Key takeaways:

- According to a recent report by financial behemoth Goldman Sachs, Bitcoin could reach $100,000 if investors embrace it as an alternative to gold

- Bitcoin would have to capture 50% of the “store of value” market in order to hit the six-figure milestone

- Goldman Sachs analyst Zach Pandl envisions that the adoption of Bitcoin will continue growing “as a byproduct of broader adoption of digital assets”

On Wednesday, investment banking giant Goldman Sachs (GS) published a note to its client in which it detailed how Bitcoin could reach a $100,000 price tag and grow past $1.8 trillion market valuation.

Goldman Sachs predicts Bitcoin could be worth $100K if investors embrace it as digital gold

The world’s largest crypto has recently faced severe hardship in the markets, dropping to September lows below the $42,000 level after losing roughly 10% of its value on Thursday. However, Goldman Sachs is looking past day-to-day price fluctuations and is instead focusing on broader macroeconomic trends that have contributed to the meteoric rise of Bitcoin and other digital assets over the last couple of years.

Goldman Sachs’ prediction is founded on the premise that Bitcoin could be a viable alternative to gold as an inflation hedge asset and a stable store of value. Zach Pandl, a senior market analyst at Goldman Sachs, commented on Bitcoin in the report:

“We think that bitcoin’s market share will most likely rise over time as a byproduct of broader adoption of digital assets. … We think that comparing its market capitalization to gold can help put parameters on plausible outcomes for bitcoin returns.”

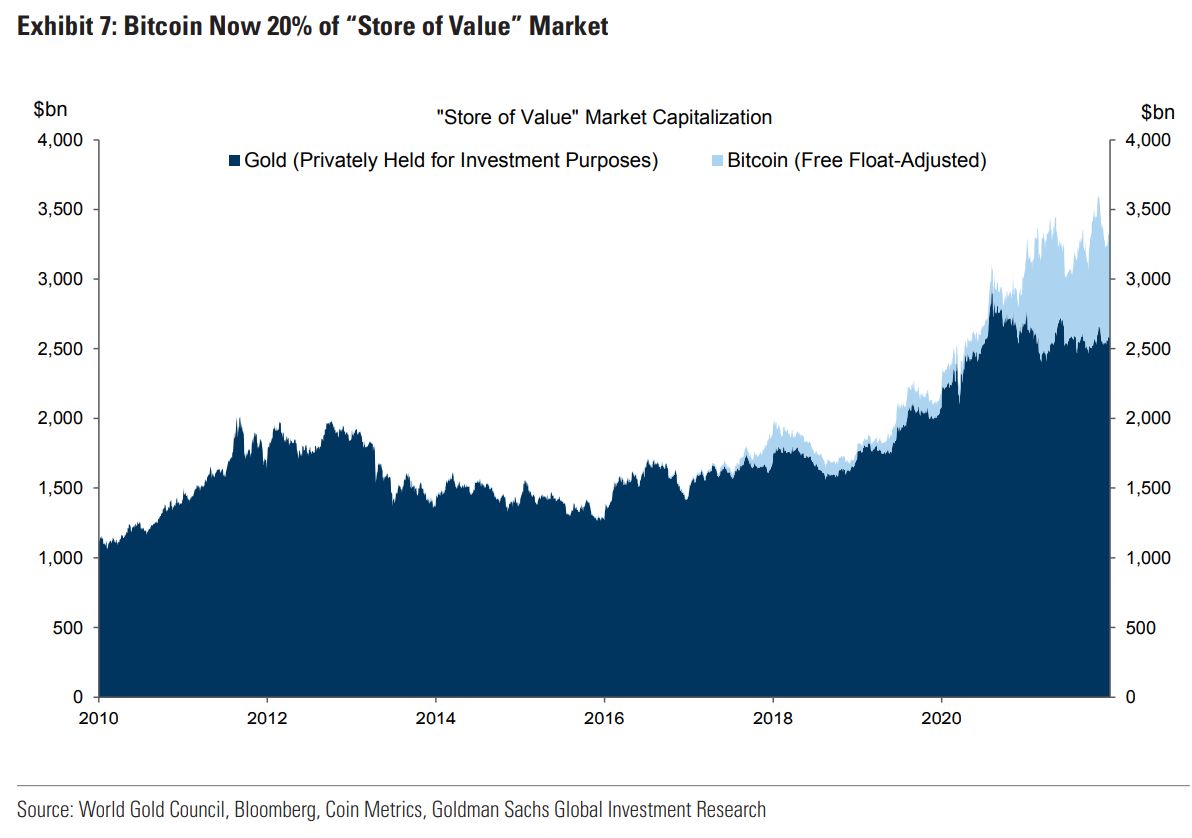

According to GS’ analysts, Bitcoin accounts for a fifth of the global $2.6 trillion “store of value” market at current market rates. Pandl forecasts that Bitcoin will continue to expand its dominance in the sector and could eventually displace gold as a leading store of value in the space. The senior analyst added that if Bitcoin were to capture 50% of the market in the coming years, the price of the world’s oldest crypto would reach almost precisely $100,000.

Grayscale Has More Assets Under Management Than the World’s Largest Gold ETF

While it is hard to envision a 50% increase given the current market state, let’s not forget that Bitcoin has gained nearly 5,000% since 2016 alone.

Interestingly, the recent report from Goldman Sachs comes just a couple of days after the President of El Salvador, Nayib Bukele, presented his own case for a $100K Bitcoin.