The third week of 2023 brought us the continuation of the uptrend, which carried the total market capitalization from $1.00 trillion at the beginning of the week to $1.07 trillion. Bitcoin is up by almost 10% last week, while the second largest cryptocurrency, Ethereum, has posted a weekly gain of a bit less than 7%. Top gainer from the Top 10 cryptocurrencies was OKB, which appreciated by 17% last week and thereby managed to overtake SOL (Solana) and re-enter the 10 largest cryptocurrencies by market capitalization. But you are likely asking yourself which coins are in for some interesting price movement this week? Read through and familiarize yourself with our Top 3 Coins to Watch in Week 4.

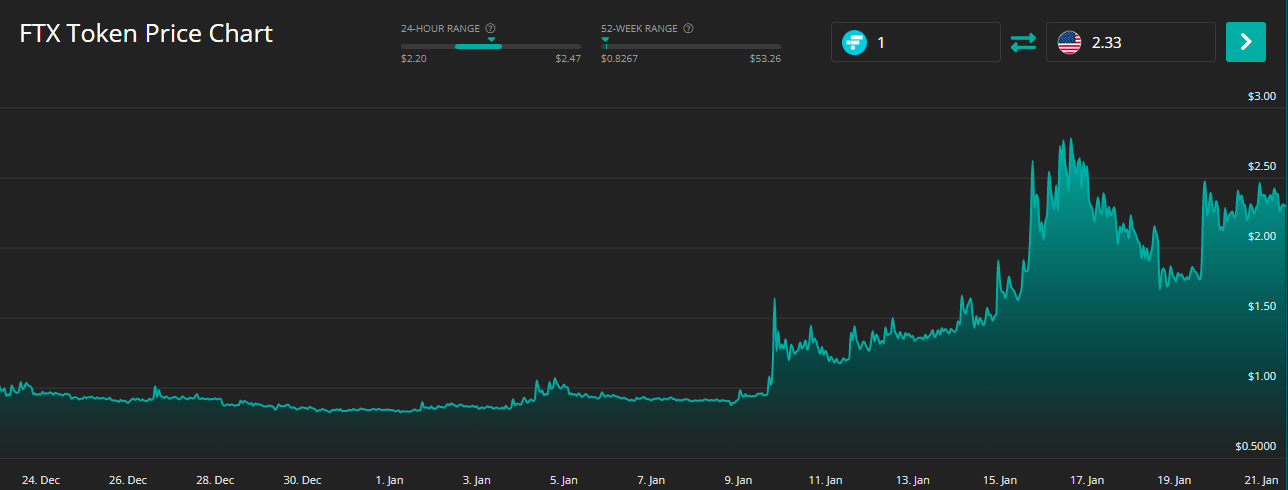

3. FTX Token (FTT)

FTX is a now defunct cryptocurrency derivatives exchange that offered futures, leveraged ERC-20 tokens and OTC trading but went bankrupt in November 2022. FTX Token (FTT) was the official token and the backbone of the FTX cryptocurrency derivatives exchange and its ecosystem, dropped from $26 to below $2 in a matter of a few days after the exchange’s collapse. The maximum supply of FTT was capped at 350 million tokens, but the FTX exchange used a portion of its profits to buy back and burn FTT, so the current circulating supply stands at 328.9 million tokens. While users could once utilize FTT as collateral for futures positions, for earning rebates on trading fees, or even stake tokens to earn additional rewards, the use cases of FTT have become very limited following the collapse of its issuer.

New FTX CEO sends FTT price on the move again by hinting at a plausible exchange revival

The FTT token price has seen a rapid decline of almost 95% after the FTX exchange turned out to be built like a house of cards and collapsed in November 2022. Furthermore, the collapse of the FTX exchange, did not only cause the price of FTT to plummet, but also caused the wipe-out of several billion USD from the total cryptocurrency market capitalization. But after trading below the $1.50 valuation for more than a month the FTT price is on the move and investors seem to be flocking in again. The reason for this revived interest is the appointment of John J. Ray as the new CEO of FTX, who in his first public interview after taking over the company revealed that he is considering resuming operation (in other words reviving the exchange and all its activities). The FTT price has increased by 60% over the past week and over 170% in the past month, outperforming almost all other top 100 cryptocurrencies over both periods. The main question remains – is it possible for the FTX exchange to resume operation?

2. Nexo (NEXO)

Nexo started out as a centralized lending and borrowing platform that allows people to take out stablecoin loans as well as fiat cash loans by depositing their crypto holdings as collateral. The platform also offers high yield interest accounts, which act as the source of liquidity for the platform’s loans. Through its history Nexo kept expanding its range of services, which now also include a cryptocurrency exchange with over 300 trading pairs and a Nexo Card, which allows you to spend your crypto without selling it. Nexo Token is the native cryptocurrency of the ecosystem and the basis of the Nexo loyalty program. Users who hold a larger percentage of their portfolio in NEXO can enjoy reduced trading fees as well as higher interest rates when lending and lower interest rates when borrowing. In addition, Nexo has also committed to buy and burning $50 million worth of Nexo Tokens as part of its most recent Buyback Program.

Nexo settled the case with the U.S. SEC for $45 million

After years of litigation, the cryptocurrency lender Nexo agreed to pay $45 million to settle a case with the U.S. Securities and Exchange Commission (SEC) over the unregistered offering of its crypto asset product, the company announced on Twitter:

The SEC claimed that Nexo’s Earn Interest Product (EIP) constituted an unregistered securities offering, but since day one of the allegations Nexo has cooperated with the U.S. regulator and even voluntary stopped offering its EIP on U.S. territory. Nevertheless, the legal saga dragged out over the course of a few years and has only recently reached the end with Nexo agreeing to pay a monetary penalty of $45 million, payable over a 12-month period. Nexo’s representatives were content with the result and highlighted that the settlement was reached on a no-admit-no-deny basis. The SEC also confirmed the news in their own press release. NEXO token rallied on the news of the settlement, gaining 16% in a single day on January 20 and peaking at the price of $0.85 per token. At the time of writing, NEXO is changing hands at a price of a bit less than $0.84 and is up by 12% in last 7 days. In addition, Nexo is one of the few remaining centralized cryptocurrency lenders in the market, as its competitors Celsius, BlockFi, Vauld, Voyager, and several others either went bankrupt or massively restructured their businesses during the bear market of 2022.

3. Kava (KAVA)

Kava is a high throughput Layer 1 blockchain developed by Kava Labs. It is designed to use an innovative blockchain architecture of two co-chains working side by side to create a unified scalable network and facilitate a myriad of decentralized finance (DeFi) use cases. Kava’s own Tendermint consensus engine combines Ethereum’s smart contract capabilities with Cosmos’ interoperability to facilitate transactions for thousands of supported decentralized applications. To achieve cross-chain communication and asset transfers, the Kava ecosystem utilizes IBC Protocol and ChainLink’s decentralized blockchain oracle network. Kava Labs have also established close partnerships with industry leaders such as Binance, Kraken and Ripple. The platform’s native token KAVA is used to transfer value on the network and plays a key role in the governance of the blockchain.

Coinbase listed KAVA just a few days before the scheduled launch of Kava 12

Kava earned the top spot on our this week’s list due to the upcoming launch of Kava 12. According to Kava developers, the update that is scheduled to roll-out on January 25 will be a total game-changer.

By implementing a new module called x/kavamint, the platform will give Cosmos chain DAOs far more control and flexibility over their emissions. In addition, Kava 12 will also improve the transparency of Kava DAO communities, giving all participants a clear insight into community portfolio and flow of funds. Kava 12 will also implement the ability to set burning mechanisms based tied to various on-chain parameters and a few other innovative features. The full list of features included in the new module can be found here. In addition, KAVA recently got listed on Coinbase. KAVA trading on the largest U.S.-based cryptocurrency exchange commenced on January 19, but KAVA pumped by more than 15% already the day before, when the listing was announced on Kava’s official Twitter. Kava representatives also highlighted that the listing will not only benefit KAVA but the whole Cosmos ecosystem. According to Kava developers, all Cosmos Inter Blockchain Communication (IBC) Protocol compatible projects will now enjoy a far shorter time to listing on Coinbase, which could be reduced from current 18 months to as short as 1 month. KAVA is currently trading at $1.05 and is up by 24% in the last 7 days and 83% YTD. Will this positive trend continue and push KAVA price even higher?