Key Highlights:

- Ethereum saw a further 10.45% price hike today as the cryptocurrency hits the $730 level.

- The coin has now seen a substantial 35% price hike over the past month of trading and created a fresh 2020 high today at $738.

- Against Bitcoin, Ethereum rebounded from the ₿0.024 support yesterday and is now trading at ₿0.0268.

Ethereum price at the time of writing: $733

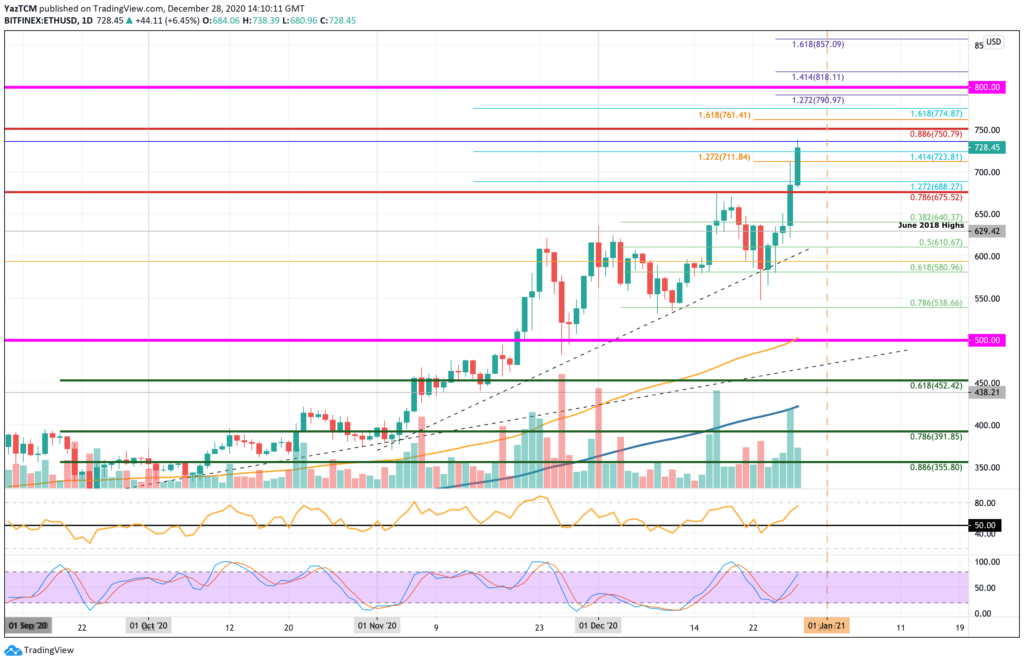

ETH Resistance Levels: $738, $750, $761, $775, $790

ETH Support levels: $711, $700, $688, $675, $650

Etheruem set a fresh 2020 high today, around $738, after seeing a 35% price hike over the past month of trading. The coin had set the previous 2020 high toward mid-December but failed to break the resistance at $675 (bearish .786 Fib Retracement). From there, ETH dropped back into the $580 support where it rebounded last week. Yesterday, ETH managed to break the $675 resistance to reach as high as $688 by the time the candle closed.

ETH continued further above $700 today to reach as high as $738.

There are many reasons why Ethereum is surging in December. The Bitcoin price boom is one of the primary drivers. However, with Ethereum reversing against Bitcoin, some additional reasons are helping Ethereum.

One of the main reasons is that Etheereum has already started the migration from ETH 1 to ETH 2. The upgrade will shift the consensus mechanism from Proof-of-Work to Proof-of-Stake, increasing scalability, performance, and security. So far, a total of 2.1 million ETH have been deposited into the eth2 staking contract to secure the Eth2 blockchain. This is around $1.53 billion worth of ETH deposited.

The transition to ETH2 will also provide new hope for the next DeFi boom. With DeFi Devs knowing that Ethereum can finally handle the extra load on the blockchain, they are more likely to choose ETH to deploy their dApps.

In addition to ETH2, there is also the incoming EIP-1559, which will establish the market rate for block inclusion for transactions. It will also burn the majority of ETH in the transaction fees, leading to Ethereum becoming deflationary in the future.

Institutional investors have primarily driven the Bitcoin price boom. They are seeking a method to hedge their cash reserves against inflation of the US Dollar. Satisfied with their gains, it is likely that these institutions will look elsewhere to find further gains and look for another coin to invest in. ETH is most likely to be the prime candidate – especially when we consider that the CME will create an ETH Futures market in Feb 2021.

Lastly, BTC has already created fresh ATHs. This is likely to cause retail investors to look away as they might deem it too risky to invest in BTC at these prices. On the other hand, ETH is still down by around 57% from its previous ATH price – providing room for significant growth ahead.

Let us continue to take a look at the markets and see where they might be heading.

Ethereum Price Analysis

What has been going on?

Looking at the daily chart above, ETH rebounded from the support at $580 (.618 Fib) and has finally penetrated above the $700 level today. Previously, it struggled to break the $675 resistance – provided by a bearish .786 Fib Retracement level. Today, the price surge allowed ETH to climb above $700 and create a fresh 2020 high at around $738.

Ethereum price short term prediction: Bullish

Ethereum is most certainly bullish right now. The coin would need to drop beneath the $540 level to turn neutral again, and it would have to continue further beneath $400 to be in danger of turning bearish.

If the sellers push lower, the first level of support lies at $711. This is followed by support at $700, $688, $675, and $640 (.382 Fib). Additional support is then expected at $630 (June 2018 Highs), $610 (.5 Fib), and $580 (.5 Fib).

Where Is The Resistance Toward The Upside?

On the other side, the first level of resistance is expected at $738. This is followed by resistance at $750 (bearish .886 Fib Retracement), $761, $775, and $790 (1.272 Fib Extension). Above this, resistance lies at $800, $818 (1.414 Fib Extension), $840, and $857 (1.618 Fib Extension).

What has been going on?

Against Bitcoin, we can see that ETH dropped beneath the November lows this week and continued to plummet until support was found at ₿0.024 yesterday. The buyers managed to rebound from this level of support to reach ₿0.026 by the closing time yesterday.

Today, Ethereum continued higher to reach the current ₿0.0268 resistance – provided by a bearish .382 Fibonacci Retracement level.

Ethereum price short term prediction: Neutral

With the break back above ₿0.025, Ethereum can be considered as neutral again. It would need to fall back beneath ₿0.024 to turn bearish. On the other side, it would have to break beyond ₿0.03 to start to turn bullish again in the short term.

If the sellers do cause ETH to head lower again, the first level of strong support lies at ₿0.026. Beneath this, support is located at ₿0.0253, ₿0.025, and ₿0.0245 (.786 Fib). Added support is found at ₿0.024, ₿0.0235, ₿0.023, and ₿0.0226.

Where Is The Resistance Toward The Upside?

On the other side, if the buyers can break the resistance at ₿0.0269 (bearish .382 Fib), the first level of higher resistance lies at ₿0.0278 (Feb 2020 Highs). Above this, resistance lies at ₿0.0282 (bearish .5 Fib), ₿0.029, and ₿0.0295 (bearish .618 Fib).

Keep up to date with the latest ETH price predictions here.