Key takeaways:

- Grayscale’s application to convert Grayscale Bitcoin Trust (GBTC) to spot Bitcoin ETF was rejected by the SEC

- Grayscale’s legal team has filed an appeal with the US Court of Appeals for the DC Circuit

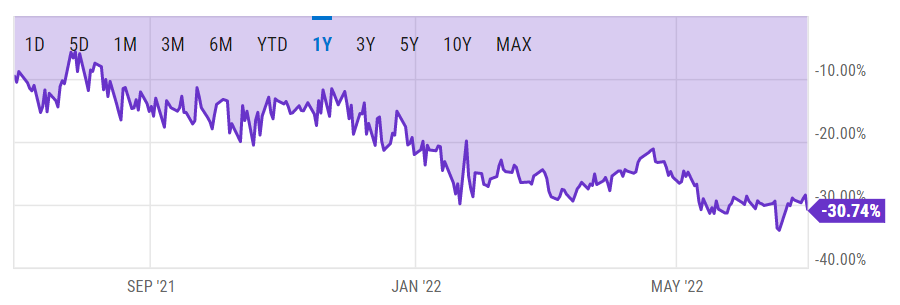

- The shares of GBTC have been trading at historically low discount rates as of late

Top US financial regulator rejects Grayscale’s application to convert GBTC to a physical BTC ETF

On Thursday, the US Securities and Exchange Commission (SEC) announced it rejected Grayscale’s Bitcoin exchange traded fund (ETF) application over concerns of potential price manipulation and the lack of investors’ protection.

While optimistic about the outcome of the SEC’s ruling earlier in the month, Grayscale did announce the hiring of top legal counsel should the regulator reject its application. Now, roughly three weeks later, the digital assets management giant finds itself holding onto its promise to pursue all available legal avenues to convert the Grayscale Bitcoin Trust (GBTC) into an ETF tracking the spot market performance of Bitcoin.

“At Grayscale, we have not and will not waver in our commitment to converting GBTC to a spot Bitcoin ETF. The decision to pursue litigation is not one we take lightly, but we are confident in our legal team, as well as our compelling, common-sense legal arguments,” wrote the Grayscale team in a statement.

The head of the Grayscale legal representation is Donald B. Verrilli, President Obama’s former Solicitor General. According to the official statement, Verrilli has already filed a “petition for review” of the SEC’s decision-making process on behalf of Grayscale with the US Court of Appeals for the DC Circuit.

According to data from Bitcoin Treasuries, Grayscale’s GBTC has 654,885 BTC (worth $12.5 billion at current market rates) in assets under management (AUM). The Trust has been trading at a historically low discount rate in comparison to the net asset value (NAV) of Bitcoin as of late.

Grayscale was hoping for the Trust to be converted into a Bitcoin price tracking ETF, which would eliminate the discount and lead to investors who were buying shares of the Trust in the past couple of months to instantly make a profit on their GBTC investment, amounting to the difference between GBTC’s share value and the NAV of BTC (-30.74% as of June 30).

The firm has recently published an in-depth analysis of the potential benefits of a BTC spot ETF for investors, deduced from over 11,000 comment letters submitted by “academics, market participants, other communities.” It is worth noting that in excess of 99% of comment letters were submitted in favor of converting GBTC to ETF.

Following the rejection of Grayscale’s application yesterday, Bitcoin plunged below $19,000, retesting its support in the upper $18,000 price region for the second time in the past month. At press time, the world’s largest crypto is trading at $19,170, essentially breakeven over the past 24-hour period.