The cryptocurrency market has started the week off on a bearish footing, losing roughly 9% and shrinking to $2.01 trillion since yesterday’s peak valuation of $2.18T. Virtually all coins in the top 100 are posting considerable losses.

Bitcoin is below $45,000 for the first time in the last 7 days

The price of the largest crypto has reached the weekly high point of $48,800 on September 18. Since then, Bitcoin has faced a considerable amount of selling pressure, which pushed the value down to $44,840 at the time of this writing. Despite the bearish trend, Bitcoin has managed to regain some of its overall share in the market in proportion to other coins as the BTC dominance grew to almost 42% in the last day. The change in the dominance ratio shows that altcoins have had an even rougher go in the last 24 hours than Bitcoin.

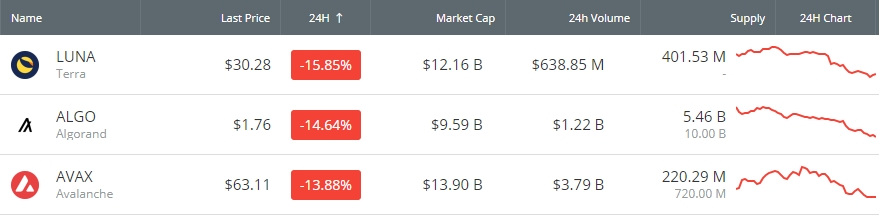

Terra, Algorand, and Avalanche lost the most among major projects

It is somewhat surprising to find the trio of Terra, Algorand, and Avalanche at the top of the list of biggest losers in the past 24 hours (when filtering for top 30 cryptocurrencies by market cap). All three projects have been immensely successful as of late. ALGO and AVAX have enjoyed the boost provided by their respective decentralized finance (DeFi) incentive programs, while LUNA’s Columbus-5 upgrade has been attracting a lot of attention.

The trio of successful altcoin projects is seemingly following in the footsteps of the largest altcoin of them all. Ethereum has lost approximately 13% since September 16, dropping from $3,650 to $3,125 at press time. While ETH burning introduced with the London hard fork has played a crucial deflationary role with more than $1 billion worth of ETH being burned since the EIP-1599 launch, it wasn’t enough to overcome the bearish market trend.

Generally speaking, the past month has been a bit rough for the cryptocurrency marketplace. Most of the blame for the subpar performance can easily be attributed to the fairly recent flash crash that wiped out more than $300 billion from the market in the span of hours. Despite this fact, major coins and the cryptocurrency market, in general, are still showing immense growth when looking at 6M and 12M time scales. Cardano and Solana are definitely the highlights of the show with their meteoric rise in 2021. Despite both tokens losing roughly a third of their value since their respective all-time highs, they are nevertheless still up by thousands of percent in the last 1-year period.

The total cryptocurrency market cap is staying above the cumulative value of $2T for the moment. It will be interesting to observe where we go from here. Bitcoin regaining the $45,000 level as quickly as possible and Ethereum staying above the $3,000 mark will be crucial.