One such exchange that has risen to prominence in recent years is Bitget, the world’s largest cryptocurrency copy trading platform. Since establishing itself in 2018, Bitget has grown exponentially to serve over 20 million users globally with a daily trading volume of $10 billion. So what exactly makes Bitget stand out from the crowd and how can you leverage its features to trade smarter? Let’s take a deeper dive.

Pros and cons of Bitget

To provide a balanced perspective, here are some key pros and cons:

Pros of Bitget:

- Industry-leading copy trading features

- Regulated and possesses required licenses

- Robust security infrastructure and protection fund

- Low fees and high leverage futures trading

- Over 500 tradeable assets and pairs

- Advanced trading tools and educational resources

Cons of Bitget:

- Steep learning curve for advanced order types

- Low direct crypto purchase limits for fiat

- Customer service response times may vary

An Overview of Bitget Exchange

Bitget describes itself as creating “a more equitable future where crypto evolution reforms the way finance works.” Through simple yet powerful trading tools, it aims to empower individuals to embrace the future of finance safely, easily, and efficiently.

In addition to basic spot trading of over 500 coins and 500 trading pairs, Bitget is best known for its copy trading and futures trading products. Copy trading allows you to automatically replicate the trades of experienced traders while futures trading offers highly leveraged contracts for magnifying profits or losses. Further innovative features include strategy trading with preset auto-trade bots and spot margin trading that lets you trade larger volumes using leverage.

The key to Bitget’s success has been its community-focused approach to continuously innovating based on user feedback and safeguarding funds with measures like a $300 million protection fund and Merkle Tree proof of reserves. Under Gracy Chen’s leadership as Managing Director, Bitget has expanded from 4 million users in 2020 to over 20 million today, cementing its position as a top-five futures and spot platform.

Key things to know before getting started

Fees: Bitget has competitive fees compared to peers. Maker fees for spot trading are 0.1% and takers 0.1% with a 20% discount for paying in BGB tokens. Futures fees are 0.02% for makers and 0.06% for takers.

Supported Currencies: Over 500 trading pairs including major coins like Bitcoin, Ethereum as well as altcoins. You can also purchase crypto directly using fiat.

Security: Bitget employs bank-level security with multi-layer authentication, two-factor authentication, and all funds stored in both hot and cold wallets.

Withdrawals & Deposits: Supports bank transfers and stablecoin withdrawals. Deposit options include credit cards, Apple Pay, and bank transfers. The average processing time is 10 minutes or less.

KYC Requirements: Identity verification is mandatory to access some advanced features. Bitget requires basic information like ID, address proof, and selfies for level 1 KYC.

Customer Support: Live chat and email support available 24/7. Response times are generally less than 15 minutes.

Tools & Resources: Beginner-friendly learning center and wiki provide guides on trading basics, strategies, and tutorials for using Bitget services.

Now that you understand the key aspects, let’s explore some tips for taking your trading to the next level on Bitget.

Trade smarter with Bitget’s copy-trading feature

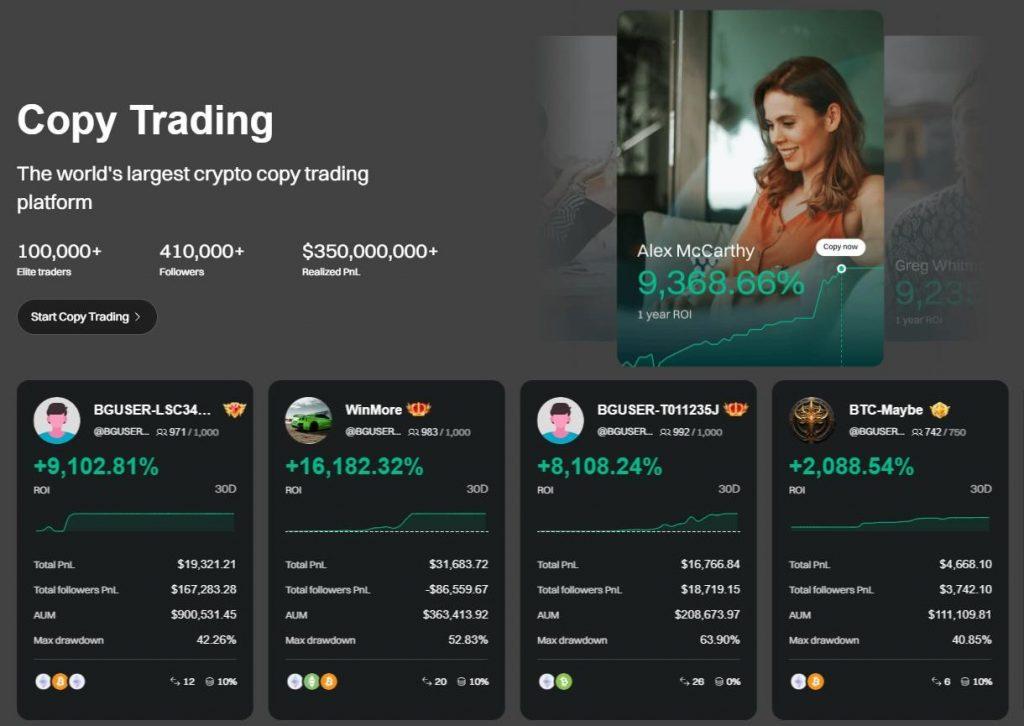

Leveraging the expertise of skilled traders is one of the easiest ways to gain a profitable edge. Copy trading lets you automatically replicate the positions of the top traders on Bitget who have a proven track record after thorough screening by the platform.

Rather than endlessly searching for the next big coin or timing the market, follow traders specializing in strategies like scalping, day trading, grid trading and more based on your preferred niche and risk tolerance. Many of the top traders can achieve returns of over 100% annually.

To get started, search traders by filter options like their rating, followers, and profit/loss percentage. Then choose your preferred trading pairs and leverage before activating the copy. Set appropriate risk controls and you’re now benefiting from the “wisdom of the crowd”.

Amplify gains with futures & margin trading

While borrowing can exponentially grow your profits, the associated risks must be appropriately managed. Futures contracts on Bitget offer up to 125x leverage on major coins like BTC and ETH, magnifying even small price movements. Pair this high leverage with solid risk management practices.

Some tips include only risking 1-2% of your account per trade, placing stop losses, and hedging positions to limit the downside during volatility. The cross-margin mode lets you utilize your entire futures balance as a margin while the isolated margin calculates risk independently on each position.

You can also trade larger spot volumes through Bitget’s margin trading feature with up to 10x leverage. Maintain a positive funding rate, watch your liquidation price, and scale into larger positions slowly as your skills and market awareness improve over time.

Earn passive income through savings and staking

Diamond hands are rewarded on Bitget through a selection of savings and staking options. The flexible Bitcoin Savings product lets you lock BTC for a set period to earn daily compound interest of up to 15% APY.

Alternatively, stake BGB governance tokens to receive trading fee discounts and participate in project governance. Strategically parking funds in stablecoin savings at 8-15% APY is another smart way to generate risk-free returns while retaining upside market potential.

These features are perfect for long-term holding strategies and empower users to earn income from their digital asset holdings instead of relying only on price appreciation. Consider setting aside a small portion of your portfolio for such passive income streams.

Automate trading with strategies

The strategy trading module on Bitget unleashes automation potential by offering ready-made algorithms and templates designed by expert traders. Options span grid, mean reversion, and DCA blueprints optimized for coins like ETH and BTC.

Automating repetitive tasks through these bots allows setting and forgetting positions according to pre-programmed rules like scaling in or out. For ultimate flexibility, advanced users can also build entirely custom strategies using variables and conditional logic.

Automation streamlines the process, upholds prudent risk controls, and diligently backtests strategies on paper before activating with real funds to avoid potential pitfalls. Monitor performance closely over different market conditions as well.

To conclude – trade smarter on Bitget

Bitget brings a user-friendly experience paired with powerful advanced services that appeal to all experience levels. From spot trading basics to leveraged derivatives, you can grow and fine-tune your skills while Bitget’s comprehensive security safeguards protect your digital assets.

Tools like copy trading remove the need to predict short-term market nuances, while strategy automation executes intricate plans systematically. Always deploy prudent risk management according to your specific goals and circumstances.

By understanding and leveraging Bitget’s full suite holistically through practices outlined here, traders of any experience level can stay one step ahead of the competition and consistently trade smarter.