Decentralized finance continues to attract much attention in the cryptocurrency industry. Gauging an ecosystem’s success is often done by looking at the Total Value Locked. Cronos continues to make solid inroads and highlights its growing dominance in the space.

Cronos DeFi TVL Is Moving Up

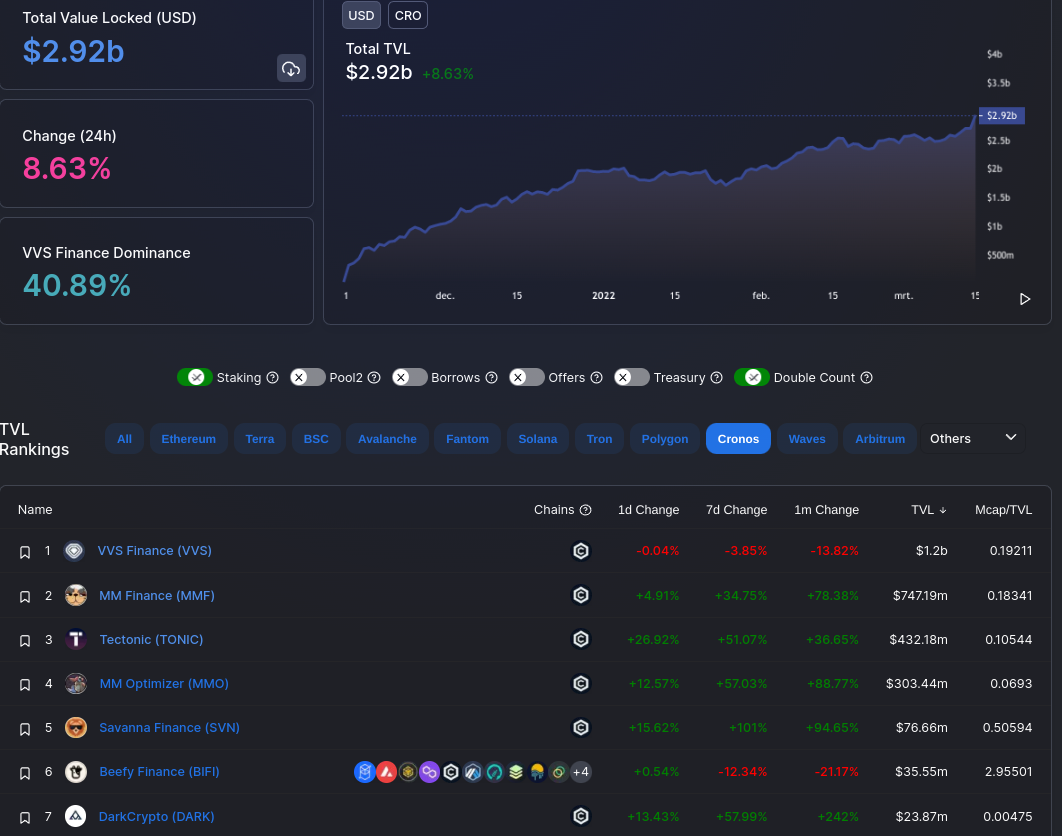

Dozens of blockchains and ecosystems compete for traction in decentralized finance. Some projects explore cross-chain opportunities, whereas others are built on one native chain. Cronos continues to make inroads in this space as its Total Value Locked (TVL) approaches $3 billion. It is a strong rise from just over $300 million on November 12, 2021.

What is even more impressive is how numerous projects on Cronos have made significant TVL leaps lately.

- CyborgSwap increased its TVL by 710%.

- DarkCrypto notes a 242% Total Value Locked increase.

- Savanna Finance surpasses $75 million in TVL following a 94.65% increase.

- MM Finance notes a 78.38% increase, bringing its TVL to just below $750 million.

Additionally, the ecosystem has four projects with over $300 million in Total Value Locked. VVS Finance is, despite a monthly dip of over 13%, the only protocol that has surpassed the $1 billion mark on Cronos so far. However, MM Finance is on the cusp of doing so, especially if the protocol can sustain the current growth rate. MM Finance gained almost 25% in TVL this week alone, indicating more momentum in the tank.

Substantial Dominance Improvements

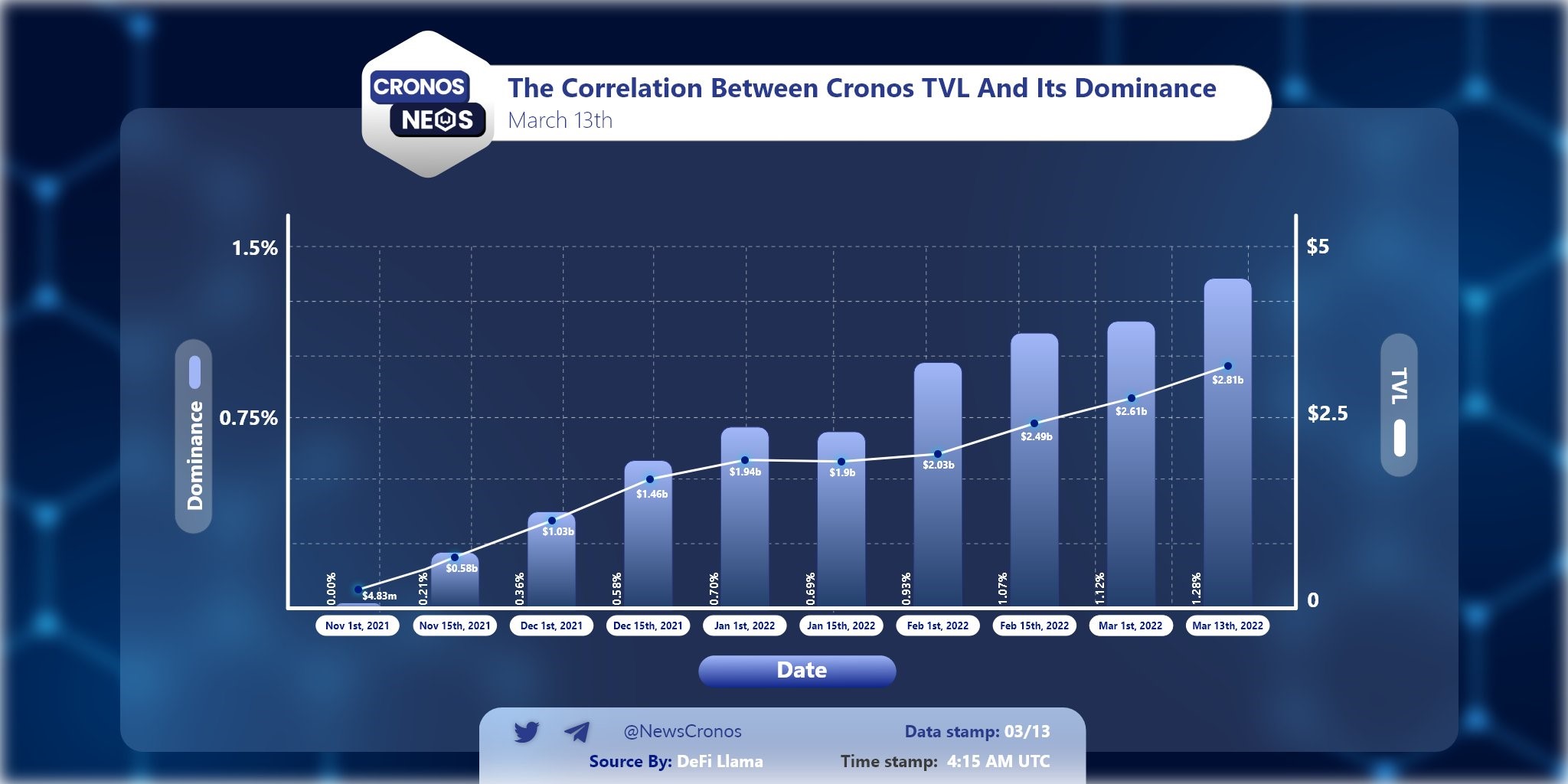

Ethereum remains the “biggest” blockchain for Total Value Locked in the decentralized finance world. LUNA comes in second place, but Cronos is moving up slowly. In November of 2021, Cronos represented less than 0.00% of the global TVL, although that percentage rose quickly to 0.58% by mid-December 2021. Thanks to ongoing increases across the board, the ecosystem now represents 1.28% as of March 12, 2022.

There is still work to do to make a bigger impact on decentralized finance. However, 46 different protocols, products, and services are operational on this network. Most of them are Cronos-native solutions, confirming developers have confidence in the ecosystem and how it behaves in a decentralized finance setting.

More interestingly, cross-chain DeFi protocols have started paying attention to Cronos lately. Some examples are Beefy Finance, Autofarm, Crysti Finance, Annex, EmpireDEX, and Elk. These protocols try to attract more users and liquidity for their protocol. Cross-chain interoperability is a crucial pillar of cryptocurrency and blockchain development, especially in DeFi.

Achieving Crucial Milestones Is Key

Any blockchain ecosystem will stand or fall depending on the developer’s promises and community support. A team of developers delivering on their promises will instill trust in the community. Those community members will bring more value to the network and help attract new users, ensuring long-term sustainability.

Cronos has ticked off numerous milestones since the blockchain was announced in July of 2021, including:

- Solid partnerships: Chainlink, Bond Protocol, Nabox, Duelist King, and Stakin all signed up before the network went live in mid-August 2021.

- Crucial integrations: DeBank, MultiWallet, Autofarm, Beefy Finance, Kyber Network, imToken, and more.

- The team announced ecosystem Grants in December 2021 to ensure ongoing development on the network.

- Inter-Blockchain Communication (IBC) channel with Terra in January 2022

- Bridging Polkadot’s DOT to Cronos in February 2022.

- Bridging Cardano’s ADA to Cronos in February 2022.

- Enabling Cronos NFTs through the Crypto.com exchange platform

- And much more.

The team explores numerous opportunities to ensure Cronos is at the front and center of development. For example, bridging various native currencies from other chains to the Cronos blockchain is a smart decision that enables cross-chain waps and enhances overall liquidity. Moreover, it can strengthen the network’s position in decentralized finance.

Conclusion

Statistics-wise, Cronos noted a 50% total transaction increase from January to February 2022. There are also more unique wallet addresses, CRC-20 tokens minted, mainnet projects, and more. All developments confirm the momentum is in Cronos’ camp today. Sustaining growth across all verticals will prove crucial in the months ahead.