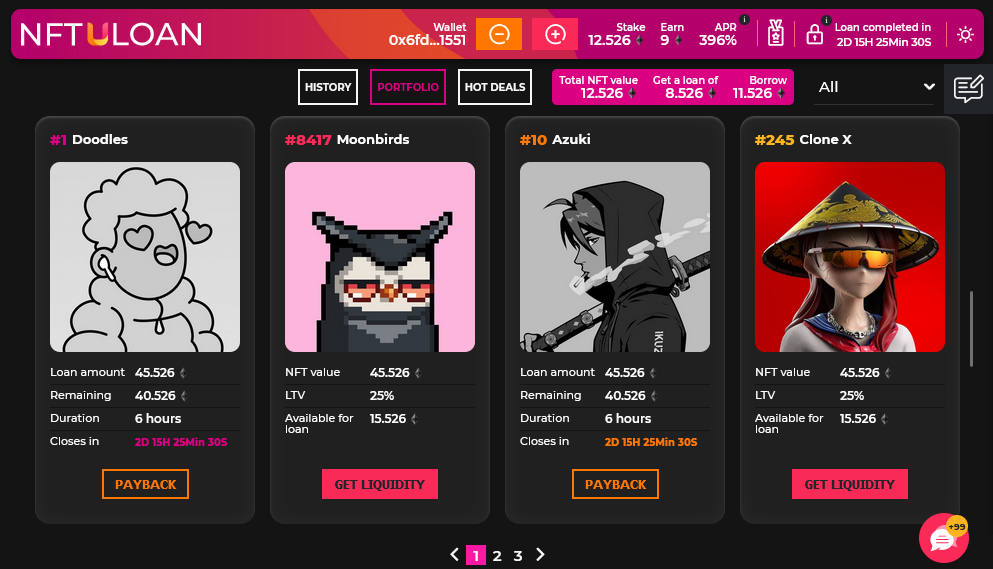

NFTuLoan essentially operates as a peer-to-peer lending pool. To access the loans, users first register on the NFTuLoan website. This process allows them to link an Ethereum wallet, preferably Metamask. Even though the platform is themed on NFTs and loans, not all are acceptable. Unfortunately, the industry is rife with junk NFTs, and the development team has identified around 200 reputable collections.

NFTuLoan automatically gauges each NFT offered as collateral for its value and suggests an appropriate loan. The time limit that the user sets for payment determines interest rates, a factor that also depends on the value of the NFT. Once the terms are set, the borrower gets the equivalent value in ETH sent to their wallets. Ultimately, automation makes the loan fast, transparent, and fair.

However, the platform integrates an external marketplace for borrowers who default on their loans. NFTuLoan will sell the collateral at a 30 percent discount to interested users, payable in ULOAN, the protocol’s native token.

What the project means for DeFi and NFTs

The NFTuLoan is the essence of Fintech. Users can transfer their NFTs and access loans in a frictionless manner. The platform accepts over 200 NFT collections, meaning that the most notable collections will be acceptable. You don’t have to go through the bureaucratic bottlenecks of centralized banks to access vital loans, an advantage offered by DeFi.

Therefore, lenders donate liquidity to the pool in which borrowers use their NFTs as collateral for loans. NFTuLoan relies on an EMV-compatible machine and smart contracts to manage the decentralized pool. This model limits human bias in the determination of loans and interest rates. Accordingly, NFT creators and holders of collectibles, digital land, digital art, and other forms of acceptable collaterals can access loans at ease for growing their projects and portfolios.

The idea of leveraging NFTs to access short-term loans via a P2P pool opens up another horizon for NFTs while drastically boosting their liquidity. Because of the merger of NFTs with DeFi, NFTs are being brought to the fore. They are becoming as dynamic, recognizable, and fluid as physical assets like land, real estate, and physical assets.