Bybit is one of the leading digital asset trading platforms with a rich suite of crypto investment products and services. It offers up to 100x leverage on BTC/USD perpetual contracts, industry-leading transaction times, and a comprehensive system of safety measures, along with an intuitive and customizable user interface.

A comprehensive suite of financial instruments paired with high liquidity across all trading pairs makes Bybit an excellent choice for newcomers and crypto veterans alike, and one of the better alternatives to Binance. Bybit prides itself on transparency and regulatory compliance, which is why it adheres to strict KYC and AML regulations, which, in turn, permits it to offer its services to users from all over the world.

What is Know Your Customer (KYC)?

Know your customer, or KYC, is verification of a customer’s identity by a financial institution. As the crypto industry continues to mature, the KYC requirement has become a staple among leading digital asset trading platforms. Compliance with the KYC guidelines benefits both the customer and the financial institution itself – it ensures a greater level of transparency between the two parties and significantly reduces the potential for illegal financial activity, such as money laundering.

KYC is part of a broader group of anti-money laundering (AML) regulations primarily designed to curtail financial crime. In order to pass the KYC process, a customer typically needs to provide a copy of a government-issued self-identification document (e.g., ID, passport, driver’s license) and proof of address (e.g., utility bill, bank statement).

Benefits of completing KYC on Bybit

Completing KYC on Bybit grants several perks that you would miss out on if you are an unverified user. For starters, the withdrawal limit is increased from 2 BTC to up to 100 BTC when fully verified. Secondly, not only is your account more secure, the whole Bybit community benefits from greater transparency, which minimizes the risk of malicious acts ranging from hacking attacks to money laundering.

Finally, as a verified Bybit user, you are privy to exclusive features, including token airdrop events and the ability to invest in Launchpool projects.

How to do KYC on Bybit?

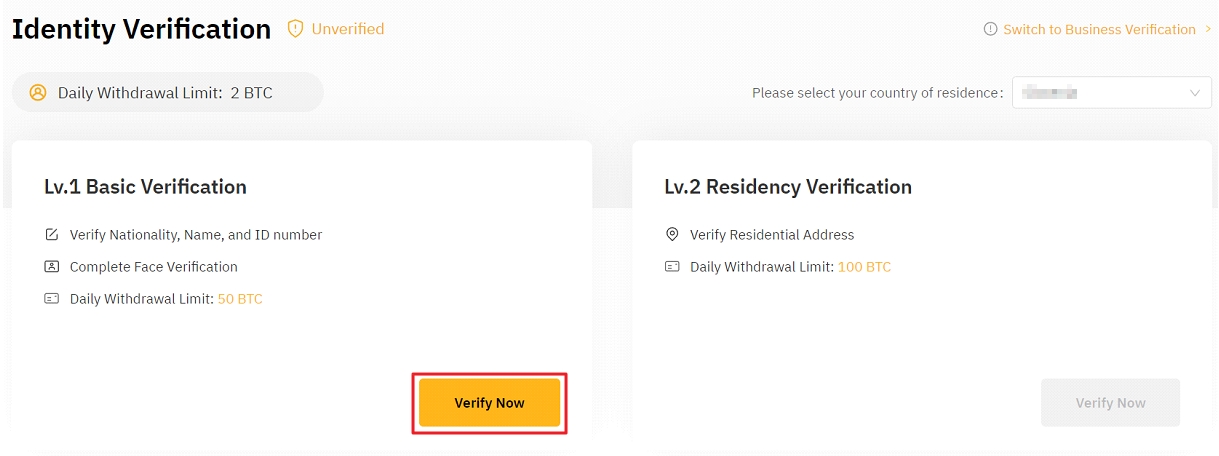

Bybit offers two tiers of identity verification – Level 1 (Basic verification) unlocks the majority of platform’s features, while Level 2 (Residency verification) introduces some additional perks but requires more user data.

The following step-by-step guide will help you through the process of completing personal verification on Bybit.

To start the verification process, you first need to register an account with Bybit.

How to complete Basic verification?

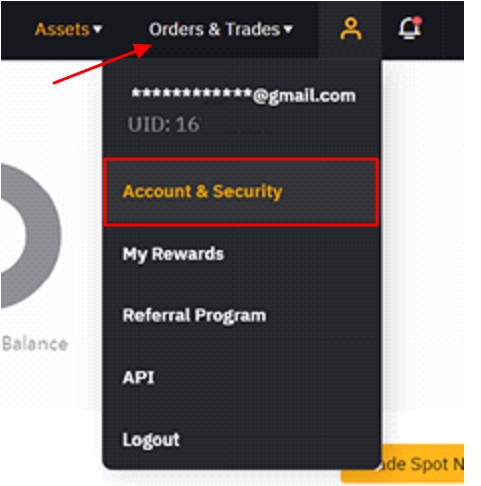

Step 1 – Log in to your Bybit account and navigate to the “Account & Security” section located in the “Orders & Trades” drop-down menu in the upper right corner on the homepage.

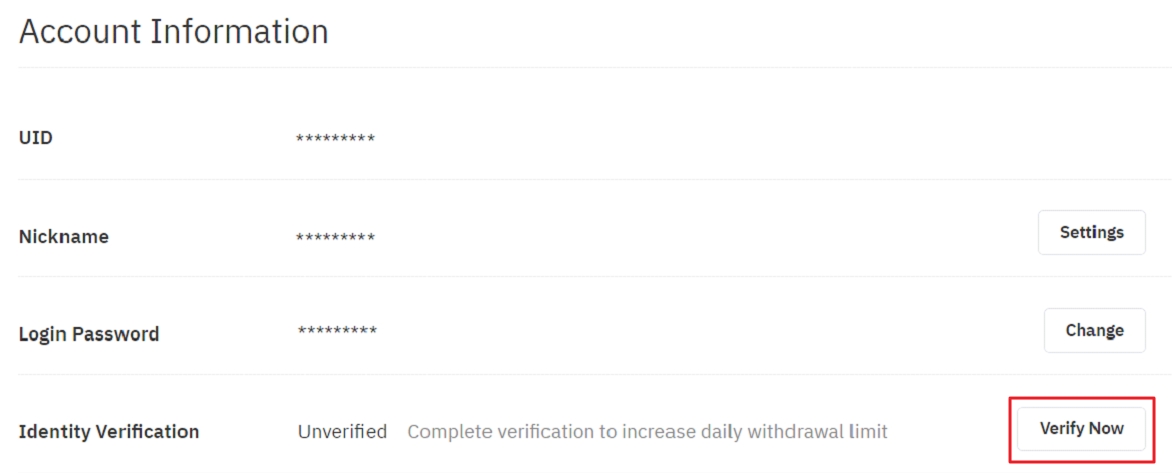

Step 2 – Scroll down to the identity verification option and click on “Verify Now”.

Step 3 – For the Level 1 verification, you’ll need to provide basic personal information that must match your government-issued document and complete the face recognition process.

Click on “Verify Now” and enter your name, date of birth, country of residence, and address in the following form.

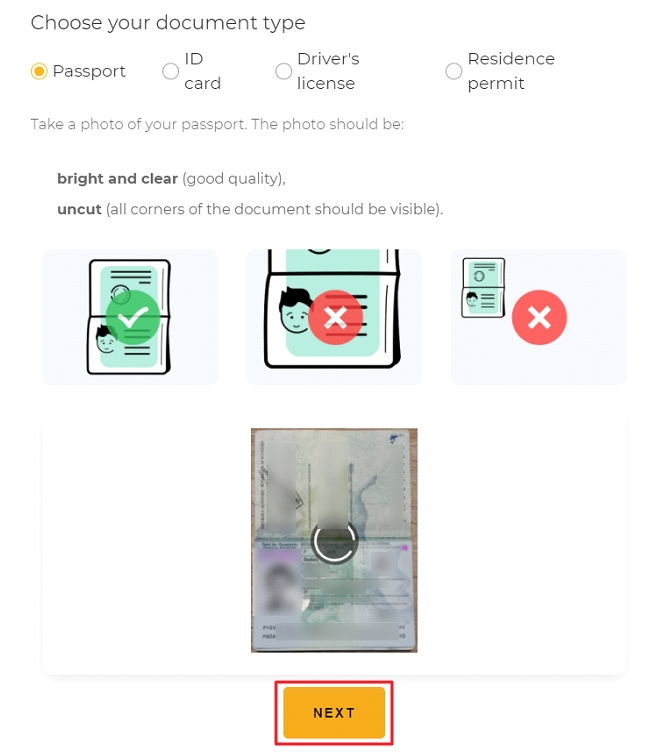

Step 4 – Once your personal information is filled out, you will need to provide a front and backside copy of the following acceptable document types: ID, passport, driver’s license, or residence permit. Make sure the uploaded image is readable, and click “NEXT” to proceed to facial recognition.

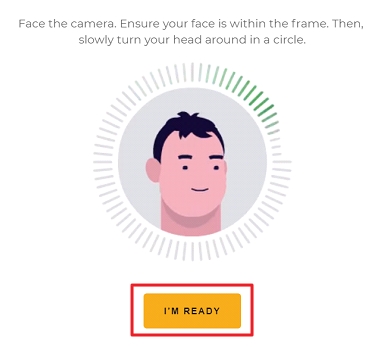

Step 5 – You’ll need to position your face in the circle-shaped frame and click the “I’M READY” button to start. The system will then scan your face. If it’s successfully matched with the image on the document you provided in the previous step, you will have successfully completed the Level 1 identification process. If you lack a webcam on your PC, you can continue the process on your phone.

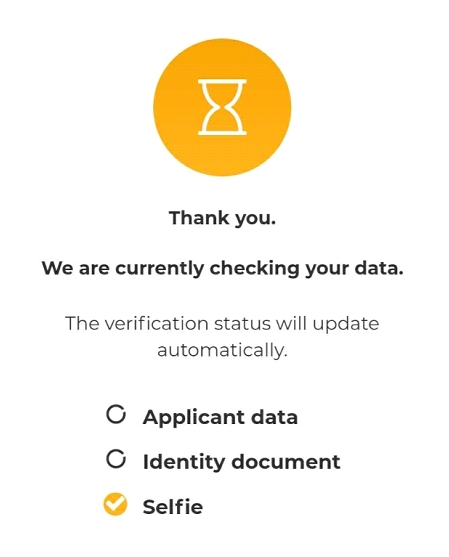

Step 6 – If everything checks out, your verification application will be approved in about 5 minutes. If not, you’ll be asked to provide additional information or repeat the process.

How to complete Residency verification?

After completing the Level 1 verification, you can proceed to Level 2, which grants a higher Bitcoin withdrawal limit of 100 BTC.

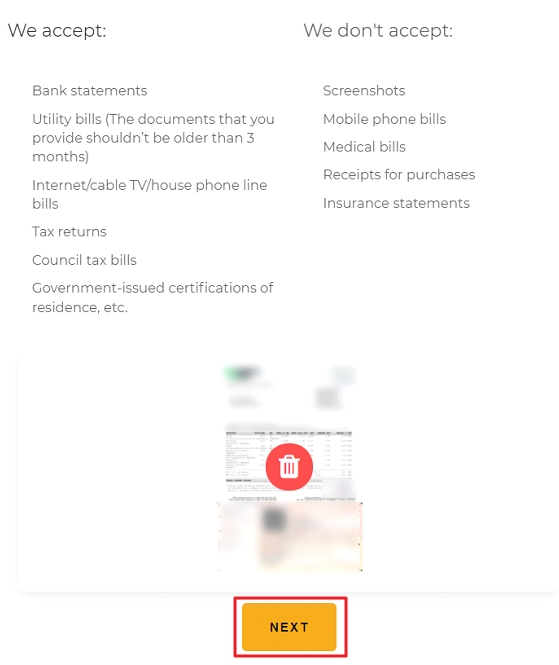

Step 1 – For this step, you’ll need to provide the following personal information:

- Nationality

- Proof of address (the complete list of acceptable documents can be found in the ‘We accept’ column in the image below)

Once you have successfully uploaded a high-resolution copy of your proof of address document, click “NEXT”.

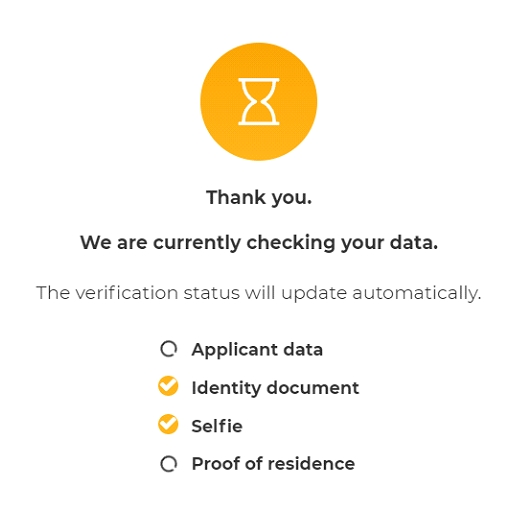

Step 2 – The Bybit team will check and verify the data you provided. In our case, the verification process was completed in just under 10 minutes.

For more information about the verification process, you can head to Bybit’s Help Center or watch the video tutorial below.

In addition to the process described in this article, Bybit offers a KYC method specifically tailored for businesses. For more information about the Business Verification procedure, click here.

Final thoughts

Bybit provides a simple, fast, and intuitive approach to user verification. While you don’t have to complete KYC to use most features, verified users gain access to exclusive features, such as Bybit Launchpad and token airdrops.

Additionally, completing KYC lifts the limitations on crypto withdrawals from 2 BTC to up to 100 BTC and contributes to an overall safer and more transparent crypto trading environment.