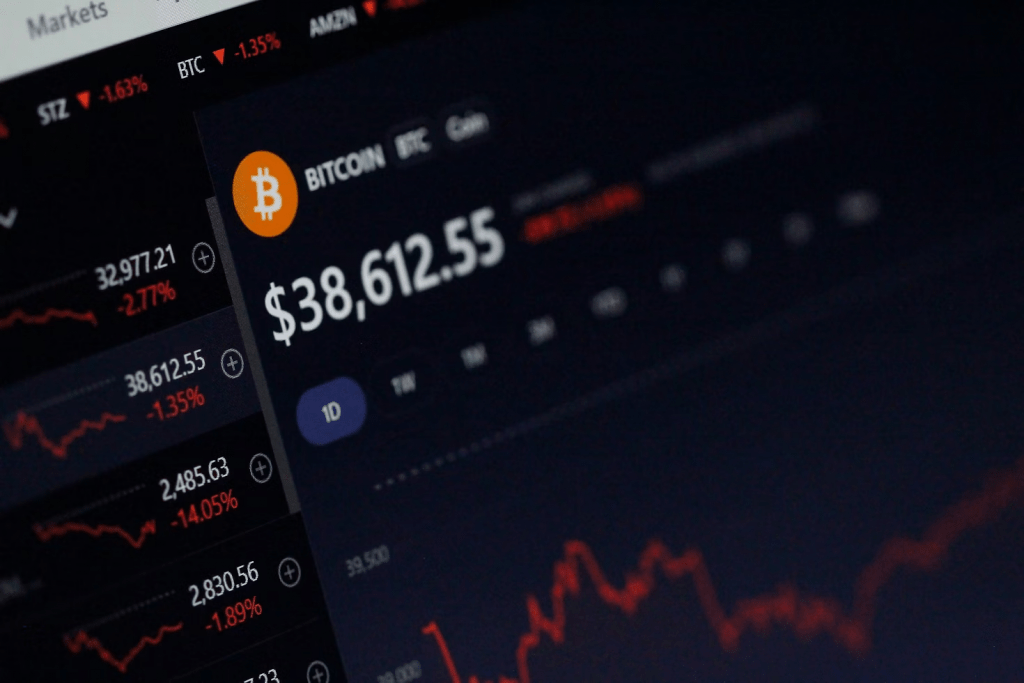

Getting a second opinion when trading cryptocurrencies (also known as crypto) can make all the difference, especially when it comes from a professional point of view or reliable sources. Although trading signals used to be mainly famous in the forex retail trading scene, the adoption in the crypto market is almost as significant as it is in this space today, especially with the increasing acceptance of these assets in the financial market. For a market as volatile as this, there is some level of reassurance that comes with access to such information and a higher advantage for many traders. Here, we’ll look at how to make the most of such advantages and the roles crypto trading signals play in any investor’s portfolio.

Introduction to Long-Term Market Signals in Crypto

Market signals in crypto are trading suggestions given to investors on whether to buy an asset or not. These recommendations are given based on research and analysis from market experts, and they can be technical, fundamental, or sentimental. Crypto signals serve as a guide and directive in the volatile market, helping traders make better decisions based on relevant factors like market trends, data analysis, price performance, and historical data.

Some of these signals can be obtained from expert professionals who have spent significant time studying and understanding the market. In other circumstances, they are done using advanced tools, bots, or automation. These bots and tools use complex algorithms to make suggestions and generate recommendations for traders. You can also add them to your crypto trading platform.

Why Long-Term Market Signals Are Essential for Traders

The cryptocurrency market is highly speculative; with many new assets being introduced to the market, volatility is on the rise more than usual. The prices of these virtual assets change very often based on trends, sentiment, market perception, and performances. There is a lot of analysis when monitoring the performance of a project, and using market signals helps traders do thorough research without leaving any stones unturned. There will always be loads of deceiving information online, as well as news and events, that will likely push traders into making premature decisions. Signals are relevant in situations like these, where investors can act on facts rather than emotions. They act as a helping hand for traders — particularly the less experienced ones. They also help unravel complex market patterns, giving traders a clear roadmap on trading directions.

Types of Signals To Look Out For

Crypto trading signals can be paid or free, depending on how much you’re looking to get from the tool. The paid options come with extra features like additional daily signals, tools for leveraged trading, free educational groups, and a high win rate. Some top signals out there are Fat Pig, Binance signals, and Wolfx. The free versions might come with fewer features and be less helpful than paid alternatives. These available options can have technical, sentimental, and fundamental types of signals.

Technical signals are mostly comprised of valuable insights into asset momentum, trend strength, and volatility. Some popular indicators used to get these are moving averages, relative strength indexes, and Bollinger bands. These tools can be used to get direction on entry and exit points and overall asset performances. The sentiment signals, on the other hand, are those generated based on trends, market sentiment, and perceptions. They can be obtained from sources like social media platforms, channels, and relevant discussion groups. Lastly, fundamental signals have to do with the possible changes that could come from news-related events and economic factors.

How These Signals Affect Cryptocurrencies

We can use technical indicators to examine practical scenarios of crypto signals and what they mean for these assets. For instance, when traders use the moving average convergence/divergence (MACD) indicator and notice a MACD line crossing over the signal line, this indicates bullish momentum. On the other hand, bearish trading signals would show such a line below the signal line.

Using another indicator like Bollinger bands, when traders notice the bands narrowing, this indicates a volatility reduction and a possible price breakout. Traders watch out for these breakouts to know what their next move will be. Most traders prefer to trade more during the bull markets, buying their assets early and selling at a potential high. These signals have been good indicators of bullish and bearish trends in the past, helping traders know where a token stands in the market.

Risk Factors and Mitigation Strategies

The insights and guidance gotten from crypto signals come with risks. These risks can come in various forms, including volatility, reliability, timing, and execution, as well as over-reliance on the tools. Trading signals cannot eliminate the long-standing volatility in the crypto market, but they can help you hedge against them. However, some of these tools are automation, and their decisions can be affected by unforeseeable changes in events in the future. Also, the credibility varies, and not all signals out there would give accurate suggestions. This is why it is always advised to opt for credible and reliable services when making a choice. There are standard signal providers on platforms like Telegram and Discord, but you should remember that these applications are also famous for being susceptible to fraudulent activities. Opt for trading signals that have built a reputable community. Also, be sure to conduct personal research and try not to rely solely on signals.

Building a Long-Term Investment Strategy

Trading tools and signals are effective and beneficial additions to every investor’s portfolio. However, they are best effective when combined with personal diligence, solid market awareness, and research. Your strategy shouldn’t be to follow all given recommendations blindly but to build from there and conduct further fact-checking and research. Several platforms allow you to connect with traders like you to build a trading community and hear and see the relevant happenings that can contribute to your trading decisions.