Arriving in 2014, Monero is one of the crypto marketplace’s most famous privacy coins. Designed to be untraceable, unlinkable, and analysis resistant, the coin brings unparalleled levels of security to users – confounding even the IRS in the process.

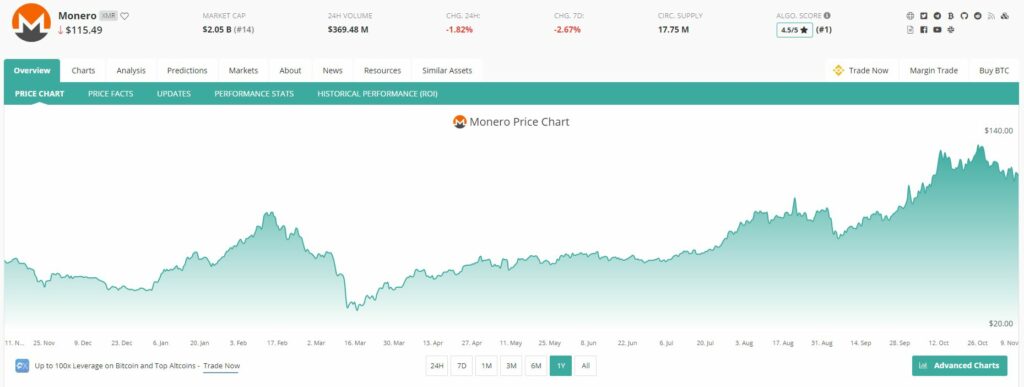

In its six years of existence, Monero has enjoyed some huge peaks, but in recent months the coin has experienced some impressive sustained growth. Today, the price of Monero is almost 110% higher than it was at the same time last year.

Despite being a consistently strong performer, Monero hasn’t been without its controversies. One of the biggest issues that the coin hasn’t addressed comes from its associations with the black market. Because the Monero protocol has proved impossible to trace, the cryptocurrency has been useful for criminals to buy illegal goods and services without the threat of the transactions being exposed.

However, true crpyto enthusiasts view Monero as a true example of digital finance at its best: a truly decentralized unit of finance that’s free of any central government regulations or influence.

But what does the future hold for the popular privacy coin? Let’s take a look at the growing role of Monero in the crypto market:

The Appeal of Security

As we can see from the table above, not all cryptocurrencies offer true decentralization, fungibility and privacy. This generally comes down to how currencies record transactions, deal with regulations and process payments.

Fungibility, in particular, refers to how interchangeable an asset is with other assets of the same type. Fundamentally, for a currency to be successful, it should be fungible to protect its value from a loss of confidence.

While Bitcoin is a hugely successful cryptocurrency and by far the most popular available to investors today, it simply doesn’t offer the same levels of security as Monero. Bitcoin doesn’t have strong fungibility because it records its transactions on public blockchains that can be viewed by anybody. This means that it’s possible for central governments to utilise chain analysis companies to trace coins involved in illegal transactions – leading to a trainted coin problem. Due to this, the market for newly minted coins with no past history is steadily growing.

To counter this, Monero’s blockchain technology is built on an obfuscated ledger that prevents anybody from viewing data related to transactions taking place on the network. The protocol ensures that details of amounts transferred, the address of origin and recipient details aren’t accessible. To achieve a consensus on transactions, Monero uses CryptoNight – a proof-of-work algorithm that uses the CryptoNote codebase.

However, despite Monero’s watertight framework, there’s been no shortage of powerful organizations aiming to breach the walls of the powerful privacy coin.

Beating The Bounty Hunters

The impregnible nature of Monero has left the coin with plenty of admirers, but for other governmental entities, like the US Internal Revenue Service (IRS), the prospect of cracking a heavily encrypted and entirely private coin to view the potentially criminal activities underneath is so tempting that a bounty has been issued to whoever can crack the coin.

In October 2020, crypto-intelligence firm Chainalysis and data forensics company Integra Fec won contracts from the IRS totalling a collective $1.25 million to try to crack Monero’s framework.

To help with their task, the IRS has advanced $500,000 to each firm in order to develop a functional tracing tool – with another $125,000 in the pipeline if the tool proves successful and is approved. The firms must produce a working submission in eight months, while testing and development will take place over the following four months.

The IRS intends to finance a solution that will enable it to track transactions to specific users, and identify certain details that can provide more information on network activity.

Chainalysis will be confident of breaking Monero down, and has previously claimed that it can track 99% of transactions involving Zcash and virtually all of the transactions of Dash – with both coins acting as more privacy-focused cryptocurrencies, similar to Monero.

However, the hyper-secure framework of Monero has led the coin to becoming an undisputed industry leader when it comes to leveraging fully private transactions. In issuing a bounty on the successful cracking of Monero may backfire for the IRS – if Chainalysis and Integra Fec fail to crack the coin, it could be seen as a green light for more criminal activity to take place using the coin.

Investing in Privacy

In pure investment terms, it’s fair to say that Monero has a bright future. As one of the only cryptocurrencies that offers truly decentralized privacy to uses, many will argue that it’s one of the only coins that’s kept true to the blueprints of the crypto market place.

The IRS attempts to undermine the security of Monero could play a big role in the future value of the cryptocurrency. If, in 2021, the Monero framework is cracked open, exposing the transaction information of buyers and sellers, the results could adversely affect the coin, with adopters losing faith in one of the currency’s most unique features.

If, however, by the end of 2021, Monero remains as secure as ever, it could lead to even more confidence from investors that they’re buying into one of the more pure interpretations of crypto.

Although its more shady usage could hurt the widespread adoption of Monero in the short term, the privacy coin has the potential to dominate the market if Bitcoin’s lack of security becomes an issue in a more regulated future.

For now, Monero appears to be pretty happy to continue building on its value without the help of outside influences. If the IRS fails in their bid to crack the coin’s framework, we could see more significant rises than just the 100% that took place between 2019 and 2020. The sky could truly be the limit for the world leaders in privacy.