The Ethereum blockchain is moving from Proof-of-Work (PoW) consensus mechanism to Proof-of-Stake (PoS). If you want to stake ETH by yourself, you must have a minimum of 32 ETH. Fortunately, there are many staking service providers that will allow you to stake smaller amounts and earn staking rewards. Additionally, you must keep in mind that it will not be possible to withdraw staked ETH coins for a period of time after The Merge is completed on the Ethereum mainnet.

To run a node by staking ETH on the Ethereum 2.0 smart contract, a processor with a certain speed and number of cores, RAM, and SSD space are also needed. Due to these requirements, several platforms have provided simpler possibilities for their users to stake ETH. These platforms have lowered the minimum amount of ETH required for staking and made it possible for users to stake in a simple way.

Staking Platforms for ETH 2.0

There are several platforms that we can use for staking ETH 2.0. The most well-known among them are Lido, Ankr, Binance, and Kraken. All these platforms are pool operators, and by staking ETHs on their operators, we can participate in the management of the Ethereum network. Below, you will see a preview of these platforms and a guide on how to stake ETH using them.

Lido

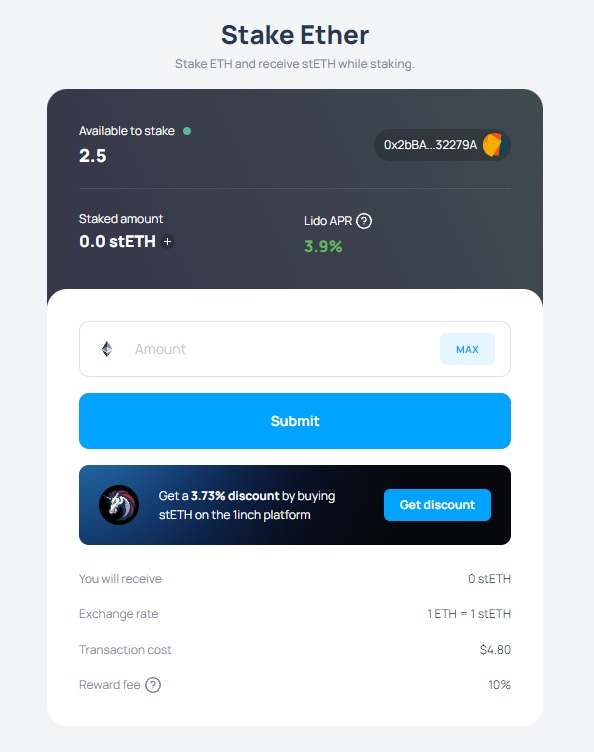

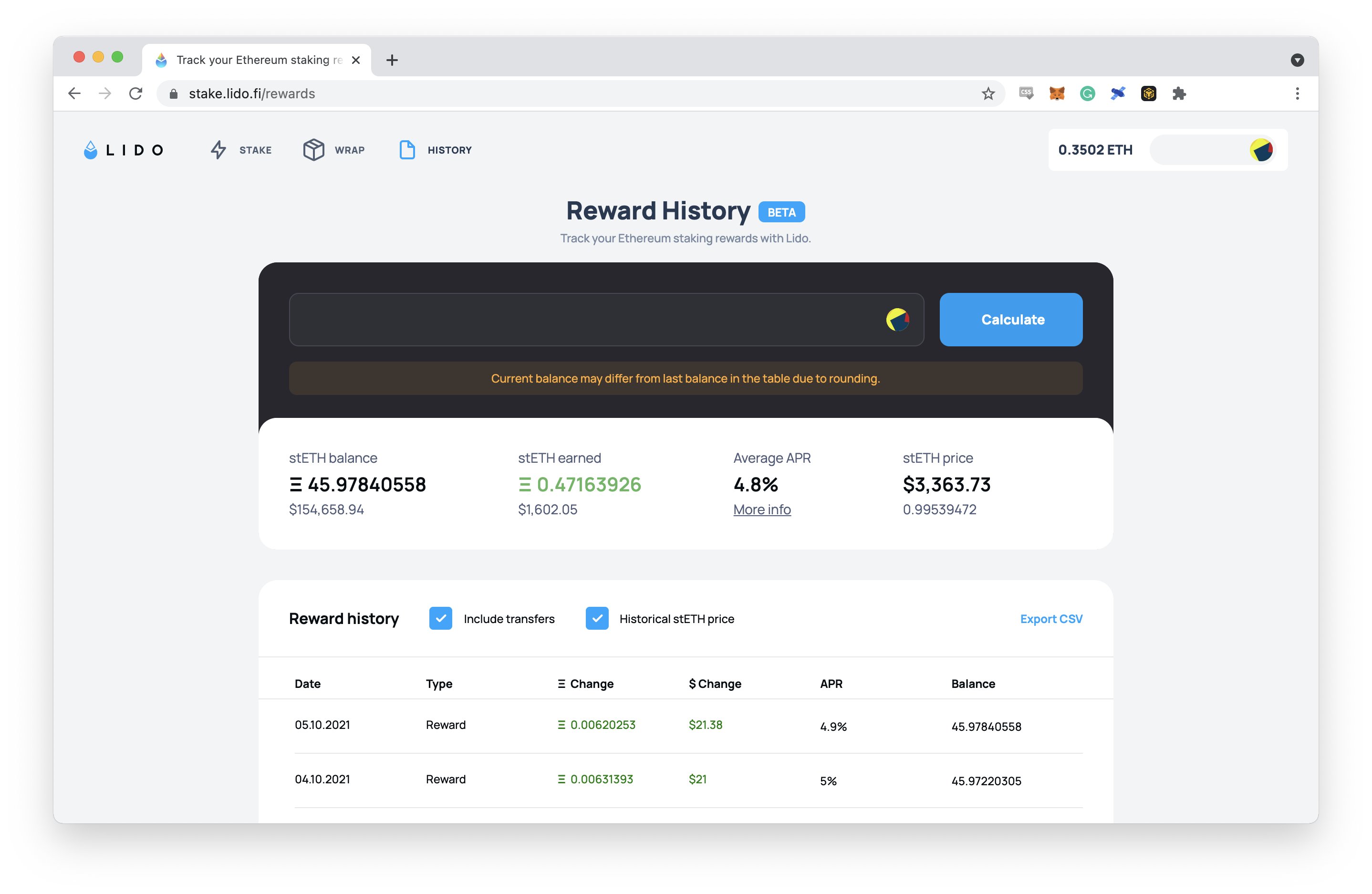

Lido is a staking platform that is focused on solving many issues for ETH 2.0 stakers. Users can deposit their funds into the protocol, which is managed by the Lido DAO. To stake ETH 2.0 on Lido, you need a Web3 wallet.

After selecting and connecting your wallet, you can view your ETH balance in the Lido widget. You must enter the amount of ETH you want to stake and click the Staking button.

In this step, you can see the transaction fee, your stETH balance, and your APR. stETH is a token that is designed to be pegged at a 1:1 ratio with ETH. You will receive the same amount of stETH for your staked ETH. With stETH, you can make DeFi transactions, trade with other tokens, and withdraw your staked tokens at any time. Once you confirm the transaction, your stETH balance will be updated daily, and you will earn ETH returns at the determined rate.

Ankr

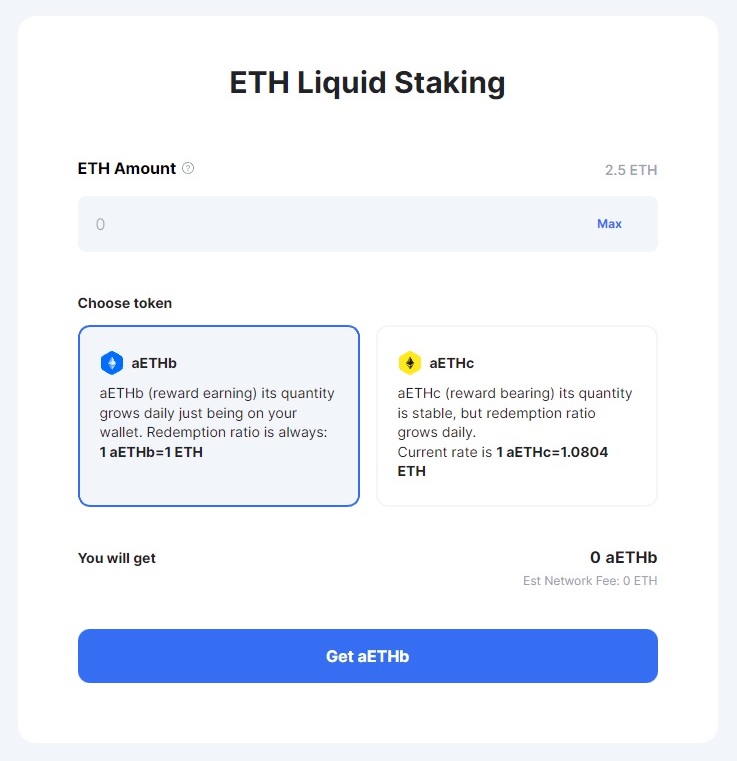

Ankr is a comprehensive platform developed to reduce entry barriers to ETH 2.0 staking. On this platform, you can stake with a minimum of 0.5 ETH, switch between node operators, and use liquid aETHb or aETHc tokens. You can withdraw both tokens from the stake at any time. There are a few key differences between the two tokens:

aETHb

The aETHb token is a reward-earning token. When you stake ETH with the aETHb token, the number of aETHb tokens in your wallet will increase day by day. There is 1 liquidity pool created for aETHb.

aETHc

The aETHc is a reward-bearing token. If you stake ETH with the aETHc token, the number of aETHc tokens in your wallet will always remain constant. The price of the aETHc token is increasing day by day against ETH. For example, today you need to spend 1.08 ETH to buy 1 aETHc token, but after 3 months you can sell your aETHc token for 1.09 ETH. There are more than 5 liquidity pools created for aETHc.

After visiting Ankr, you should connect your Web3 wallet. After viewing the ETH balance in your wallet, you can do staking by pressing ETH Liquid Staking and then choosing one of the aETHb and aETHc tokens.

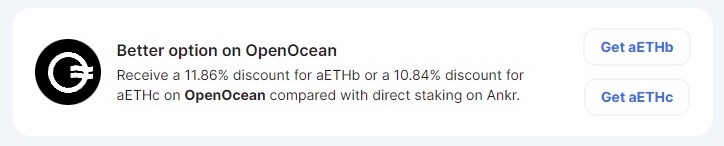

You may see a warning that you can get 11% off when you use OpenOcean to convert your ETHs to aETHb or aETHc. After you decide which staking type to choose, you can do the swap over at OpenOcean.

Binance

Binance is also a platform that offers ETH 2.0 staking and distributes rewards daily. US citizens must legally use Binance US, not the global version of Binance, and Binance US unfortunately does not offer Eth 2.0 staking. But if you reside outside the US, you can continue reading the Binance ETH 2.0 staking guide.

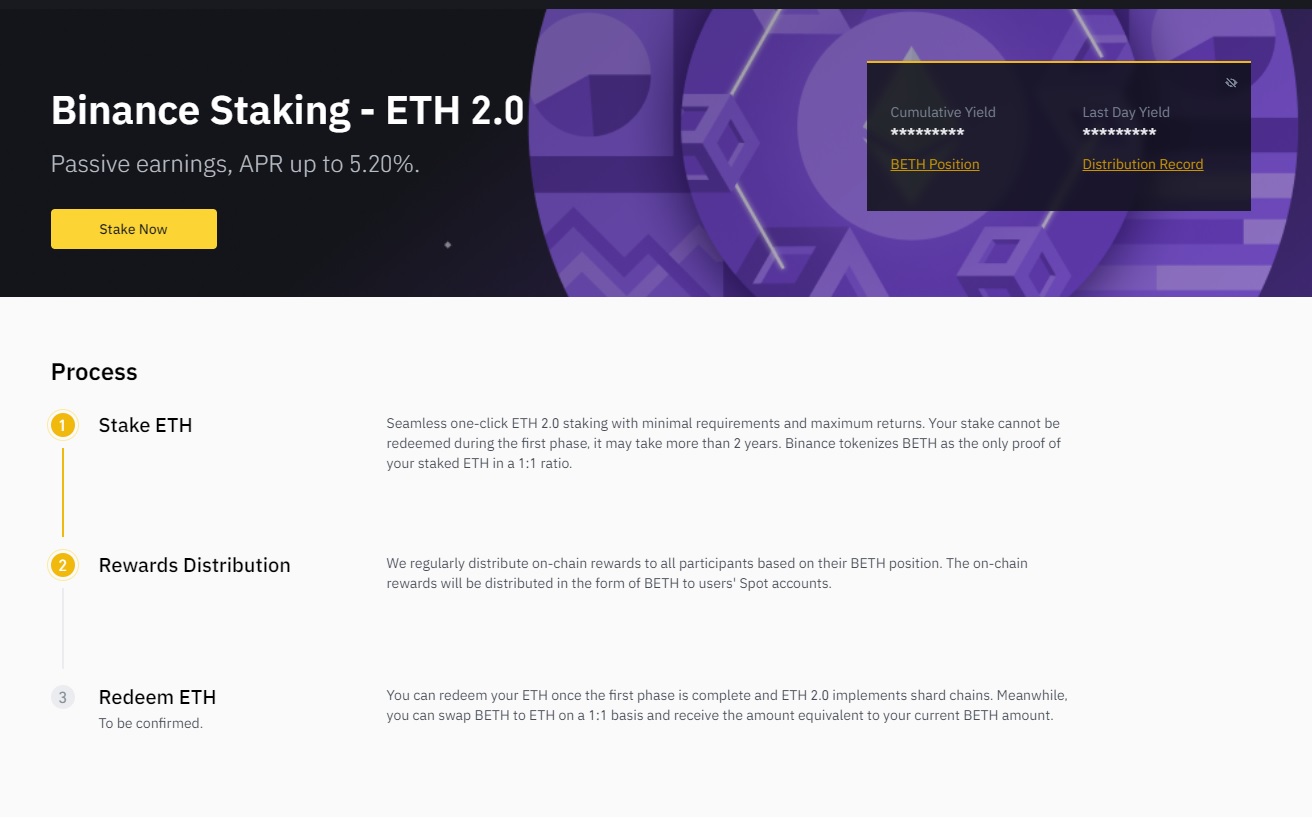

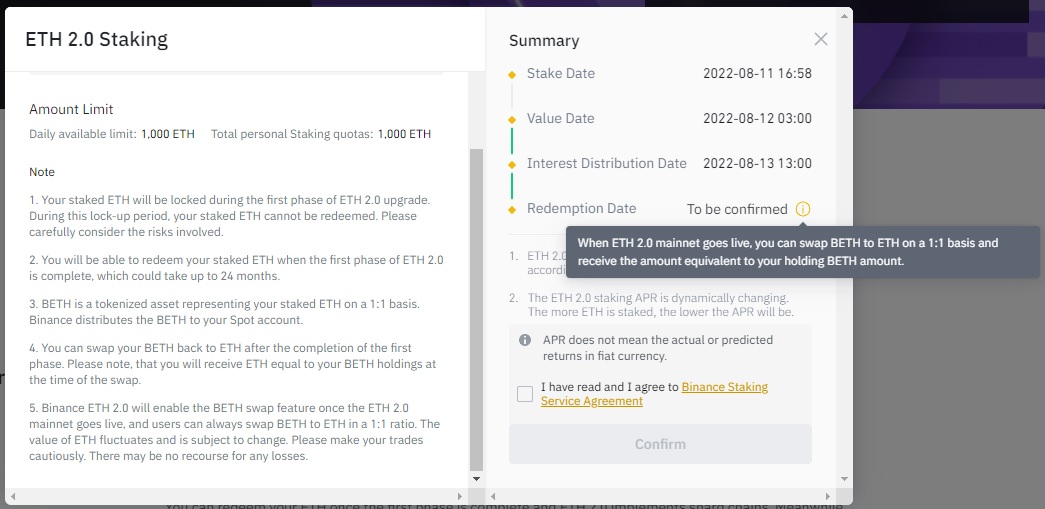

The minimum ETH staking requirement on Binance is 0.0001 ETH. Staking APY, on the other hand, varies based on staking income on the real chain. When you stake ETH on Binance, you earn rewards in BETH, Binance’s stablecoin pegged to ETH. When you stake, you will not be able to access your ETH funds again until the transition to Ethereum 2.0 is completely completed, but since BETH rewards are distributed daily, you can make any transaction with those tokens or even stake them by converting them to ETH at a ratio of 1:1.

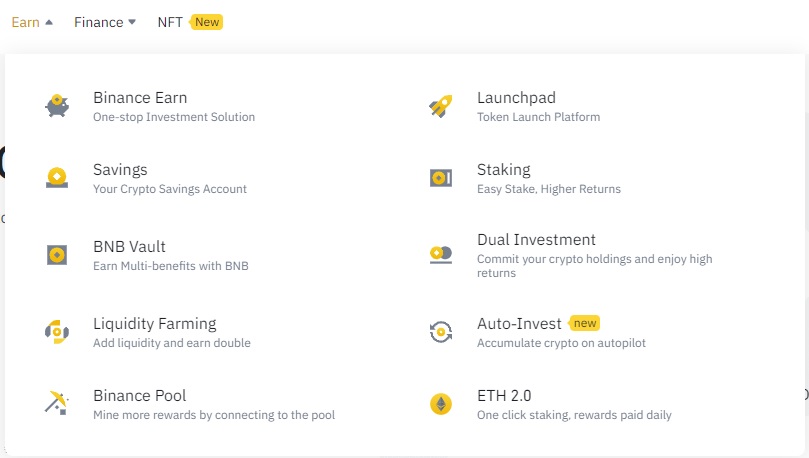

After you log in to Binance.com and become a member, you must select ETH 2.0 from the Earn option at the top. After seeing the current APR, you can stake as many ETH in your spot balance as you want on the ETH 2.0 smart contract by clicking the Stake Now button.

In the second confirmation pop-up, you must confirm that you understand the specific risks associated with staking. Binance covers the validator operating expenses of all staking users and bears the risks of on-chain penalties.

Kraken

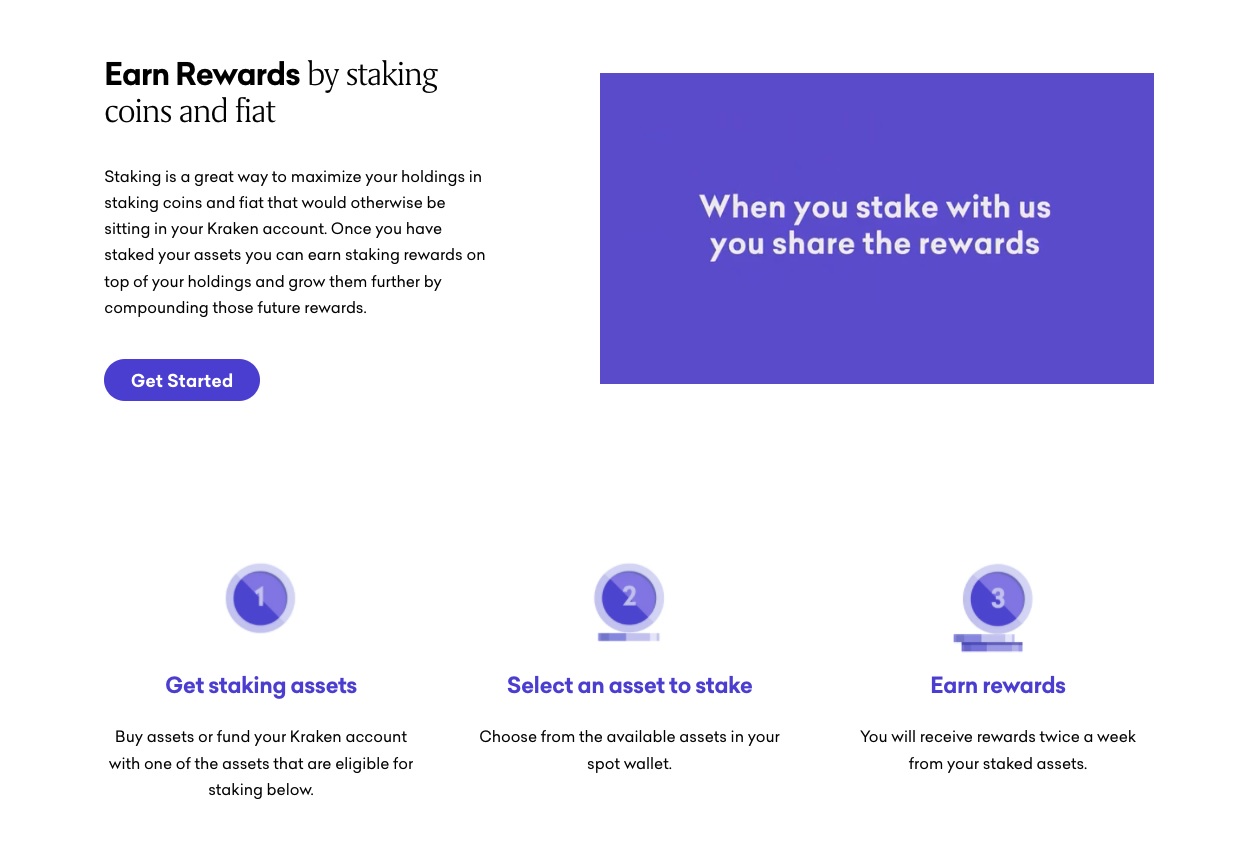

Kraken is a platform that allows you to stake ETH by combining your ETH holdings with those of other traders. The coins you stake will remain locked until the ETH 2.0 network upgrade is successfully completed. To stake ETH on Kraken, you must create an account first.

After completing the KYC steps, you can transfer as much ETH as you want to your spot wallet. Then you should click on the Staking tab in the top menu.

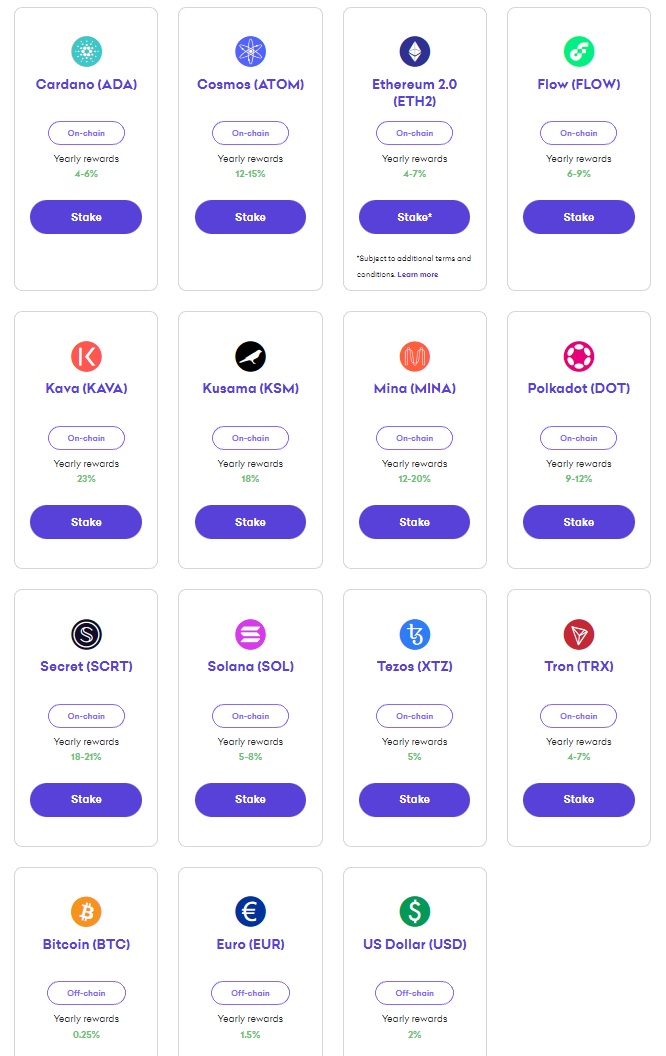

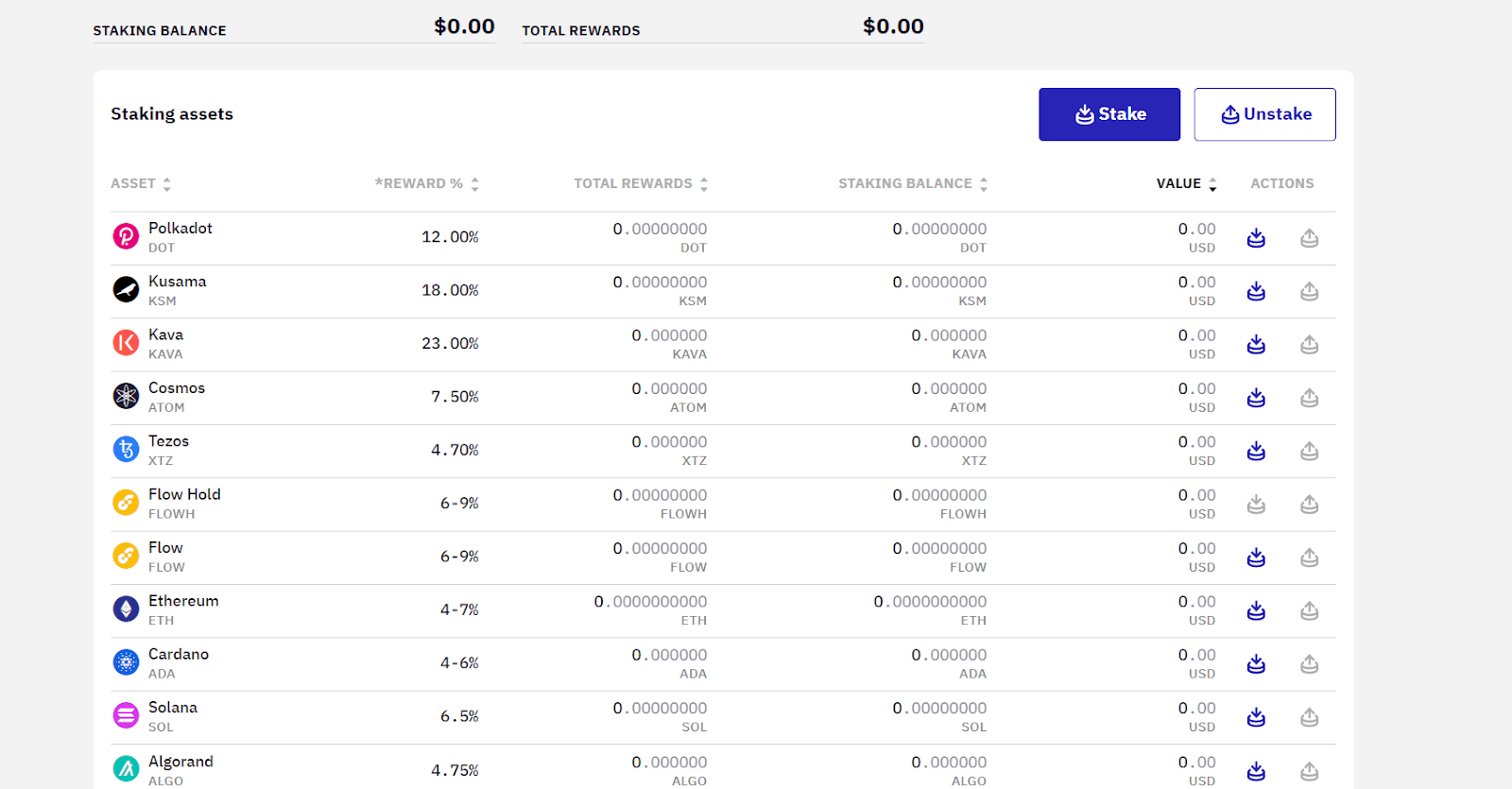

Here you will see many cryptocurrencies available for staking. After clicking Ethereum 2.0, type the amount of ETH you want to stake and click the Preview Stake button. You can see the details of the staking process in the pop-up window.

You can view the ETH you stake in the Active Stakes section and the ETH rewards you have earned in the Rewards tab. To unstake ETH, you must wait for Ethereum 2.0 to be successfully released on the Beacon Chain.

Conclusion

In order to evaluate your Ethereum investment in the long term and contribute to the blockchain network, you may want to stake Eth 2.0. This process potentially offers between 5% and 20% APR. Whichever platform you choose, you should consider the possible risks before investing. You could be exposed to price fluctuations in the cryptocurrency market.