Key takeaways:

- Following the weekend crypto market crash, digital assets have mounted a strong comeback over the last 24 hours

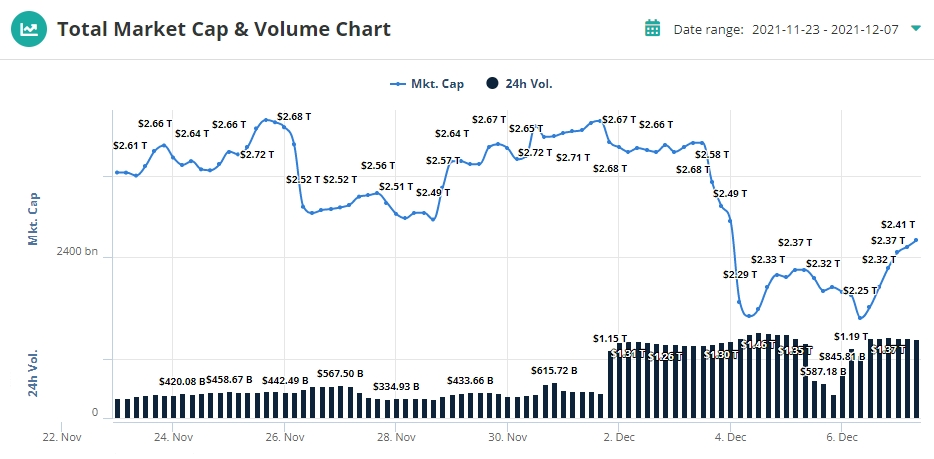

- The total market cap has increased by roughly 9% on the tailwind of Bitcoin’s price growth and impressive showings by several altcoins

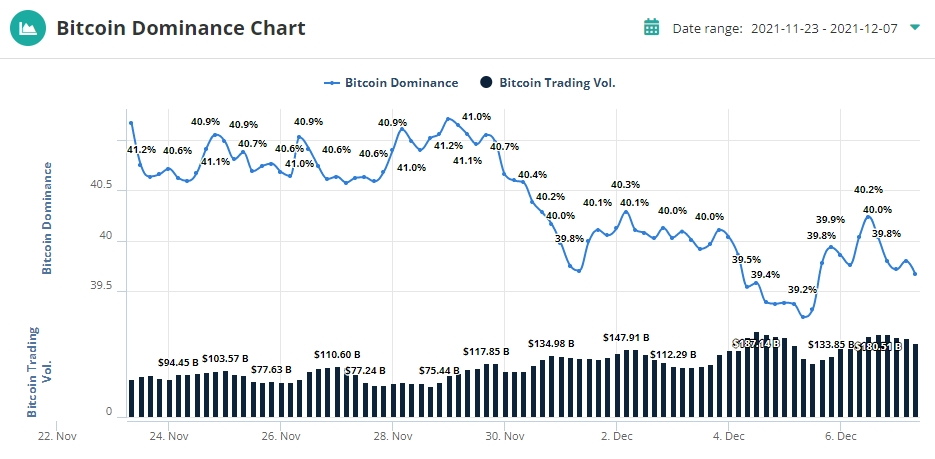

- BTC dominance has fallen to a two-month low as alternative digital assets are recovering more rapidly than Bitcoin

The cryptocurrency market is experiencing a much-needed bounce back after the weekend’s crash, which wiped out nearly $500 billion from the market in the span of hours. Bitcoin (BTC) reconquered $51,000 support earlier today and was accompanied by numerous altcoins, including Ethereum (ETH), Cardano (ADA), and Solana (SOL), to name just a few, sporting robust double-digit gains.

The crypto market cap is eyeing a $2.5 trillion valuation after gaining 9% in a single trading day

Bitcoin and other crypto assets lost as much as 20% during Friday’s flash crash, whose fallout carried over into the weekend. The 24 hour period starting on December 3 was the second-worst period for the cryptocurrency this year, trailing only the May 19 market crash.

On Friday, the total market capitalization of all digital currencies in circulation fell from $2.68 trillion to $2.25 trillion in a matter of hours. After a modest bounceback on Sunday, the market cap dug an even deeper hole Monday, reaching a two-month low of $2.25 trillion. Starting earlier today, the crypto market has started to mount a comeback and is currently sitting at $2.45 trillion, down 8% since pre-crash levels.

Bitcoin broke the critical $50K resistance level with ease

The exact reason for the severe market pullback is impossible to pinpoint with a hundred percent accuracy. However, the positive results of a recent unemployment report have led many to believe that the Fed, and central banks around the world, will soon start raising interest rates to combat the 30-year high inflation.

Bitcoin benefited greatly from expansionary monetary policy employed to negate the adverse economic effects of the Covid-19 pandemic, growing from $4,000 in March 2020 to an all-time high of $69,000 in early November.

It seems that the era of massive stimulus packages is slowly coming to an end. As a result, risk assets such as tech stocks and digital currencies have been facing considerable selling pressure. Most notably, Bitcoin fell to the $44,000 level preceding Fed chairman Jerome Powell’s statement about the upcoming interest rate hike.

After the massive drop over the weekend, Bitcoin has recovered a decent chunk of its losses during today’s trading activity. The price of the world’s largest crypto increased from $47,400 at the start of the day to $51,300 at the time of this writing, a 9% improvement.

Going forward, it will be interesting to observe whether the heavily touted notion of Bitcoin being an inflationary hedge turns out to be true. Central bankers across the world are leaning towards implementing higher interest rates to combat the rising costs of living, measured as the consumer price index (CPI), which has increased 6.7% year-over-year.

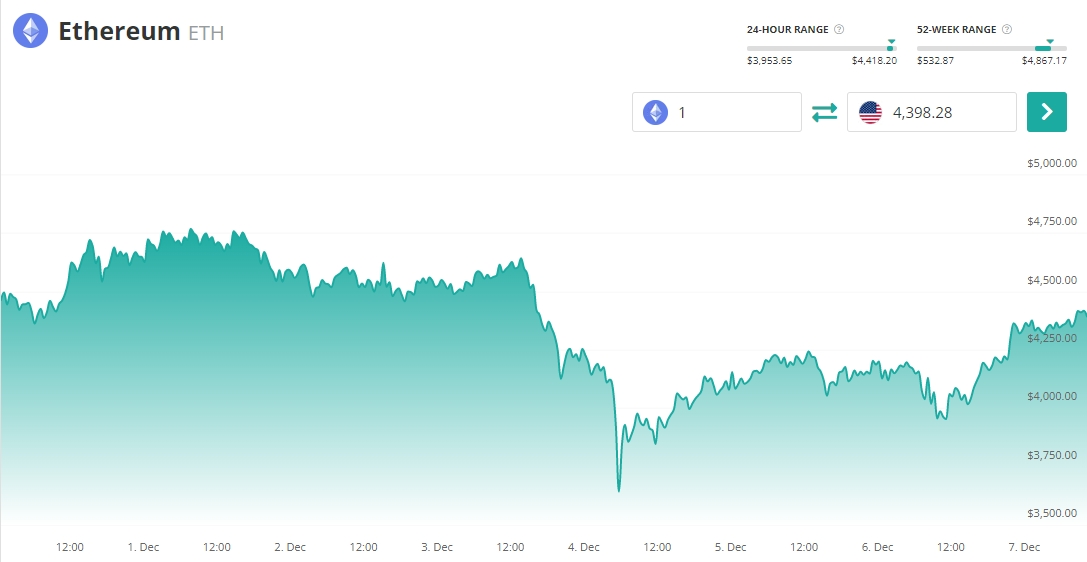

Ethereum and other altcoins are recovering their losses more aggressively than BTC

Despite significant daily gains, Bitcoin’s recovery is trailing alternative digital currencies by quite a considerable margin. The BTC dominance ratio is currently sitting at 41.3%, the second-lowest value since the last week of September.

The altcoin surge has been headlined by Ethereum, which regained lost ground much quicker than BTC, and is now exchanging hands at the $4,400 level, just 4% removed from its pre-flash crash price.

Despite impressive 10% gains posted by ETH, numerous other altcoins have managed to mount even more aggressive comebacks. For instance, BitTorrent (BTT) grew by over 65% in the last 24 hours, while Loopring (LRC), Bitcoin SV (BSV), and Kadena (KDA) all demonstrated over 30% gains.

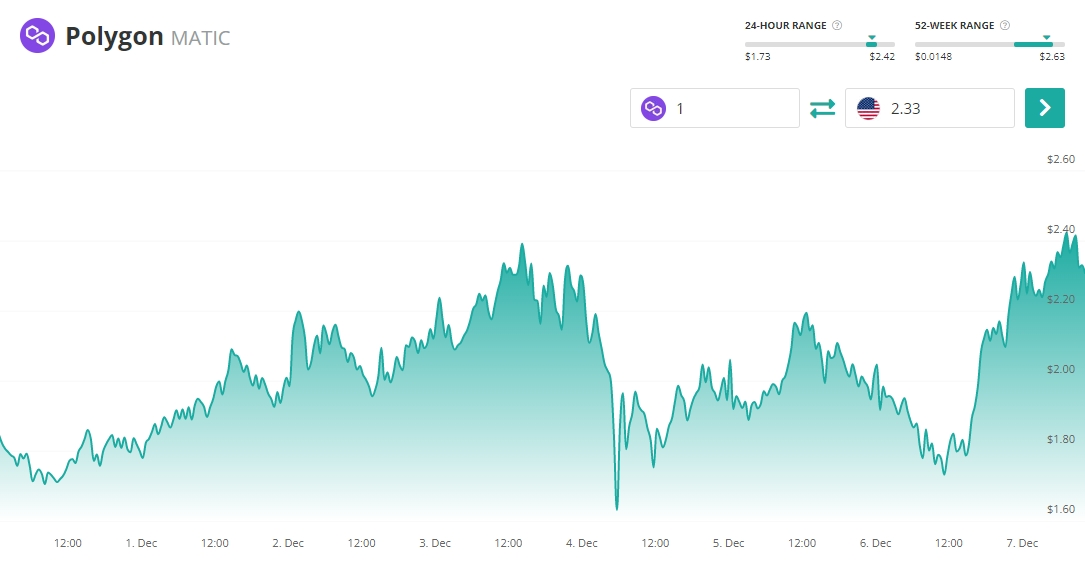

Polygon (MATIC) has been arguably today’s most impressive top 100 crypto asset by market capitalization. The 35% price increase has pushed the value of MATIC to a new cycle high of $2.44 and cemented the Layer 2 scalability solution firmly in the crypto top 20 on an $11.7 billion valuation. While the steady growth of the Polygon network and solid platform fundamentals have without a doubt been a determining factor of MATIC’s recent price rally, the listing of several exchange-traded products (ETPs) for Polygon in the recent weeks have provided an additional boost.