The Russia-Ukraine conflict has been the biggest geopolitical development of the year. Following the Russian invasion, a series of developments have left global markets rattled. Given that this is the first major, global-scale conflict since the crypto market became mainstream, analysts are eager to see how cryptocurrencies have performed thus far.

While coin prices haven’t performed terribly, they’ve not performed great either. So what are the forces behind the market’s performance? What role has this fledgling asset class played in the developing conflict?

A Short Overview Of Cryptomarket For The Past Two Months

The Russia-Ukraine conflict started at a rather inconvenient time for the crypto market. Coin prices were already falling, and the invasion immediately pressured the global economy.

What Happened To The Crypto Market?

With Russia being a major source of oil and gas and the country having a heavily interconnected economy, it became obvious that the events would affect markets globally. As expected, crypto wasn’t left out.

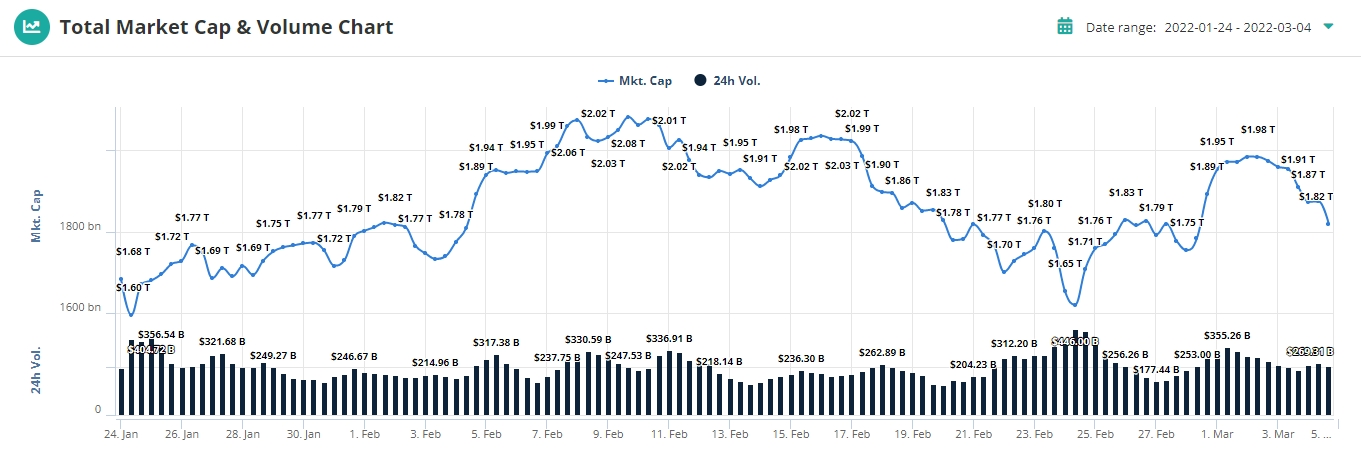

Like most conflicts, this one caused a massive flight of investors to safe-haven assets. Expectedly, gold appeared to have been the biggest beneficiary. While gold surged, the crypto market saw a massive drop the day the conflict kicked off. This was tied to the fact that no one really knew what the market’s reaction would be. Would it be a stock market like panic or a gold-like surge? The cap dropped from $1.722 trillion to $1.564 trillion within 24 hours.

Despite the initial drop, March came with gains for crypto. Stock markets globally had rebounded as increased sanctions on Russia and Russia’s retaliatory efforts caused governments worldwide to step up and shore up their oil reserves.

Why Did The Crypto Market Jump?

Against the backdrop of the conflict, crypto prices began to rise from the middle of March towards the month’s end.

The jump was primarily attributed to increased demand for cryptocurrencies in Ukraine and Russia. Both countries had seen their currencies decimated due to the conflict, and many began moving their funds to crypto. It served as a hedge move against any further currency declines. At the same time, crypto donations went pouring into Ukraine as value transfer speed became a major condition for aid.

Elsewhere, further developments in the crypto market from several blockchain projects helped prop the prices of assets. Further down the timeline, the US has also approved the bill that orders all governmental agencies to dive into crypto regulation efforts. It is not great news but the willingness to learn how to work the crypto markets is seen as a sign of goodwill.

Speaking on the increased attention of governments to cryptocurrencies, Matvey Diadkov, the CEO at Bitmedia.io crypto ad network, explained:

“Regulatory regimes – those are two words you don’t often hear in the same breath as the word cryptocurrency. And this is the downside of all the exposure that cryptocurrency has gotten during this war in Ukraine.

The problem with getting lots of attention is that sometimes it’s the wrong kind of attention. I mean, governments were already watching the crypto world pretty closely. Now they’re scrutinizing it to see where and how it can be regulated, policed and controlled. The whole point of cryptocurrency was that it was free from government interference. Now, thanks to the spotlight thrown by the war in Ukraine, governments are likely to be meddling in crypto a whole lot more. That’s kind of inevitable.

It’s really about finding the right balance so that it’s taking place in an environment that

acknowledges and respects the differences that crypto offers from the traditional financial system and allows those differences to be used in positive ways while ensuring the safety of people’s savings. All secure and insulated from government scrutiny.

As for our industry specifically, and I mean – crypto advertising, we are already seeing an increase in demand for advertising of crypto projects – especially NFT and metaverses. Compared to the previous quarter, we saw an increase of approximately 10-15%. And this is a serious indicator of the pace at which this sphere will develop in the nearest future.

Of course, this may also be due to seasonality, but we cannot deny the fact that with the increase in activity in the crypto market, there is also a need to promote new and existing projects.

The world is rapidly migrating to digital currencies, as in unstable, and even critical times, they have proven their viability, stability and reliability.”

Why Crypto Is Proving To Be A Double-Edged Weapon

As explained earlier, the Russia-Ukraine war has been the biggest geopolitical conflict since crypto became mainstream. Naturally, everyone wanted to see cryptocurrency become a safe haven during the conflict. And it did.

Immediately when the conflict broke out; crypto donations began to pour into Ukraine. Different nonprofits and platforms set up services to help convert crypto to fiat and send it to Ukraine’s government, military, and other humanitarian efforts.

Today, crypto donations to Ukraine have totaled over $100 million. Even Russian cryptocurrency enthusiasts, who are against the war, have donated funds to the Ukrainian government. It almost seems like Ukraine is becoming a crypto capital of the world.

Crypto aced the functionality test in this conflict. It offered ease, speed, and stability as a fundraising method – three factors that weren’t necessarily available in fiat and traditional payments. Even the United Nations High Commissioner for Refugees (UNHCR), a UN agency for refugees, turned to crypto earlier this month to raise funds for humanitarian aid for Ukrainians fleeing the country.

However, crypto hasn’t also been a boon to Ukrainians alone. Russia’s government has also signaled possible support for digital assets, showing that we might also have a crypto war on our hands.

One of the founding principles of cryptocurrencies is censorship resistance. This means that, in theory, Russians are free to use crypto, just like Ukrainians. And recently, the Kremlin started to support crypto as a possible means of evading sanctions.

Despite being relatively on the fence regarding crypto legalization, the Russian government and financial regulators have seemingly been active in the space ever since the war broke out. In March, the Central Bank of Russia issued a digital asset license to Sberbank – the country’s largest financial lender.

In a press release, the central bank claimed that the license would allow Sberbank and other licensed agencies to issue “digital financial assets” and exchange them between users. Given how significant the international community’s sanctions have been on Russia’s banking, crypto could theoretically offer a way out, and the Russian authorities know this.

Then came the big one. After taking sanctions on the chin for over a month, Russia retaliated and demanded that all countries pay for their oil in the Ruble. Because Russia supplies about 40% of Europe’s natural gas, this was a huge deal.

At a press conference, Pavel Zavalny, Russia’s energy chief, explained that they had begun reviewing their trade terms with countries like Turkey and China for Bitcoin payments for gas.

Since Russia had essentially been cut off from the SWIFT global banking system, it would need a better way to receive payments for exports.

Zavalny believes that Bitcoin and gold could be the alternatives to fiat.

The news of Russia possibly receiving their payments in Bitcoin set off alarms in the West. Everyone was concerned about the possibility of Moscow calling for full crypto legislation.

Lawmakers and policy chiefs began debating whether Russia could use crypto to evade the naturally rightful sanctions. In the United States, two lawmakers even proposed legislation that would force crypto exchanges to cut ties with all Russian wallets. Suddenly, we had a full-blown crypto crisis on our hands.

Despite the pressure, some companies have refused to cut ties with the aggressor, even though many crypto firms have restricted access to Russian clients.

At the same time, some experts have cast doubt on Russia’s ability to get the help it needs to evade crypto sanctions. The country’s economy is valued at over $1.4 trillion, and the entire crypto market’s capitalisation stands at just over $2 trillion. By sheer market size, crypto would be inadequate to help Russia stem the tide of growing sanctions.

Reasons Driving Crypto’s Growth

With everything happening, what’s going on with Bitcoin and the crypto market in general?

For now, cryptocurrency prices are consolidating. The past two weeks have been impressive for the crypto market, with several coins setting highs not seen since the start of the year. This shows a possible return of bullish sentiments.

One of the biggest drives of bullish sentiment is the increased demand for crypto in Russia and Ukraine.

The conflict has had significant effects on both countries and their currencies. The Ruble fell by 44% against the dollar in the past three months. The Ukrainian Hryvnias also slumped against major currencies like the Euro.

Facing economic hardships, Ukrainians and Russians have been moving to crypto to hedge against their falling currencies.

Elsewhere, bullish crypto sentiments are driven primarily by increased institutional adoption and developments in blockchain projects.

On the institutional front, we have MicroStrategy. Already one of the market’s biggest institutional investors, the Virginia-based business intelligence company committed $195 million earlier this month towards buying Bitcoin, adding 4,197 BTC to its balance sheet. Data from Bitcoin Treasuries shows that MicroStrategy now holds a staggering $5.6 billion in BTC.

Interestingly, MicroStrategy now seems to have some competition. The Luna Foundation Guard (LFG) – a nonprofit supporting the Terra stablecoin ecosystem – has committed to buying $10 billion to prop their naive stablecoin, UST. Wallet data confirmed that on April 6, the LFG added another 5,040 BTC to its balance, now totaling 35,768 BTC.

Growing inflation fears also seem to be driving the Bitcoin price. Last month, Larry Fink, the CEO of the world’s largest asset manager, BlackRock, wrote in a shareholder letter that cryptocurrencies would get a boost from the Russia-Ukraine conflict and the rising tide of inflation.

Fink noted that the ongoing conflict would force nations to reassess their currency dependencies per a Reuters report. This would eventually pave the way for a digital payment network that spans the globe. This could eventually be a catalyst for crypto prices to surge once more.