Historically, cryptocurrency bull runs occur in four-year cycles, typically beginning around six months after a Bitcoin halving. With the most recent halving in April 2024, we are now in the midst of the 2025 bull run—one that is still far from over.

From the legendary rise of Bitcoin to the introduction of thousands of altcoins, the crypto market has fascinated both investors and enthusiasts alike. The cyclical nature of the market lends itself to the question on every investor’s mind: “When is the next crypto bull run happening?”

In this article, we’ll delve into key factors, trends, and various market data to try to determine when the next crypto bull run will commence, and when it might peak.

When is the next crypto bull run happening?

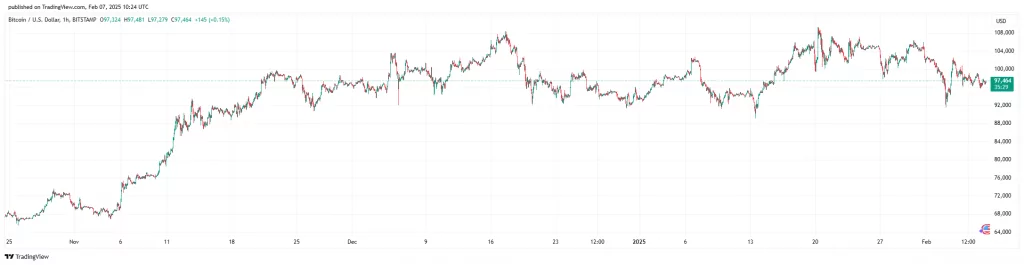

The current bull run started in early November 2024, roughly 6 months after the April Bitcoin halving. The height of each previous bull run was separated by a period of roughly 4 years, which theoretically means we’ve already reached the peak of the current bull run, though we won’t know for sure until the bull run ends. The minimum drawdown between Bitcoin’s peak and bottom price during each period was at least 77%. The next crypto bull run is likely still far away, but it could happen in early 2029 if we follow the current 4-year cycle.

Here’s a quick look at the previous bull periods, their respective peak dates, and drawdown ranges:

| Peak (date) | Bottom after peak (date) | Drawdown between peak and bottom | |

| 2013 BTC bull run | $1,150 (December 2013) | $171 (January 2015) | -85% |

| 2017 BTC bull run | $19,900 (December 2017) | $3,200 (December 2018) | -84% |

| 2021 BTC bull run | $68,700 (November 2021) | $15,600 (November 2022) | -77% |

| 2025 BTC bull run | $109,100 (January 2025)* | $92,900 (February 2025)* | -15%* |

Understanding the crypto bull run

A crypto bull run is a period characterized by a sustained and substantial increase in cryptocurrency prices. During this bullish phase, investors witness exponential growth, and profits soar to new heights. The market sentiment is overwhelmingly positive, attracting a massive influx of new investors looking to capitalize on the upward trend.

What drives the crypto bull run?

The crypto market is heavily influenced by a variety of factors that contribute to the onset and intensity of bull runs. Understanding these drivers can offer valuable insights into predicting the timing of the next bull run:

1. Market sentiment and hype

Market sentiment plays a crucial role in the crypto space. Positive news, endorsements from influential figures, and increased media coverage can create a hype cycle, triggering a bull run. Traders and investors start to buy into the market with a belief in its long-term potential, further driving prices higher.

2. Adoption and acceptance

Widespread adoption and acceptance of cryptocurrencies by mainstream financial institutions, businesses, and governments can trigger a bullish trend. As cryptocurrencies gain credibility and become more accessible, investor confidence increases, propelling the market upwards.

3. Halving events

In the case of Bitcoin, halving events occur approximately every four years, reducing the block reward for miners by half. This event historically leads to increased scarcity of Bitcoin, which can drive prices upwards as demand exceeds supply. Read our guide to learn more about past and future Bitcoin halving dates.

4. Technological advancements

Innovations in blockchain technology and cryptocurrencies can fuel investor interest. New and improved projects with real-world use cases often gain attention, leading to a surge in investment activity and contributing to a bull run.

5. Economic and political factors

Economic instability, political events, and government policies can significantly impact the crypto market. Investors seek alternative assets like cryptocurrencies during uncertain times, potentially leading to a bull run. In the case of the 2025 bull run, it’s been largely driven by the re-election of President Trump, who is currently completely in favor of cryptocurrencies—a complete 180° from his stance in 2019.

Analyzing past crypto bull runs

To gain insights into the timing and dynamics of previous bull runs, let’s take a look at some notable historical crypto market rallies:

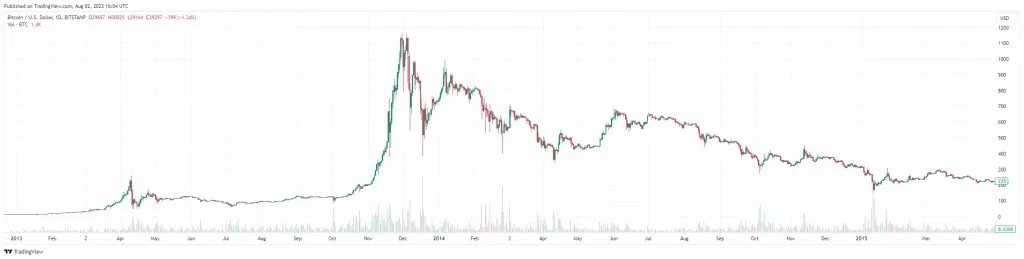

The 2013 bull run

The first major crypto bull run happened in 2013. At the time, Bitcoin’s price first exceeded $1,000, recording a massive increase compared to 2010, when the world’s first cryptocurrency was changing hands at just 50 cents per coin. The 2013 bull run was the first event that saw cryptocurrency surpass the confines of computer and cryptography enthusiasts and enter the mainstream discourse.

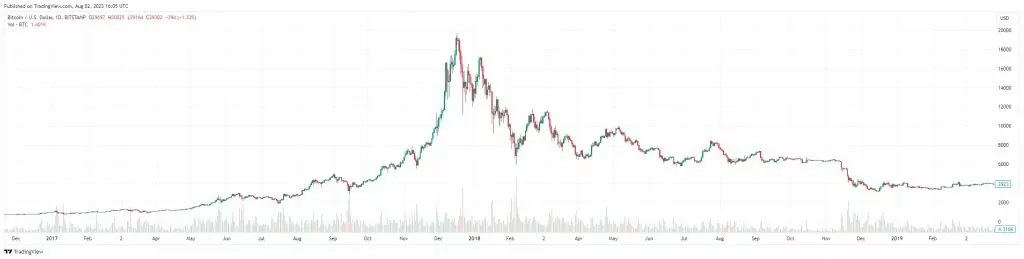

The 2017 bull run

The year 2017 witnessed one of the most infamous crypto bull runs in history. Bitcoin’s price soared to an all-time high, reaching nearly $20,000 per coin. The euphoria extended to altcoins, with many recording staggering gains. However, this bull run was followed by a significant market correction.

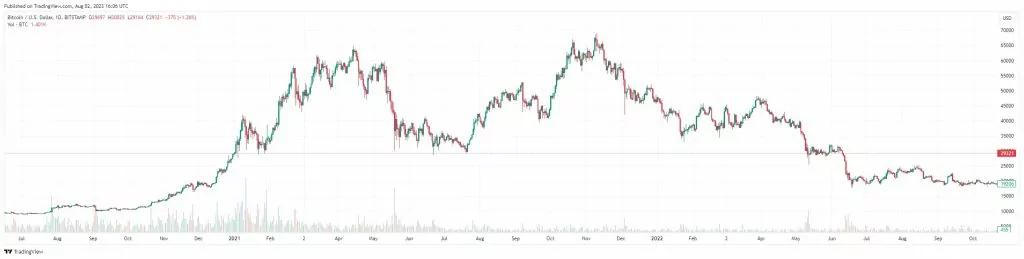

The 2021 bull run

In 2021, the crypto market experienced another remarkable bull run. Bitcoin once again reached new highs, surpassing $60,000. Altcoins like Ethereum and Dogecoin also surged, capturing the attention of the global investment community. The 2021 bull run was unique due to its very apparent “double top”, with many cryptos having reached new ATHs both in early and late 2022.

The 2025 bull run

Started in November 2024, the current bull run is still far from over. Notably, Bitcoin has reached new heights again, this time even surpassing the coveted $100,000 milestone and nearly reaching $110,000. Many altcoins have reached new peaks as well in this period—most notably, XRP went from $0.50 in November to $3.30 in January, due to speculation around Ripple’s victory against the SEC lawsuit. A notable underperformer in the current bull run is Ethereum, which, despite reaching $4,000 again after half a year, consistently lags behind other altcoins and Bitcoin.

Signs pointing to the next market rally: How to spot the onset of the next crypto bull run

While it’s impossible to predict the exact timing of the next bull run, several signs and indicators can help investors identify potential bullish trends:

1. Increasing trading volumes

A surge in trading volumes across multiple cryptocurrencies on crypto exchanges often precedes a bull run. Higher volumes indicate increased market interest and buying activity.

2. Positive price movements

Steady and consistent price increases in major cryptocurrencies may signal the start of a bull run. However, it’s essential to differentiate between short-term fluctuations and sustained uptrends. A tool focused on long-term price movements like the Bitcoin Rainbow Chart can be helpful when differentiating between short terms and long-term trends.

3. Bullish technical indicators

Technical analysis can provide valuable insights into market sentiment. Bullish patterns, such as the golden cross and high RSI levels, suggest potential upward movement in prices. Coincidentally, CoinCheckup’s Bitcoin price prediction and other digital currencies is heavily rooted in these values.

4. Growing social media activity

Increased chatter and discussions about cryptocurrencies on social media platforms often correlate with market enthusiasm, which can contribute to a bull run.

5. Positive regulatory developments

Favorable regulatory developments that promote the adoption and use of cryptocurrencies can ignite positive market sentiment and drive prices higher.

How to prepare for the next crypto bull run?

Analysts largely agree that the crypto market operates in cycles, characterized by bull runs followed by bear markets. Understanding these patterns is essential for predicting future bull runs and making informed investment choices.

While short-term gains can be tempting, experts stress the importance of adopting a long-term investment approach. This “HODL” strategy involves holding onto cryptocurrencies for extended periods, as they believe in the continuous growth and widespread adoption of digital assets over time.

To minimize risks during market fluctuations, diversifying investment portfolios is recommended. This involves spreading investments across various cryptocurrencies and traditional assets. By diversifying, investors can increase their chances of benefiting from bull runs while mitigating potential losses during bear markets.

Fundamental analysis plays a crucial role in assessing the growth potential of cryptocurrencies. Evaluating project fundamentals helps in understanding the viability and potential success of a particular digital asset. This comprehensive analysis aids investors in making informed decisions and identifying promising investment opportunities.

The bottom line

We are currently in the crypto bull run of 2025, which started just a few months ago, aligning with previous cycles that began around six months after a Bitcoin halving. While we don’t know when the current run will peak, we can still assume based on past market movements. However, it is worth noting that past historical performance is not a guarantee of future price movements.

Arguably the most sensible thing to do in preparation for the next crypto bull run is not to try and time it, but to invest in different projects with strong fundamentals that could make big gains when crypto starts to rally. Check our curated list of the best cryptos to buy for more investment ideas.