The highly anticipated transition of the Ethereum network from the Proof-of-Work (PoW) consensus to the Proof-of-Stake (PoS) consensus is one of the largest developments in the crypto space in recent months, if not years.

The event dubbed “The Merge” will see the Ethereum mainchain merge with the Beacon Chain, a PoS blockchain launched in late 2020 serving as the network’s consensus layer. After months of testnet implementations and shadow forks, the Ethereum developers are confident that The Merge won’t face any further delays and will take place on September 15/16.

What does the PoW to PoS transition mean for Ethereum users? How can one earn ETH staking rewards by participating in the process of securing the Ethereum network and validating transaction data? These are the questions we are aiming to answer in this article. But first, let’s take a step back to explain what is Ethereum 2.0.

What is ETH 2.0?

Ethereum 2.0 is a widely used name for the new version of the Ethereum network, which will use the Proof-of-Stake consensus algorithm to verify transactions via staking. The upgrade will not only make the network up to 99.9% more efficient than when it was when relying on Proof-of-Work miners, but it will also lay the groundwork for further scaling improvements, such as sharding.

It is worth noting that the Ethereum Foundation moved away from the “Ethereum 2.0” terminology in early 2022 in favor of The Merge, noting that the Ethereum 2.0 branding makes users think intuitively that the “old” Ethereum blockchain will cease to exist once the “2.0” version goes live, when that is not really the case. Despite their efforts, the broader blockchain community has continued to use the ETH 2.0 name – what term is used it’s just a matter of semantics in the end.

What is ETH staking?

After The Merge, the PoS mechanism will be used to reach a consensus about the state of the decentralized ledger. In contrast to the current system, which rewards PoW miners for their task of producing new blockchain blocks and verifying transactions, in PoS, any user with 32 ETH or more will be able to fulfill a similar to the role of miners in PoW by becoming a validator and earn a share of ETH staking rewards.

This means that ETH owners supplying their coins to the Ethereum 2.0 smart contract get to help power the consensus layer and accumulate passive income in the form of ETH staking rewards.

There is a lockup period associated with ETH locked in the smart contract. According to the Ethereum Foundation, users will be unable to redeem their locked ETH until the sharding upgrade, which could take another 2 years to roll out.

How to stake ETH and earn rewards?

Having 32 ETH just laying around to become an Ethereum validator is a steep asking price for the vast majority of the user base. Not only that, setting up your own node is a tedious process, requiring custody of one’s own secure keys, extensive computer knowledge, and a reliable and powerful hardware setup.

The other option to earn ETH staking rewards is to participate in Staking Pools. While Pooled staking generates a lower level of returns than Solo staking, users don’t have to deal with the nasal of running their own node.

Another benefit of Staking pools is that users don’t need to follow the 32 ETH requirement, but can instead join pools with much smaller amounts. Among the most popular Pooled staking services that have emerged in recent times are Lido DAO and Binance Staking. Both products charge a small fee for the service and distribute ETH rewards in their respective STETH and BETH liquidity tokens.

What is Binance ETH 2.0 Staking?

Binance ETH 2.0 Staking is a part of the overarching Binance Staking platform, which allows users to supply their tokens to earn a share of profits generated by various decentralized finance (DeFi) services and Proof-of-Stake networks.

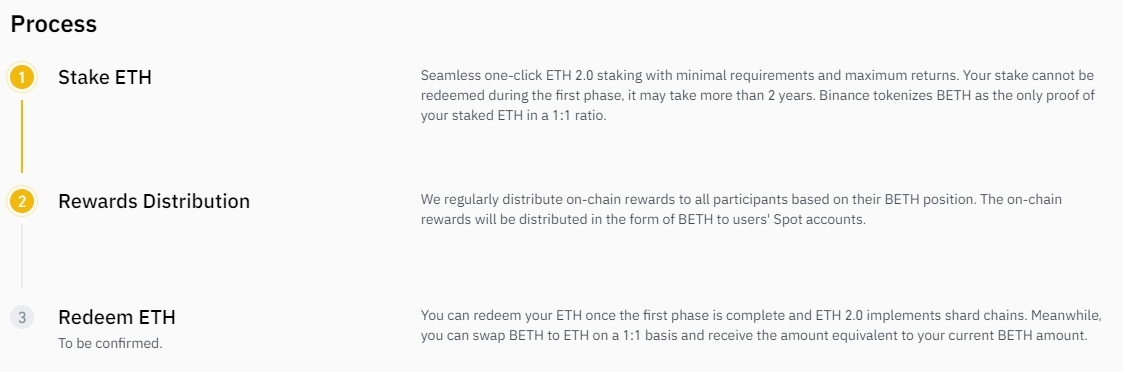

Binance allows users to lock up ETH to start earning a share of Ethereum 2.0 staking rewards in BETH. For each ETH staked, Binance distributes a corresponding amount of BETH to investors at a 1:1 ratio.

Users receive ETH staking rewards in the form of BETH tokens based on the BETH position deposited in their Binance Spot accounts. Keep in mind that BETH in external addresses or staked in Launchpool and similar services is not accounted for when distributing staking rewards.

How to use Binance ETH 2.0 Staking?

Staking Ethereum tokens on Binance is a very straightforward process that essentially requires users to have access to ETH in their spot accounts and nothing more.

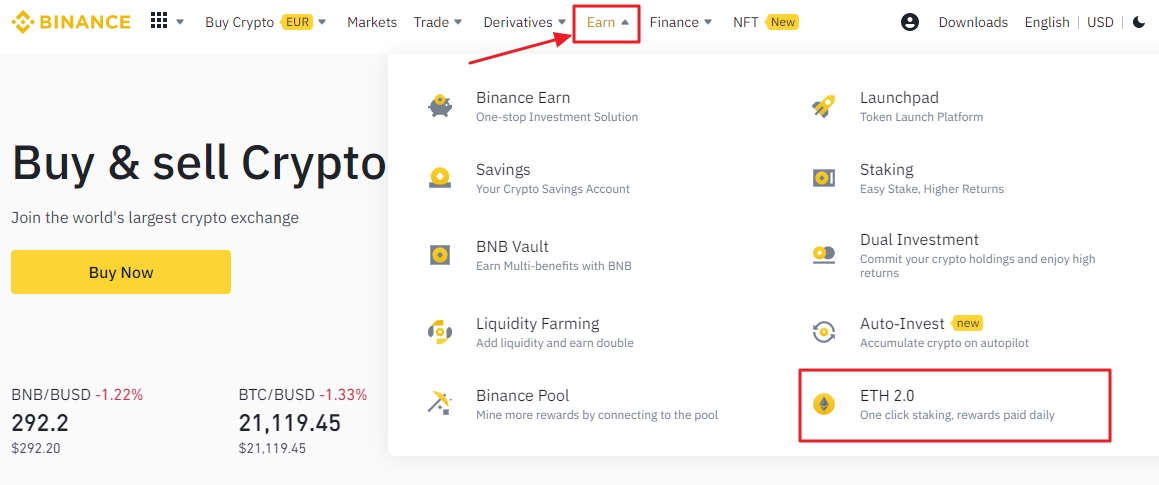

First, you need to login into your Binance account and select “ETH 2.0” from the “Earn” drop-down menu on the Binance homepage.

On the ETH 2.0 Staking homepage, Binance explains the basics of ETH 2.0 staking, the mechanics of the platform’s BETH liquidity token, and answers the most common questions in a dedicated FAQ section located at the bottom of the page.

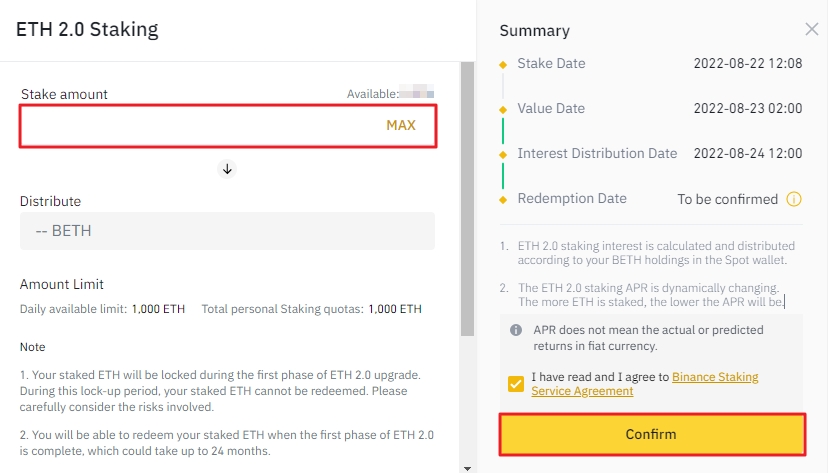

It is worth noting that the redemption date for locked ETH is not yet known. Binance says that it could take up to 24 months before users will be able to withdraw their staked ETH.

By clicking on the “Stake Now” button located at the top of the page, you can access the ETH 2.0 Staking menu. It includes a brief description of the service and a “Stake amount” field which lets users enter the amount of ETH they wish to stake. The maximum personal staking quota is 1,000 ETH, while the minimum staking among is 0.0001 ETH.

At the time of this writing, Binance enables investors to earn up to 5.20% APR on their deposited ETH. However, the final APR amount is subject to change and gradually lowers the more ETH a user stakes.

If you wish to stake your ETH to earn crypto rewards on Binance, please click on the button below.

What are the benefits of Binance ETH 2.0 Staking?

In this section, we will briefly summarize the main advantages of using Binance as an outlet to earn Ethereum 2.0 staking rewards.

Low investment requirement

Users can start earning ETH staking rewards by supplying as little as 0.0001 ETH to Binance’s staking pool.

User friendly

Binance’s offering features a streamlined interface and is very transparent about BETH rewards that accrue in users’ Spot accounts on a daily basis.

Safety of users’ funds

Participating in Binance’s ETH 2.0 staking service means that users do not have to worry about taking care of their own security keys, as is the case when staking ETH as an individual user. In addition, Binance takes care of all slashing risks, which means that users can earn the full amount of staking rewards at all times.

Bottom line

With the merge of Ethereum’s consensus and execution layer rapidly approaching, Ethereum staking has become one of the most sought-after long-term investments in the blockchain space. Binance’s ETH 2.0 staking offering stands out in the crowded space as one of the most user-friendly solutions in the blockchain sector.